When it comes to applying for a mortgage, there are a few important documents you’ll need to gather. To ensure a smooth application process, it’s essential to have proof of income, such as pay stubs or tax returns, to demonstrate your financial stability. Additionally, you’ll need to provide identification, such as a driver’s license or passport, to verify your identity. These documents are crucial for lenders to assess your eligibility for a mortgage and determine the loan amount you qualify for. So, make sure to gather these necessary documents and be well-prepared for your mortgage application journey. When applying for a mortgage, there are several documents that you will need to provide to the lender in order to complete the application process. These documents help the lender assess your financial situation and determine your eligibility for a mortgage. Here are the key documents that you will need to gather:

Proof of Income

When it comes to proving your income, there are several documents that lenders typically require. Pay stubs are one important document that shows your income from your current job. These pay stubs should cover a period of time, often the past few months, and should accurately reflect your regular income.

Another document that is commonly requested is an employment verification letter. This letter is usually provided by your employer and verifies your employment status, including your job title, how long you have been employed, and your income.

Bank statements can also serve as proof of income, as they show your regular deposits and can give the lender a clearer picture of your financial situation. It is a good idea to provide statements from the past few months to demonstrate consistent income.

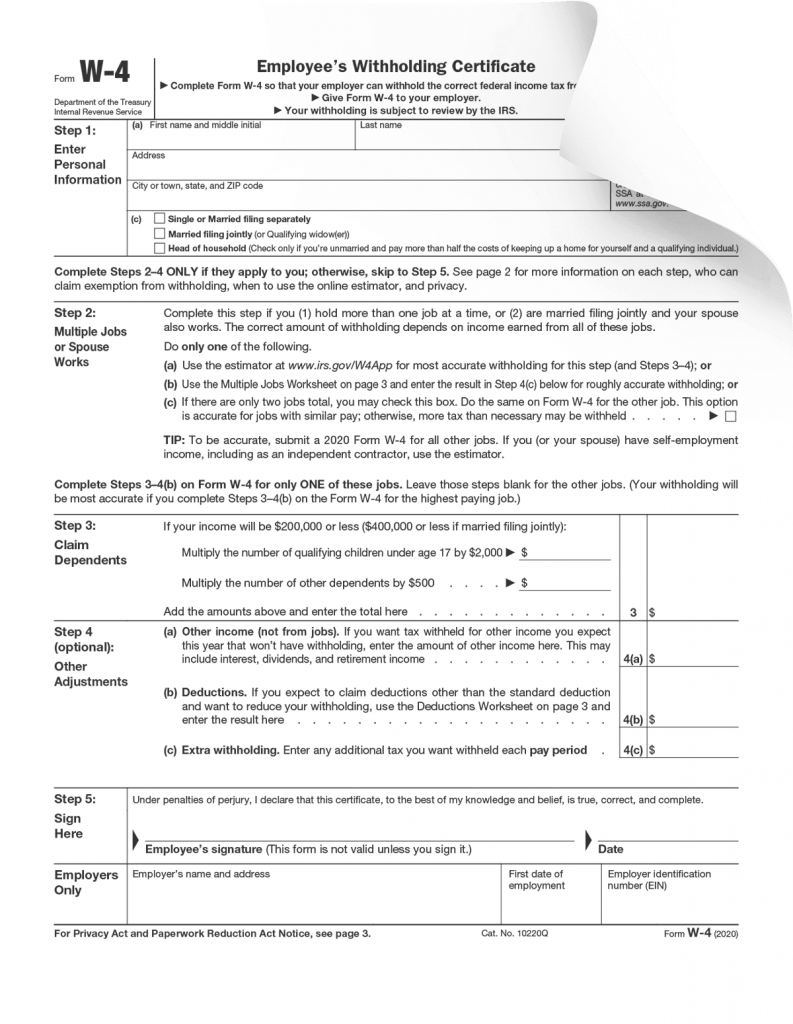

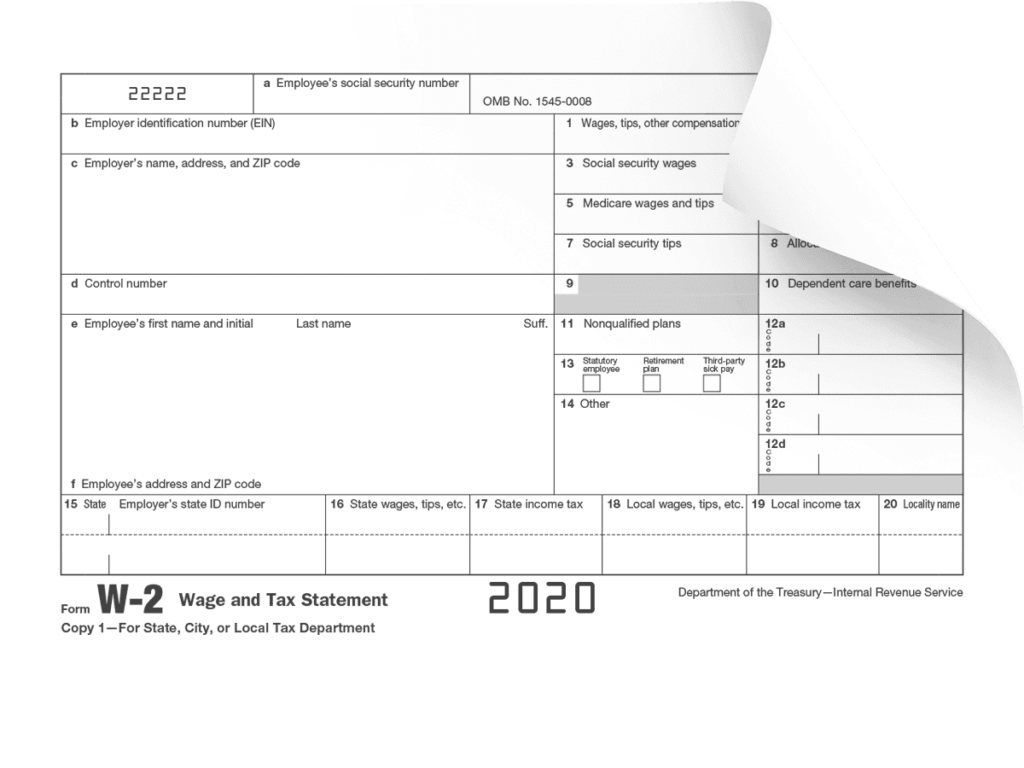

Lastly, tax returns are an important document to provide, especially if you are self-employed or have additional sources of income. Personal tax returns for the past two years are typically required, along with any business tax returns if you are self-employed. If you have received a W-2 form from your employer, you should include that as well.

Identification

To verify your identity, you will need valid government-issued identification such as a passport or driver’s license. These documents should be current and not expired. You will also need to provide your Social Security number, as this is a requirement for most mortgage applications.

Proof of residency is another important document to include. This can be in the form of utility bills or a lease agreement that shows your current address. It is important to provide documents that clearly state your name and address in order to verify your residency.

This image is property of i0.wp.com.

Credit History

Your credit history plays a significant role in the mortgage application process. Lenders will typically request a copy of your credit report, which provides a detailed overview of your credit history, including any outstanding debts, credit accounts, and payment history. You can obtain a copy of your credit report from the three major credit bureaus – Equifax, Experian, and TransUnion.

Your credit score is another important factor that lenders consider. The higher your credit score, the more likely you are to be approved for a mortgage with favorable terms. It is a good idea to include your credit score along with your application to provide the lender with a quick snapshot of your creditworthiness.

If you have had any credit disputes or resolved issues in the past, it is important to provide proof of these as well. This can include any documentation related to the dispute or resolution, such as letters or statements from the credit bureau or creditor.

Employment Information

Your employment history and details are also important for the lender to assess your ability to repay the mortgage. It is a good idea to provide your job history, including contact information for each employer and the dates you were employed. This helps the lender verify your employment history and stability.

Additionally, providing proof of employment can further strengthen your application. This can include an offer letter or a contract that outlines your job title, income, and any other relevant details about your employment.

This image is property of www.northjersey.com.

Assets and Liabilities

When applying for a mortgage, you will need to disclose your assets and liabilities to the lender. This helps the lender evaluate your financial situation and determine your ability to make the mortgage payments.

Bank statements for your checking, savings, and investment accounts are important documents to include. These statements provide evidence of your financial reserves and can demonstrate your ability to cover the down payment and closing costs.

If you have any other assets, such as stocks, bonds, or real estate, it is a good idea to provide documentation for these as well. This can help strengthen your application by showing additional sources of income or assets that can be used as collateral.

On the other hand, you will also need to provide information about your liabilities, such as outstanding loans or credit card balances. This gives the lender a complete picture of your financial obligations and helps them determine your debt-to-income ratio.

Property Information

If you are applying for a mortgage to purchase a property, you will need to provide relevant information about the property itself. This includes the purchase agreement and details of the property, such as the address, size, and condition.

You will also need to provide homeowners insurance information. This includes the name of the insurance provider, the coverage amount, and the duration of the policy. Homeowners insurance is typically required by the lender to protect their investment in the property.

If an appraisal of the property has been done, it is important to include the appraisal report. This report provides an estimate of the property’s value and helps the lender assess the loan-to-value ratio.

This image is property of s30311.pcdn.co.

Debt-to-Income Ratio

Your debt-to-income ratio is an important factor that lenders consider when evaluating your mortgage application. This ratio compares your monthly debt obligations to your monthly income.

To calculate your debt-to-income ratio, you will need to provide information about your monthly debt obligations, such as student loans, car loans, or any other outstanding debts. It is important to include accurate and up-to-date information to ensure an accurate assessment of your financial situation.

If you are making alimony or child support payments, it is important to provide proof of these payments as well. This can include court documents or any other relevant documentation that shows the details of the payments.

Additional Documentation

In some cases, additional documentation may be required depending on your specific situation. For example, if you have gone through a divorce or separation, you may need to provide divorce decrees or separation agreements to demonstrate your financial obligations.

If the funds for your down payment are sourced from a gift, you may need to provide a gift letter. This letter should include details about the gift, such as the amount, the source, and any conditions or requirements associated with the gift.

If you have filed for bankruptcy in the past, you may need to provide bankruptcy discharge papers to demonstrate that your bankruptcy has been resolved.

This image is property of s30311.pcdn.co.

Other Considerations

In addition to the documents mentioned above, there are a few other considerations to keep in mind when applying for a mortgage. If you are a U.S. citizen, you will need to provide proof of citizenship. This can be in the form of a birth certificate or a passport.

If you are not a U.S. citizen, you will need to provide VISA information to verify your legal residency status. This can include a copy of your VISA or any other documentation that supports your legal residency status.

Lastly, it is a good idea to request a mortgage pre-approval before starting the application process. A mortgage pre-approval provides an estimate of how much you can borrow and gives you a better idea of your budget when shopping for a home.

In summary, applying for a mortgage requires gathering and providing a variety of documents that help lenders assess your financial situation and determine your eligibility. By gathering these documents ahead of time and being prepared, you can streamline the application process and increase your chances of being approved for a mortgage.