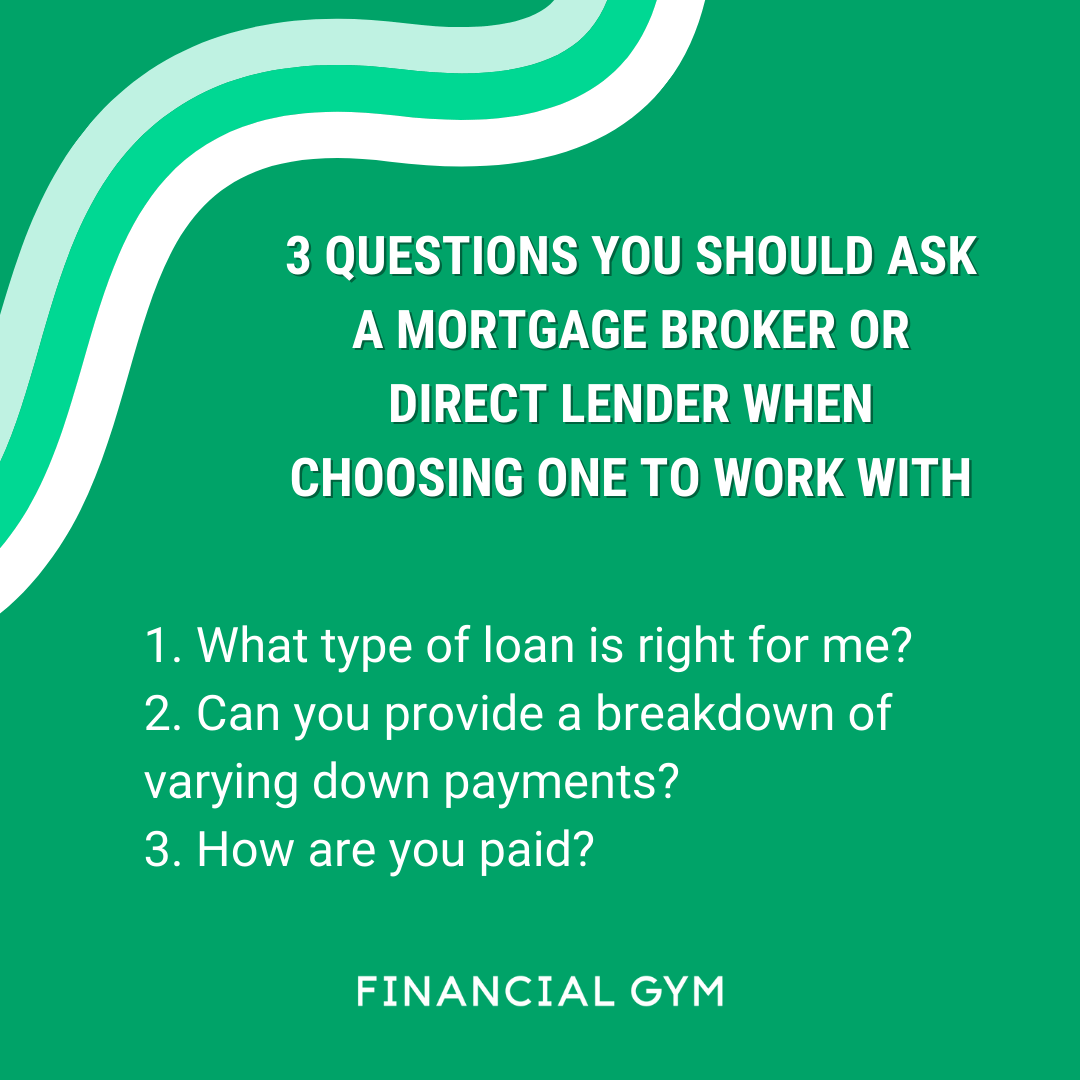

When considering a mortgage option, it’s essential to ask the right questions to ensure that you make an informed decision. Some questions to ask a mortgage lender include: What types of mortgages do you offer? What are the Interest rates and terms? Are there any additional fees or closing costs? What are the eligibility requirements? Can I get pre-approved for a mortgage? How long does the application process take? By asking these questions, you can gather the necessary information to make the best choice for your homeownership goals. With Bad Credit Loan as your trusted partner, you can confidently navigate the mortgage process and unlock the opportunities of homeownership. When considering a mortgage option, it’s important to gather all the necessary information to make an informed decision. Here are some questions you can ask a mortgage lender to ensure you have a clear understanding of the eligibility requirements, loan options, terms and conditions, and the level of support provided throughout the process:

1. Eligibility and Qualifications

What are the minimum credit score requirements?

Understanding the minimum credit score requirements is crucial, especially if you have a less-than-perfect credit history. By knowing the specific credit score needed, you can determine if you meet the eligibility criteria and whether you need to take any steps to improve your credit before applying for a mortgage.

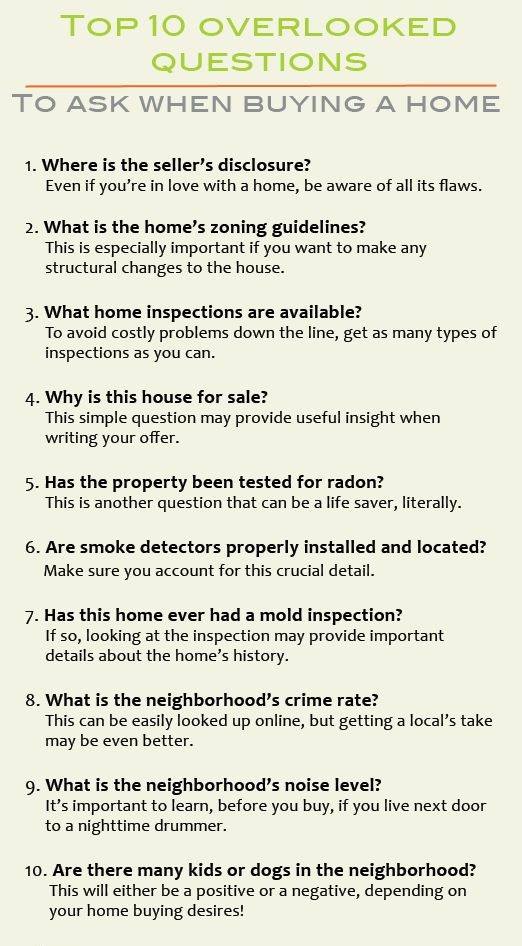

What factors affect the eligibility for a mortgage?

In addition to credit scores, there are other factors that lenders consider when assessing eligibility for a mortgage. This could include your income, employment history, debt-to-income ratio, and any existing financial obligations. Knowing the factors that lenders consider will help you better prepare your application and present a strong case for approval.

Are there any specific requirements for self-employed borrowers?

If you are self-employed, it’s essential to understand if there are any additional requirements or documentation needed to prove your income stability. Self-employed individuals often face unique challenges when applying for a mortgage, and knowing the specific requirements will help you navigate the process more effectively.

2. Loan Types and Options

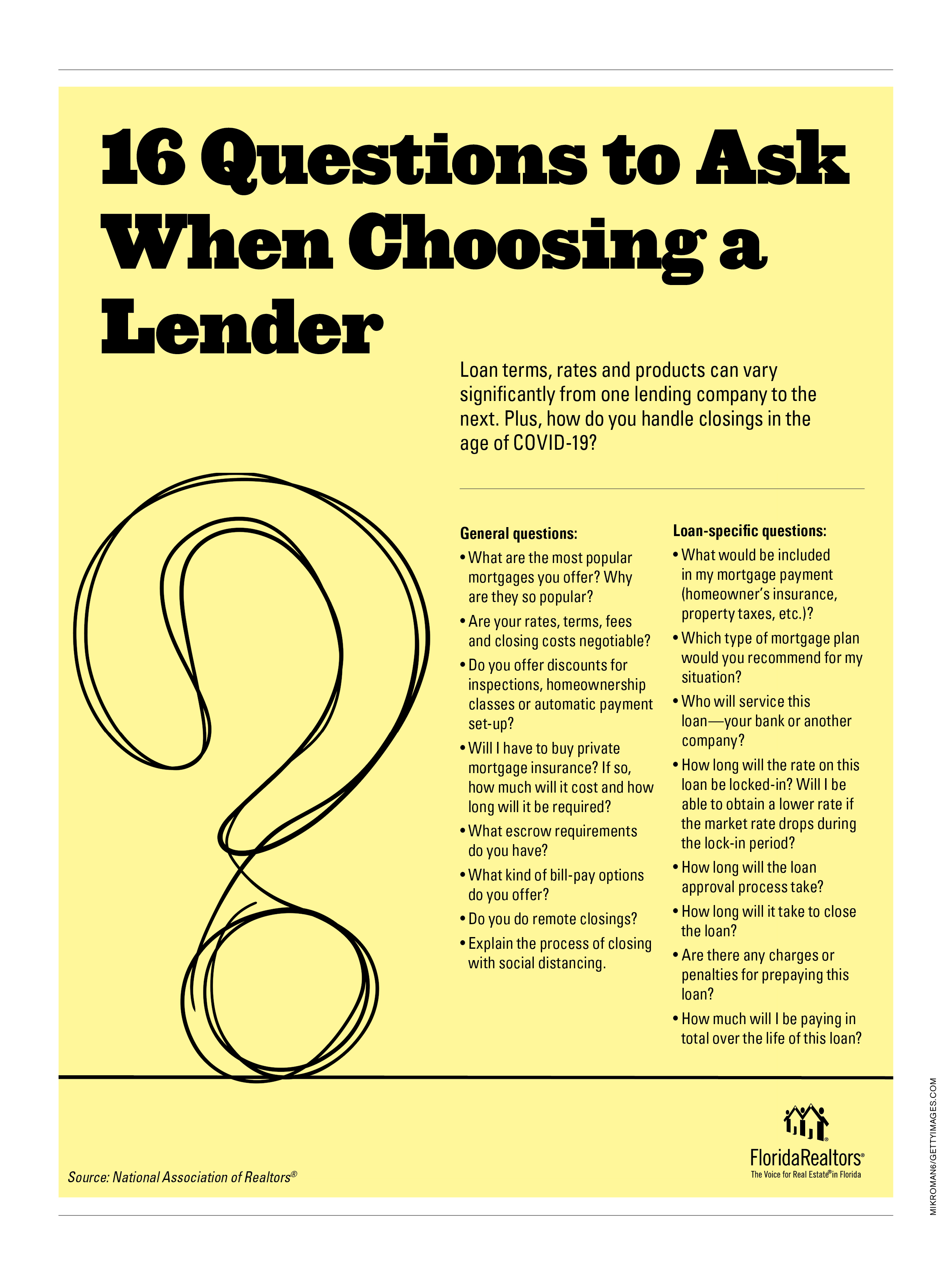

What types of mortgages do you offer?

Understanding the different types of mortgages available will help you determine which option best suits your needs. Whether it’s a conventional loan, FHA loan, VA loan, or other specialized programs, knowing the options available will allow you to make an informed decision about the type of mortgage that is most suitable for your situation.

What are the interest rates for each loan option?

Interest rates play a significant role in the overall cost of the mortgage. It’s important to ask the mortgage lender about the interest rates for each loan option and how they may vary based on your credit score, loan amount, and other factors. This will help you make a realistic assessment of the affordability of each loan option.

Are there any adjustable-rate mortgage (ARM) options?

Adjustable-rate mortgages (ARMs) may be an option for borrowers who prefer flexibility in their mortgage payments. If the lender offers ARMs, ask about the specific terms, how the interest rate adjusts over time, and any caps or limits on interest rate changes. Understanding the risks and benefits of ARMs will help you decide if it’s the right choice for you.

This image is property of images.squarespace-cdn.com.

3. Down Payment and Closing Costs

What is the minimum down payment requirement?

Down payment requirements can vary depending on the type of mortgage and your personal financial situation. It’s essential to clarify the minimum down payment required and whether there are any options for lower down payments. This information will help you plan your finances and determine how much you need to save before applying for a mortgage.

What are the closing costs associated with the mortgage?

Closing costs are additional fees associated with the mortgage transaction. They can include appraisal fees, title insurance, attorney fees, and other expenses. By understanding the closing costs involved, you can budget accordingly and ensure you have enough funds to cover these expenses.

Are there any down payment assistance programs available?

Some lenders and government programs offer down payment assistance programs that can help borrowers with limited funds for a down payment. Inquire about any available assistance programs and the eligibility requirements. This could be a valuable resource for you if you need financial assistance to meet the down payment requirements.

4. Loan Terms and Repayment

What is the duration of the loan term?

Loan terms can vary, with the most common being 15 years and 30 years. Ask the lender about the available loan term options and how they may affect your monthly payments and the total cost of the mortgage over time. Understanding the loan term will allow you to select the option that aligns with your long-term financial goals.

Is there a prepayment penalty for paying off the loan early?

Paying off your mortgage early can save you money on interest payments. However, some mortgages have prepayment penalties, which are fees charged for paying off the loan before a specified period of time. It’s important to ask the lender if there are any prepayment penalties associated with the mortgage and how they may impact your plans for early repayment.

Can I choose between different repayment options?

Different repayment options, such as bi-weekly payments or accelerated payments, can help you pay off your mortgage faster and potentially save on interest. Check with the lender to see if they offer repayment options beyond the standard monthly payment, and if there are any additional fees or requirements associated with these options.

This image is property of erickinnemanloans.com.

5. Mortgage Insurance

Do I need mortgage insurance?

Mortgage insurance is typically required for borrowers who make a lower down payment or have a higher risk profile. Ask the lender if mortgage insurance is necessary for your loan and what the specific requirements are. This will help you budget for any additional costs associated with mortgage insurance.

What are the costs of mortgage insurance?

If mortgage insurance is required, inquire about the costs associated with it. This could include monthly premiums or an upfront payment. Understanding the costs of mortgage insurance will help you evaluate the overall affordability of the loan and factor in these additional expenses.

Is there an option to cancel or remove mortgage insurance in the future?

Once you have built sufficient equity in your home or your credit profile has improved, you may be eligible to cancel or remove mortgage insurance. Ask the lender about the specific criteria and process for cancelling or removing mortgage insurance in the future. This information will help you plan for potential savings in the long run.

6. Interest Rate Lock

Can I lock in the interest rate?

Interest rates can fluctuate, so it’s important to ask the lender if you can lock in the interest rate at the time of application or during the mortgage process. Locking in the interest rate can provide peace of mind and protect you from potential rate increases while your mortgage is being processed.

What is the timeframe for the rate lock?

Rate locks typically have an expiration period. Ask the lender how long the rate lock is valid and whether there are any extensions available if needed. Understanding the timeframe for the rate lock will help you plan your mortgage process accordingly and avoid any potential rate changes.

Is there a fee for extending the rate lock?

In some cases, extending the rate lock beyond the initial timeframe may incur a fee. It’s important to ask the lender if there are any fees associated with extending the rate lock and what the specific terms and conditions are. This will help you assess the potential costs and make an informed decision about extending the rate lock if necessary.

This image is property of uploads.pl-internal.com.

7. Loan Origination Process

How long does it take to process the loan application?

Knowing the timeframe for loan processing will help you plan ahead and set realistic expectations. Ask the lender about the average time it takes to process a loan application and what factors may contribute to any delays. This information will help you manage your timeline and avoid any unnecessary stress during the process.

What documents are required for the application?

Loan applications typically require supporting documents to verify your income, assets, and other financial information. Ask the lender for a comprehensive list of documents needed for the application. Having these documents ready in advance will streamline the process and help expedite the approval and closing process.

What is the timeline for loan approval and closing?

Understanding the timeline for loan approval and closing is important, especially if you have a specific timeframe for purchasing a home. Ask the lender about the average time it takes to receive loan approval and how long the closing process typically takes. This will help you plan and coordinate with other parties involved, such as sellers and real estate agents.

8. Additional Fees and Charges

Are there any additional fees or charges associated with the mortgage?

In addition to closing costs and mortgage insurance, there may be other fees or charges associated with the mortgage. These could include origination fees, underwriting fees, or administrative fees. Ask the lender to provide a breakdown of any additional fees or charges so you can assess the overall cost of the mortgage.

What are the costs of appraisal and home inspection?

Appraisal and home inspection are essential steps in the mortgage process. Ask the lender about the costs associated with these services and whether they are included in the closing costs or if they need to be paid separately. Understanding the costs of appraisal and home inspection will help you budget for these necessary expenses.

Are there any penalties for late payments?

Late payments can have significant consequences, including penalties and potential damage to your credit score. It’s important to ask the lender about the specific penalties for late payments and what options may be available if you encounter financial difficulties. Understanding the consequences of late payments will help you prioritize your mortgage payments and avoid any potential penalties.

This image is property of cmsmortgage.com.

9. Customer Support and Communication

How can I contact the mortgage lender for assistance or questions?

Having access to reliable customer support is essential throughout the mortgage process. Ask the lender about the available methods of communication, such as phone, email, or online chat, and the hours of operation. This will help you understand how to reach out for assistance or clarification whenever needed.

Will I have a dedicated loan officer throughout the process?

Having a dedicated loan officer can provide personalized support and guidance during the mortgage process. Ask the lender if you will have a dedicated loan officer assigned to your application or if you will be working with different representatives at different stages. Knowing who to contact for specific questions or concerns will help streamline communication and ensure a smooth process.

What is the best method of communication during the loan process?

Different lenders may have different preferences for communication during the loan process. Some may prefer email for document submission and updates, while others may prefer phone calls for more immediate communication. Ask the lender what their preferred method of communication is to ensure effective and timely communication throughout the process.

10. Post-Closing Support

Will the mortgage lender service the loan or sell it to another company?

After closing on your mortgage, the servicing of the loan may be transferred to a different company. Ask the lender if they service the loans or if they typically sell them to other companies. Understanding the post-closing process and who will be managing your loan will help you know whom to contact for future mortgage-related inquiries or assistance.

What resources or support are available after closing on the mortgage?

Ask the lender about the resources or support they provide to borrowers after closing on the mortgage. This could include online account management platforms, educational resources for homeownership, or assistance with refinancing options. Understanding the post-closing support available will help you navigate the responsibilities of homeownership and make informed decisions about your mortgage in the future.

What options are available for refinancing in the future?

As your financial situation or market conditions change, you may consider refinancing your mortgage to take advantage of lower interest rates or to access the equity in your home. Ask the lender about the refinancing options available and the criteria for qualifying for a refinance. This will help you plan for potential refinancing opportunities in the future.

In conclusion, asking these questions to a mortgage lender will help you gather all the necessary information to make an informed decision about your mortgage options. Understanding the eligibility requirements, loan types, costs, repayment terms, and support provided by the lender will empower you to choose the mortgage option that best fits your financial goals and needs. Remember to review all terms and conditions carefully and seek advice from a financial professional if needed to ensure responsible borrowing and successful homeownership.