Are you dreaming of owning your own home but worried about your credit history holding you back? Look no further than Bad Credit Loan. With their specialized mortgages designed for individuals with diverse credit backgrounds, they make the seemingly impossible, possible. Their user-friendly online platform allows you to conveniently apply for a mortgage from the comfort of your home, eliminating the hassles of traditional applications. Not only do they provide customizable mortgage options to meet your unique needs, but they also prioritize transparency in every interaction, ensuring you fully understand the terms of your mortgage agreement. And it doesn’t stop there; Bad Credit Loan offers resources and support to help you succeed in your homeownership journey. With responsible borrowing and diligent repayment, you can build financial stability and achieve your goals with confidence. So, why wait? Let Bad Credit Loan be your trusted partner in unlocking the opportunities of homeownership.

Determining Your Budget

When it comes to determining your budget for a monthly mortgage payment, it’s important to take a comprehensive look at your financial situation. This involves calculating your monthly income, evaluating your monthly expenses, and determining your maximum monthly payment.

Calculate Your Monthly Income

To get started, calculate your monthly income. This includes your regular salary or wages, as well as any additional sources of income such as bonuses or rental income. It’s important to have a clear understanding of your total monthly income in order to accurately determine your budget for a mortgage payment.

Evaluate Your Monthly Expenses

Next, evaluate your monthly expenses. This includes all your regular monthly bills, such as utilities, groceries, transportation costs, and any other necessary expenses. It’s important to be thorough and include all expenses, both fixed and variable, to get an accurate picture of your financial obligations.

Determine Your Maximum Monthly Payment

Once you have a clear understanding of your monthly income and expenses, you can determine your maximum monthly payment for a mortgage. This is the amount you can comfortably afford to allocate towards your mortgage payment each month without compromising your other financial obligations.

Debt-to-Income Ratio

Understanding your debt-to-income ratio is crucial when determining your budget for a mortgage payment. This ratio compares your monthly debt payments to your monthly income and helps lenders assess your ability to take on additional debt.

Understanding Debt-to-Income Ratio

Your debt-to-income ratio is calculated by dividing your total monthly debt payments by your gross monthly income. It is typically expressed as a percentage. Lenders generally prefer borrowers to have a lower debt-to-income ratio, as it indicates a lower risk of defaulting on loan payments.

Calculating Your Debt-to-Income Ratio

To calculate your debt-to-income ratio, add up all your monthly debt payments, including credit card bills, loan payments, and any other outstanding debts. Then, divide this total by your gross monthly income (your income before taxes and deductions). Multiply the result by 100 to get your debt-to-income ratio as a percentage.

Recommended Debt-to-Income Ratio

While specific guidelines may vary depending on the lender and the type of mortgage, a general recommendation is to have a debt-to-income ratio of 43% or lower. This provides a good balance between managing your existing debts and taking on a mortgage payment.

This image is property of i0.wp.com.

Factors to Consider

In addition to your income and debt-to-income ratio, there are several other factors to consider when determining your budget for a monthly mortgage payment.

Other Financial Obligations

Consider any other financial obligations you may have, such as child support, alimony payments, or student loan payments. These should be factored into your budget to ensure you can comfortably afford your mortgage payment while still meeting these obligations.

Emergency Fund

It’s important to have an emergency fund in place before purchasing a home. This fund should cover unexpected expenses such as medical bills or home repairs. Consider setting aside enough money to cover three to six months’ worth of living expenses.

Future Financial Goals

Think about your future financial goals and how a mortgage payment will impact your ability to achieve them. Consider factors such as saving for retirement, paying for your children’s education, or starting a business. Ensure that your mortgage payment aligns with your long-term financial plans.

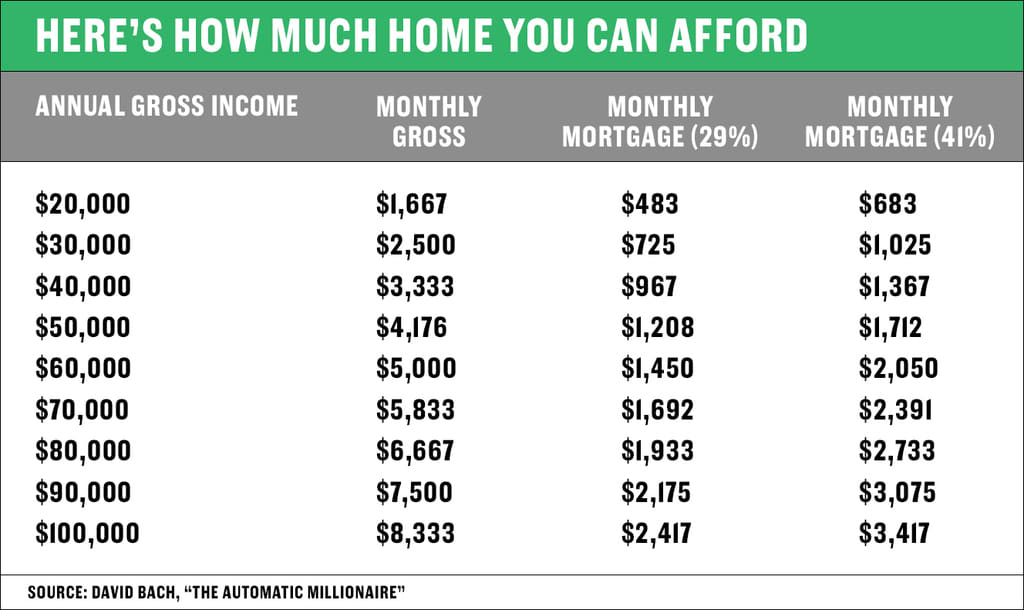

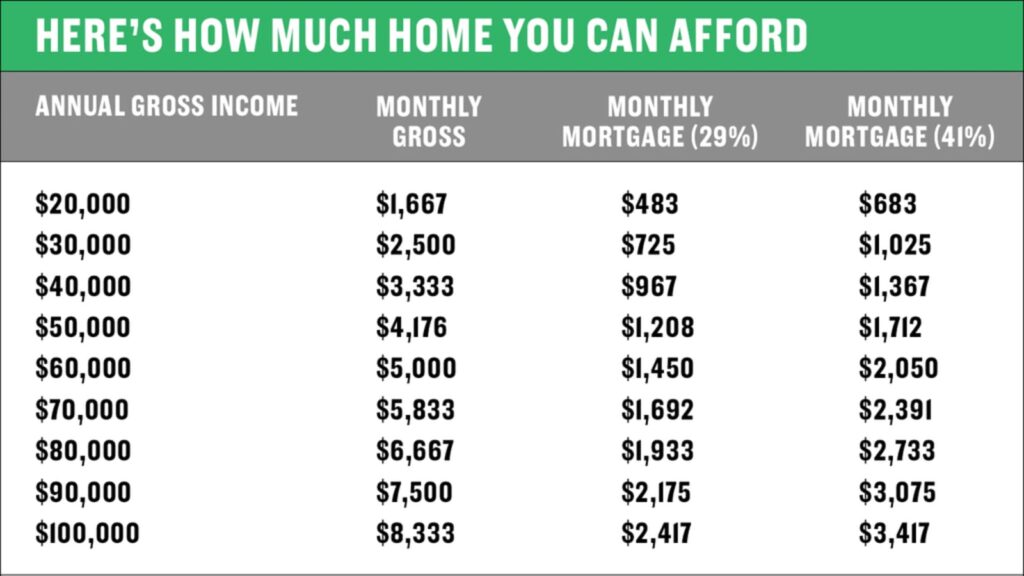

Affordability Guidelines

There are several affordability guidelines that can help you determine how much you can comfortably afford for a monthly mortgage payment.

Rule of Thumb

One common rule of thumb is the 28/36 rule. This means that your total monthly housing expenses (including mortgage payment, property taxes, and homeowners insurance) should not exceed 28% of your gross monthly income. Additionally, your total monthly debt payments (including housing expenses) should not exceed 36% of your gross monthly income.

Front-End Ratio

The front-end ratio is another affordability guideline that focuses specifically on your housing expenses. It is calculated by dividing your total monthly housing expenses by your gross monthly income. Lenders generally prefer a front-end ratio of 28% or lower.

Back-End Ratio

The back-end ratio includes all your monthly debt payments, not just your housing expenses. It is calculated by dividing your total monthly debt payments by your gross monthly income. Lenders generally prefer a back-end ratio of 36% or lower.

This image is property of image.cnbcfm.com.

Down Payment and Interest Rates

Your down payment and the interest rate on your mortgage can have a significant impact on your monthly mortgage payment and overall affordability.

Impact of Down Payment

A larger down payment will reduce the principal amount of your mortgage, resulting in a lower monthly payment. It can also help you secure a lower interest rate and reduce the amount of private mortgage insurance (PMI) required. Saving for a larger down payment can therefore make your monthly mortgage payment more affordable.

Effect of Interest Rates

Interest rates can greatly affect the affordability of your mortgage payment. Higher interest rates will result in a higher monthly payment, while lower interest rates will result in a lower monthly payment. It’s important to consider the current interest rate environment and how it may impact your monthly mortgage payment.

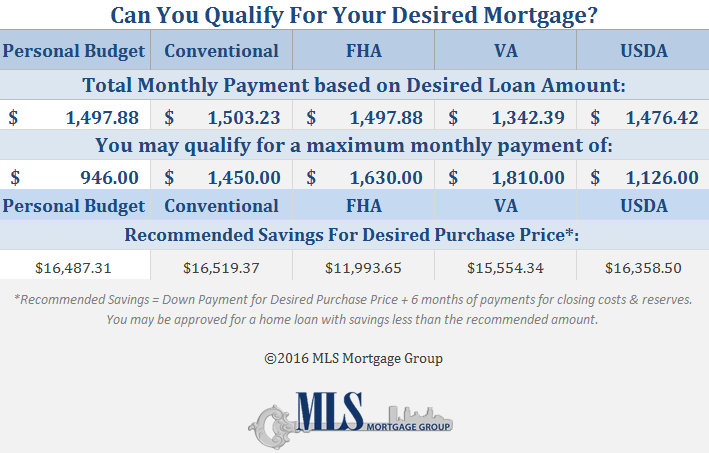

Mortgage Options

There are several mortgage options available, each with its own advantages and considerations. Understanding these options can help you determine the most suitable mortgage for your financial situation.

Fixed-Rate Mortgage

A fixed-rate mortgage offers a consistent interest rate and monthly payment for the entire term of the loan. This can provide stability and predictability for budgeting purposes, as your monthly mortgage payment will remain the same throughout the life of the loan.

Adjustable-Rate Mortgage

An adjustable-rate mortgage (ARM) offers an initial fixed interest rate for a specified period, after which the rate will adjust periodically based on market conditions. ARMs often offer lower initial interest rates, but they can increase in the future, potentially resulting in higher monthly payments.

Government-Backed Loans

Government-backed loans, such as those offered by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), provide financing options with lower down payment requirements and more flexible qualification criteria. These loans can be beneficial for borrowers who may not meet the strict requirements of conventional mortgages.

This image is property of fastercapital.com.

Additional Costs

When budgeting for a monthly mortgage payment, it’s important to consider the additional costs associated with homeownership.

Homeowners Insurance

Homeowners insurance is necessary to protect your investment in case of damage or loss. The cost of homeowners insurance will vary depending on factors such as the value of your home, location, and coverage options. Be sure to budget for this additional expense when determining your monthly mortgage payment.

Property Taxes

Property taxes are another ongoing expense associated with homeownership. The amount you’ll owe in property taxes will depend on the assessed value of your home and the tax rate in your area. It’s important to factor in these taxes when budgeting for your monthly mortgage payment.

Maintenance and Repairs

Owning a home comes with ongoing maintenance and repair costs. From routine maintenance tasks to unexpected repairs, it’s important to allocate funds for these expenses to ensure the long-term affordability of your mortgage payment.

Pre-Approval Process

Before you start searching for your dream home, it’s beneficial to go through the pre-approval process. This involves gathering necessary documents, submitting an application, and receiving a pre-approval letter.

Gather Necessary Documents

To begin the pre-approval process, gather the necessary documents that lenders will require. These may include proof of income, bank statements, tax returns, and proof of identity. Having these documents ready will streamline the pre-approval process.

Submit Application

Once you’ve gathered the necessary documents, you can submit your pre-approval application to a lender. This will involve providing information about your income, assets, employment history, and any outstanding debts. The lender will review this information to determine the amount you can be pre-approved for.

Receive Pre-Approval Letter

If your pre-approval application is successful, you will receive a pre-approval letter from the lender. This letter will state the maximum amount you are pre-approved for, which can help guide your home search and negotiations with sellers. Having a pre-approval letter in hand demonstrates to sellers that you are a serious and qualified buyer.

This image is property of i0.wp.com.

Working with a Lender

Once you have been pre-approved for a mortgage, it’s important to choose the right lender and understand your loan options.

Choosing the Right Lender

When selecting a lender, consider factors such as interest rates, loan terms, fees, and customer service. It’s important to choose a lender that offers a mortgage product that aligns with your financial goals and provides excellent customer support throughout the process.

Getting Pre-Qualified

Once you have chosen a lender, you may also want to get pre-qualified for a mortgage. This involves providing some basic financial information to the lender, who will then provide an estimate of the amount you may be eligible to borrow. While pre-qualification is not as comprehensive as pre-approval, it can give you a general idea of what you can afford.

Reviewing Loan Options

Work closely with your lender to review the various loan options available to you. Consider factors such as interest rates, loan terms, and down payment requirements. Your lender can help guide you through the process and provide insights into which loan option may be the best fit for your financial situation.

Seeking Professional Advice

If you have any doubts or concerns about determining your budget for a monthly mortgage payment, it can be beneficial to seek professional advice from a financial advisor or mortgage broker.

Consulting with a Financial Advisor

A financial advisor can provide personalized guidance based on your unique financial situation. They can help you assess your current financial position, determine a suitable budget for a monthly mortgage payment, and ensure that taking on a mortgage aligns with your long-term financial goals.

Getting Help from a Mortgage Broker

A mortgage broker can provide assistance in finding the right mortgage for your needs. They have access to a wide range of mortgage products from different lenders and can help you compare options and find the most suitable terms and rates. Working with a mortgage broker can simplify the mortgage process and ensure that you are getting the best possible loan for your financial situation.

In conclusion, determining your budget for a monthly mortgage payment requires a comprehensive evaluation of your financial situation. By calculating your monthly income, evaluating your monthly expenses, and understanding your debt-to-income ratio, you can determine a comfortable and affordable budget. Additionally, considering factors such as your down payment, interest rates, and mortgage options can further help you determine the right mortgage for your needs. Remember to also factor in additional costs associated with homeownership, such as insurance and property taxes. And don’t hesitate to seek professional advice from a financial advisor or mortgage broker to ensure you make informed decisions throughout the process. With careful planning and consideration, you can confidently navigate the journey towards homeownership.