In the realm of bad credit loans, collateral can play a crucial role in securing financing when traditional banks may turn you away. Options like Bad Credit Loans provide a lifeline for individuals with less-than-ideal credit scores by offering various loan products tailored to their needs. Secured loans, which require collateral such as a vehicle or real estate, are one common type of loan available. This collateral provides a level of security to the lender, increasing the chances of approval despite poor credit. So, when seeking a bad credit loan, consider the types of collateral you might be able to offer in exchange for the funds you need to meet your financial obligations. So you’re in need of a loan but have bad credit – what type of collateral can you use to help secure the funds you need? Let’s explore the world of bad credit loans and the collateral options available to you.

Understanding Collateral in Bad Credit Loans

When you have bad credit, lenders often require collateral to secure the loan. Collateral is an asset that you pledge to the lender as a form of security, ensuring that if you default on the loan, the lender can seize the asset to recoup their losses. Having collateral reduces the risk for the lender and can make it easier for you to qualify for a loan despite your poor credit history.

The Role of Collateral in Securing a Loan

Collateral serves as a guarantee for the lender that they will recoup some or all of their funds if you fail to repay the loan. It provides an added layer of security for the lender, especially when dealing with borrowers who have a history of financial difficulties. By pledging collateral, you demonstrate your commitment to repay the loan, which can help you secure the financing you need.

Types of Collateral Accepted in Bad Credit Loans

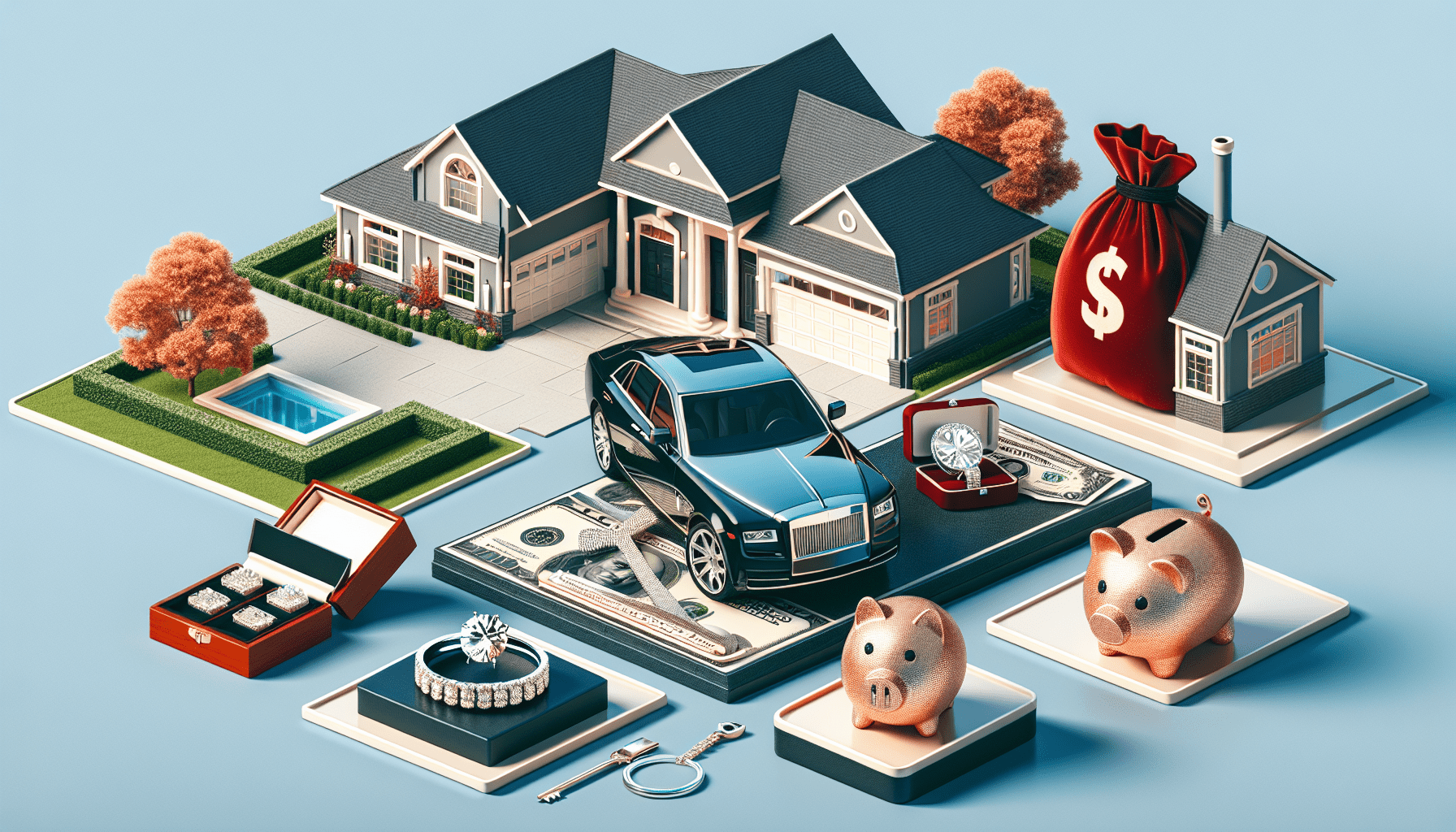

Now that you understand the importance of collateral in bad credit loans, let’s explore the different types of assets that lenders commonly accept as collateral.

Real Estate

One of the most common forms of collateral for a bad credit loan is real estate, such as your home or other property you own. Lenders often accept real estate as collateral due to its tangible value and the ability to easily sell it to recover their funds in case of default.

Vehicles

Another popular form of collateral is a vehicle, such as a car, truck, or motorcycle. The lender may place a lien on the vehicle’s title, allowing them to repossess and sell it if you fail to repay the loan. The value of the vehicle will determine how much you can borrow, with newer models typically holding more value.

Jewelry and Valuables

If you have valuable jewelry, watches, or other high-end items, you may be able to use them as collateral for a bad credit loan. Lenders may require an appraisal to determine the value of these items and assess their suitability as collateral.

Savings or Investments

Some lenders may allow you to use savings accounts, certificates of deposit (CDs), or other investment accounts as collateral for a loan. By pledging these assets, you demonstrate a strong financial position and reduce the lender’s risk, potentially qualifying for better loan terms despite your bad credit.

Electronic Devices

In some cases, lenders may accept electronic devices, such as smartphones, laptops, or tablets, as collateral for a loan. These items must be in good working condition and have resale value to be considered suitable collateral.

Other Personal Assets

Additionally, personal assets such as valuable artwork, antiques, collectibles, or other high-ticket items may be accepted as collateral by certain lenders. These assets must have a verifiable market value to be considered eligible.

Pros and Cons of Using Collateral in Bad Credit Loans

Now that you’re familiar with the types of collateral accepted in bad credit loans, let’s explore the advantages and disadvantages of using collateral to secure your financing.

Pros of Using Collateral

- Higher Loan Amounts: By pledging collateral, you may qualify for a higher loan amount than you would with an unsecured loan.

- Lower Interest Rates: Lenders may offer lower interest rates on secured loans due to the reduced risk associated with collateral.

- Improved Approval Odds: Collateral can increase your chances of loan approval, especially if you have bad credit.

Cons of Using Collateral

- Risk of Asset Loss: If you default on the loan, you risk losing the collateral you pledged to secure the funds.

- Limited Asset Availability: Not everyone has valuable assets to pledge as collateral, limiting their borrowing options.

- Additional Documentation: Lenders may require appraisals or documentation for certain types of collateral, adding to the loan application process.

Tips for Using Collateral Effectively

If you decide to use collateral to secure a bad credit loan, here are some tips to help you navigate the process effectively:

- Value Your Assets: Get a professional appraisal or assessment of your collateral’s value to ensure you are pledging an asset worth enough to secure the loan amount you need.

- Read the Fine Print: Review the loan terms carefully, including the collateral agreement, to understand your responsibilities and the lender’s rights in case of default.

- Make Timely Payments: By repaying the loan on time, you can avoid the risk of losing your collateral and potentially improve your credit score over time.

Final Thoughts

In the world of bad credit loans, collateral can be a valuable tool to help you secure the financing you need when traditional lenders turn you away. By understanding the types of collateral accepted, weighing the pros and cons of using collateral, and following best practices for pledging assets, you can navigate the loan process with confidence and responsibility. Remember that using collateral is a serious commitment, so proceed with caution and prioritize loan repayment to protect your assets and financial well-being.