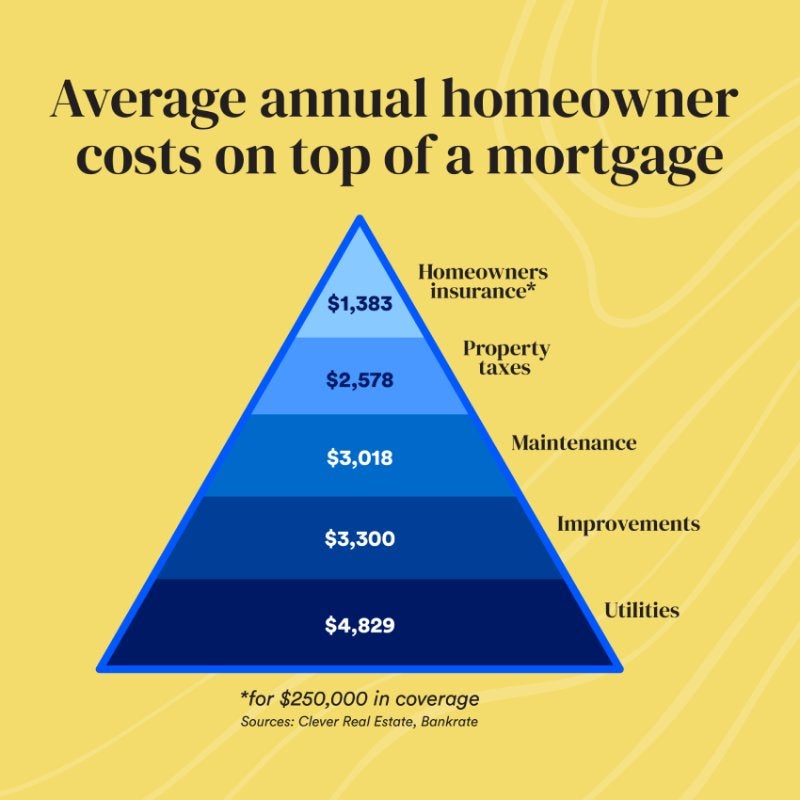

When it comes to buying a home, there are more costs to consider than just the down payment and closing costs. Property taxes and homeowners insurance are two unexpected expenses that homeowners need to factor in. Property taxes vary depending on the location of the home and can have a significant impact on the overall cost of homeownership. Homeowners insurance is another expense that protects your investment and provides peace of mind. These additional costs may seem daunting, but with the right financial planning and the assistance of Bad Credit Loan, individuals can navigate the complexities of homeownership with confidence and achieve their goals.

This image is property of fastercapital.com.

Maintenance and Repairs

Regular maintenance costs

Owning a home comes with regular maintenance expenses that should be accounted for in your budget. These costs can vary depending on the size and condition of your home, but they typically include items such as cleaning supplies, HVAC system inspections and filter replacements, pest control services, and general maintenance tasks like painting or repairing minor damages. It’s important to set aside funds for these ongoing expenses to keep your home in good condition.

Unexpected repair costs

In addition to regular maintenance, homeowners should also be prepared for unexpected repair costs that may arise. These can include major repairs such as a leaky roof, a malfunctioning HVAC system, plumbing issues, or electrical problems. It’s advisable to have an emergency fund specifically designated for these unexpected expenses. While you can’t predict when repairs will be needed, having a financial safety net can help alleviate the stress and financial burden that come with unexpected home repairs.

Homeowners Association Fees

Monthly or annual fees

If you live in a community governed by a homeowners association (HOA), you may be required to pay monthly or annual fees to cover the costs of maintaining common areas and amenities. These fees can vary significantly depending on the location and amenities provided. For example, a community with a pool, clubhouse, and landscaping services may have higher HOA fees compared to a community without these amenities. It’s important to factor in these fees when budgeting for your monthly homeownership expenses.

Special assessments

In addition to regular HOA fees, homeowners may also be subject to special assessments. These are one-time fees charged by the HOA to cover unexpected expenses or capital improvements. Special assessments are typically levied when there is a shortfall in the association’s reserves or when there is a need for significant repairs or upgrades. It’s important to be aware of the possibility of special assessments and to plan accordingly, as they can be a significant financial burden if not anticipated.

This image is property of i.insider.com.

Utilities

Electricity

Electricity is a basic necessity for any home, and the cost of electricity can vary depending on factors such as the size of your home, the number of residents, and the local utility rates. It’s important to budget for monthly electricity bills and to consider energy-efficient measures to help reduce your energy consumption and lower your utility costs in the long run.

Water and sewer

Water and sewer services are essential for maintaining a habitable living environment. The cost of water and sewer varies depending on factors such as the size of your property, the number of occupants, and the local utility rates. It’s important to budget for monthly water and sewer bills and to implement water-saving measures such as low-flow fixtures and efficient irrigation systems to help reduce the consumption and associated costs.

Gas

If your home is connected to a gas line, you will need to budget for the cost of natural gas to heat your home, operate appliances such as stoves and dryers, and provide hot water. The cost of natural gas can fluctuate depending on changes in the market, so it’s important to monitor your gas usage and adjust your budget accordingly.

Internet and cable

In today’s digital world, internet and cable services have become essential utilities for many homeowners. The cost of internet and cable can vary depending on factors such as the speed of the internet connection, the number of channels or streaming services subscribed to, and any additional features or packages. It’s important to consider these costs when budgeting for your monthly expenses and to shop around for the best deals and bundles to suit your needs and budget.

Homeowners Insurance Premiums

Annual or monthly premiums

Homeowners insurance is a crucial protection against unexpected events such as fire, theft, or natural disasters. The cost of homeowners insurance can vary depending on factors such as the location of your home, the age and condition of the property, and the coverage options you choose. Typically, homeowners insurance premiums are paid either annually or monthly. It’s important to budget for these premiums and to compare quotes from different insurance providers to ensure you are getting the best coverage at the most affordable price.

Additional coverage options

Standard homeowners insurance policies may not cover certain events or possessions, so it’s important to consider additional coverage options that may be necessary for your specific needs. For example, if you live in an area prone to flooding, you may need to purchase separate flood insurance. Additionally, if you have valuable or high-cost items such as jewelry or artwork, you may need additional endorsements or riders to ensure they are adequately covered. It’s important to discuss your specific needs with your insurance provider to determine if any additional coverage options are necessary and to factor in the associated costs.

This image is property of www.piperpartners.com.

Property Taxes

Annual taxes based on home value

Property taxes are determined based on the assessed value of your home and are typically paid annually. The amount of property taxes you will owe can vary depending on factors such as the location of your home, the local tax rates, and any exemptions or deductions you may qualify for. It’s important to research the property tax rates in your area and to budget for these annual expenses accordingly.

Potential tax increases

Property tax rates can change over time, so it’s important to be aware of the potential for tax increases in the future. Factors such as changes in local tax policies or an increase in property values could result in higher property tax bills. It’s advisable to consider the potential for tax increases when budgeting for your homeownership expenses and to plan accordingly to avoid any financial strain.

Home Warranty

Cost of home warranty plan

A home warranty is a service contract that provides coverage for the repair or replacement of certain systems and appliances in your home. The cost of a home warranty plan can vary depending on factors such as the level of coverage, the size of your home, and the specific items included in the plan. It’s important to research different home warranty providers, compare their coverage options and pricing, and determine if a home warranty is a cost-effective investment for your needs.

Coverage limitations and exclusions

It’s important to carefully review the terms and conditions of a home warranty plan to understand the coverage limitations and exclusions. Different providers may have different coverage limits, deductibles, and exclusions for certain items or pre-existing conditions. It’s important to fully understand what is covered and what is not covered by your home warranty plan to avoid any surprises or misunderstandings when filing a claim.

This image is property of www.thebalancemoney.com.

Furniture and Furnishings

Cost of furnishing the home

When moving into a new home, you will likely need to purchase furniture and furnishings to make your house feel like a home. The cost of furnishing a home can vary depending on factors such as the size of your home, your personal style and preferences, and whether you choose to buy new or used items. It’s important to budget for these expenses and to prioritize your purchases based on your immediate needs.

Appliances and home decor

In addition to furniture, you may also need to budget for appliances and home decor items. Appliances such as refrigerators, stoves, and washing machines can be significant expenses, especially if you choose higher-end or energy-efficient models. Home decor items such as curtains, rugs, and wall art can also add up. It’s important to prioritize your purchases and to consider shopping for sales or second-hand items to help manage the costs.

Landscaping and Outdoor Maintenance

Lawn care

Maintaining a well-kept lawn requires regular care and maintenance. This can include tasks such as mowing, fertilizing, weeding, and seeding. These costs can vary depending on factors such as the size of your lawn and the complexity of the landscaping. It’s important to budget for these ongoing expenses and to consider whether you will hire a professional lawn care service or if you will take care of these tasks yourself.

Tree and shrub maintenance

If you have trees and shrubs on your property, you will need to budget for their maintenance as well. This can include tasks such as pruning, trimming, and removing dead or diseased branches. Depending on the size and number of trees and shrubs on your property, it may be necessary to hire an arborist or tree care professional for these tasks. It’s important to include the cost of tree and shrub maintenance in your budget to ensure their health and longevity.

Gardening supplies

If you have a garden or plan on doing any landscaping or gardening, you will need to budget for gardening supplies such as seeds, plants, soil, fertilizer, and gardening tools. The cost of these supplies can vary depending on the size and complexity of your garden. It’s important to factor in these expenses when budgeting for your homeownership costs and to consider whether you will start your garden from seeds or purchase pre-grown plants to help manage the initial investment.

External property upkeep

In addition to lawn care and landscaping, there may be other external property upkeep tasks that you need to consider. This can include items such as pressure washing the exterior of your home, cleaning or repairing the driveway or walkways, and maintaining the condition of your fences or gates. These tasks may require occasional professional services or the purchase of specialized equipment or materials. It’s important to budget for these external property upkeep costs to ensure the overall maintenance and curb appeal of your home.

This image is property of blog.easyknock.com.

Homeowner’s Association Rules and Regulations

Costs associated with complying with rules

If you live in a community governed by a homeowners association (HOA), you may need to factor in the costs associated with complying with the rules and regulations set by the HOA. These costs can include items such as purchasing and maintaining specific exterior paint colors or materials, adhering to landscaping guidelines, or ensuring the proper maintenance of your property. It’s important to carefully review the HOA’s governing documents and to budget for any additional expenses that may arise due to the requirements set forth by the HOA.

Fine or penalty fees for violations

Failure to comply with the rules and regulations set by the homeowners association may result in fines or penalty fees. These fees can be levied for violations such as improper landscaping, failure to maintain the exterior of your home, or violating noise restrictions. It’s important to be aware of the potential for fines or penalty fees and to budget accordingly to avoid any financial surprises resulting from HOA violations.

Additional Mortgage Fees

Application fees

When applying for a mortgage, there may be upfront application fees charged by the lender. These fees can vary depending on the lender and the complexity of your mortgage application. It’s important to factor in these application fees when determining your overall homeownership costs and to compare quotes from different lenders to ensure you are getting the most favorable terms and fees.

Origination fees

Origination fees are charged by the lender for processing and underwriting the mortgage. These fees are typically a percentage of the loan amount and can vary depending on the lender and the type of mortgage. It’s important to consider these origination fees when comparing mortgage offers and to factor them into your overall homeownership costs.

Private Mortgage Insurance (PMI)

If you make a down payment of less than 20% of the purchase price of your home, you may be required to pay for private mortgage insurance (PMI). PMI is designed to protect the lender in case you default on your mortgage payments. The cost of PMI can vary depending on factors such as the loan amount, the length of the mortgage, and your credit score. It’s important to factor in the cost of PMI when budgeting for your monthly mortgage payments and to explore options for removing PMI once you have built up enough equity in your home.