Discover effective strategies for negotiating the purchase price of a home to impact the mortgage amount. Understand the market, set a realistic budget, get pre-approved, work with a skilled agent, and more. Take control of your home buying process.

How Much Can I Comfortably Afford As A Monthly Mortgage Payment? (Budgeting And Debt-to-income Considerations)

Learn how to determine your budget for a monthly mortgage payment. Consider factors like income, expenses, debt-to-income ratio, and affordability guidelines. Find the right mortgage option for your financial situation and understand additional costs. Get pre-approved and work with a lender to make your homeownership dreams a reality.

What Are The Benefits Of Using A Mortgage To Buy A Home? (Building Equity, Long-term Investment)

Discover the benefits of using a mortgage to buy a home such as building equity and long-term investment. Find out more about this valuable financial tool.

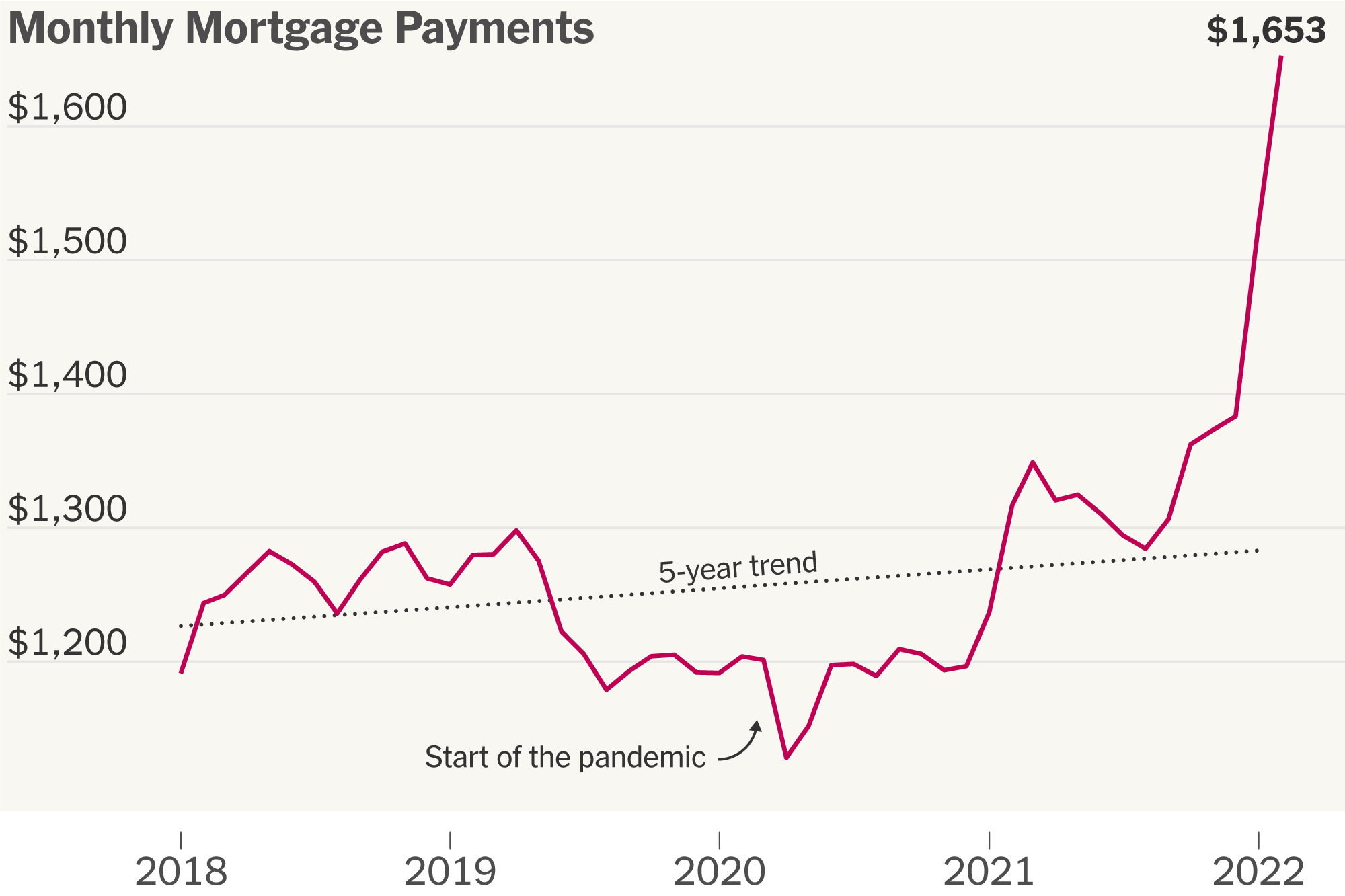

What Is The Average Interest Rate For A Mortgage? (Current Market Trends)

Looking for the average interest rate for a mortgage? Discover current market trends and factors affecting rates in this informative post.

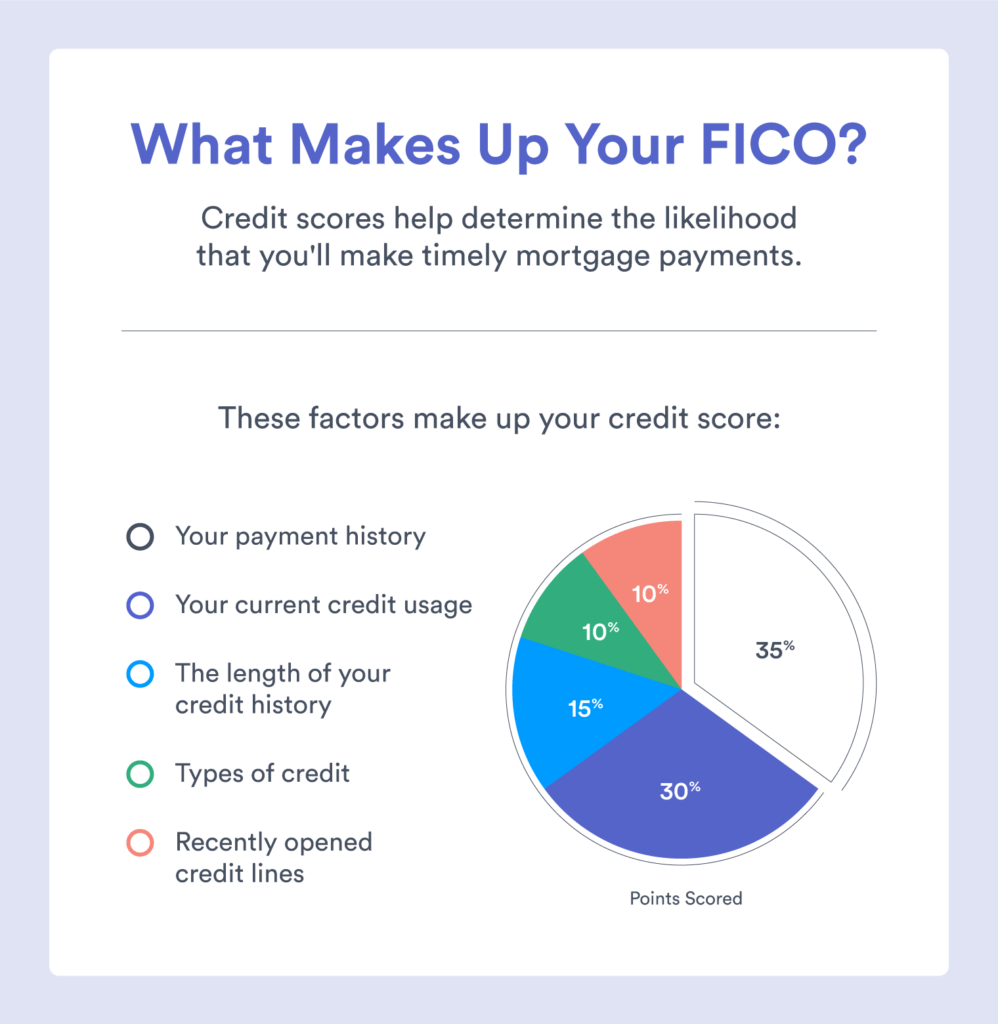

What Credit Score Do I Need For A Mortgage? (Minimum Requirements And Impact)

What credit score do you need for a mortgage? Learn the minimum requirements and impact on terms in this informational post. Get the guidance you need to achieve your homeownership goals.

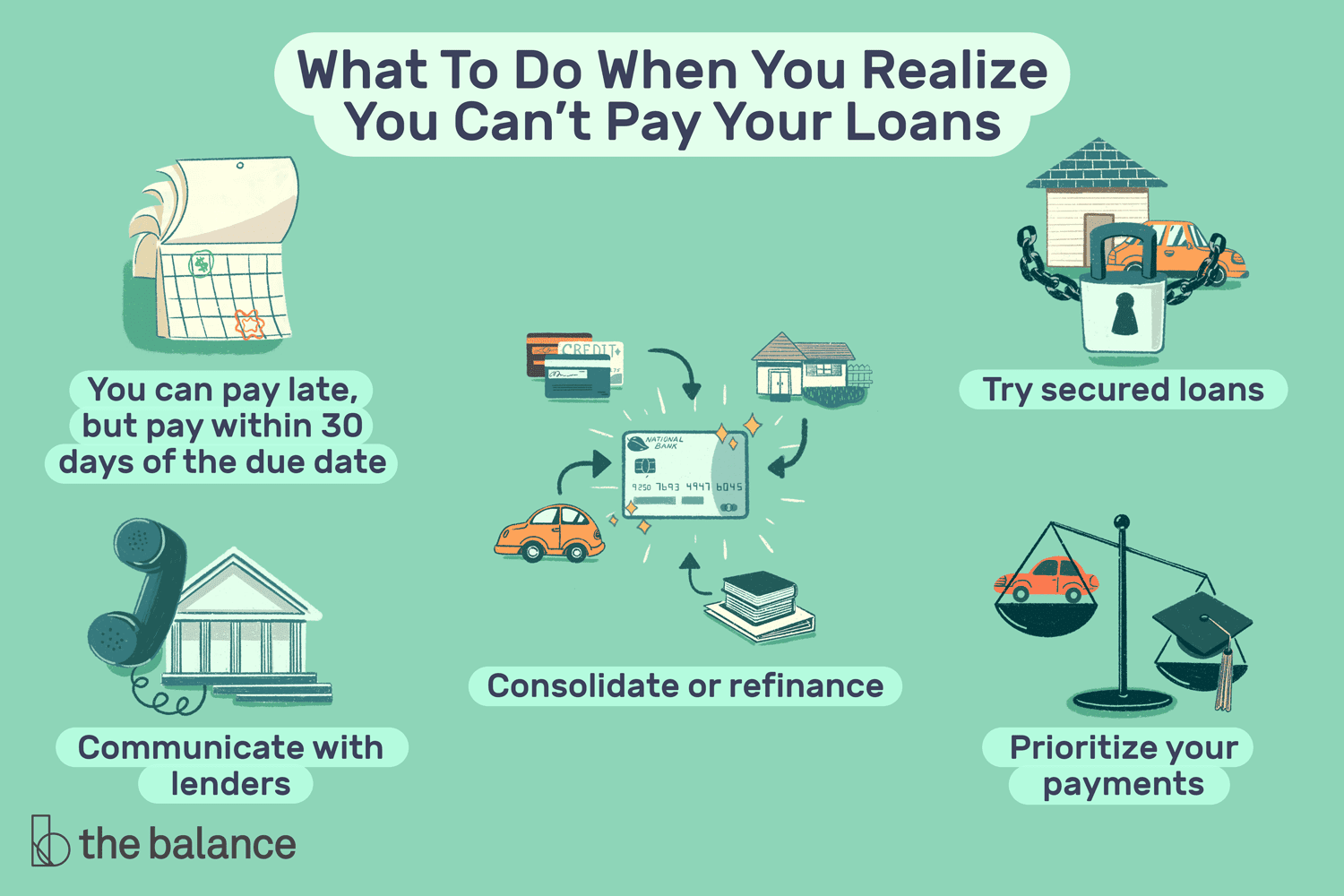

What Happens If I Can’t Make A Payment On My Mortgage? (Delinquency And Foreclosure)

Learn what happens if you can’t make a payment on your mortgage. Explore the consequences of delinquency and foreclosure, and discover options to help you navigate through difficult financial circumstances. Find tailored solutions with Bad Credit Loan.

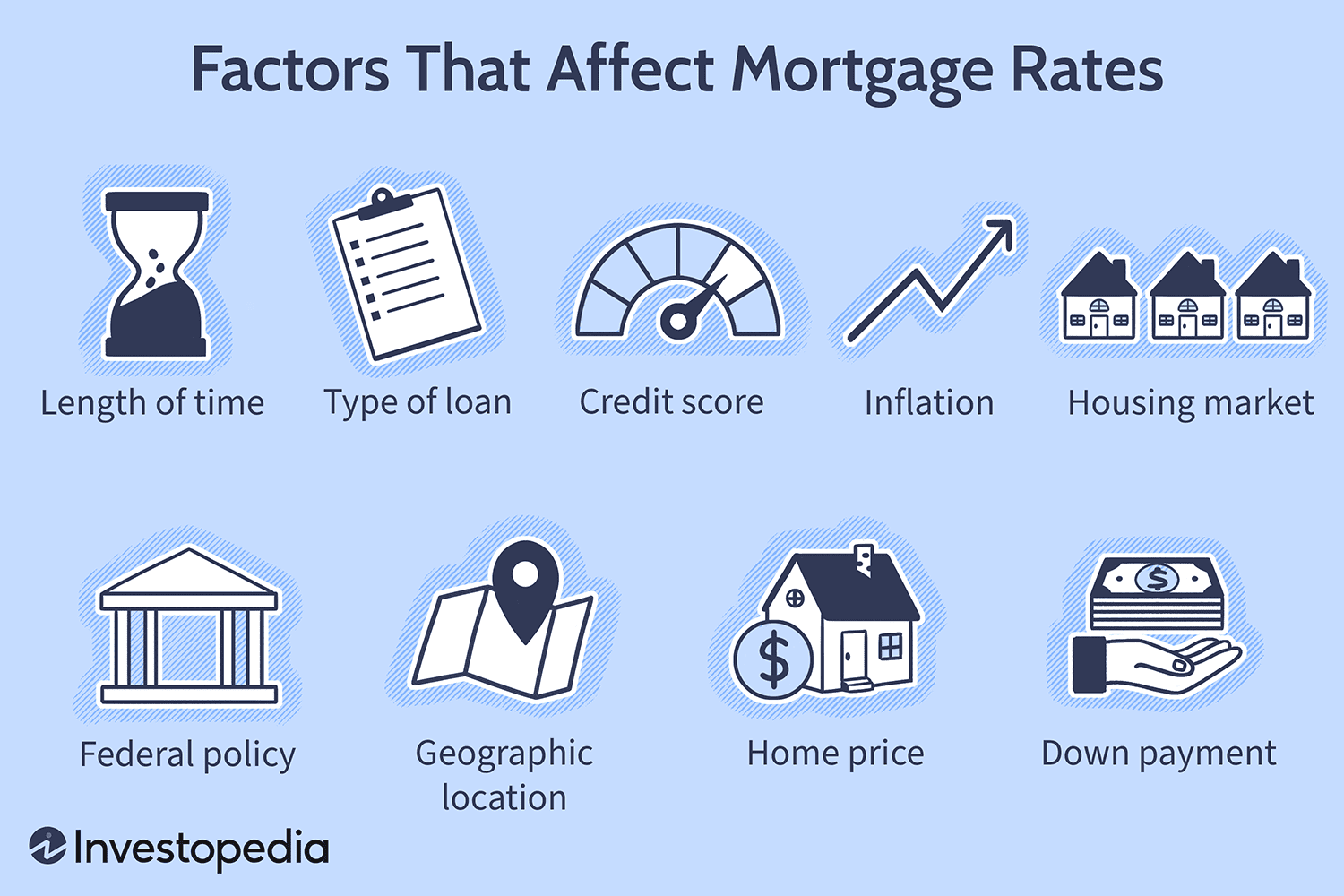

How Are Mortgage Interest Rates Determined? (Credit Score, Loan Type, Economic Factors)

Find out how mortgage interest rates are determined. Learn about credit scores, loan types, and economic factors that impact your rate. Visit Bad Credit Loan for tailored mortgage options.

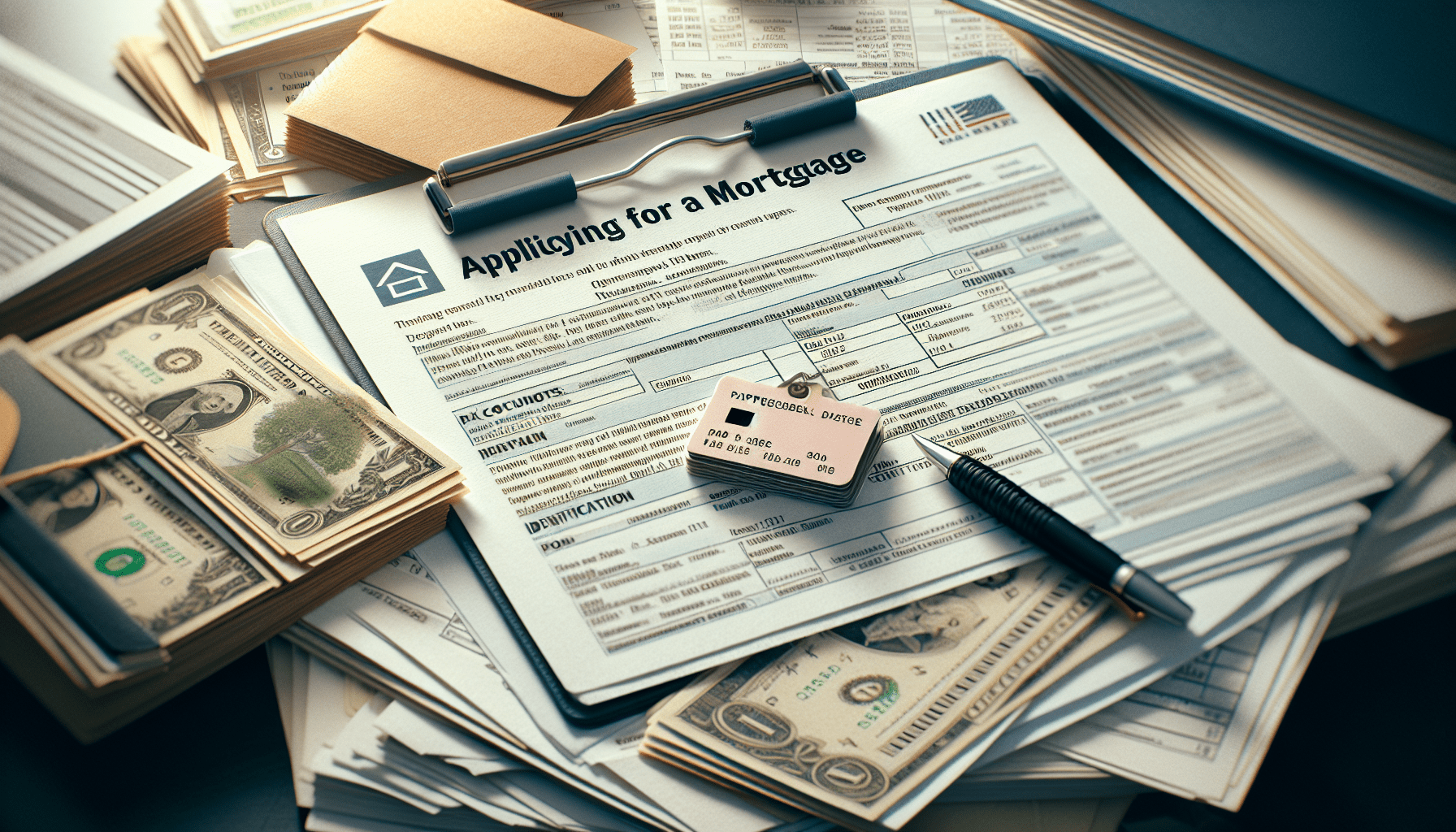

What Documents Do I Need To Apply For A Mortgage? (Proof Of Income, Tax Returns, Identification)

Learn what documents you need to gather when applying for a mortgage, including proof of income, tax returns, and identification. Be prepared for your mortgage application journey.

What Are The Drawbacks Of Taking Out A Mortgage? (Debt Commitment, Long-term Financial Responsibility)

Consider the drawbacks of taking out a mortgage: debt commitment, long-term financial responsibility. Understand the impact on credit score, difficulty in qualifying for additional loans, high interest payments, upkeep and maintenance costs, market fluctuations, and potential loss of investment. Make informed decisions about homeownership and navigate the mortgage process with confidence. Visit official website for more information.

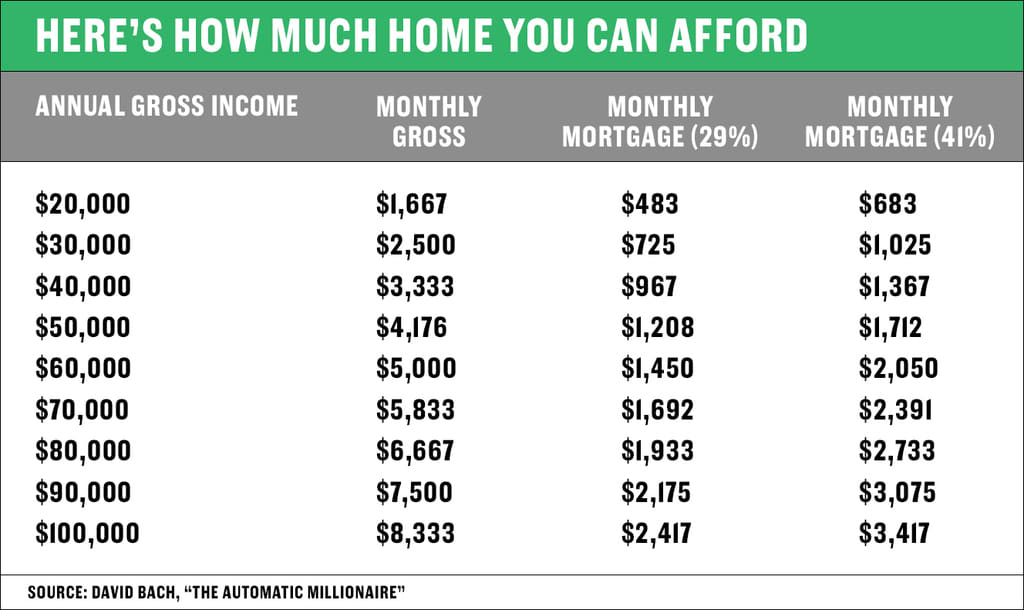

What Are The Income Requirements For A Mortgage? (Debt-to-income Ratio)

Learn about the income requirements for a mortgage and how to calculate your debt-to-income ratio. Discover tips for improving your chances of approval.