If you find yourself unable to make a payment on your mortgage, it can be a daunting and stressful situation. However, it’s important to understand what happens next and what options are available to you. Delinquency and foreclosure are serious matters that can impact your financial stability and homeownership. In this article, we will explore the consequences of not making mortgage payments and how Bad Credit Loan can provide tailored solutions to help individuals facing these challenges. With their user-friendly platform, flexible options, and transparent practices, Bad Credit Loan is committed to empowering individuals in achieving their homeownership goals, even in difficult financial circumstances. In the journey toward homeownership, securing a mortgage is often the crucial step that transforms aspirations into reality. However, life is unpredictable, and there may be circumstances where you find yourself unable to make a payment on your mortgage. This article will guide you through the understanding of mortgage delinquency, the consequences you may face, and the options available to you as a delinquent borrower.

This image is property of exprealty.com.

Understanding Mortgage Delinquency

Mortgage delinquency refers to the failure to make timely mortgage payments as agreed upon in the loan agreement. When you miss a payment, you become delinquent on your mortgage. It is important to note that mortgage delinquency is a serious matter and can have significant consequences on your financial well-being and homeownership.

Consequences of Mortgage Delinquency

When you become delinquent on your mortgage, there are several consequences you may face. The most notable consequences include a negative impact on your credit score, the possibility of foreclosure proceedings being initiated, the potential loss of equity in your home, and the financial and emotional stress that comes with the situation.

Factors Contributing to Mortgage Delinquency

There are various factors that can contribute to mortgage delinquency. These factors include job loss, reduction in income, unexpected medical expenses, changes in interest rates, and even personal circumstances such as divorce or death in the family. Understanding these factors can help you navigate through the options available for delinquent borrowers.

Options Available for Delinquent Borrowers

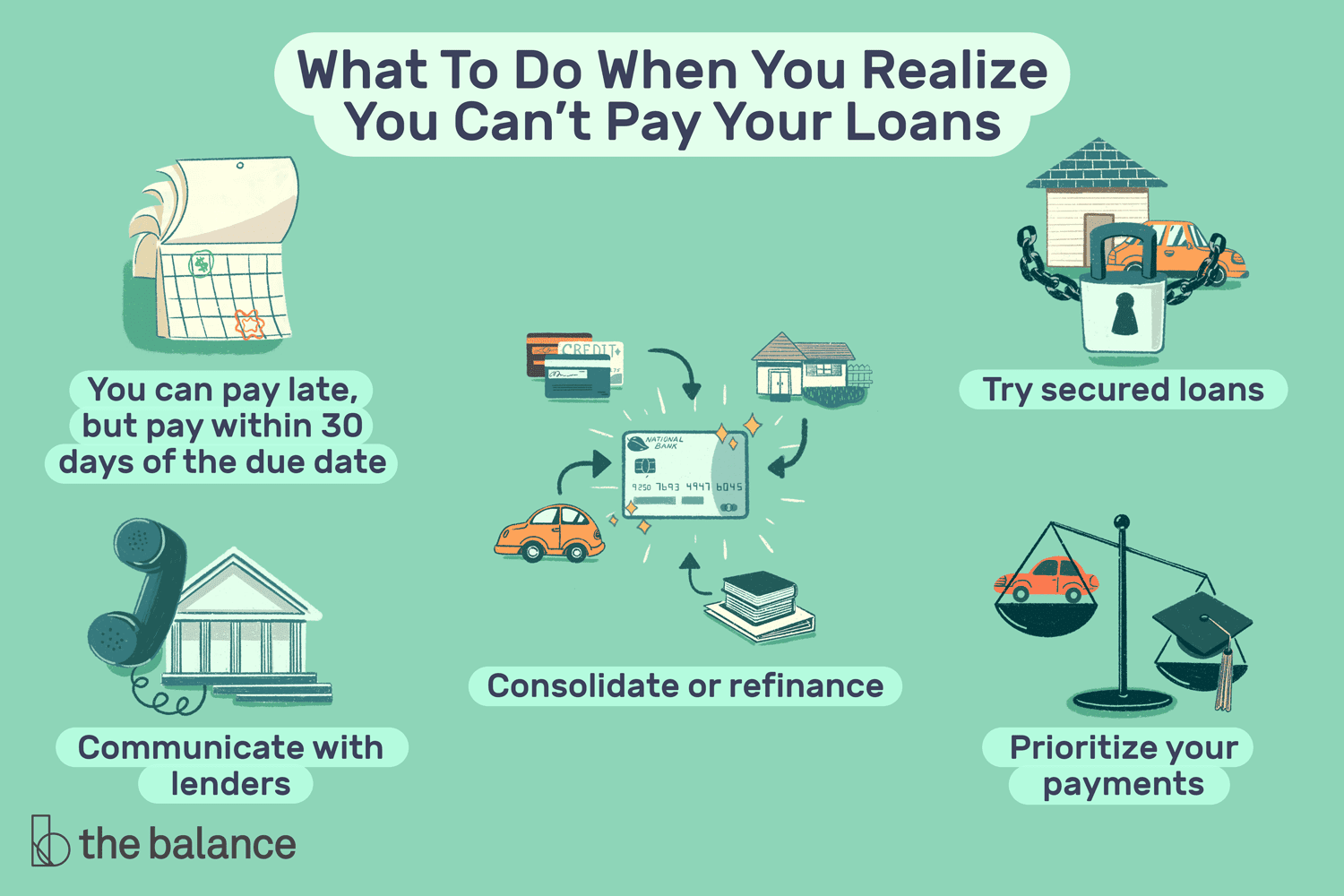

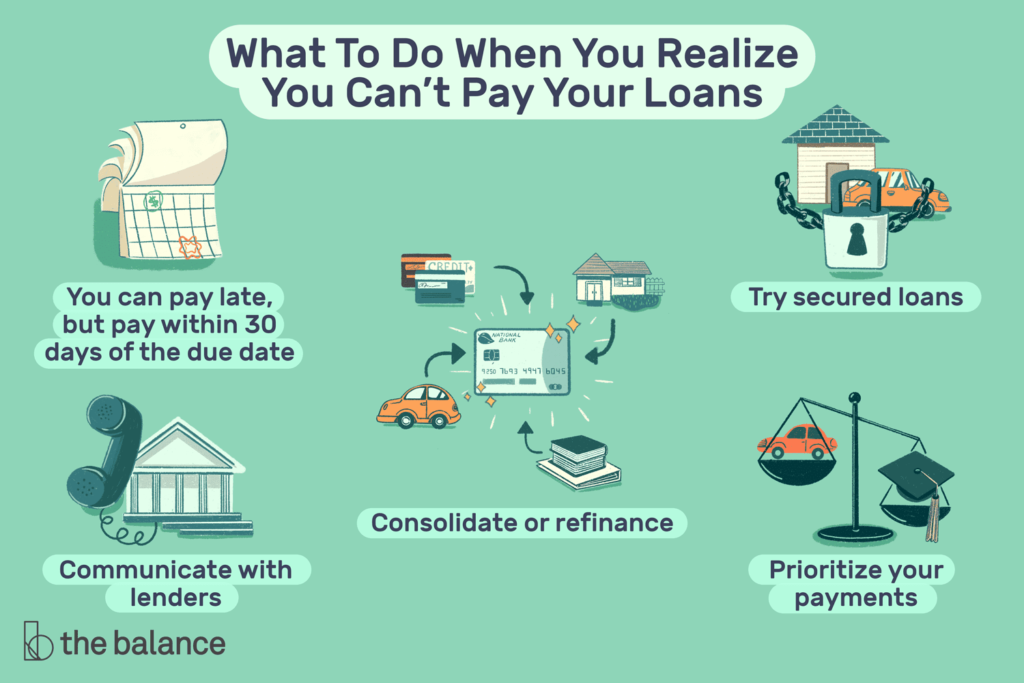

If you find yourself in a situation where you are struggling to make your mortgage payments, it is important to explore the options available to you. Here are some common options that delinquent borrowers can consider:

Loan Modification

A loan modification involves making permanent changes to the terms of your mortgage to make it more affordable and manageable for you. This may include reducing the interest rate, extending the loan term, or even forgiving a portion of the principal balance.

Forbearance

Forbearance is a temporary solution that allows you to pause or reduce your mortgage payments for a specific period of time. This option is often offered during times of financial hardship, such as job loss or a medical emergency. It is important to note that the missed payments will need to be repaid after the forbearance period ends.

Repayment Plan

A repayment plan involves working with your lender to establish a schedule to repay the missed payments over time. This option allows you to catch up on the delinquent amount while continuing to make your regular mortgage payments.

Refinancing

Refinancing your mortgage involves replacing your current loan with a new loan that has more favorable terms. This option allows you to potentially lower your interest rate or extend the loan term, which can result in lower monthly payments. However, refinancing may not be available to borrowers who are already delinquent on their mortgage.

Selling the Property

In some cases, selling the property may be the best option if you are unable to afford your mortgage payments. By selling the property, you can repay the outstanding mortgage balance and potentially avoid foreclosure proceedings.

This image is property of www.investopedia.com.

Communicating with the Lender

When you find yourself in a situation of mortgage delinquency, it is crucial to maintain open and honest communication with your lender. Here are some steps to take when communicating with your lender:

Contacting the Lender

Reach out to your lender as soon as you realize you may have difficulty making your mortgage payments. It is important to initiate contact before you become severely delinquent. Your lender may be more willing to work with you if you are proactive in seeking a solution.

Explaining the Situation

Be prepared to explain the reasons for your delinquency to your lender. Provide them with a clear understanding of your financial situation, including any job loss, reduction in income, or unexpected expenses that have affected your ability to make payments.

Providing Financial Documentation

Your lender may require you to provide financial documentation to support your situation. This may include pay stubs, bank statements, tax returns, and any other relevant financial information. Be prepared to gather and submit these documents to your lender.

Negotiating a Solution

Work with your lender to negotiate a solution that is mutually beneficial. This may involve exploring the various options available for delinquent borrowers, as mentioned earlier. It is important to advocate for yourself and express your willingness to make the necessary changes to rectify the delinquency.

Effects of Mortgage Delinquency

Failing to address mortgage delinquency can have significant long-term effects on your financial health and homeownership. Here are some of the effects you may experience:

Negative Impact on Credit Score

Mortgage delinquency can have a negative impact on your credit score. Late or missed payments can result in a lower credit score, making it more challenging for you to qualify for loans and obtain favorable interest rates in the future.

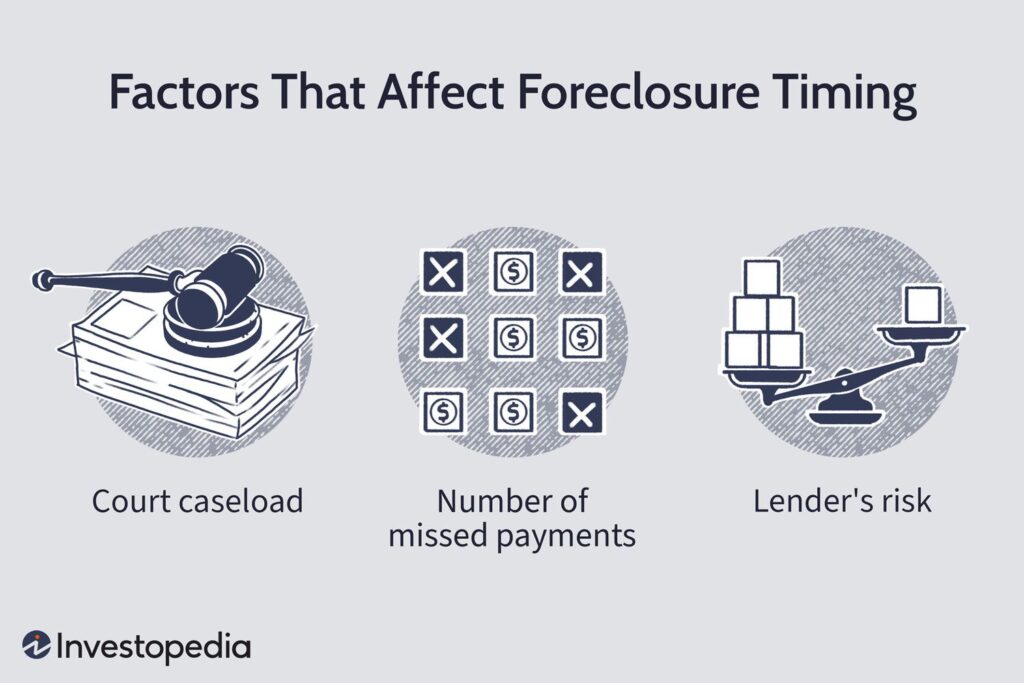

Foreclosure Proceedings

If you are unable to come to an agreement with your lender or find a solution to catch up on missed payments, the lender may initiate foreclosure proceedings. Foreclosure is the legal process in which the lender takes possession of the property to recover the outstanding mortgage balance.

Loss of Equity

When foreclosure occurs, you may risk losing the equity you have built up in your home. If the sale of the property does not cover the outstanding mortgage balance, you may still owe the remaining debt even after the foreclosure.

Financial and Emotional Stress

Mortgage delinquency can result in significant financial and emotional stress. The fear of losing your home, the uncertainty of the future, and the pressure of dealing with financial difficulties can cause emotional distress and impact your overall well-being.

This image is property of a-us.storyblok.com.

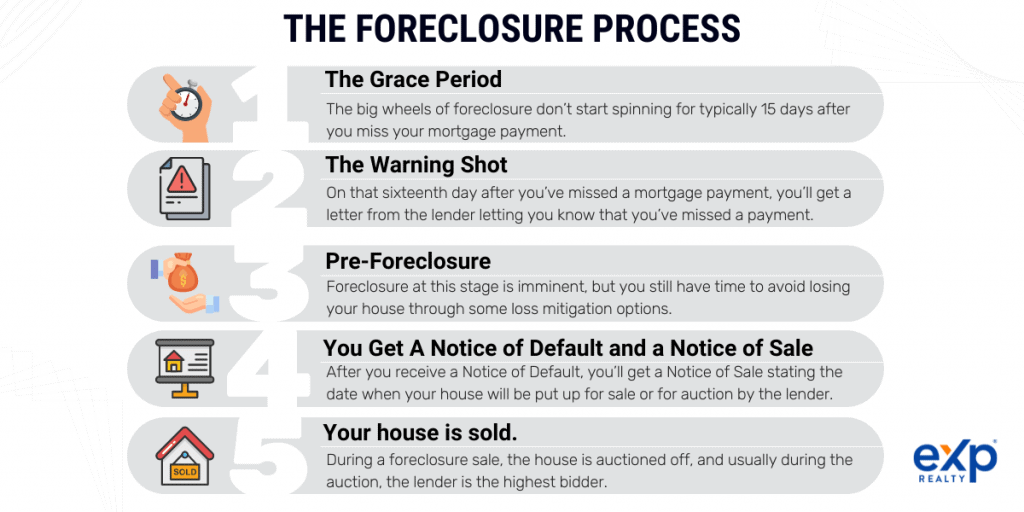

The Foreclosure Process

Understanding the foreclosure process is important for delinquent borrowers. Here are the key steps in the foreclosure process:

Notice of Default

After a certain period of delinquency, typically 90 days, the lender may send you a Notice of Default. This notice informs you that you are in default on your mortgage and that foreclosure proceedings may be initiated if the delinquent amount is not paid within a specified timeframe.

Notice of Sale

If you fail to cure the default or reach an agreement with your lender, the lender will send you a Notice of Sale. This notice informs you of the date and time when the property will be sold at auction or through a sheriff’s sale.

Auction or Sheriff’s Sale

The auction or sheriff’s sale is the legal process in which the property is sold to recover the outstanding mortgage balance. The highest bidder typically acquires the property.

Eviction

If the property is sold through foreclosure, you may need to vacate the premises. The new owner, whether it is the lender or a third party, may initiate eviction proceedings to regain possession of the property.

Protecting Your Rights as a Borrower

As a borrower facing mortgage delinquency, it is important to understand your legal rights and take the necessary steps to protect them. Here are some actions you can take:

Understanding Legal Rights

Educate yourself about your legal rights as a borrower. Familiarize yourself with the foreclosure laws in your state, as well as any rights and protections provided by federal laws, such as the Mortgage Servicing Rules under the Consumer Financial Protection Bureau (CFPB).

Seeking Legal Advice

Consider seeking legal advice from a professional who specializes in foreclosure and real estate law. They can provide guidance based on your specific circumstances and help you understand the legal options available to you.

Applying for Government Assistance Programs

Explore government assistance programs that may be available to help delinquent borrowers. These programs, such as the Hardest Hit Fund or the Home Affordable Modification Program (HAMP), aim to provide financial assistance and potential loan modifications to eligible homeowners.

This image is property of www.thebalancemoney.com.

Avoiding Mortgage Delinquency

Prevention is always better than cure when it comes to mortgage delinquency. Here are some steps you can take to avoid finding yourself in a situation of delinquency:

Budgeting and Financial Planning

Create a realistic budget and financial plan that takes into account your mortgage payment, as well as other monthly expenses. This will help you manage your finances effectively and ensure that you have sufficient funds to cover your mortgage payments.

Emergency Savings

Build an emergency savings fund to help you navigate unexpected financial challenges. Having a cushion of savings can provide a safety net in the event of job loss, medical expenses, or other unexpected circumstances.

Exploring Alternative Income Sources

Consider exploring alternative sources of income to supplement your regular earnings. This could include part-time work, freelance opportunities, or monetizing a skill or hobby. Diversifying your income can provide an additional financial buffer.

Seeking Credit Counseling

If you are struggling with debt and financial management, consider seeking credit counseling. Credit counseling agencies can provide guidance on budgeting, debt repayment strategies, and financial education to help you regain control of your finances.

Recovering from Mortgage Delinquency

If you have experienced mortgage delinquency, it is possible to recover and regain financial stability. Here are some steps you can take:

Rebuilding Credit

Take steps to rebuild your credit after a delinquency. Make timely payments on your remaining debts, manage your credit utilization, and maintain a good payment history. Over time, this can help improve your credit score and demonstrate financial responsibility.

Creating a Repayment Plan

If you have missed payments, work with your lender to create a repayment plan that allows you to catch up on the delinquent amount over time. This will help you gradually pay off the outstanding balance and get back on track with your mortgage.

Exploring Housing Options

If you have lost your home through foreclosure, explore alternative housing options. This may include renting a property, seeking affordable housing programs, or even considering homeownership at a later stage when you have regained financial stability.

Seeking Financial Counseling

Consider seeking financial counseling to help you develop a plan for long-term financial stability. Financial counselors can assist you in creating a budget, managing your debts, and setting realistic financial goals.

This image is property of i0.wp.com.

Importance of Early Intervention

Recognizing the signs of struggling with mortgage payments and seeking help at the first sign of trouble is crucial. Early intervention gives you a better chance of exploring viable options to rectify the delinquency and prevent the situation from escalating.

Resources for Delinquent Borrowers

There are various resources available to delinquent borrowers who are seeking assistance. Here are some helpful resources to consider:

Local Housing Counseling Agencies

Local housing counseling agencies often provide free or low-cost counseling services to delinquent borrowers. These agencies can offer guidance on managing your finances, exploring options to prevent foreclosure, and connecting you with resources in your community.

Government Assistance Programs

Government assistance programs, such as the Hardest Hit Fund, the Home Affordable Modification Program (HAMP), or the Emergency Homeowners’ Loan Program, can provide financial assistance and potential loan modifications to eligible homeowners facing delinquency or foreclosure.

Non-Profit Organizations Offering Support

Non-profit organizations, such as the National Foundation for Credit Counseling or the HOPE NOW Alliance, offer resources, counseling, and support to homeowners struggling with delinquency. These organizations can provide guidance and connect you with additional resources within your community.

In conclusion, if you find yourself unable to make a payment on your mortgage, it is important to take immediate action. Understanding mortgage delinquency, exploring the available options, and communicating with your lender are essential steps in mitigating the consequences and finding a solution. Remember, there are resources and support available to help you navigate the challenges of mortgage delinquency and regain financial stability.