When juggling a mortgage payment along with other debt obligations, it’s important to have strategies in place to effectively manage your finances. Prioritize your debts by considering interest rates, payment terms, and any potential consequences for non-payment. Create a budget that includes your mortgage payment, as well as your other debt repayments, and stick to it. Consider exploring options such as refinancing or consolidating your debts to make them more manageable. Additionally, communicate with your creditors and mortgage lender if you’re facing financial difficulties, as they may be able to offer alternative payment arrangements. By being proactive and mindful of your financial obligations, you can effectively navigate the challenges of managing your mortgage payment alongside other debts.

This image is property of images.pexels.com.

Evaluate Your Financial Situation

Before diving into strategies for managing your mortgage payment alongside other debt obligations, it’s important to start by evaluating your overall financial situation. This involves assessing your income and expenses, calculating your debt-to-income ratio, and considering your financial goals.

Assess Your Income and Expenses

The first step in evaluating your financial situation is to take a closer look at your income and expenses. Calculate how much money you earn each month from all sources and compare it to your monthly expenses. This will give you a clear picture of your cash flow and help you understand how much you have available to put towards your mortgage payment and other debts.

Calculate Your Debt-to-Income Ratio

Your debt-to-income ratio is a crucial metric to understand when managing your mortgage payment alongside other debts. It is calculated by dividing your total monthly debt payments by your gross monthly income. This ratio helps lenders assess your ability to repay debts and manage your financial obligations. Ideally, your debt-to-income ratio should be below 43%, but the lower the ratio, the better.

Consider Your Financial Goals

Before making any decisions about managing your mortgage payment and other debts, consider your long-term financial goals. Are you working towards paying off all your debts as quickly as possible? Or are you more focused on saving for retirement or other major life events? Understanding your goals will help you prioritize and allocate your resources effectively.

Create a Budget

Once you have evaluated your financial situation, it’s time to create a budget to better manage your income and expenses. A budget is a tool that allows you to track your income, prioritize debt payments, and trim expenses if necessary.

Track Your Income and Expenses

Start by tracking your income and expenses in detail. Keep a record of all your sources of income and categorize your expenses into fixed costs (such as mortgage payments and utility bills) and variable costs (such as groceries, entertainment, and transportation). This will give you a clear understanding of where your money is going and help you identify areas where you can cut back if needed.

Prioritize Debt Payments

Once you have a clear picture of your income and expenses, it’s important to prioritize your debt payments. Focus on paying off high-interest debts first, as they can quickly accumulate and become a burden on your finances. By tackling these debts aggressively, you can save money on interest payments and free up more funds to put towards your mortgage payment.

Trim Expenses if Necessary

If your budget reveals that your expenses exceed your income, it’s time to trim those expenses. Look for areas where you can cut back without sacrificing your basic needs or quality of life. This might involve reducing discretionary spending, finding more affordable alternatives for certain expenses, or renegotiating bills and contracts. Every dollar you save can be put towards paying off your debts and managing your mortgage payment more effectively.

This image is property of images.pexels.com.

Explore Debt Consolidation

Debt consolidation is a strategy that can help simplify your debt obligations and potentially save you money on interest payments. It involves combining multiple high-interest debts into a single, lower-interest loan or credit account.

Consolidate High-Interest Debts

Start by identifying your high-interest debts, such as credit card balances or personal loans, and explore options for consolidating them into a single loan with a lower interest rate. This can help streamline your payments and make it easier to manage your debts. You may consider options such as a balance transfer credit card, a debt consolidation loan, or a home equity loan.

Consider Refinancing Your Mortgage

If you’re struggling to manage your mortgage payment alongside other debts, refinancing your mortgage might be a viable option. Refinancing involves replacing your current mortgage with a new one that has more favorable terms, such as a lower interest rate or longer repayment period. This can lower your monthly mortgage payment and free up funds to put towards your other obligations.

Communicate with Lenders and Creditors

When dealing with financial difficulties, it’s essential to open lines of communication with your lenders and creditors. They may be willing to work with you to find solutions that make managing your mortgage payment and other debts more manageable.

Negotiate Lower Interest Rates

Reach out to your lenders and creditors to explore the possibility of negotiating lower interest rates. Explain your financial situation and ask if they can offer any temporary or permanent rate reductions. Lower interest rates can significantly reduce the financial strain and make it easier to manage your mortgage payment and other debts.

Request Payment Flexibility

If you’re having difficulty making your monthly payments, don’t hesitate to reach out to your lenders and ask for payment flexibility. They may be willing to offer you temporary relief by temporarily lowering or deferring your payments. However, keep in mind that any changes to your payment terms may have long-term implications, so it’s essential to fully understand the terms before agreeing to any modifications.

Seek Professional Advice if Needed

If you’re feeling overwhelmed and unsure how to navigate your financial challenges, consider seeking professional advice. Consult with a financial advisor who can provide personalized guidance based on your specific situation. They can help you create a comprehensive plan for managing your mortgage payment and other debts, taking into account your financial goals and resources.

This image is property of images.pexels.com.

Consider Increasing Your Income

An effective strategy for managing your mortgage payment alongside other debts is to consider increasing your income. By finding additional sources of income or investing in skill development, you can improve your financial situation and have more resources to put towards your various obligations.

Look for Additional Sources of Income

Explore opportunities for increasing your income, such as taking on a part-time job, freelancing, or starting a side business. Even a small additional income can make a significant difference in managing your mortgage payment and other debts. Consider your skills, interests, and available time when looking for additional sources of income.

Invest in Skill Development for Better Job Opportunities

Investing in skill development can open up better job opportunities and potentially lead to higher-paying positions. Consider taking courses, attending workshops, or pursuing certifications in areas that are in-demand in your industry. By improving your skills and knowledge, you can increase your earning potential and better manage your financial obligations.

Prioritize Debt Payments

As you work towards managing your mortgage payment alongside other debts, it’s crucial to prioritize your debt payments effectively. This involves paying off high-interest debts first and implementing strategies such as the debt snowball or debt avalanche method.

Pay Off High-Interest Debts First

High-interest debts, such as credit cards or payday loans, can quickly accumulate and become a significant financial burden. Prioritize paying off these debts first by allocating more funds towards their repayment. Once the highest-interest debt is paid off, you can redirect those funds towards the next highest-interest debt, creating a snowball effect that accelerates your debt payoff.

Use the Debt Snowball or Debt Avalanche Method

The debt snowball and debt avalanche methods are two popular strategies for prioritizing debt payments. The debt snowball method involves paying off your debts in order from smallest to largest balance, regardless of interest rate. This method provides psychological motivation as you see small debts being eliminated, which can keep you motivated to continue paying off your debts. The debt avalanche method, on the other hand, involves paying off debts in order of highest to lowest interest rate. While it may take longer to see a debt fully paid off, this method can save you more money in interest payments over time.

Explore Government Assistance Programs

If you’re struggling to manage your mortgage payment and other debts, it’s worth exploring government assistance programs that may provide relief or support.

Research Mortgage Assistance Programs

Check if there are any mortgage assistance programs available in your area. These programs are often designed to help homeowners facing financial difficulties by providing assistance with mortgage payments or refinancing options. Research the eligibility criteria and application process for these programs to determine if they can provide the relief you need.

Look for Debt Relief Programs or Grants

In addition to mortgage assistance programs, there may be other debt relief programs or grants available to help individuals manage their debts. These programs can provide financial relief, counseling services, or educational resources to support individuals in overcoming their financial challenges. Research local and national programs to see if you qualify for any assistance.

Seek Professional Financial Advice

If you’re feeling overwhelmed and unsure how to manage your mortgage payment and other debts effectively, it’s always a good idea to seek professional financial advice. There are professionals available who can provide guidance tailored to your situation and help you make informed decisions about your finances.

Consult with a Financial Advisor

Consider scheduling a consultation with a financial advisor who specializes in debt management and mortgage planning. They can analyze your financial situation, provide personalized advice, and help you create a comprehensive plan for managing your mortgage payment alongside other debts.

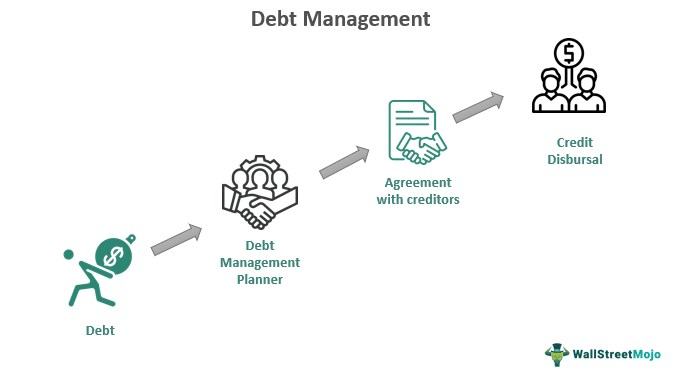

Consider Credit Counseling

Credit counseling agencies offer services to help individuals manage their debts and improve their financial situation. These agencies can negotiate with creditors on your behalf, create a debt management plan, and provide educational resources to support your financial well-being. Look for reputable credit counseling agencies that are accredited by organizations such as the National Foundation for Credit Counseling.

Explore Legal Assistance Options

In some cases, it may be necessary to seek legal assistance if you’re facing serious financial difficulties and struggling to manage your mortgage payment and other debts. Consult with a lawyer specializing in bankruptcy or foreclosure to understand your rights and explore potential legal options. Keep in mind that legal assistance should be a last resort, but it’s important to be aware of your options if you find yourself in a dire financial situation.

Review and Adjust Your Mortgage Terms

Reviewing and adjusting your mortgage terms can be a strategic move to more effectively manage your mortgage payment alongside other debts. By refinancing or seeking a loan modification, you can potentially lower your monthly mortgage payment and ease the financial burden.

Consider Refinancing for Better Terms

Refinancing your mortgage involves replacing your current mortgage with a new one that has more favorable terms. This can include a lower interest rate, longer repayment period, or different loan type. By refinancing, you can reduce your monthly mortgage payment and have more funds available to manage your other debts. However, it’s important to carefully consider the costs and potential long-term implications of refinancing before making a decision.

Request a Loan Modification

If refinancing is not a viable option, you may consider requesting a loan modification from your mortgage lender. A loan modification involves negotiating changes to the terms of your existing mortgage, such as lowering the interest rate, extending the repayment period, or changing the type of loan. This can help make your mortgage payment more affordable and manageable in conjunction with your other debts.

Stay Organized and Monitor Progress

Once you have implemented strategies for managing your mortgage payment alongside other debts, it’s crucial to stay organized and monitor your progress. This will help you stay on track and make any necessary adjustments along the way.

Keep Track of Payments and Due Dates

Make sure to keep track of all your payments and due dates to avoid missing any obligations. Set reminders and establish a routine for reviewing and paying your bills on time. Late payments can have a negative impact on your credit score and make it more difficult to manage your debts effectively.

Regularly Review and Update Your Budget

Your budget is a living document that should be regularly reviewed and updated as your financial situation evolves. Set aside time each month to review your income and expenses, adjust your budget as needed, and make sure it aligns with your financial goals. By staying proactive and making necessary adjustments, you can better manage your mortgage payment alongside your other debts.

Monitor Your Credit Score

Your credit score is an important measure of your financial health and can impact your ability to access credit in the future. Regularly monitor your credit score and credit reports to ensure there are no errors or discrepancies. Taking care of your credit score can help you qualify for better interest rates on loans, including your mortgage, and improve your overall financial well-being.

In conclusion, managing your mortgage payment alongside other debts can be a challenging task, but with careful planning and strategic approaches, it is achievable. By evaluating your financial situation, creating a budget, exploring debt consolidation options, communicating with lenders and creditors, considering increasing your income, prioritizing debt payments, exploring government assistance programs, seeking professional financial advice, reviewing and adjusting your mortgage terms, and staying organized and monitoring your progress, you can effectively manage your mortgage payment and other debts. Remember to stay proactive, make informed decisions, and prioritize responsible borrowing and diligent repayment to ensure long-term financial stability and maintain homeownership.