If you find yourself in the fortunate position of having paid off your current mortgage and are considering downsizing to a smaller home, you may be wondering what options are available to you. One possibility to explore is the concept of reverse mortgages, which allow homeowners to access the equity in their homes while still being able to live there. By downsizing to a smaller home, you can potentially free up funds for your retirement or other financial goals. This article will delve into the financial implications and benefits of downsizing, as well as provide insights into utilizing reverse mortgages as a viable option for making this transition.

This image is property of housenumbers.io.

Introduction

Congratulations on paying off your current mortgage! Now that you have reached this milestone, you may be considering downsizing to a smaller home. Downsizing offers numerous benefits, including reduced expenses, a simpler lifestyle, and the opportunity to unlock home equity. In this article, we will explore various smaller home options, discuss the financial implications of downsizing, and delve into the concept of reverse mortgages as a potential solution. By the end, you will have a comprehensive understanding of downsizing and the options available to you.

Why Consider Downsizing?

Reduced Expenses

Downsizing to a smaller home can significantly reduce your monthly expenses. Smaller homes typically have lower mortgage payments, reduced property taxes, and decreased maintenance costs. By downsizing, you can free up more of your monthly income for other important priorities, such as saving for retirement or enjoying your newfound financial freedom.

Simpler Lifestyle

Downsizing often comes hand-in-hand with a simpler lifestyle. With a smaller home, you will have less space to clean and maintain, allowing you to spend more time doing the things you love. Additionally, downsizing can help declutter your living space, leading to less stress and a greater sense of peace and tranquility.

Unlocking Home Equity

One of the most appealing aspects of downsizing is the opportunity to unlock the equity in your current home. If your home has appreciated in value since you purchased it, selling it and purchasing a smaller home can provide you with a significant sum of money. You can then use this money for various purposes, such as securing your retirement, funding your children’s education, or taking that dream vacation you’ve always wanted.

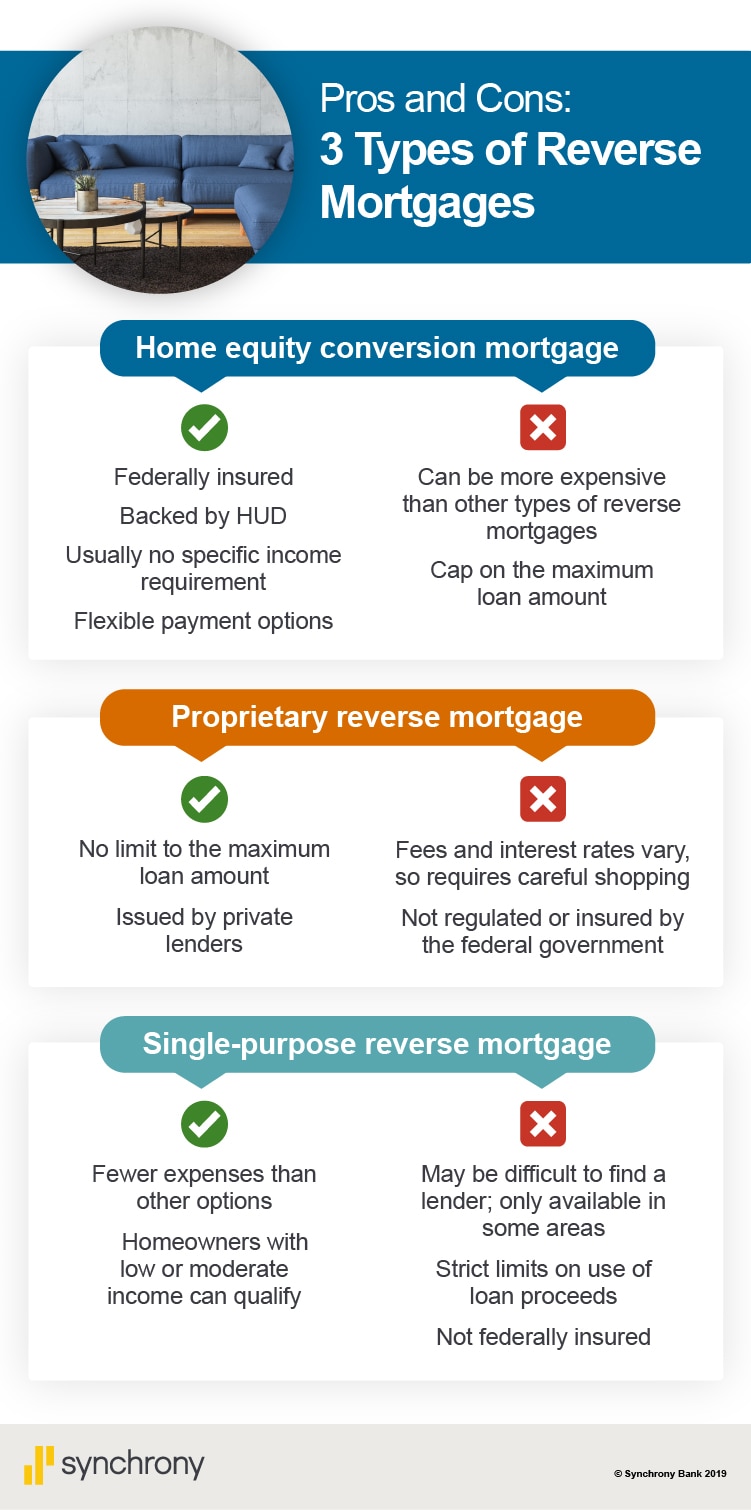

This image is property of www.synchronybank.com.

Exploring Smaller Home Options

When it comes to downsizing, there are several smaller home options to consider. Here are a few popular choices:

Condominiums

Condominiums, or condos, are a popular downsizing option for many individuals. These units are typically located within a larger building or complex and offer a range of amenities and services. Condos often require less maintenance than single-family homes, making them ideal for those looking for a simpler living situation.

Townhouses

Townhouses offer a middle-ground between condos and single-family homes. They are typically multi-level homes that share walls with neighboring units. Townhouses provide the benefits of homeownership, such as a yard and private entrance, while often requiring less maintenance than a standalone house.

Single-Story Homes

If you prefer the privacy and independence of a standalone house, but still want to downsize, single-story homes are an excellent option. These homes eliminate the need for navigating stairs, making them suitable for individuals with mobility concerns or those who simply prefer a single-level living space.

Tiny Houses

For those who truly want to downsize and embrace a minimalist lifestyle, tiny houses are worth considering. These compact homes are typically less than 500 square feet and are designed to maximize functionality and efficiency. Tiny houses can be a great option for those seeking a smaller ecological footprint and a simpler way of life.

Financial Implications of Downsizing

Lower Mortgage Payments

One of the primary financial benefits of downsizing is the potential for lower mortgage payments. Smaller homes generally come with smaller price tags, which equates to a reduced mortgage payment each month. This can free up more funds to allocate towards other financial goals or increase your overall financial stability.

Reduced Property Taxes

Property taxes are often directly tied to the value of your home. By downsizing to a smaller home, you will likely see a decrease in your property tax bill. This can provide long-term savings and help you better manage your financial resources.

Decreased Maintenance Costs

Smaller homes typically require less maintenance than larger ones. By downsizing, you can potentially save on various maintenance costs, such as repairs, landscaping, and utility bills. This reduction in expenses can make a significant difference in your monthly budget and overall financial well-being.

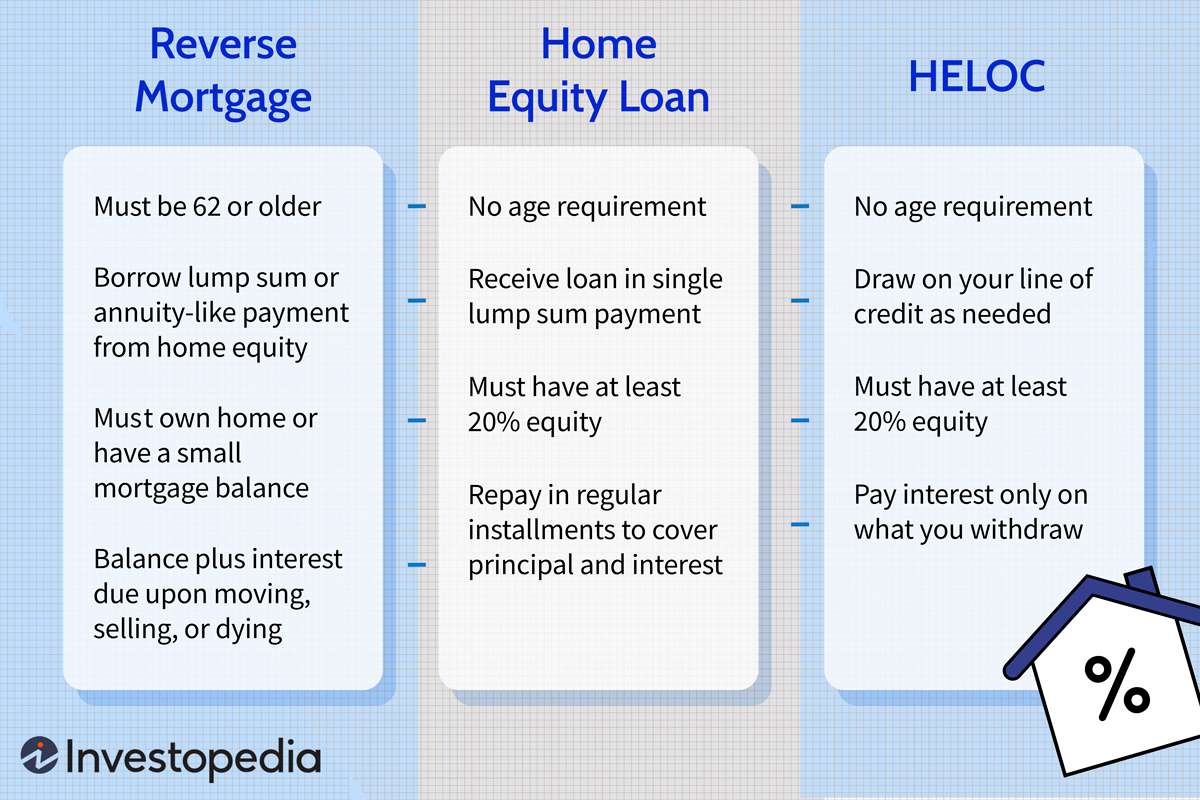

This image is property of www.investopedia.com.

Considering Reverse Mortgages

What is a Reverse Mortgage?

A reverse mortgage is a special type of loan that allows homeowners who are 62 years of age or older to convert a portion of their home equity into cash. Unlike a traditional mortgage, where you make monthly payments to the lender, a reverse mortgage pays you instead. The loan is repaid when you sell the home, move out, or pass away.

Pros of Reverse Mortgages

There are several advantages to consider when thinking about a reverse mortgage:

- Access to funds: A reverse mortgage allows you to tap into your home equity without having to sell the property.

- No monthly mortgage payments: With a reverse mortgage, you are not required to make monthly mortgage payments. This can provide additional financial flexibility, especially for retirees living on a fixed income.

- You retain ownership of your home: Despite accessing your home equity, you still own your home and can continue to live in it without disruption.

Cons of Reverse Mortgages

While reverse mortgages can be beneficial for some individuals, it is important to consider the potential drawbacks:

- Accrued interest: Unlike a traditional mortgage where you pay down the loan balance over time, a reverse mortgage accrues interest over the life of the loan, potentially leading to a higher overall repayment amount.

- Limited options for heirs: When you pass away or move out of the home, the reverse mortgage will need to be repaid. This can limit the options for your heirs, potentially reducing the inheritance they receive.

- Upfront costs: Reverse mortgages often come with upfront costs, such as closing fees and mortgage insurance premiums. It is essential to understand these costs and how they will impact your overall financial situation.

Understanding Reverse Mortgage Eligibility

Age Requirements

To be eligible for a reverse mortgage, you must be at least 62 years old. This age requirement ensures that the loan provides financial assistance to retirees or older individuals who may be facing financial challenges or are looking to supplement their retirement income.

Home Equity Criteria

In addition to the age requirement, reverse mortgages also consider your home equity. The amount you can borrow through a reverse mortgage is based on the appraised value of your home and the age of the youngest borrower. Generally, the higher your home value and the older you are, the more equity you can access.

Financial Assessment

While credit scores and income are not determining factors for reverse mortgage eligibility, lenders will conduct a financial assessment to ensure you can meet your ongoing financial obligations, such as property taxes and insurance. This assessment helps protect borrowers from potentially unsustainable financial situations.

This image is property of img.money.com.

Reverse Mortgage Options for Downsizing

Selling and Purchasing a New Home

One option for downsizing with a reverse mortgage is to sell your current home and use the proceeds to purchase a new, smaller home. This allows you to convert your home equity into cash and simultaneously downsize to a more manageable living space.

Refinancing with a Reverse Mortgage

If you already own a smaller home but are interested in accessing your home equity, you can consider refinancing with a reverse mortgage. This involves paying off your existing mortgage with the proceeds from the reverse mortgage and potentially receiving additional funds to support your financial needs.

Financial Considerations for Reverse Mortgages

Interest Rates and Fees

Reverse mortgages often come with higher interest rates and fees compared to traditional mortgages. It is important to carefully consider these costs and evaluate whether the benefits of a reverse mortgage outweigh the potential long-term financial implications.

Implications for Inheritance

As mentioned earlier, a reverse mortgage can impact the inheritance you leave for your heirs. It is important to have open and honest discussions with your loved ones about the potential implications of a reverse mortgage on any inheritance expectations.

Long-Term Financial Planning

A reverse mortgage should be part of a broader financial plan. It is crucial to consider how a reverse mortgage fits into your long-term financial goals, such as retirement planning and the overall sustainability of your financial situation.

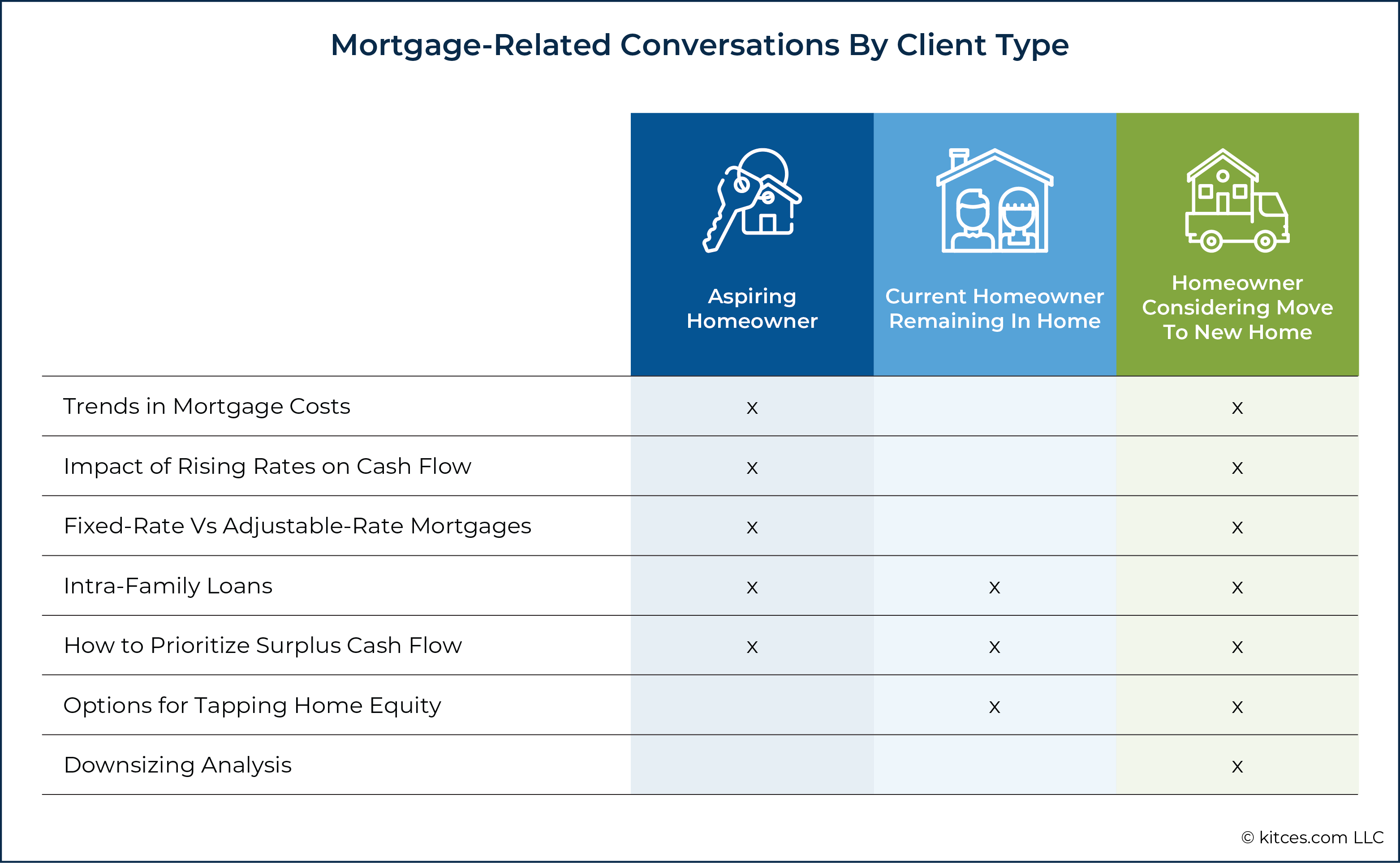

This image is property of www.kitces.com.

Consulting with a Financial Advisor

Seeking Professional Guidance

Before making any decisions regarding downsizing or a reverse mortgage, it is highly recommended to consult with a qualified financial advisor. A financial advisor can provide personalized guidance based on your specific financial situation, helping you make informed decisions that align with your goals and priorities.

Evaluating Individual Financial Situation

Every individual’s financial situation is unique, and what may work for one person may not work for another. By evaluating your individual financial situation and consulting with a financial advisor, you can determine whether downsizing and/or a reverse mortgage is the right option for you.

Conclusion

Downsizing to a smaller home after paying off your current mortgage offers numerous benefits, including reduced expenses, a simpler lifestyle, and the potential to unlock home equity. Whether you choose to explore smaller home options such as condominiums, townhouses, single-story homes, or even tiny houses, it is essential to consider the financial implications. This includes evaluating the potential impact on your mortgage payments, property taxes, and maintenance costs.

For those who want to tap into their home equity without selling their property, reverse mortgages offer a viable solution. Understanding the concept of reverse mortgages, the pros and cons, and the eligibility criteria is crucial before deciding whether it is the right option for your downsizing journey. With options such as selling and purchasing a new home or refinancing with a reverse mortgage, you have flexibility in how you can utilize your home equity while downsizing.

Ultimately, every financial decision should be made with careful consideration and professional guidance. Consulting with a financial advisor who can evaluate your individual financial situation and provide personalized advice is key to making informed choices that align with your long-term financial goals. By approaching downsizing and reverse mortgages with thoughtfulness and planning, you can achieve a smoother transition to a smaller home and enjoy the financial benefits this decision can bring.