If you’re dreaming of homeownership but are worried about the costs, you may be wondering if there are any down payment assistance programs available to help. Look no further than Bad Credit Loan, a company specializing in tailored mortgages for individuals with diverse credit backgrounds. With their user-friendly online platform and transparent practices, Bad Credit Loan aims to empower individuals to access the housing they deserve. From flexible options to personalized guidance, they are committed to helping you achieve your homeownership goals. So, don’t let your credit history hold you back – Bad Credit Loan is here to support you every step of the way.

This image is property of images.pexels.com.

Understanding Down Payment Assistance Programs

What are down payment assistance programs?

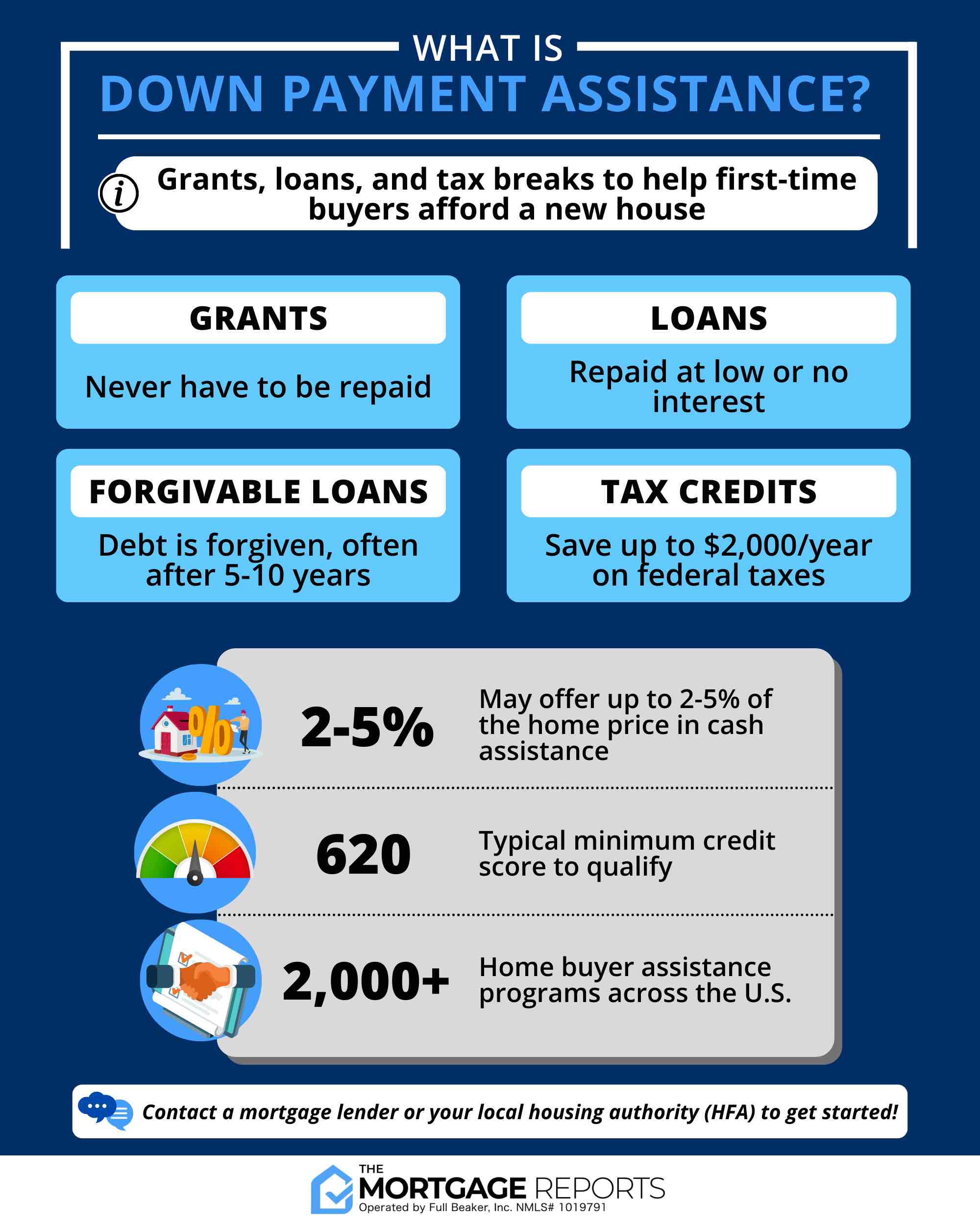

Down payment assistance programs are financial initiatives designed to help individuals or families overcome the hurdle of a large upfront payment typically required when purchasing a home. These programs provide funds or grants to assist with the down payment, closing costs, or other homeownership expenses.

How do down payment assistance programs work?

Down payment assistance programs work by offering financial aid to eligible homebuyers. The assistance can come in the form of grants, low-interest loans, or deferred payment loans. The funds are intended to supplement the homebuyer’s own savings, making it more affordable to purchase a home.

Who qualifies for down payment assistance programs?

Qualification requirements for down payment assistance programs vary depending on the specific program. Generally, these programs target first-time homebuyers or individuals with low to moderate incomes. Some programs may have additional criteria based on factors such as credit score, employment status, or location.

Types of down payment assistance programs

There are various types of down payment assistance programs available, including government-sponsored programs, non-profit initiatives, employer-sponsored programs, and state housing finance agency programs. Each type has its own eligibility criteria and may offer different forms of assistance, such as grants, loans, or assistance with closing costs.

Benefits of Down Payment Assistance Programs

Reduced upfront costs

One of the main benefits of down payment assistance programs is that they help reduce the upfront costs associated with buying a home. By providing financial aid for the down payment or closing costs, these programs enable homebuyers to enter the housing market with less of a financial burden.

Increased affordability

Down payment assistance programs make homeownership more affordable for individuals or families who may be struggling to save up for a down payment. By bridging the gap between the homebuyer’s savings and the required amount, these programs make it possible for more people to achieve their homeownership goals.

Access to affordable housing

Down payment assistance programs can also help individuals or families gain access to affordable housing options that they may otherwise not be able to afford. With the assistance provided, individuals can explore a wider range of housing options and potentially find a home in a neighborhood or area that fits their needs.

Ability to qualify for a mortgage

For individuals who may have difficulty qualifying for a mortgage due to factors such as low income or less-than-perfect credit scores, down payment assistance programs can help bridge the gap. By providing financial support, these programs may improve the chances of getting approved for a mortgage and becoming a homeowner.

Eligibility Requirements for Down Payment Assistance Programs

Income limits

Many down payment assistance programs have income limits to ensure that the aid is targeted towards individuals or families with lower incomes. These limits may vary depending on the specific program and the area in which the homebuyer is looking to purchase a property.

Credit score requirements

While some down payment assistance programs are more lenient when it comes to credit scores, others may have minimum credit score requirements. These requirements help ensure that the homebuyer has demonstrated responsible financial behavior and is less likely to default on the assistance provided.

Occupancy and property requirements

Certain down payment assistance programs may have occupancy requirements, meaning that the homebuyer must live in the property as their primary residence. Additionally, there may be property requirements such as minimum property standards or restrictions on certain types of properties.

Homebuyer education

To promote responsible homeownership, many down payment assistance programs require homebuyers to complete a homebuyer education course. These courses provide valuable information about the home buying process, financial management, and maintaining a home.

Finding Down Payment Assistance Programs

Local government programs

Many local governments offer down payment assistance programs to support homeownership in their communities. These programs may be administered through city or county government agencies and may have specific eligibility criteria based on location.

Non-profit organizations

Non-profit organizations often provide down payment assistance programs to help individuals or families achieve homeownership. These organizations may receive funding from private donors, government grants, or other sources and may have specific requirements for participation.

Employer-sponsored programs

Some employers offer down payment assistance programs as part of their employee benefits package. These programs may provide financial aid or special financing options for employees looking to purchase a home. Requirements and eligibility for these programs can vary depending on the employer.

State housing finance agencies

State housing finance agencies are government entities that provide various housing-related programs, including down payment assistance. These agencies may have their own programs or may administer federal programs on behalf of the state. Eligibility requirements and available assistance can differ by state.

Online resources

There are several online resources available to help individuals find down payment assistance programs. These websites provide information about different programs, eligibility requirements, and how to apply. Some websites may also offer search tools to help users find programs specific to their location.

This image is property of images.pexels.com.

How to Apply for Down Payment Assistance Programs

Gather necessary documentation

When applying for a down payment assistance program, it is important to gather all necessary documentation. This may include proof of income, tax returns, bank statements, identification documents, and any other documents required by the specific program.

Complete the application

Once you have gathered all the necessary documentation, you can proceed with completing the application for the down payment assistance program. The application will typically require personal and financial information, as well as details about the property you intend to purchase.

Submit the application

After completing the application, you will need to submit it to the appropriate entity administering the down payment assistance program. This may be a local government agency, non-profit organization, employer, or state housing finance agency. Follow the specified submission instructions provided by the program.

Follow-up and track the progress

After submitting your application, it is important to follow up and track the progress of your application. This may involve contacting the program administrator, providing any additional documentation if requested, and staying informed about the status of your application.

Challenges and Limitations of Down Payment Assistance Programs

Limited availability

One challenge with down payment assistance programs is that they may have limited funding or be available only for a specific period of time. This means that not all individuals who are eligible may be able to access the assistance they need.

Stringent eligibility requirements

While down payment assistance programs aim to support individuals and families in achieving homeownership, they often have specific eligibility requirements. These requirements may exclude certain individuals or may make it more difficult for some to qualify for assistance.

Funding limitations

Down payment assistance programs rely on available funding, which can be affected by economic factors or changes in government policies. This means that the amount of assistance or the availability of programs may vary over time.

Potential restrictions on property types

Some down payment assistance programs may have restrictions on the types of properties that can be purchased with the assistance. For example, certain programs may exclude investment properties or properties that require extensive repairs.

This image is property of images.pexels.com.

Alternatives to Down Payment Assistance Programs

Saving for a down payment

One alternative to down payment assistance programs is to save up for a down payment on your own. This may involve budgeting, reducing expenses, and setting aside a portion of your income specifically for your homeownership goals.

Gift funds from family or friends

Another option is to receive gift funds from family or friends to help with your down payment. These funds can be used in combination with your own savings to meet the required amount.

Borrowing from retirement accounts

Some individuals may choose to borrow from their retirement accounts, such as a 401(k) or IRA, to fund their down payment. This option should be approached with caution and may have tax implications or impact your future retirement savings.

Government-backed loan programs

Government-backed loan programs, such as FHA loans or VA loans, often have lower down payment requirements compared to conventional loans. These programs may be a viable alternative for individuals who may not qualify for or have access to down payment assistance programs.

Tips for Successful Homeownership with Down Payment Assistance

Explore all available options

When considering homeownership with the help of down payment assistance programs, it is important to explore all available options. Research different programs, compare their benefits and requirements, and choose the one that best suits your needs.

Review and compare program requirements

Carefully review the eligibility requirements and terms of each down payment assistance program you are considering. Compare the income limits, credit score requirements, and any other criteria to ensure that you meet the qualifications and understand what is expected.

Attend homebuyer education courses

Taking advantage of homebuyer education courses can provide valuable knowledge and skills to navigate the homebuying process successfully. These courses can educate you about budgeting, financial management, and maintaining a home.

Budget for ongoing homeownership costs

Remember to factor in ongoing homeownership costs when budgeting for your new home. This includes expenses such as property taxes, insurance, maintenance, and utilities. Planning ahead will help you avoid financial strain and ensure that you can comfortably afford homeownership.

This image is property of assets.themortgagereports.com.

Conclusion

Down payment assistance programs can play a crucial role in making homeownership more accessible and affordable for individuals or families who may face financial barriers. By reducing upfront costs, increasing affordability, and providing access to affordable housing, these programs empower more individuals to realize their dreams of owning a home. It is important to research and explore the different programs available, taking advantage of the resources and support provided to navigate the homeownership process with confidence. Whether through government programs, non-profit initiatives, or employer-sponsored options, down payment assistance can make a significant difference in achieving the goal of homeownership.