Are you dreaming of owning a home in a rural area but struggling with less-than-perfect credit? Look no further than Bad Credit Loan. With a mission to make homeownership accessible to all, Bad Credit Loan offers tailored mortgage solutions designed for individuals with diverse credit backgrounds. Through their user-friendly online platform, you can conveniently apply for a mortgage from the comfort of your home, eliminating the bureaucratic hurdles associated with traditional applications. With customizable loan options, transparent practices, and additional resources and support, Bad Credit Loan is your trusted partner in achieving your rural homeownership dreams.

This image is property of cdn2.assets-servd.host.

What is a USDA loan?

A USDA loan, also known as a Rural Development Loan, is a mortgage loan program offered by the United States Department of Agriculture (USDA). It is specifically designed to help moderate to low-income households purchase homes in designated rural areas.

Definition

A USDA loan is a type of mortgage loan that offers a variety of benefits to borrowers looking to purchase a home in a rural area. It is backed by the USDA and provides low to moderate-income borrowers with affordable financing options.

Eligibility requirements

To be eligible for a USDA loan, certain requirements must be met. These include:

- The property must be located in a designated rural area.

- The borrower’s income must fall within the specified limits.

- The borrower must be a U.S. citizen or have permanent residency.

- The borrower must have a stable income and an acceptable credit history.

Benefits

There are several benefits to obtaining a USDA loan, including:

- Zero down payment: One of the main advantages of a USDA loan is that it requires no down payment. This makes it an attractive option for borrowers who may not have the funds to make a substantial down payment.

- Low interest rates: USDA loans typically offer competitive interest rates, making them an affordable option for borrowers.

- Flexible credit requirements: USDA loans are more lenient when it comes to credit requirements. Borrowers with less-than-perfect credit may still be eligible for a USDA loan.

- No private mortgage insurance (PMI): Unlike other types of loans, USDA loans do not require borrowers to pay for private mortgage insurance, saving borrowers money over the life of the loan.

- Fixed-rate mortgages: USDA loans offer fixed interest rates, providing borrowers with stability and predictability in their monthly mortgage payments.

Understanding the USDA loan process

The process of obtaining a USDA loan involves several steps that borrowers need to follow. These steps include:

Step 1: Prequalification

Before starting the loan application process, it is recommended to get prequalified for a USDA loan. This involves providing basic financial information to a USDA-approved lender who will evaluate your eligibility based on income, credit history, and other factors.

Step 2: Property eligibility

It is important to determine if the property you are interested in is eligible for a USDA loan. The USDA provides an online tool where you can enter the property address to check its eligibility.

Step 3: Loan application

Once you have determined your eligibility and found a suitable property, you can begin the loan application process. This involves providing documentation such as income verification, employment history, and bank statements to the lender.

Step 4: Loan processing and underwriting

After submitting your loan application, the lender will review your documents, verify your information, and determine if you meet all the USDA loan requirements. This process can take several weeks, so it is important to be patient and responsive to any requests for additional information.

Step 5: Loan approval

If your loan application is approved, the lender will issue a loan commitment letter outlining the terms and conditions of the loan. This letter will also include the interest rate, loan amount, and other important details.

Step 6: Loan closing

The final step in the USDA loan process is the loan closing. This is when all the necessary documents are signed and the loan funds are disbursed. It is important to review all the documents carefully and ask any questions before signing.

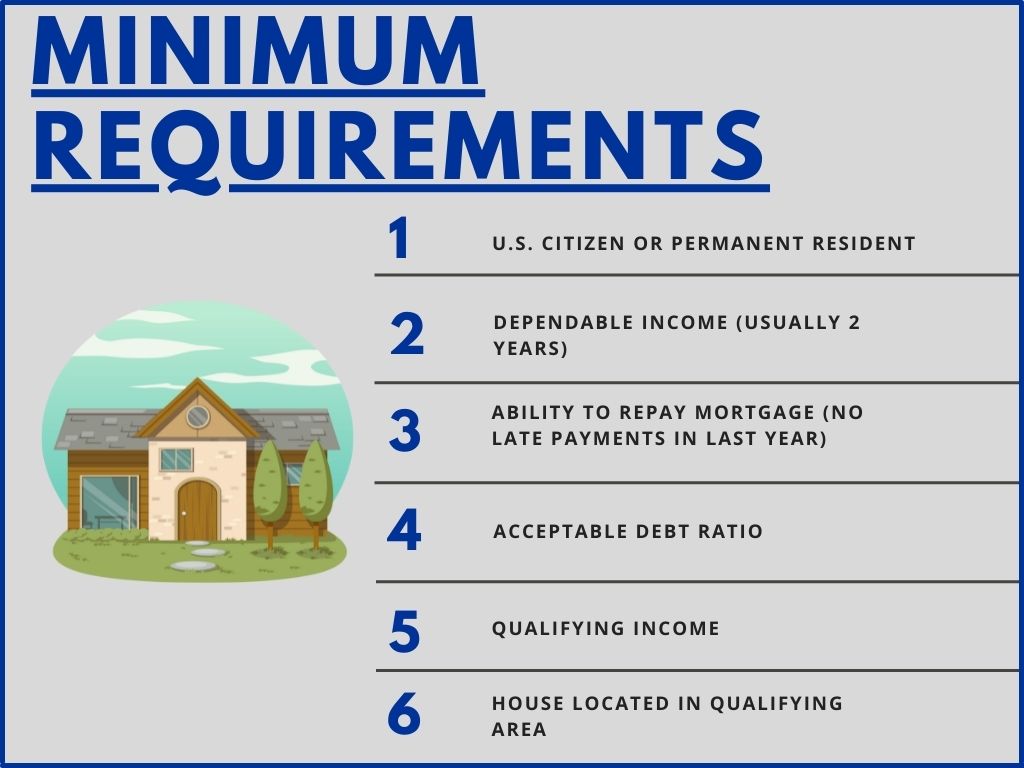

This image is property of www.mortgagecalculator.org.

USDA loan requirements

To be eligible for a USDA loan, borrowers must meet certain requirements. These requirements include:

Minimum credit score

While USDA loans are more lenient when it comes to credit requirements compared to conventional loans, there is still a minimum credit score requirement. The exact credit score needed may vary depending on the lender, but a score of at least 640 is typically required.

Income limits

USDA loans are designed to help low to moderate-income households, so there are income limits that borrowers must meet. These income limits are based on the area’s median income and the number of people in the household. The exact limits vary by location.

Property requirements

To be eligible for a USDA loan, the property must meet certain requirements. This includes being located in a designated rural area as defined by the USDA. The property must also meet certain standards for safety and livability.

Debt-to-income ratio

Borrowers must have a reasonable debt-to-income ratio to qualify for a USDA loan. This ratio compares the borrower’s monthly debt payments to their gross monthly income. Generally, the debt-to-income ratio should not exceed 41%.

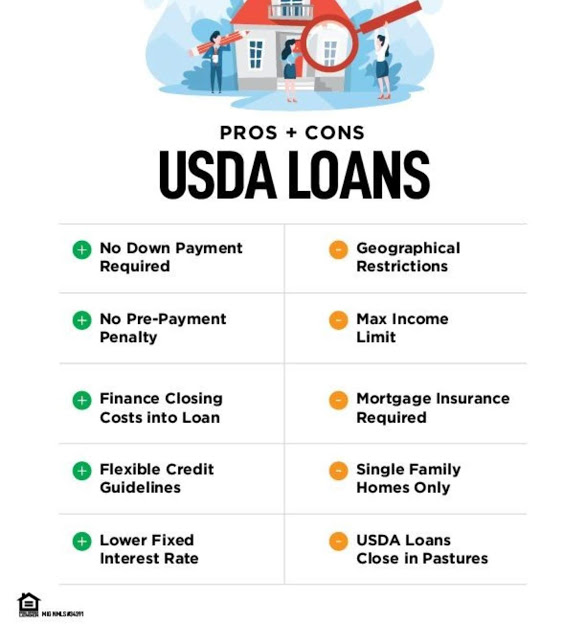

Advantages of USDA loans

USDA loans offer several advantages to borrowers looking to purchase a home in rural areas. These advantages include:

Zero down payment

One of the key advantages of a USDA loan is the ability to finance 100% of the purchase price of the home. This means that borrowers do not need to make a down payment, making homeownership more accessible to those who may not have the funds for a large down payment.

Low interest rates

USDA loans typically offer competitive interest rates, often lower than those offered by conventional loans. This can result in significant savings over the life of the loan.

Flexible credit requirements

USDA loans are more lenient when it comes to credit requirements. Borrowers with less-than-perfect credit may still be eligible for a USDA loan, making it an attractive option for those who may have had some financial challenges in the past.

No private mortgage insurance (PMI)

Unlike other types of loans, USDA loans do not require borrowers to pay for private mortgage insurance (PMI). This can result in significant savings over the life of the loan.

Fixed-rate mortgages

USDA loans offer fixed interest rates, providing borrowers with stability and predictability in their monthly mortgage payments. This can make budgeting and financial planning easier for homeowners.

This image is property of lh7-us.googleusercontent.com.

Disadvantages of USDA loans

While USDA loans offer many advantages, there are also some disadvantages to consider. These include:

Geographic restrictions

One of the main disadvantages of USDA loans is that they are only available for homes located in designated rural areas. This means that borrowers looking to purchase a home in an urban or suburban area may not be eligible for a USDA loan.

Income limitations

USDA loans are designed to assist low to moderate-income households, so there are income limitations. Borrowers whose income exceeds the specified limits may not be eligible for a USDA loan.

Funding limitations

USDA loans are subject to funding availability, which means that there is a limited amount of funding allocated for these loans. In some cases, funds may run out, and borrowers may need to wait for additional funding to become available.

Loan processing times

Due to the comprehensive underwriting and approval process, USDA loans can take longer to process compared to other types of loans. Borrowers should be prepared for potentially longer wait times before their loan is approved and closed.

Applying for a USDA loan

If you are interested in applying for a USDA loan, here are the steps you should follow:

Find a USDA-approved lender

Start by finding a lender that is approved by the USDA to offer these loans. The USDA provides a list of approved lenders on their website. It is a good idea to research and compare multiple lenders to find one that offers competitive rates and terms.

Gather necessary documents

Before applying for a USDA loan, gather all the necessary documents, including proof of income, tax returns, bank statements, and any other documentation that the lender may request.

Complete the loan application

Once you have gathered all the necessary documents, complete the loan application provided by the lender. Make sure to fill out all the required fields accurately and provide any additional information or explanations as needed.

Submit the application

After completing the loan application, submit it to the lender along with all the necessary documents. The lender will review your application and documents and begin the underwriting process.

Wait for loan approval

Once your application has been submitted, the lender will review your documents, verify your information, and determine if you meet all the USDA loan requirements. This process can take several weeks, so it is important to be patient and responsive to any requests for additional information.

This image is property of sellbuymdhomes.com.

USDA loan repayment

When it comes to repaying a USDA loan, there are a few important factors to consider.

Interest rates

USDA loans typically offer competitive interest rates, which can vary depending on the lender and current market conditions. It is important to review the terms of your loan and understand the interest rate you will be paying.

Loan terms and repayment period

The repayment terms for USDA loans can vary, but they typically range from 15 to 30 years. This means that borrowers have a significant amount of time to repay the loan, making it more affordable for many households.

Payment options

USDA loans offer various payment options, including monthly or bi-weekly payments. Borrowers can choose the option that works best for their budget and financial situation.

USDA loan alternatives

While USDA loans can be a great option for eligible borrowers, there are also alternative loan programs that may be worth considering.

FHA loans

FHA loans are backed by the Federal Housing Administration and offer low down payment options and flexible credit requirements. Like USDA loans, FHA loans are available to borrowers with lower income and credit scores.

VA loans

VA loans are available to current and former members of the military and offer several benefits, including no down payment requirements and competitive interest rates. These loans are guaranteed by the Department of Veterans Affairs.

Conventional loans

Conventional loans are not backed by a government agency and typically have stricter credit and income requirements compared to USDA loans. However, they may be a good option for borrowers who do not meet the criteria for other loan programs.

This image is property of kentuckyusdaloan.files.wordpress.com.

Tips for financing a home with a USDA loan in rural areas

If you are considering financing a home with a USDA loan in a rural area, here are some tips to help you navigate the process:

Research eligible areas

Before starting your home search, research the eligible areas where USDA loans are available. This will help you narrow down your options and focus on properties that meet the USDA loan criteria.

Review your credit history

Even though USDA loans have more flexible credit requirements compared to other loan programs, it is still important to review your credit history and address any issues before applying for a loan. Make sure to pay bills on time, reduce credit card balances, and dispute any inaccuracies on your credit report.

Get prequalified

Before starting the loan application process, get prequalified for a USDA loan. This will give you an idea of how much you can afford to borrow and help you set realistic expectations for your home search.

Work with a USDA-approved lender

To ensure a smooth loan process, work with a lender that is approved by the USDA to offer these loans. They will have the experience and expertise to guide you through the process and answer any questions you may have.

Conclusion

Financing a home with a USDA loan in rural areas can be an excellent option for borrowers looking for affordable homeownership opportunities. USDA loans offer several benefits, including zero down payment, low-interest rates, flexible credit requirements, and no private mortgage insurance. While there are some disadvantages to consider, such as geographic restrictions and potential funding limitations, USDA loans provide a viable path to homeownership for low to moderate-income households. By understanding the USDA loan process, meeting the eligibility requirements, and working with a USDA-approved lender, borrowers can navigate the journey toward homeownership with confidence and ease.