In the journey towards homeownership, obtaining a mortgage can feel like an insurmountable challenge for individuals with less-than-perfect credit histories. However, Bad Credit Loan offers tailored solutions to empower individuals to access the housing they deserve. With a user-friendly online platform, customizable mortgage options, and a commitment to transparency and support, Bad Credit Loan serves as a trusted partner for those seeking access to mortgages tailored to their unique financial circumstances. Whether it’s purchasing a dream home, refinancing for better terms, or accessing home equity, Bad Credit Loan stands ready to support borrowers in achieving their homeownership goals. In the journey toward homeownership, securing a mortgage is often the crucial step that transforms aspirations into reality. However, for individuals grappling with less-than-perfect credit histories, obtaining a mortgage can feel like an insurmountable challenge. This is where Bad Credit Loan steps in, offering tailored solutions to empower individuals to access the housing they deserve.

This image is property of www.lexingtonlaw.com.

Understanding Bad Credit and Mortgages

Before delving into the challenges and alternative options for securing a mortgage with bad credit, it’s crucial to understand what is considered bad credit. Bad credit refers to a low credit score resulting from a history of late payments, defaults, or other negative financial behavior. Lenders view bad credit as an indication of a higher risk borrower, making it more challenging to qualify for traditional mortgage loans.

What is considered bad credit?

Bad credit is typically defined as a credit score below 600, although specific criteria may vary depending on the lender. It is important to note that different lenders may have different standards for what they consider as bad credit.

Effects of bad credit on mortgage applications

When applying for a mortgage with bad credit, the most significant effect is the impact on interest rates and loan terms. Lenders often consider borrowers with bad credit as higher risk, and as a result, they may offer less favorable interest rates and stricter loan terms. This can result in higher monthly payments and overall increased costs for the borrower.

Why is it challenging to get a mortgage with bad credit?

There are several reasons why it is challenging to get a mortgage with bad credit. Firstly, lenders are typically risk-averse and prefer to lend to borrowers with a proven track record of responsible financial behavior. Bad credit is seen as an indicator of potential repayment difficulties, leading to a higher chance of default.

Secondly, bad credit limits the number of mortgage options available to borrowers. Traditional mortgage lenders may be hesitant to approve loans for individuals with bad credit, leaving them with limited options and potentially higher costs.

Lastly, bad credit often results in higher down payment requirements. Lenders may require borrowers with bad credit to provide a larger down payment as a way to mitigate the risk. This can be a significant challenge for individuals who are struggling to save up for a down payment while also dealing with the financial implications of their credit history.

Challenges in Getting a Mortgage with Bad Credit

For individuals with bad credit, there are several challenges that they may face when trying to secure a mortgage. It’s important to be aware of these challenges in order to understand the potential difficulties and explore alternative options.

Higher interest rates

One of the most significant challenges of getting a mortgage with bad credit is the higher interest rates. Lenders view bad credit borrowers as higher risk, and to compensate for that risk, they charge higher interest rates. This means that individuals with bad credit may end up paying more in interest over the life of their mortgage compared to borrowers with good credit.

Limited loan options

Another challenge of securing a mortgage with bad credit is the limited loan options available. Traditional mortgage lenders often have strict eligibility criteria, which can make it difficult for individuals with bad credit to qualify. This limited availability of loan options can make it harder for individuals with bad credit to find terms that suit their needs and financial situation.

Higher down payment requirements

Bad credit can also lead to higher down payment requirements. Lenders may require borrowers with bad credit to provide a larger down payment as a way to mitigate the risk associated with their credit history. This can be challenging for individuals who are already struggling to save up for a down payment while also dealing with the financial implications of their bad credit.

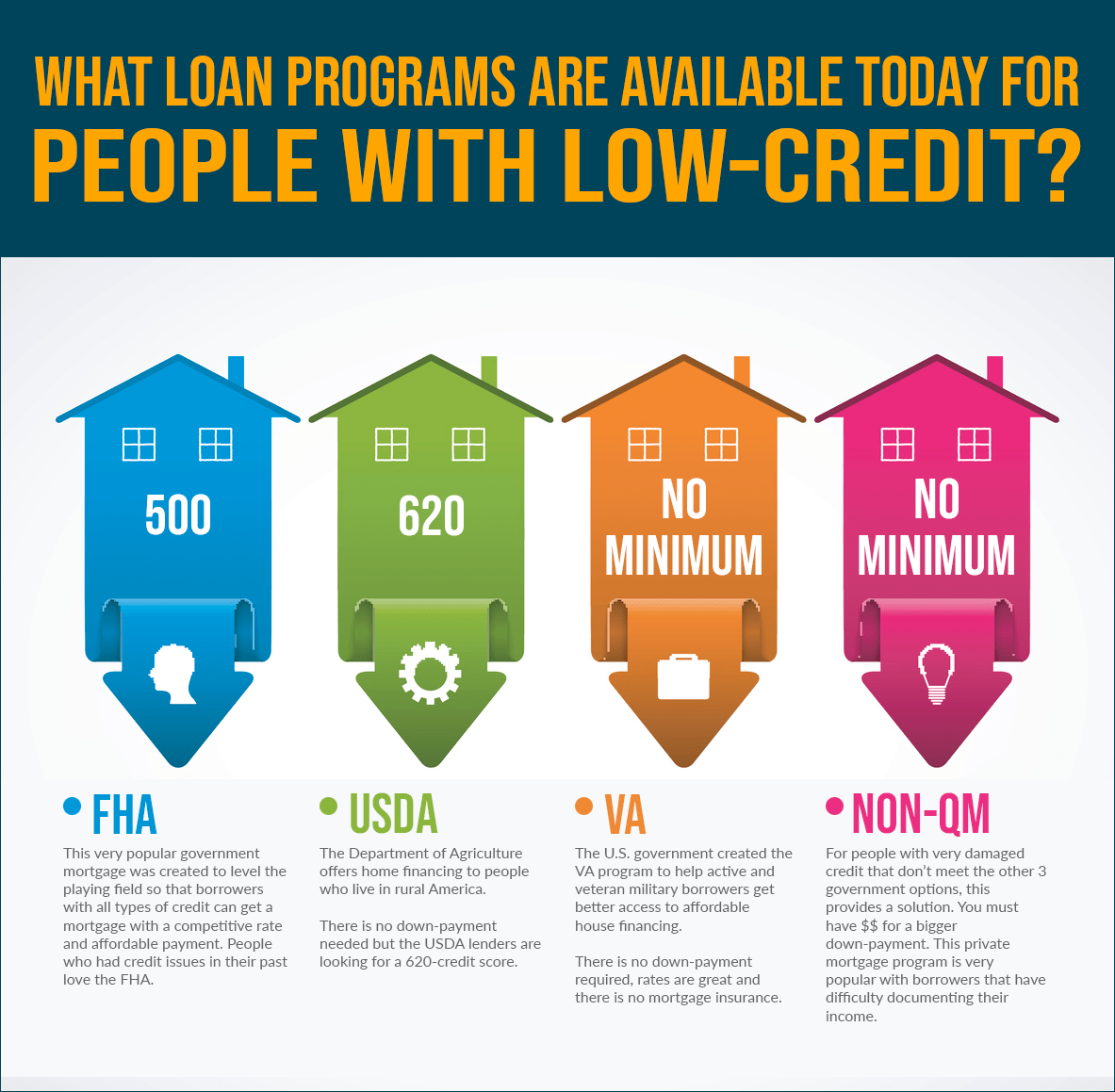

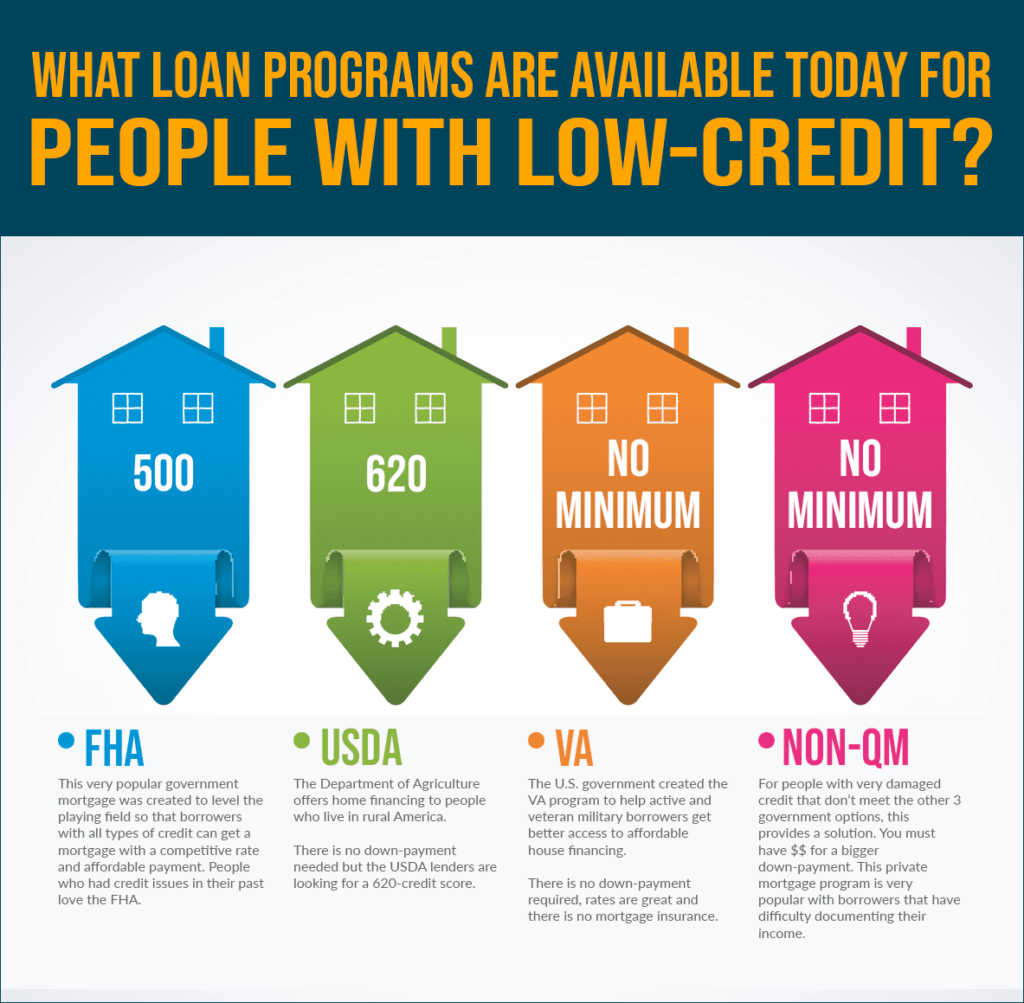

Alternative Mortgage Options for Bad Credit

While traditional mortgage loans may be challenging to obtain with bad credit, there are alternative mortgage options that individuals with bad credit can explore. These alternative options are designed to provide opportunities to borrowers with less-than-ideal credit histories.

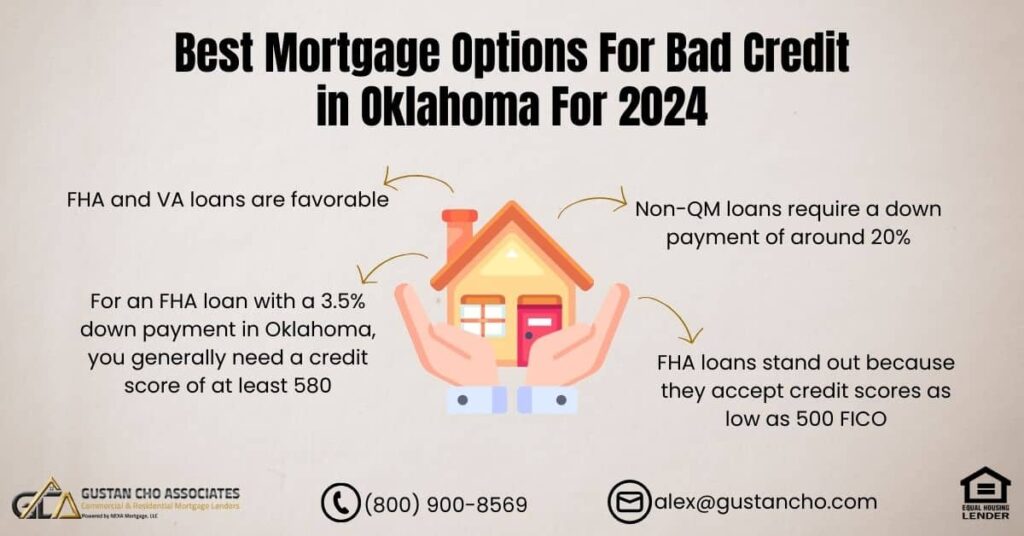

FHA loans

The Federal Housing Administration (FHA) offers loans specifically designed for borrowers with lower credit scores. FHA loans have more lenient eligibility criteria and lower down payment requirements compared to traditional mortgage loans. This makes them a popular choice for individuals with bad credit.

VA loans

VA loans are available to eligible veterans, active-duty military personnel, and their spouses. These loans are guaranteed by the U.S. Department of Veterans Affairs and often have more flexible eligibility criteria, including lower credit score requirements. VA loans can be an attractive option for those with bad credit who have a military background.

USDA loans

The U.S. Department of Agriculture (USDA) offers loans specifically for rural homebuyers. These loans, known as USDA loans, often have more flexible eligibility requirements, including lower credit score thresholds. They also offer competitive interest rates and require little to no down payment.

Subprime mortgages

Subprime mortgages are designed for borrowers with low credit scores. These mortgages carry higher interest rates and stricter terms, but they can provide an opportunity for individuals with bad credit to access homeownership. It’s essential to carefully consider the terms and costs associated with subprime mortgages before pursuing this option.

Hard money loans

Hard money loans are typically offered by private lenders and are based on the value of the property being purchased rather than the borrower’s creditworthiness. While hard money loans often have higher interest rates and shorter repayment terms, they can be a viable option for individuals with bad credit who are looking for short-term financing or unique circumstances.

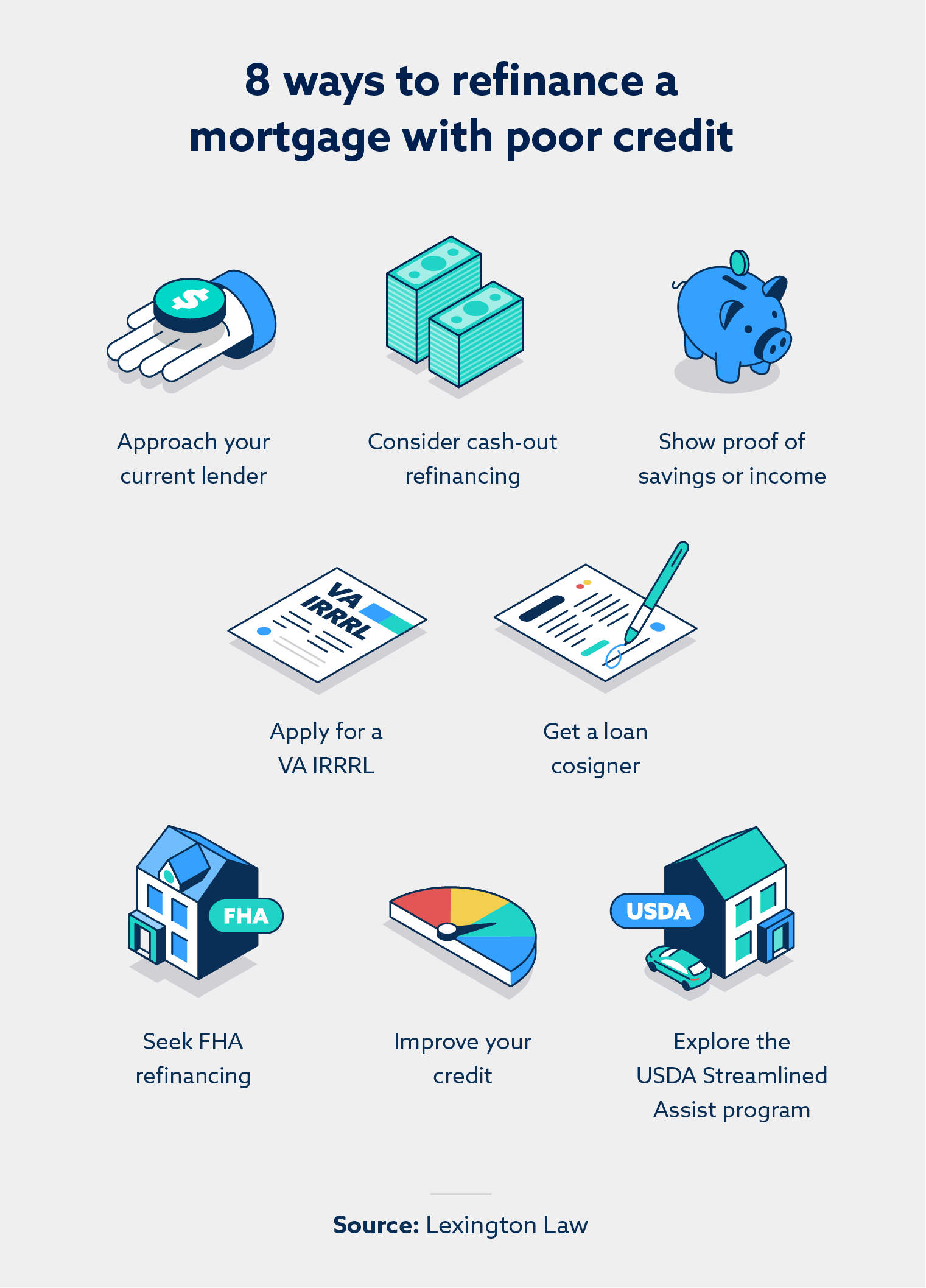

Improving Your Chances of Getting a Mortgage

While alternative mortgage options can provide opportunities for individuals with bad credit, it’s important to work on improving your credit score and overall financial standing. By taking proactive steps to improve your creditworthiness, you can increase your chances of obtaining a mortgage with more favorable terms.

Working on credit score improvement

Improving your credit score is a crucial step in increasing your chances of getting a mortgage. This can be achieved by making timely payments, reducing your outstanding debt, and maintaining a low credit utilization ratio. It’s also important to regularly review your credit report for any errors or discrepancies that may be negatively impacting your score.

Building a stable employment history

Lenders consider stable employment history as an indicator of financial stability and responsibility. Building a stable employment history can boost your chances of getting a mortgage, even with bad credit. Demonstrating a consistent income and a steady job can help mitigate concerns about your credit history.

Saving for a larger down payment

Saving for a larger down payment can help offset the negative impact of bad credit. By providing a larger down payment, you can show lenders that you are committed to the purchase and are willing to take on a larger financial stake in the property. This can improve your chances of getting approved for a mortgage, even with bad credit.

Reducing existing debts

Reducing your existing debts can not only improve your credit score but also increase your chances of obtaining a mortgage. Lenders consider your debt-to-income ratio when evaluating your loan application. By reducing your outstanding debts, you can lower this ratio, making you a more attractive borrower.

This image is property of b3353362.smushcdn.com.

The Role of Bad Credit Loan in Mortgage Approval

Bad Credit Loan specializes in providing mortgages designed for individuals with diverse credit backgrounds. Recognizing the hurdles faced by those with less-than-ideal credit scores, Bad Credit Loan adopts an inclusive approach, ensuring that financial opportunities are not limited by past credit setbacks.

Specializing in mortgages for individuals with bad credit

One of the key roles of Bad Credit Loan is to provide mortgages specifically tailored for individuals with bad credit. By specializing in this niche, the company can assess applicants based on a comprehensive understanding of their credit history and financial circumstances.

Tailoring solutions to diverse credit backgrounds

Bad Credit Loan understands that each borrower’s credit background is unique. As such, the company tailors solutions to meet the individual needs of borrowers with bad credit. This approach allows borrowers to access mortgage options that align with their financial capabilities and homeownership goals.

Providing flexible mortgage options

Flexibility is a central component of Bad Credit Loan’s approach to mortgages. By offering customizable mortgage options, the company ensures that borrowers with bad credit can find terms that suit their specific circumstances. This flexibility allows individuals to pursue homeownership with confidence and peace of mind.

Benefits of Bad Credit Loan

In addition to their specialized approach to mortgages for individuals with bad credit, Bad Credit Loan offers several benefits that make them an attractive option for prospective homeowners.

User-friendly online platform for convenient applications

Bad Credit Loan provides a user-friendly online platform that allows individuals to conveniently apply for a mortgage from the comfort of their homes. This streamlined process eliminates the need for extensive paperwork and bureaucratic hurdles, making it easier for individuals to initiate the mortgage application process.

Streamlined process with minimal paperwork

Traditional mortgage applications often require extensive paperwork and documentation. Bad Credit Loan simplifies this process by streamlining the application process and minimizing the paperwork required. This not only saves time but also reduces the stress associated with gathering and submitting documents.

Customizable mortgage options to meet individual needs

Bad Credit Loan recognizes that every borrower’s situation is unique. To address this, the company offers customizable mortgage options that can be tailored to individual financial circumstances and homeownership goals. This ensures that borrowers have access to suitable loan terms that align with their specific needs.

Transparent communication of interest rates, fees, and criteria

Transparency is a cornerstone of Bad Credit Loan’s operations. The company believes in clear and open communication, ensuring that borrowers have a complete understanding of the interest rates, fees, and eligibility criteria associated with their mortgage. This transparency enables borrowers to make informed decisions and mitigate potential surprises in the future.

Additional resources and support for successful homeownership

Bad Credit Loan understands that homeownership is a significant milestone in life. In addition to providing mortgage assistance, the company offers additional resources and support to help individuals succeed in their homeownership journey. Whether it’s mortgage planning tools, homeownership education, or personalized guidance, Bad Credit Loan aims to empower individuals to navigate the complexities of mortgages and achieve their homeownership goals.

This image is property of b9v9j8r7.rocketcdn.me.

Responsibility in Borrowing and Maintaining Homeownership

While Bad Credit Loan provides opportunities for individuals with less-than-perfect credit scores, it’s crucial to practice responsible borrowing and diligent repayment when taking on a mortgage. Responsible borrowing is essential for building financial stability and maintaining homeownership in the long run.

Importance of responsible borrowing

Responsible borrowing involves making informed financial decisions and managing debt responsibly. This includes making timely mortgage payments, staying within financial limits, and avoiding unnecessary debt. By practicing responsible borrowing habits, borrowers can build a positive credit history and improve their overall financial standing.

Factors to consider before taking on a mortgage

Before taking on a mortgage, there are several factors that borrowers with bad credit should consider. This includes assessing their financial readiness for homeownership, understanding the costs associated with purchasing and maintaining a home, and ensuring that they have a realistic budget in place. It’s essential to have a comprehensive understanding of the responsibilities and obligations that come with homeownership before committing to a mortgage.

Diligent repayment for building financial stability

Diligent repayment is crucial for building financial stability and maintaining homeownership in the long run. By making timely mortgage payments and consistently meeting financial obligations, borrowers with bad credit can demonstrate their commitment to financial responsibility. This can improve their credit score over time and open up opportunities for better loan terms in the future.

Maintaining good credit for future opportunities

Even after obtaining a mortgage with bad credit, it’s important to continue working on improving and maintaining good credit. By continuing to practice responsible financial habits, borrowers can gradually rebuild their credit score and open up opportunities for future financial endeavors. This includes potential refinancing options, access to more favorable loan terms, and a broader range of financial opportunities.

Conclusion

In conclusion, Bad Credit Loan serves as a trusted partner for individuals seeking access to mortgages tailored to their unique financial circumstances. Through its accessible platform, flexible options, and transparent practices, the company empowers individuals to unlock the opportunities of homeownership. Whether it’s purchasing a dream home, refinancing for better terms, or accessing home equity, Bad Credit Loan stands ready to support borrowers in achieving their homeownership goals. By practicing responsible borrowing and diligent repayment, individuals can build financial stability and lay the foundation for long-term homeownership success with the help of Bad Credit Loan.