Are you curious about the current average interest rate for a mortgage? As you embark on the journey towards homeownership, finding the right mortgage can feel like an overwhelming task. However, Bad Credit Loan is here to provide you with tailored solutions that empower individuals to access the housing they deserve. With a focus on inclusivity and accessibility, Bad Credit Loan offers user-friendly online applications, customizable mortgage options, and transparent practices that build trust and confidence. Whether you’re purchasing your first home or refinancing an existing mortgage, Bad Credit Loan is committed to supporting you in achieving your homeownership goals.

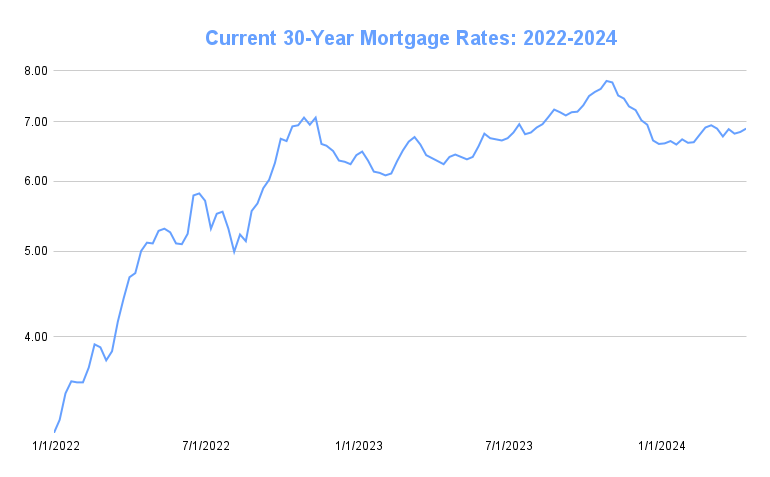

This image is property of assets.themortgagereports.com.

Factors Affecting Mortgage Interest Rates

Getting a mortgage is a significant financial decision, and one important aspect to consider is the interest rate. Mortgage interest rates determine how much you’ll pay over the life of your loan, so it’s crucial to understand the factors that can affect these rates. Here are some key factors to consider:

Economic Conditions

Interest rates are influenced by the overall health of the economy. When the economy is doing well, interest rates tend to be higher. Conversely, when the economy is in a downturn, interest rates usually decrease. This is because lenders take into account the risk associated with lending money during different economic conditions.

Inflation

Inflation is another factor that affects mortgage interest rates. When inflation is high, the purchasing power of money decreases, and lenders may feel the need to charge higher interest rates to account for the diminishing value of money over time.

Credit Score

Your credit score plays a significant role in determining the interest rate you’ll receive on your mortgage. Lenders view borrowers with higher credit scores as less risky and therefore offer them lower interest rates. On the other hand, borrowers with lower credit scores may face higher interest rates as lenders perceive them to be more of a risk.

Loan Type

Different types of loans come with different interest rates. For example, conventional loans typically have higher interest rates compared to government-backed loans such as FHA loans or VA loans. The type of loan you choose will impact the interest rate you’ll be offered.

Loan Term

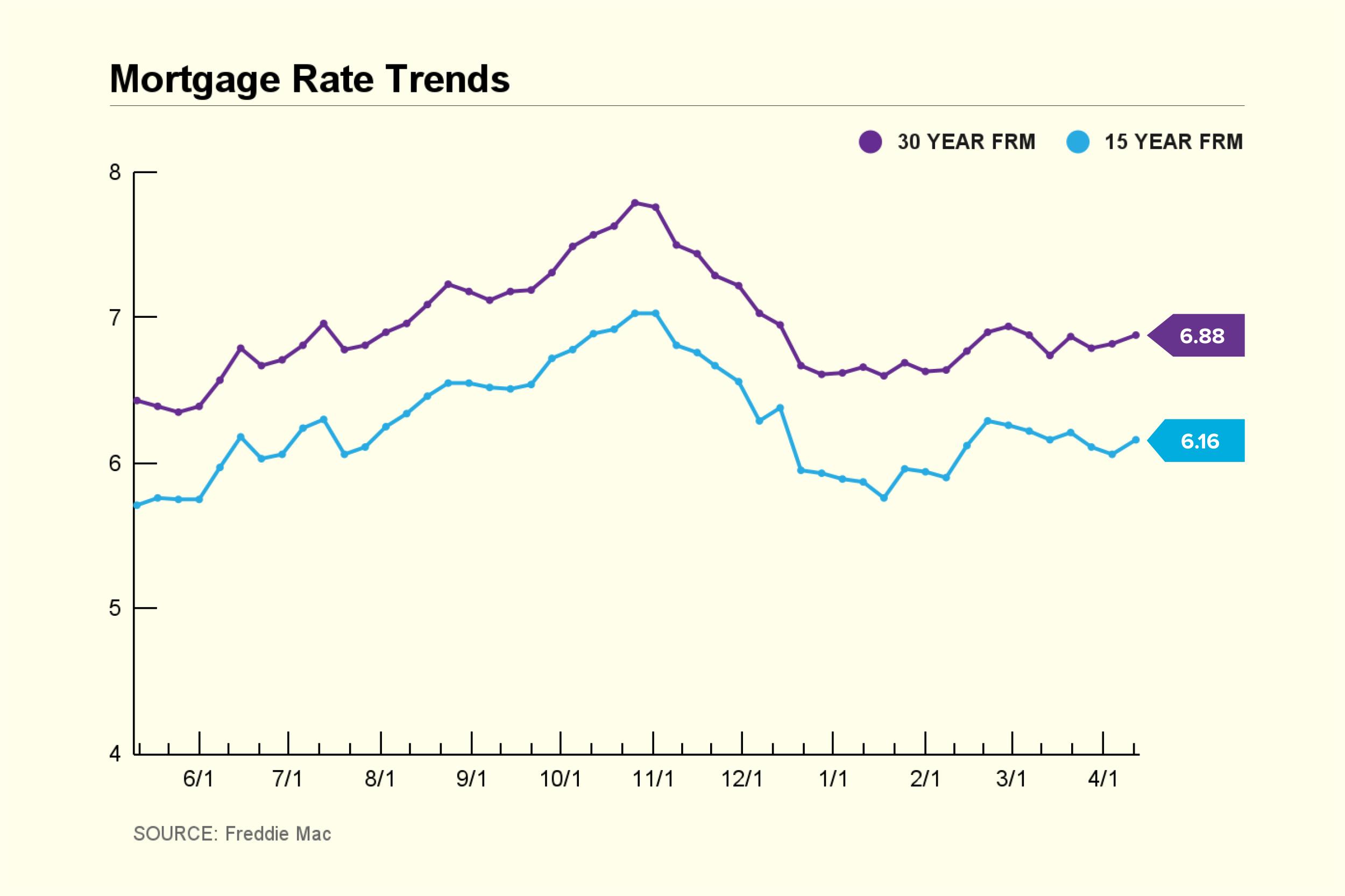

The length of the loan term also affects the interest rate. Generally, shorter-term loans like 15-year mortgages have lower interest rates compared to longer-term loans like 30-year mortgages. This is because shorter loan terms are considered less risky for lenders as they require shorter repayment periods.

Current Average Interest Rates

To get a better understanding of the current interest rate landscape, let’s explore the average interest rates for different types of mortgages.

Fixed-Rate Mortgages

Fixed-rate mortgages have interest rates that remain the same throughout the life of the loan. As of [current date], the average interest rate for a 30-year fixed-rate mortgage is [percentage], while the average interest rate for a 15-year fixed-rate mortgage is [percentage]. These rates can vary depending on economic conditions and individual borrower qualifications.

Adjustable-Rate Mortgages

Unlike fixed-rate mortgages, adjustable-rate mortgages (ARMs) have interest rates that can change over time. Typically, ARMs offer a fixed rate for an introductory period, after which the rate adjusts periodically based on market conditions. As of [current date], the average interest rate for a 5/1 ARM is [percentage]. It’s important to consider if an adjustable-rate mortgage aligns with your long-term financial goals and risk tolerance.

FHA Loans

FHA loans, insured by the Federal Housing Administration, are designed to help borrowers with lower credit scores and down payments. These loans often have more lenient requirements and may offer competitive interest rates. As of [current date], the average interest rate for an FHA loan is [percentage]. FHA loans can be a viable option for borrowers who may not qualify for conventional loans.

Trends in Mortgage Interest Rates

To make informed decisions about your mortgage, it’s essential to be aware of the trends that influence interest rates. Here are some factors that have historically impacted mortgage interest rates:

Historical Trends

Mortgage interest rates have shown fluctuation over the years, influenced by various economic factors. When the economy is strong, rates tend to rise, while during economic downturns, rates tend to decrease. Analyzing historical trends can provide insights into how interest rates may change in the future.

Impact of COVID-19

The COVID-19 pandemic has had a significant impact on mortgage interest rates. As a response to the economic challenges posed by the pandemic, the Federal Reserve implemented policies to lower interest rates, which have resulted in historically low rates for borrowers. However, as the economy recovers, interest rates may gradually rise.

Federal Reserve Policy

The Federal Reserve plays a crucial role in setting interest rates. By adjusting the federal funds rate, the central bank influences borrowing costs for individuals and businesses. When the Federal Reserve lowers interest rates, mortgage rates tend to follow suit.

Housing Market Conditions

The health of the housing market can also impact mortgage interest rates. During periods of high demand, interest rates may rise as lenders adjust to market dynamics. Conversely, in a buyer’s market or during periods of low demand, interest rates may decrease to attract more borrowers.

How to Get the Best Mortgage Rates

Securing the best mortgage rate involves careful consideration and research. Here are some strategies to help you obtain favorable rates:

Improve Credit Score

One of the most effective ways to secure lower interest rates is by improving your credit score. Paying bills on time, reducing debt, and maintaining a low credit utilization ratio can help boost your credit score and increase your chances of qualifying for competitive rates.

Shop Around

Don’t settle for the first offer you receive. Take the time to shop around and compare rates from multiple lenders. Each lender may offer different terms and rates, so it’s essential to explore your options and negotiate for the best possible deal.

Consider a Mortgage Broker

Working with a mortgage broker can be beneficial as they have access to multiple lenders and can assist in finding the best rates based on your financial situation. They can also help navigate the application process and provide guidance throughout the mortgage journey.

Pay Points

Paying points upfront is an option to lower your interest rate. Each point is equal to 1% of your loan amount, and by paying points at closing, you can potentially secure a lower rate for the life of the loan. However, it’s important to evaluate whether paying points makes financial sense based on your individual circumstances.

Choose a Shorter Loan Term

Opting for a shorter loan term, such as a 15-year mortgage instead of a 30-year mortgage, can result in lower interest rates. While this may mean higher monthly payments, the interest savings over the life of the loan can be substantial.

This image is property of img.money.com.

Considerations When Applying for a Mortgage

When applying for a mortgage, certain factors can impact your ability to qualify for favorable interest rates. Here are some considerations to keep in mind:

Down Payment

The amount of your down payment can influence the interest rate you’ll receive. Generally, a larger down payment demonstrates financial stability and lowers the loan-to-value ratio, which can result in better interest rates.

Debt-to-Income Ratio

Lenders evaluate your debt-to-income ratio to assess your ability to repay the mortgage. A lower debt-to-income ratio indicates a lower risk for lenders, which may result in more favorable interest rates.

Employment History

A stable employment history, with consistent income and tenure at your current job, can positively impact your mortgage application. Lenders look for reliable income sources when determining interest rates and loan approval.

Loan Amount

The loan amount you’re seeking can also affect your interest rate. Higher loan amounts may result in higher interest rates, as lenders perceive larger loans to carry more risk.

Mortgage Interest Rate vs. APR

When considering a mortgage, it’s important to understand the difference between the interest rate and the annual percentage rate (APR). While the interest rate represents the cost of borrowing, the APR provides a more comprehensive view of the total cost of the loan.

Understanding APR

The APR includes not only the interest rate but also other costs associated with the loan, such as origination fees, closing costs, and discount points. It reflects the true cost of the loan over its term and allows for easier comparison between different mortgage offers.

Factors Included in APR

The APR takes into account both the upfront costs and the ongoing interest charges. It’s important to review the APR when comparing mortgage offers to get a more accurate understanding of the long-term costs.

How APR Affects Total Loan Cost

Choosing a loan with a lower APR can result in significant savings over the life of the loan. While a mortgage with a lower interest rate may seem appealing, it’s crucial to consider the overall APR to make an informed decision.

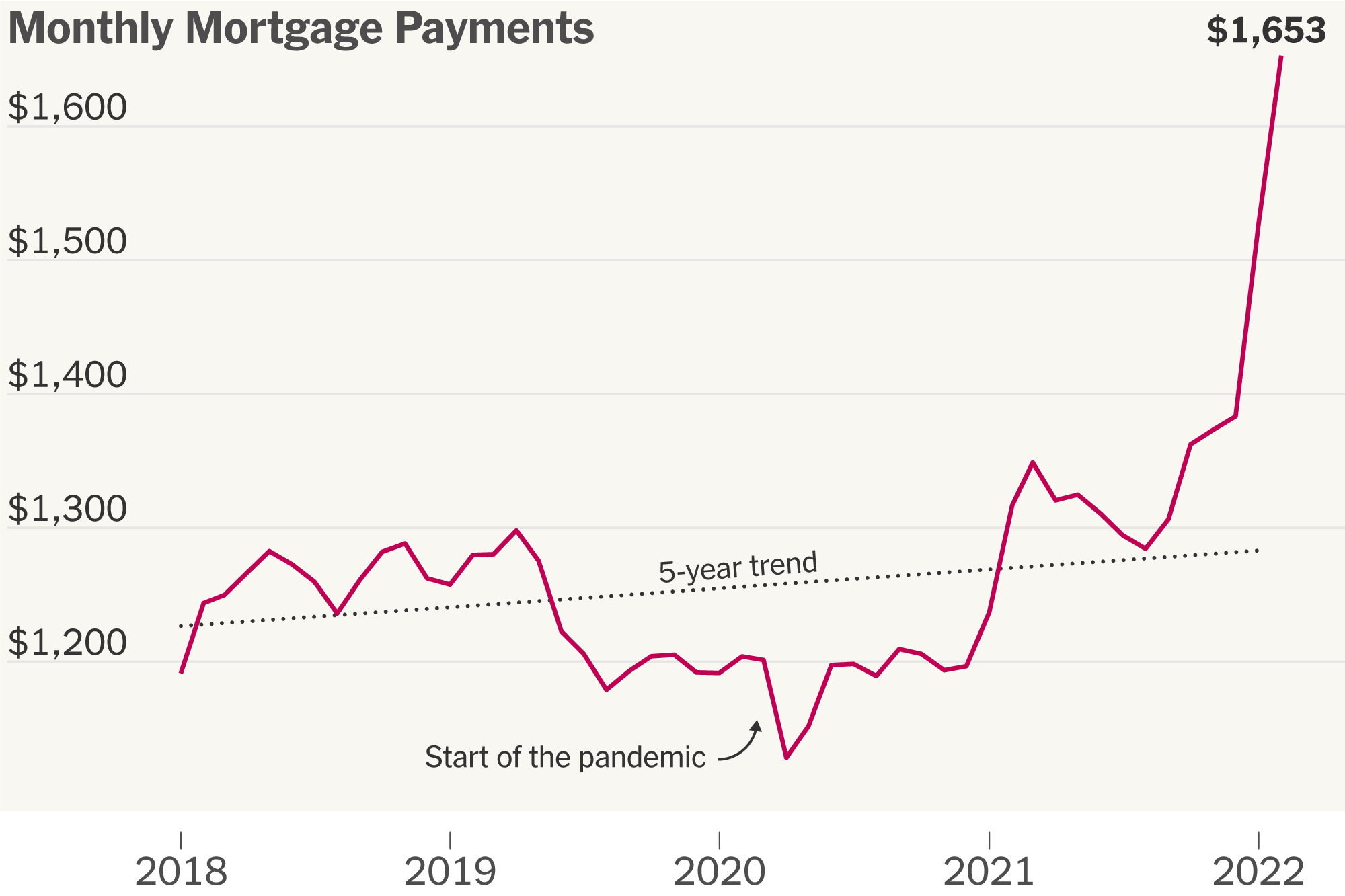

This image is property of images.squarespace-cdn.com.

Impact of Mortgage Interest Rates on Monthly Payments

Understanding how mortgage interest rates impact monthly payments is essential for budgeting and financial planning. The interest rate directly affects the amount you’ll pay each month. Here’s how it works:

Amortization

Mortgages are typically amortized, which means your monthly payment is divided into principal and interest. At the start of the loan term, more of your payment goes toward interest, while gradually, a larger portion goes toward reducing the principal balance.

Example Calculations

Let’s consider a hypothetical scenario. If you have a 30-year fixed-rate mortgage of $200,000 with an interest rate of 4%, your monthly principal and interest payment would be approximately $955. If the interest rate were to increase to 5%, your monthly payment would increase to approximately $1,073. This example highlights how even a small change in interest rates can have a significant impact on monthly payments.

Long-Term vs. Short-Term Interest Rates

When choosing a mortgage, it’s important to evaluate the pros and cons of long-term and short-term interest rates.

Pros and Cons of Long-Term Rates

Long-term rates offer stability and consistency as your rate remains fixed throughout the term of the loan. This can provide peace of mind if you prefer predictable monthly payments. However, long-term rates may be slightly higher compared to short-term rates.

Pros and Cons of Short-Term Rates

Short-term rates typically offer lower interest rates compared to long-term rates. This can result in significant interest savings over the life of the loan. However, short-term rates come with the risk of future rate increases when the initial fixed-rate period ends in adjustable-rate mortgages.

This image is property of static01.nyt.com.

Predictions for Future Mortgage Interest Rates

While predicting future mortgage interest rates is challenging, experts and economic factors can provide insights into potential trends. Here are some considerations:

Expert Forecasts

Various financial institutions and experts provide forecasts for future mortgage rates. These predictions consider economic indicators, market trends, and policy changes to project potential interest rate movements. However, it’s important to note that these forecasts are not guaranteed and should be used as guidance.

Economic Factors

Factors such as GDP growth, inflation, employment rates, and government policies play a significant role in impacting mortgage interest rates. Monitoring these economic indicators can provide insights into possible interest rate movements.

Federal Reserve Policy

The Federal Reserve’s monetary policy decisions can influence mortgage interest rates. By adjusting the federal funds rate, the central bank aims to stimulate or control economic growth. Staying informed about the Federal Reserve’s actions can help gauge potential interest rate changes.

Conclusion

Understanding mortgage interest rates is crucial for making informed decisions when obtaining a mortgage. Factors such as economic conditions, inflation, credit score, loan type, and loan term all impact the interest rate you’ll receive. By staying informed about current average interest rates, trends, and predictions, you can better navigate the mortgage landscape.

To secure the best mortgage rates, focus on improving your credit score, shopping around, considering a mortgage broker, paying points, and choosing a shorter loan term. Additionally, factors like down payment, debt-to-income ratio, employment history, and loan amount can influence the interest rate you’ll qualify for.

Differentiating between interest rates and APR, understanding the impact of interest rates on monthly payments, and weighing the pros and cons of long-term vs. short-term rates are all crucial aspects of the mortgage process.

In conclusion, by understanding the factors affecting mortgage interest rates and staying informed about current trends, you can make informed decisions about your mortgage and work towards achieving your homeownership goals.