In the journey towards homeownership, obtaining a mortgage can feel like an insurmountable challenge for individuals with less-than-perfect credit histories. That’s where Bad Credit Loan comes in. Specializing in mortgages designed for people with diverse credit backgrounds, Bad Credit Loan offers tailored solutions to empower individuals to access the housing they deserve. With a user-friendly online platform, customizable options, and transparent practices, Bad Credit Loan is committed to helping borrowers unlock the opportunities of homeownership. Whether it’s purchasing a dream home, refinancing for better terms, or accessing home equity, Bad Credit Loan is there to support borrowers in achieving their homeownership goals. In the journey toward homeownership, securing a mortgage is often the crucial step that transforms aspirations into reality. However, for individuals grappling with less-than-perfect credit histories, obtaining a mortgage can feel like an insurmountable challenge. This is where Bad Credit Loan steps in, offering tailored solutions to empower individuals to access the housing they deserve.

Bad Credit Loan specializes in providing mortgages designed for individuals with diverse credit backgrounds. Recognizing the hurdles faced by those with less-than-ideal credit scores, Bad Credit Loan adopts an inclusive approach, ensuring that financial opportunities are not limited by past credit setbacks.

Accessibility is fundamental to Bad Credit Loan’s mission. Through its user-friendly online platform, individuals can apply for mortgages conveniently from the comfort of their homes. This streamlined process eliminates the bureaucratic hurdles and time-consuming paperwork often associated with traditional mortgage applications, allowing individuals to focus on finding the right home for their needs.

Flexibility is another key advantage of Bad Credit Loan’s offerings. Whether it’s purchasing a first home, refinancing an existing mortgage, or accessing home equity, Bad Credit Loan provides customizable mortgage options to meet the diverse needs of borrowers. By tailoring loan terms to individual circumstances, the company empowers individuals to pursue their homeownership goals with confidence.

Transparency is paramount in every interaction with Bad Credit Loan. From interest rates and mortgage terms to fees and eligibility criteria, all relevant information is clearly communicated to applicants. This transparency builds trust and confidence, ensuring that borrowers understand the terms of their mortgage agreements and can make informed decisions about their homeownership finances.

Moreover, Bad Credit Loan offers more than just financial assistance. Recognizing that homeownership is a significant milestone in life, the company provides additional resources and support to help individuals succeed. Whether it’s mortgage planning tools, homeownership education, or personalized guidance, Bad Credit Loan is committed to empowering individuals to navigate the complexities of mortgages with confidence.

It’s important for borrowers to use mortgages responsibly, regardless of their credit history. While Bad Credit Loan provides opportunities for individuals with less-than-perfect credit scores, responsible borrowing and diligent repayment are essential for building financial stability and maintaining homeownership.

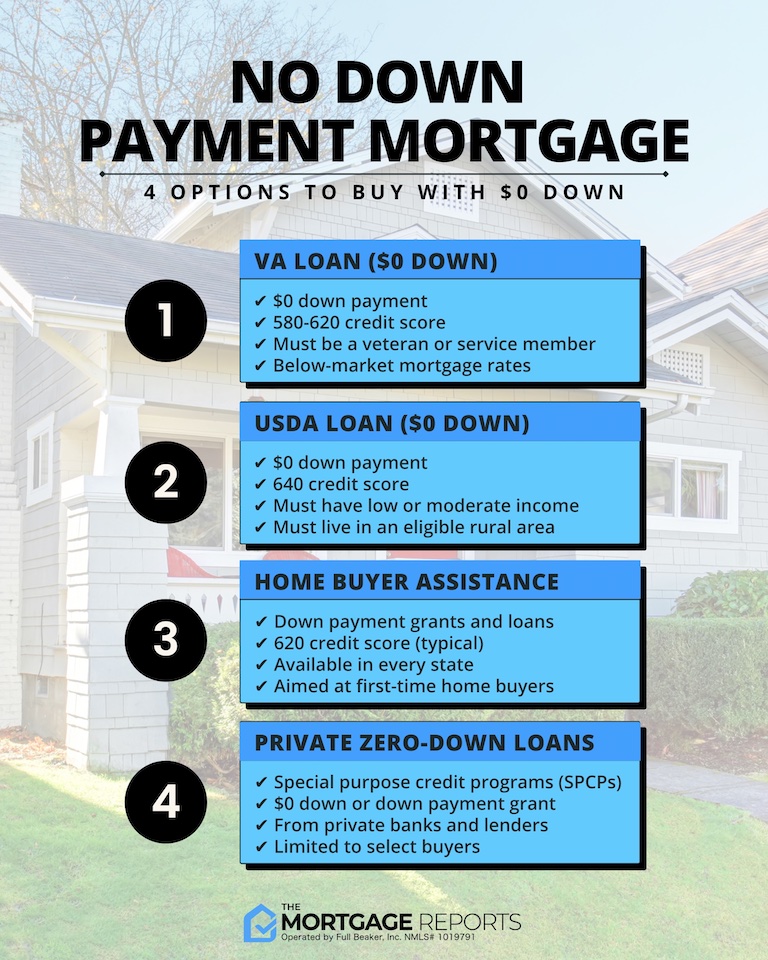

This image is property of assets.themortgagereports.com.

Overview of Mortgages with No Down Payment Options

Owning a home is a dream for many, but coming up with a large down payment can be a major barrier. That’s where mortgages with no down payment options come in. These types of mortgages allow homebuyers to purchase a house without having to put any money down upfront. In this article, we will explore two popular types of no down payment mortgages – USDA loans and VA loans. We will also discuss the benefits and drawbacks of these mortgages, as well as other low or no down payment options available.

USDA Loans

USDA loans, also known as Rural Development loans, are mortgages backed by the U.S. Department of Agriculture. These loans are designed to promote homeownership in rural areas and offer attractive terms, including no down payment requirements. Here’s what you need to know about USDA loans:

Definition

USDA loans are mortgages offered to eligible homebuyers who meet certain income and property location criteria. These loans are specifically designed for individuals or families who wish to buy homes in eligible rural or suburban areas.

Eligibility requirements

To be eligible for a USDA loan, you must meet certain criteria set by the USDA. These include:

- Income limit: Your income must not exceed the limit set for the area in which you are buying a home.

- Property location: The home you are purchasing must be located in an eligible rural or suburban area as defined by the USDA.

Pros and cons of USDA loans

There are several advantages to USDA loans, including:

- No down payment requirements: This allows borrowers to purchase a home without having to save up for a down payment.

- Low interest rates: USDA loans often offer competitive interest rates, making homeownership more affordable.

- Flexible credit requirements: While USDA loans do consider credit history, they may be more lenient compared to conventional mortgages.

However, it’s important to consider the potential drawbacks of USDA loans, such as:

- Property location restrictions: The home you wish to purchase must be in an eligible rural or suburban area, which may limit your options.

- Income limitations: USDA loans have income limits, and if you exceed them, you may not be eligible for this type of mortgage.

How to apply for a USDA loan

To apply for a USDA loan, you will need to follow these steps:

- Find an approved lender: USDA loans are offered through approved lenders, so you will need to find one that participates in the USDA loan program.

- Determine your eligibility: Check the income limits for your area and make sure the property you want to buy is in an eligible location.

- Gather necessary documentation: This may include proof of income, bank statements, tax returns, and other financial documents.

- Submit your application: Complete the application provided by your lender and submit all required documentation.

- Wait for approval: The lender will review your application and make a decision on whether to approve your loan.

This image is property of mortgageone.com.

VA Loans

VA loans, or Veterans Affairs loans, are mortgages available to active-duty military personnel, veterans, and their families. These loans are backed by the U.S. Department of Veterans Affairs and offer several benefits, including no down payment options. Here’s what you need to know about VA loans:

Definition

VA loans are mortgages provided to eligible veterans, active-duty military personnel, and their families. These loans are designed to help service members and veterans become homeowners by offering favorable terms and benefits.

Eligibility requirements

To be eligible for a VA loan, you must meet certain criteria set by the Department of Veterans Affairs. These include:

- Service requirements: You must have served a certain length of time depending on your branch of service.

- Certificate of Eligibility: You will need to obtain a Certificate of Eligibility (COE) from the VA to verify your eligibility for a VA loan.

Pros and cons of VA loans

There are many advantages to VA loans, including:

- No down payment requirements: This allows eligible veterans and service members to buy a home with no upfront costs.

- No mortgage insurance: VA loans do not require mortgage insurance, which can save borrowers money on their monthly payments.

- Flexible credit requirements: VA loans may be more forgiving of credit issues compared to other types of mortgages.

However, there are a few potential drawbacks to consider:

- VA funding fee: While VA loans have no private mortgage insurance, they do come with a funding fee that is typically a percentage of the loan amount.

- Property restrictions: VA loans cannot be used to purchase investment properties or homes in certain locations.

How to apply for a VA loan

If you’re eligible for a VA loan and want to apply, here are the steps to follow:

- Obtain your Certificate of Eligibility: This can be done online through the VA’s eBenefits portal or by contacting the appropriate VA office.

- Find a VA-approved lender: Look for lenders that offer VA loans and are familiar with the process.

- Gather necessary documentation: This may include proof of income, service records, and other financial documents.

- Complete the application: Fill out the application provided by your chosen lender and submit all required documentation.

- Wait for approval: The lender will review your application and documentation and make a decision on whether to approve your loan.

Comparison of USDA Loans and VA Loans

Both USDA loans and VA loans offer no down payment options, but there are key differences between the two. Let’s compare these types of loans to help you decide which one is better for your needs:

Key differences between USDA loans and VA loans

- Eligibility: USDA loans have income limits and property location requirements, while VA loans have service requirements and a need for a Certificate of Eligibility (COE).

- Borrower types: USDA loans are available to anyone who meets the eligibility requirements, while VA loans are only available to eligible veterans, active-duty military personnel, and their families.

- Property restrictions: USDA loans are limited to rural or suburban areas, while VA loans can be used to purchase homes in a wider range of locations.

- Funding fees: VA loans require a funding fee, while USDA loans do not.

- Mortgage insurance: VA loans do not require mortgage insurance, while USDA loans typically require it.

Which loan is better for me?

The best loan for you depends on your specific circumstances and eligibility. If you are a veteran or an active-duty military member, a VA loan may be the better option for you. However, if you do not meet the VA loan eligibility criteria but are looking to buy a property in a rural or suburban area, a USDA loan may be a better fit.

Factors to consider when choosing between USDA loans and VA loans

When deciding between USDA loans and VA loans, here are some factors to consider:

- Eligibility requirements: Make sure you meet the eligibility criteria for each loan program.

- Property location: Determine where you want to buy a home and check if it falls within the eligible location for a USDA loan.

- Service requirements: If you are a veteran or active-duty military member, you may want to explore the benefits and advantages of a VA loan.

- Funding fees and mortgage insurance: Consider the cost implications of the funding fees and mortgage insurance associated with each loan type.

This image is property of www.cua.com.

Other Mortgage Options with Low or No Down Payment

If you don’t qualify for a USDA loan or VA loan, there are other mortgage options available with low or no down payment requirements. Here are two popular alternatives:

FHA loans

FHA loans, or Federal Housing Administration loans, are mortgages insured by the FHA. They often require a low down payment of 3.5% and have more lenient credit requirements compared to conventional mortgages. FHA loans are available to a wide range of borrowers, including first-time buyers, and can be used to purchase a variety of property types.

Conventional loans with low down payment

While conventional loans typically require a down payment of at least 5%, there are options for borrowers with limited funds. Some lenders offer conventional loans with lower down payments, such as 3% or even 1%. These options may have stricter credit requirements, so borrowers should be prepared to meet those criteria.

It’s essential to explore all available mortgage options and compare the terms and requirements to find the best fit for your specific financial situation.

How to Qualify for a Mortgage with No Down Payment

Qualifying for a mortgage with no down payment requires meeting certain criteria. Here are the key factors lenders consider during the qualification process:

Credit score requirements

While credit scores vary depending on the loan type, borrowers generally need a minimum credit score of 620 or higher to qualify for a mortgage with no down payment. However, individual lenders may have their own credit score requirements, so it’s important to check with potential lenders.

Income and employment verification

Lenders typically require borrowers to provide proof of income and employment stability. This helps lenders assess your ability to repay the loan. Providing pay stubs, tax returns, and other relevant documentation is necessary during the application process.

Debt-to-income ratio

Lenders also consider your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income. Most lenders prefer a DTI ratio below 43%, although some may be more flexible.

Other eligibility factors to consider

In addition to the above criteria, lenders may also consider other factors such as:

- Employment history: A stable employment history demonstrates your ability to maintain a steady source of income.

- Reserves: Having some savings or reserves can provide reassurance to lenders that you can handle unexpected expenses.

- Property appraisal: The value of the property you wish to purchase may also affect your eligibility, as lenders want to ensure they are providing a mortgage that aligns with the property’s value.

Remember that each lender may have their own specific requirements, so it’s important to research and compare different lenders to find the best fit for your situation.

This image is property of assets.themortgagereports.com.

Benefits and Drawbacks of No Down Payment Mortgages

No down payment mortgages can offer several benefits, but they also come with drawbacks that borrowers should consider. Let’s explore the advantages and disadvantages:

Advantages of no down payment mortgages

- Access to homeownership: No down payment mortgages allow individuals who may not have significant savings to become homeowners.

- Immediate gratification: Buying a home without having to save for a down payment means you can achieve homeownership sooner.

- Potential savings: By not having to put money down, you can retain your savings for other purposes such as home improvements or emergencies.

Disadvantages of no down payment mortgages

- Higher costs: No down payment mortgages often come with higher interest rates, fees, or mortgage insurance requirements to offset the risk for lenders.

- Limited options: Some lenders may have stricter eligibility requirements for no down payment mortgages, limiting your lender options.

- Negative equity risk: Without an initial down payment, you’re starting your homeownership journey with less equity in your home. This could pose challenges if property values decrease or you need to sell your home in the early years of ownership.

It’s important to carefully consider these factors and assess your personal financial situation before deciding if a no down payment mortgage is the right choice for you.

Tips for Responsible Borrowing and Homeownership

Although obtaining a mortgage with no down payment can be an attractive option, it’s crucial to practice responsible borrowing and maintain good financial habits to ensure successful homeownership. Here are some tips to consider:

Budgeting for monthly mortgage payments

Before taking on a mortgage, it’s essential to assess your finances and create a budget that factors in your monthly mortgage payments. This budget should consider other expenses such as utilities, maintenance costs, and insurance. Be sure to leave room for savings and emergencies.

Maintaining a good credit score

Even with a mortgage that doesn’t require a down payment, maintaining a good credit score is crucial for future financial opportunities. Pay your bills on time, keep credit card balances low, and avoid taking on additional debt.

Building equity in your home

Building equity in your home can provide financial security and open up opportunities in the future. Consider making extra mortgage payments or exploring options to accelerate the repayment of your loan, such as bi-weekly payments or refinancing to a shorter term.

Understanding the terms and conditions of your mortgage agreement

Before signing any mortgage agreement, carefully review and understand the terms and conditions. Be aware of the interest rate, any additional fees, and important dates such as the maturity date or any penalty provisions. Seek legal or financial advice if needed.

This image is property of anexerciseinfrugality.com.

How Bad Credit Loan Can Help

For individuals with diverse credit backgrounds, Bad Credit Loan is here to provide mortgage solutions tailored to your unique needs. Here’s how Bad Credit Loan can assist you:

Tailored mortgage solutions for individuals with diverse credit backgrounds

Bad Credit Loan understands that everyone’s financial situation is different. They offer mortgage options that consider your unique credit history and work with you to find a solution that meets your needs.

User-friendly online platform for convenient applications

Gone are the days of filling out paper forms and waiting in line. Bad Credit Loan offers a user-friendly online platform that allows you to conveniently apply for a mortgage from the comfort of your own home. The streamlined process saves you time and eliminates unnecessary hassle.

Flexible mortgage options for different homeownership goals

Whether you’re a first-time homebuyer, looking to refinance, or accessing home equity, Bad Credit Loan provides customizable mortgage options. They work with you to find the best solution for your unique homeownership goals.

Transparent practices and clear communication of terms

Transparency is a core value of Bad Credit Loan. They ensure that all relevant information, including interest rates, mortgage terms, fees, and eligibility criteria, is clearly communicated to applicants. This transparency builds trust and helps borrowers make informed decisions.

Additional resources and support to assist borrowers

Bad Credit Loan understands that homeownership is a significant milestone. That’s why they provide additional resources and support to help borrowers succeed. Whether it’s mortgage planning tools, homeownership education, or personalized guidance, Bad Credit Loan is committed to empowering individuals throughout their homeownership journey.

Conclusion

In conclusion, Bad Credit Loan serves as a trusted partner for individuals seeking access to mortgages tailored to their unique financial circumstances. Through its accessible platform, flexible options, and transparent practices, the company empowers individuals to unlock the opportunities of homeownership. Whether it’s purchasing a dream home, refinancing for better terms, or accessing home equity, Bad Credit Loan stands ready to support borrowers in achieving their homeownership goals.

While these no down payment mortgages provide opportunities for individuals with less-than-perfect credit scores, responsible borrowing and diligent repayment are essential for building financial stability and maintaining homeownership. It’s important to consider your financial situation, budget appropriately, and make informed decisions about your mortgage agreement. With the right resources and responsible financial habits, you can achieve your homeownership goals and enjoy the benefits of owning a home.