In the journey toward homeownership, securing a mortgage can often feel like an insurmountable challenge for individuals with less-than-perfect credit histories. That’s where Bad Credit Loan steps in, offering tailored solutions to empower individuals to access the housing they deserve. With a user-friendly online platform and a focus on transparency, Bad Credit Loan provides customizable mortgage options to meet diverse needs, ensuring that financial opportunities are not limited by past credit setbacks. Whether it’s purchasing a first home, refinancing, or accessing home equity, Bad Credit Loan stands ready to support borrowers in achieving their homeownership goals.

This image is property of www.homesforheroes.com.

Understanding Credit Scores for Mortgages

In the journey toward homeownership, securing a mortgage is often the crucial step that transforms aspirations into reality. However, for individuals grappling with less-than-perfect credit histories, obtaining a mortgage can feel like an insurmountable challenge. This is where Bad Credit Loan steps in, offering tailored solutions to empower individuals to access the housing they deserve.

Credit Scores and Mortgage Approval

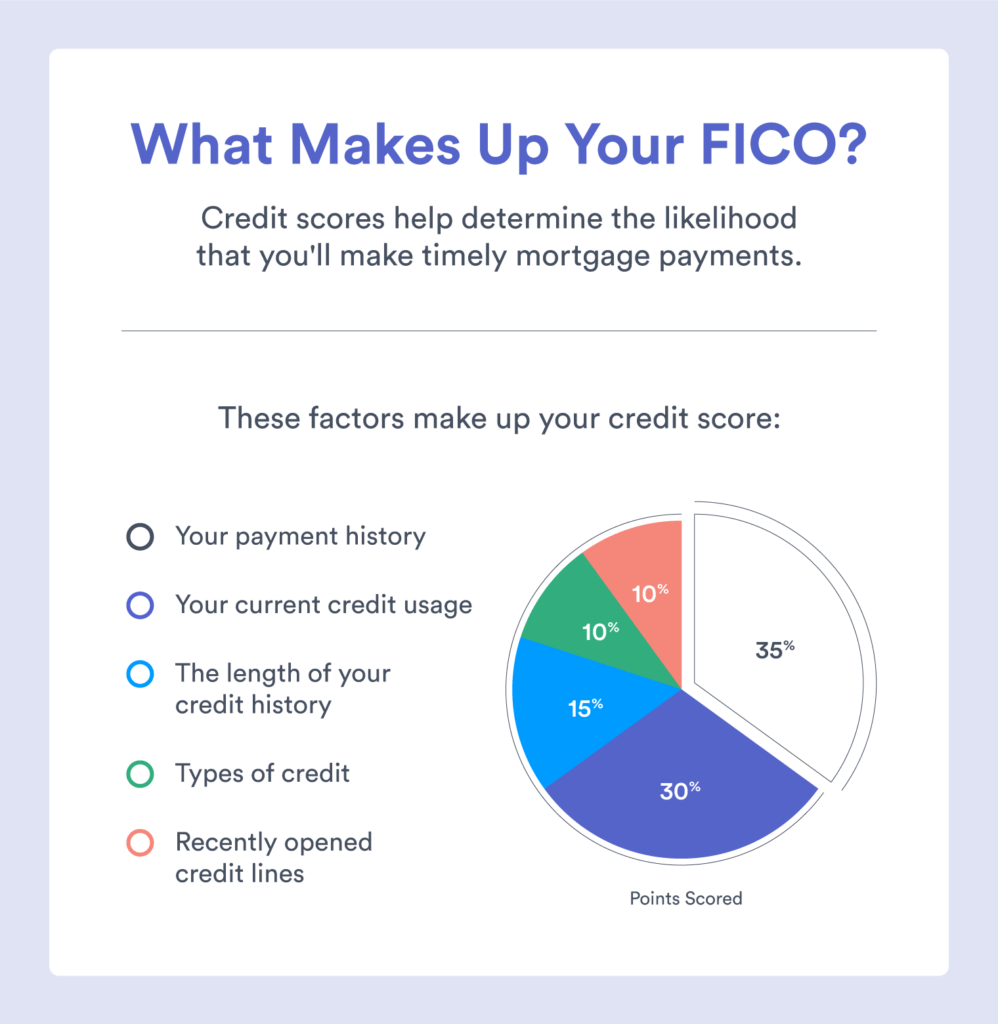

When applying for a mortgage, lenders assess the creditworthiness of borrowers by examining their credit scores. Credit scores, typically ranging from 300 to 850, are a numerical representation of an individual’s creditworthiness, based on their credit history and financial behavior. These scores help lenders determine the level of risk associated with lending money to a particular borrower.

A higher credit score indicates a lower level of risk, making borrowers more likely to be approved for a mortgage and receive better terms, such as lower interest rates. On the other hand, a lower credit score may make it more challenging to secure a mortgage, and borrowers may face higher interest rates or stricter qualification requirements.

Factors Affecting Mortgage Approval

Various factors can impact mortgage approval beyond credit scores. Lenders consider a borrower’s income, employment history, debt-to-income ratio, and the amount of down payment available.

Stable employment, a steady income, and a reasonable debt-to-income ratio can strengthen a borrower’s mortgage application. Lenders want to ensure that borrowers have the financial capacity to repay their mortgage loans.

The amount of down payment available also plays a role in mortgage approval. A larger down payment demonstrates financial responsibility and reduces the lender’s risk. Some loan programs have specific down payment requirements, and borrowers with lower credit scores may be required to provide a higher down payment to offset their credit risk.

Minimum Credit Score Requirements for Mortgages

Different mortgage loan programs have varying minimum credit score requirements. Let’s explore the requirements for some common loan types:

Conventional Mortgages

Conventional mortgages are mortgages not insured or guaranteed by government entities like the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). The minimum credit score required for a conventional mortgage typically ranges from 620 to 680, depending on the lender and other factors.

FHA Loans

FHA loans are mortgages insured by the FHA and are popular among first-time homebuyers. The minimum credit score requirement for an FHA loan is generally lower compared to conventional mortgages. Borrowers with a credit score of 580 or above may be eligible for an FHA loan with a down payment as low as 3.5%. However, borrowers with credit scores between 500 and 579 may still qualify with a higher down payment requirement of 10%.

VA Loans

VA loans are available to eligible veterans, active-duty service members, and surviving spouses. The Department of Veterans Affairs guarantees these loans, making them accessible with more lenient requirements, including credit scores. While there is no specific minimum credit score requirement for VA loans, most lenders prefer borrowers with a credit score of at least 620.

USDA Loans

USDA loans, backed by the United States Department of Agriculture, are designed to assist low to moderate-income borrowers in rural areas. Similar to VA loans, there is no set minimum credit score requirement for USDA loans. However, lenders typically prefer borrowers with a credit score of 640 or above.

Impact of Credit Score on Mortgage Terms

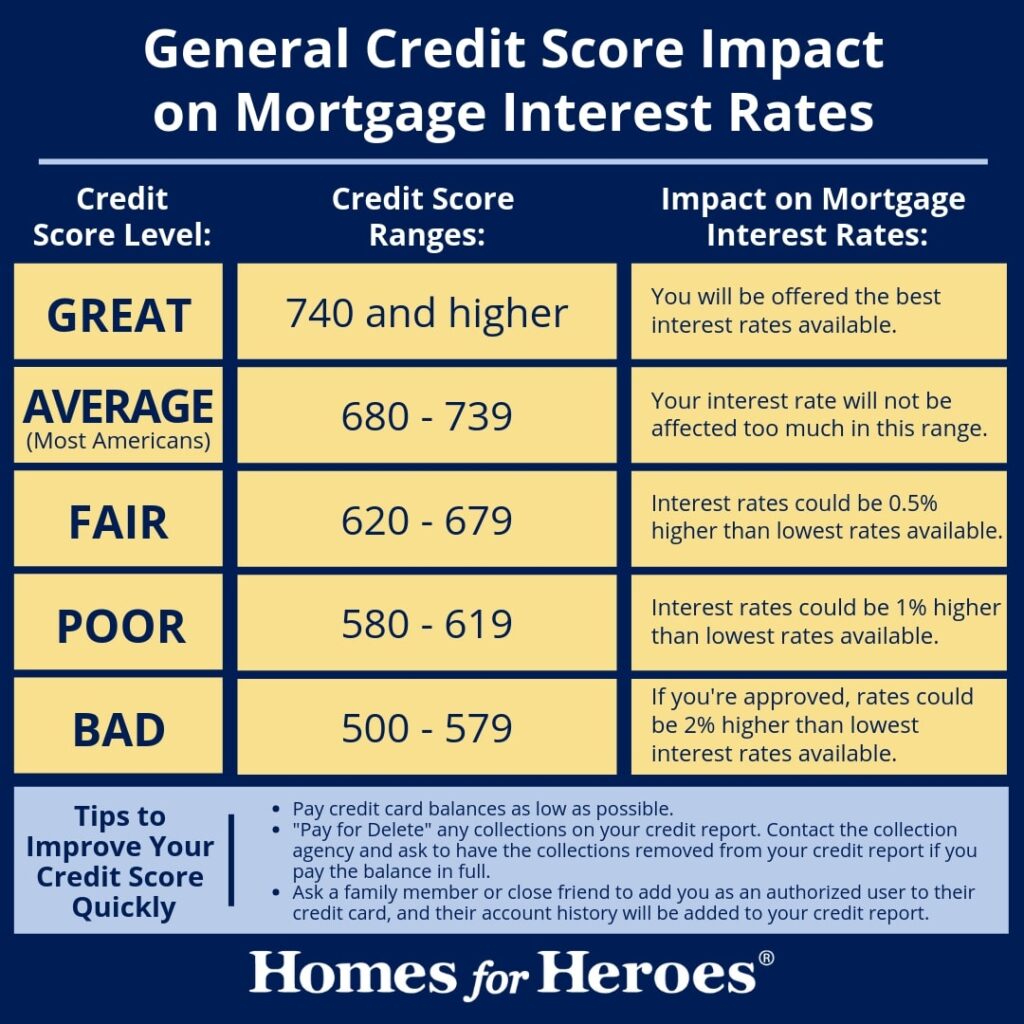

A borrower’s credit score can significantly influence various aspects of their mortgage terms. Let’s explore some of the areas where credit scores can make a difference:

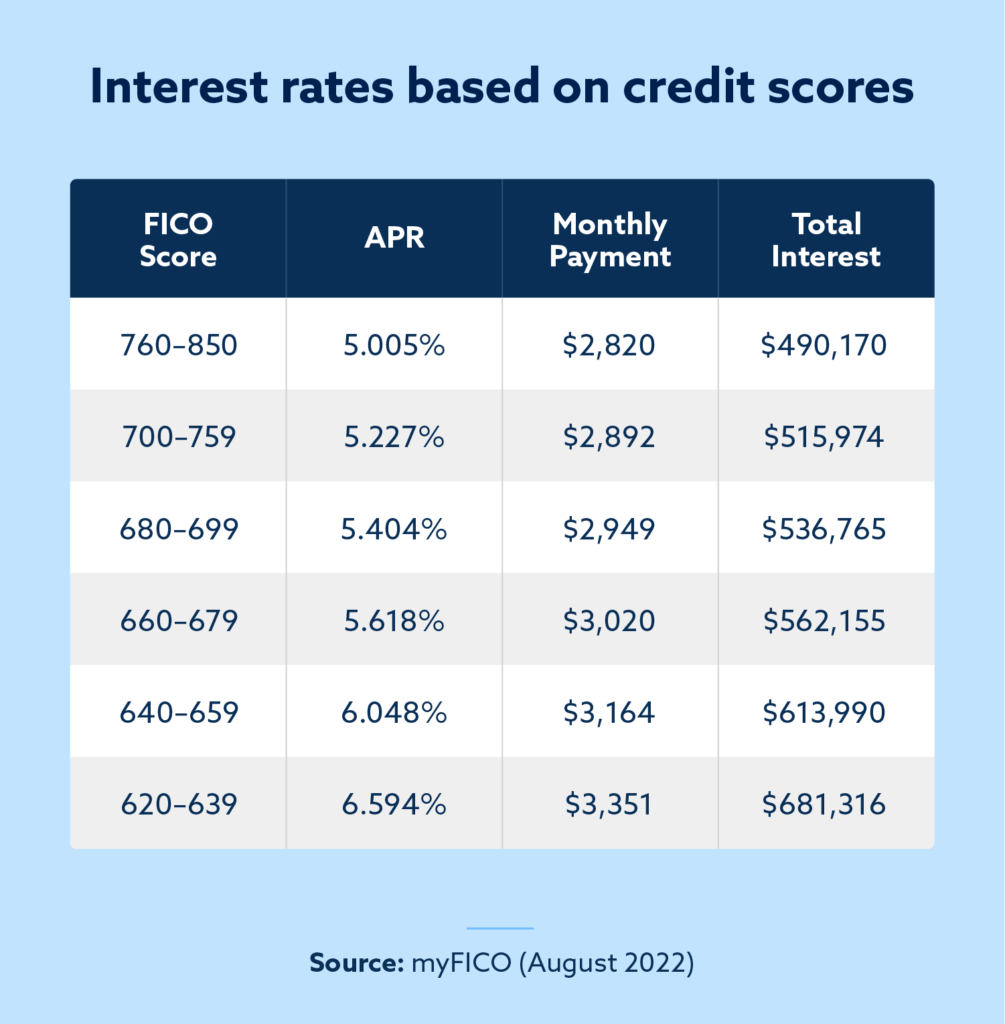

Interest Rates

Credit scores have a direct impact on the interest rates offered for a mortgage. Borrowers with higher credit scores tend to qualify for lower interest rates, resulting in lower monthly mortgage payments. Conversely, borrowers with lower credit scores may face higher interest rates, increasing the overall cost of borrowing.

Loan Amounts

Credit scores can also affect the maximum loan amount a borrower can qualify for. Lenders may limit the loan amount or require a higher down payment for borrowers with lower credit scores. This is to minimize the lender’s risk and ensure that the borrower has sufficient financial capacity to repay the loan.

Down Payments

While down payment requirements vary based on the loan program, credit scores can impact the minimum down payment amount. Borrowers with higher credit scores may be eligible for lower down payment options, allowing them to preserve more savings or invest in other financial goals.

Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is typically required for borrowers who make a down payment of less than 20% on a conventional mortgage. Credit scores can affect the cost of PMI, with lower credit scores resulting in higher premiums. Improving your credit score may enable you to avoid or reduce the cost of PMI.

Loan Approval

Ultimately, credit scores play a significant role in mortgage approval. While minimum credit score requirements vary depending on the loan program, higher credit scores generally increase the likelihood of being approved for a mortgage. It’s essential to work on improving credit scores to access better mortgage options and increase the chances of loan approval.

Improving Credit Score for Better Mortgage Options

If your credit score is lower than desired, there are several steps you can take to improve it:

Reviewing Credit Reports

Start by obtaining a copy of your credit report from the three major credit bureaus – TransUnion, Experian, and Equifax. Review the report for any errors or inaccuracies and dispute them if necessary. Understanding your credit report can provide insights into areas for improvement.

Disputing Inaccuracies

If you come across any mistakes or inaccuracies on your credit report, take immediate action to dispute them with the credit bureau. Mistakes can negatively impact your credit score, and getting them corrected can potentially improve your score.

Paying Bills on Time

Consistently paying your bills on time is one of the most crucial factors in building a positive credit history. Set up automatic payments or reminders to ensure you don’t miss any due dates. Even one late payment can negatively impact your credit score, so it’s important to prioritize timely payments.

Reducing Debt

High levels of debt can harm your credit score. Develop a plan to pay off existing debts, starting with high-interest accounts or those with the smallest balances. By reducing your debt-to-income ratio, you can improve your creditworthiness and increase the chances of mortgage approval.

Increasing Credit Limits

Another strategy for improving your credit score is to increase your credit limits. Contact your credit card issuers and request a credit limit increase. By doing so, you can improve your credit utilization ratio, which compares the amount of credit you use to your total available credit. A lower credit utilization ratio can positively impact your credit score.

This image is property of www.lexingtonlaw.com.

Alternative Mortgage Options for Lower Credit Scores

While a higher credit score is generally preferred for traditional mortgage programs, individuals with lower credit scores still have options. Let’s explore some alternative mortgage options:

Subprime Mortgages

Subprime mortgages are designed for borrowers with lower credit scores or a history of credit challenges. These mortgages typically have higher interest rates to compensate for the increased risk associated with lending to borrowers with lower credit scores. Although subprime mortgages may be a viable option, it’s essential to carefully consider the terms and costs associated with these loans.

Non-Qualified Mortgages

Non-Qualified Mortgages (non-QM) are loans that don’t meet the Qualified Mortgage standards set by the Consumer Financial Protection Bureau (CFPB). These loans cater to borrowers who may not meet traditional mortgage requirements, such as those with unique income or employment situations. Non-QM loans often have more flexible underwriting criteria but may come with higher interest rates and fees.

Hard Money Loans

Hard money loans are typically provided by private lenders or investors and are based on the value of the property rather than the borrower’s credit score. These loans can be a suitable option if you have a low credit score but substantial equity or a high-value property. Hard money loans often come with higher interest rates and shorter repayment terms.

It’s worth noting that alternative mortgage options may come with higher costs, including interest rates, fees, and sometimes more stringent requirements. Exploring these options should be done in consultation with a mortgage professional or financial advisor.

The Importance of Responsible Borrowing

While there are options available for individuals with lower credit scores, responsible borrowing is crucial for long-term financial stability and successful homeownership. Regardless of credit history, it’s important to practice responsible financial habits:

Maintaining a Good Credit History

Making timely payments, avoiding excessive debt, and responsibly managing credit accounts are essential for maintaining a good credit history. Consistently demonstrating positive financial behavior can help improve credit scores over time and open up more opportunities for future borrowing.

Managing Debt

Keeping debt levels manageable is key to financial stability. Aim to pay down existing debts and avoid accumulating new debt unnecessarily. By maintaining a low debt-to-income ratio, you can improve your creditworthiness and reduce financial stress.

Avoiding Late Payments

Late payments can significantly impact your credit score and may lead to additional fees and penalties. Make it a priority to pay all bills on time, including credit card payments, utility bills, and any other financial obligations. Set up reminders or automatic payments to ensure you don’t miss any due dates.

This image is property of unlock-cms-uploads.s3.us-west-1.amazonaws.com.

Seeking Professional Guidance

Navigating the world of mortgages can be complex, especially when dealing with credit challenges. Seeking professional guidance can provide valuable insights and help you make informed decisions. Consider the following avenues for assistance:

Consulting a Mortgage Broker

A mortgage broker can assess your financial situation, credit score, and homeownership goals to help you find the most suitable mortgage options. They have access to a range of loan programs and can guide you through the application process.

Working with a Credit Counselor

A credit counselor can provide personalized advice and guidance to help you improve your credit score. They can review your financial situation, offer budgeting tips, and provide strategies for managing debt. Credit counselors can also assist in creating a plan to achieve your homeownership goals.

Conclusion

In conclusion, Bad Credit Loan serves as a trusted partner for individuals seeking access to mortgages tailored to their unique financial circumstances. Through its accessible platform, flexible options, and transparent practices, the company empowers individuals to unlock the opportunities of homeownership. Whether it’s purchasing a dream home, refinancing for better terms, or accessing home equity, Bad Credit Loan stands ready to support borrowers in achieving their homeownership goals.

While credit scores play a significant role in mortgage approval and terms, individuals with lower credit scores still have options available. By taking steps to improve credit scores, managing debt responsibly, and seeking professional guidance, borrowers can increase their chances of accessing better mortgage options and ultimately achieving their homeownership dreams. Remember, responsible borrowing and diligent repayment are essential for building financial stability and maintaining successful homeownership.