When it comes to mortgages, understanding the different fees involved is essential for borrowers. From origination fees to closing costs and points, these expenses can add up and impact the overall cost of homeownership. Bad Credit Loan, a trusted partner for individuals seeking tailored mortgage solutions, aims to provide clarity and transparency on these fees. By offering accessible online applications, flexible options, and comprehensive support, Bad Credit Loan empowers borrowers to navigate the complexities of mortgages with confidence. Whether it’s purchasing a dream home, refinancing for better terms, or accessing home equity, Bad Credit Loan is committed to helping individuals achieve their homeownership goals.

Origination fees

Definition of origination fees

Origination fees are charges that borrowers pay to the lender or loan officer for processing and underwriting the mortgage loan. These fees cover the administrative costs involved in evaluating the borrower’s financial information, verifying documentation, and making the final decision on whether to approve the loan.

Purpose of origination fees

The purpose of origination fees is to compensate the lender or loan officer for the time and effort involved in processing and approving the mortgage loan. These fees help cover the costs associated with evaluating the borrower’s creditworthiness, verifying income and assets, and assessing the overall risk of lending.

How origination fees are calculated

Origination fees are typically calculated as a percentage of the total loan amount. For example, if the origination fee is 1% and the loan amount is $200,000, the borrower would be required to pay $2,000 as an origination fee. However, the specific calculation method may vary depending on the lender and loan program.

Examples of common origination fees

Common origination fees include application fees, processing fees, underwriting fees, and loan origination points. These fees can vary depending on the lender, loan type, and the borrower’s credit profile. It’s important for borrowers to review the loan estimate provided by the lender to understand the specific origination fees associated with their mortgage loan.

Closing costs

Definition of closing costs

Closing costs are the fees and expenses that borrowers pay when finalizing the mortgage loan. These costs include various charges associated with the home purchase or refinance, such as lender fees, title and escrow fees, appraisal fees, and prepaid expenses like property taxes and homeowners insurance.

Types of closing costs

Closing costs can be categorized into several types. Lender fees include origination fees, application fees, and discount points. Third-party fees cover services provided by professionals involved in the transaction, such as the title search, appraisal, and survey. Prepaid expenses include items like property taxes, homeowners insurance, and prepaid interest. Government fees include recording fees and transfer taxes.

Calculation of closing costs

Closing costs are typically calculated as a percentage of the loan amount, with the exact amount varying depending on factors like the loan program and the location of the property. On average, closing costs range from 2% to 5% of the loan amount. For example, if the loan amount is $200,000, closing costs can range from $4,000 to $10,000.

Examples of common closing costs

Common closing costs include appraisal fees, credit report fees, title insurance fees, attorney fees, transfer taxes, and recording fees. These costs can vary depending on the location and the specifics of the mortgage transaction. It’s important for borrowers to review the loan estimate and closing disclosure provided by the lender to understand the specific closing costs associated with their mortgage loan.

This image is property of images.pexels.com.

Points

Definition of points

Points, also known as discount points, are upfront fees that borrowers pay to the lender in exchange for a lower interest rate on their mortgage loan. Each point is equal to 1% of the loan amount, and paying points can be beneficial for borrowers who plan to stay in their homes for an extended period, as it can result in long-term savings on interest payments.

Types of points

There are two types of points: discount points and origination points. Discount points are paid by the borrower to lower the interest rate on the loan, while origination points are paid to the lender or loan officer as compensation for originating and processing the loan. Both types of points are typically expressed as a percentage of the loan amount.

Calculation of points

Points are calculated as a percentage of the loan amount. For example, if the loan amount is $200,000 and the borrower decides to pay 1 discount point, they would need to pay $2,000 upfront. The exact cost of points can vary depending on the lender, loan program, and the borrower’s credit profile.

Examples of common points

Common examples of points include discount points used to buy down the interest rate on the loan. For example, a borrower might pay 2 points upfront to lower their interest rate by 0.25%. By paying these points, the borrower can reduce their monthly mortgage payment and potentially save thousands of dollars in interest over the life of the loan.

Other Mortgage Fees

Appraisal fees

Appraisal fees are charges that borrowers pay to have a professional appraiser assess the value of the property. The lender typically requires an appraisal to ensure that the property is worth the amount being borrowed.

Credit report fees

Credit report fees cover the cost of obtaining a borrower’s credit report from one or more credit bureaus. Lenders use credit reports to evaluate a borrower’s creditworthiness and determine the terms of the mortgage loan.

Underwriting fees

Underwriting fees are charged by the lender to cover the cost of evaluating the borrower’s financial information and determining the risk associated with lending. These fees help cover the administrative costs involved in reviewing the borrower’s income, assets, credit history, and other relevant factors.

Title search fees

Title search fees are charged by a title company or attorney to investigate the property’s history and ensure that there are no liens or claims against it. This fee is typically paid by the buyer and is essential for obtaining title insurance.

Escrow fees

Escrow fees are charged by a third-party escrow company or attorney to handle the transfer of funds and documents during the mortgage closing process. These fees cover the administrative costs involved in ensuring that all parties fulfill their obligations and that the transaction is completed smoothly.

This image is property of images.pexels.com.

Negotiating Mortgage Fees

Understanding fee structures

To negotiate mortgage fees, it’s crucial to first understand the fee structures involved. Review the loan estimate and closing disclosure provided by the lender to identify the specific fees associated with the mortgage loan. It’s important to ask questions and seek clarification on any fees that are unclear or seem excessive.

Comparing offers from different lenders

To negotiate fees effectively, it’s important to compare offers from different lenders. Obtain quotes from multiple lenders and carefully review the loan estimates and closing disclosures to compare the fees and terms of each offer. This will give you a better understanding of the market rates and enable you to negotiate more effectively.

Negotiating fees with the lender

Once you have gathered multiple offers, you can negotiate with the lender to potentially reduce or eliminate certain fees. Be prepared to demonstrate your creditworthiness, provide evidence of other competitive offers, and highlight your long-term value as a borrower. Open and honest communication is key to successful fee negotiation.

Factors Affecting Mortgage Fees

Loan amount

The loan amount directly affects the fees associated with the mortgage. Generally, higher loan amounts result in higher fees. It’s important to consider the potential impact of these fees on overall affordability and choose a loan amount that aligns with your financial goals.

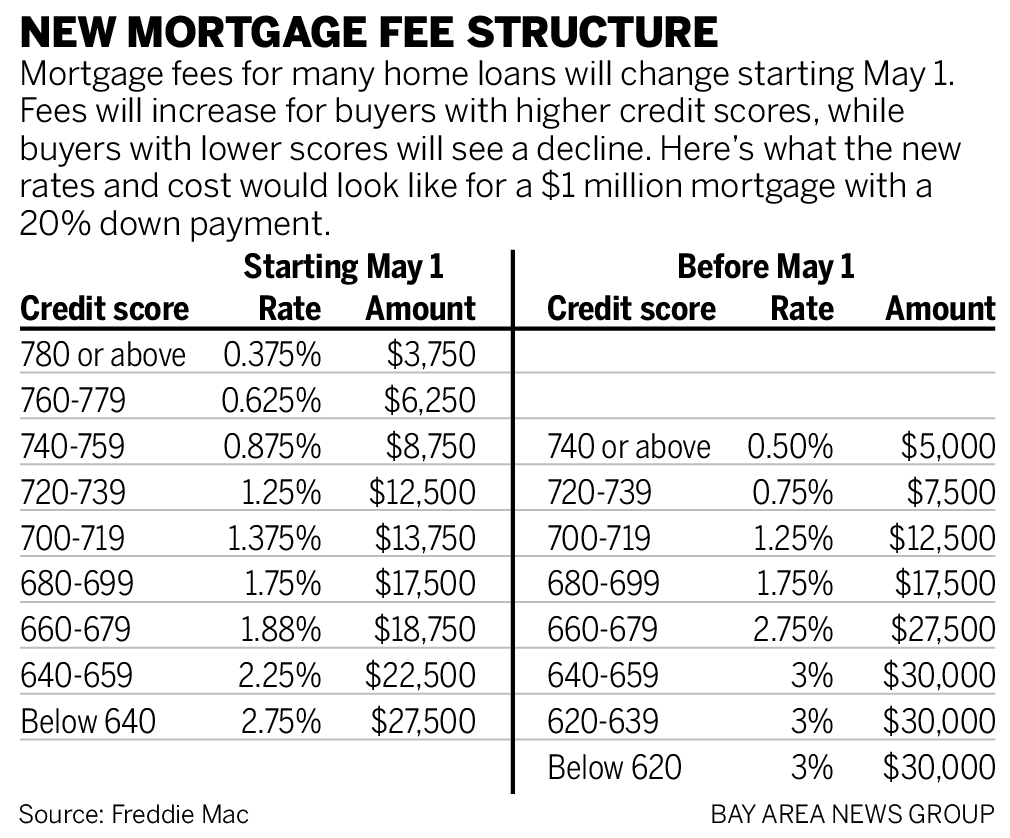

Credit score

Credit scores play a significant role in determining the fees charged by lenders. Borrowers with higher credit scores tend to qualify for better interest rates and lower fees, while those with lower credit scores may face higher interest rates and additional fees. Maintaining a good credit score can help borrowers secure more favorable fee structures.

Loan-to-value ratio

The loan-to-value (LTV) ratio, which is the ratio of the loan amount to the appraised value of the property, can impact the fees associated with the mortgage. Higher LTV ratios may result in higher fees or additional requirements, such as private mortgage insurance (PMI), which can increase the overall cost of the loan.

Type of property

The type of property being financed can also impact the fees associated with the mortgage. For example, investment properties or non-owner-occupied properties may have higher fees due to the increased risk associated with these types of properties. It’s important to consider the specific fees associated with the type of property being financed and factor them into the overall cost of the mortgage.

This image is property of images.pexels.com.

Tips for Managing Mortgage Fees

Save for upfront costs

To manage mortgage fees effectively, it’s important to save for upfront costs. This includes not only the down payment but also the various fees associated with the mortgage, such as origination fees and closing costs. By budgeting and saving in advance, borrowers can ensure they have sufficient funds to cover these expenses.

Shop around for the best rates and fees

To minimize mortgage fees, borrowers should shop around for the best rates and fees. Obtain quotes from multiple lenders and compare the loan estimates and closing disclosures to identify the most favorable terms. By diligently researching and comparing options, borrowers can potentially save thousands of dollars in fees over the life of the loan.

Understand the trade-off between fees and interest rates

When evaluating mortgage options, it’s essential to understand the trade-off between fees and interest rates. A mortgage with lower fees may have a higher interest rate, while a mortgage with higher fees may have a lower interest rate. It’s important to carefully consider these factors and choose a mortgage that aligns with your financial goals and priorities.

Closing Thoughts

Importance of understanding mortgage fees

Understanding mortgage fees is crucial for borrowers to make informed decisions and avoid unnecessary costs. By familiarizing themselves with the various fees associated with mortgages, borrowers can better plan and budget for these expenses, ultimately saving money and minimizing financial stress.

Planning and budgeting for mortgage fees

Planning and budgeting for mortgage fees is essential for a smooth and successful homebuying or refinancing process. By carefully reviewing the loan estimates and closing disclosures provided by lenders, borrowers can anticipate and prepare for these fees, ensuring that they have sufficient funds available when needed.

Seeking professional advice

When navigating the complexities of mortgage fees, it’s helpful to seek professional advice from a mortgage broker, financial advisor, or real estate attorney. These professionals can provide guidance on fee structures, negotiate on behalf of the borrower, and help ensure that the borrower makes the most informed decisions regarding their mortgage.

In conclusion, understanding the different fees associated with mortgages is crucial for borrowers to navigate the home financing process effectively. By comprehending origination fees, closing costs, points, and other mortgage-related fees, borrowers can make informed decisions, negotiate more effectively, and ultimately achieve their homeownership goals with confidence. With the assistance of trusted professionals and careful planning, borrowers can manage mortgage fees responsibly and secure the best possible terms for their mortgage loan.