If you find yourself being harassed by a personal loan collector, it’s important to know your rights and take action to protect yourself. First, document any abusive or threatening communication from the collector, including phone calls, emails, or letters. Next, contact the Consumer Financial Protection Bureau or your state’s attorney general’s office to report the harassment. Additionally, consider seeking assistance from a legal professional who can help you navigate the situation and ensure that your rights are upheld. Remember, you have the right to be treated with respect and professionalism, even when dealing with debt collectors.

What Should I Do If I’m Being Harassed By A Personal Loan Collector?

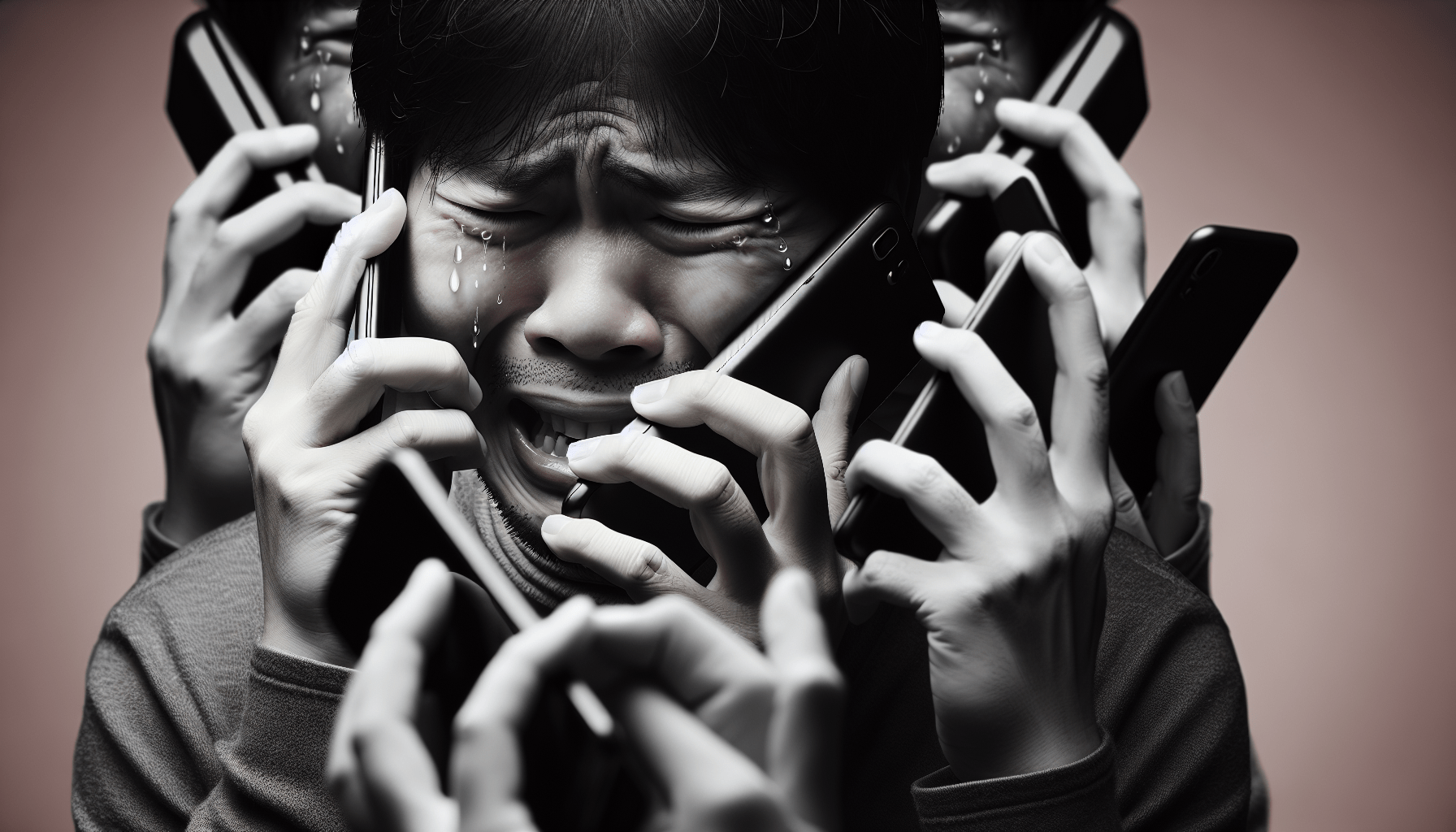

In today’s increasingly digital world, personal loans have become a common solution for individuals facing unexpected financial challenges. While personal loans can provide much-needed relief, dealing with aggressive or harassing tactics from loan collectors can add additional stress to an already difficult situation. If you find yourself in this predicament, it’s important to know your rights, understand your options, and take steps to protect yourself.

Understand Your Rights as a Borrower

When dealing with personal loan collectors, it’s crucial to know and understand your rights as a borrower. The Fair Debt Collection Practices Act (FDCPA) is a federal law designed to protect consumers from abusive debt collection practices. Under the FDCPA, loan collectors are prohibited from engaging in actions such as:

- Calling you before 8 a.m. or after 9 p.m. without your permission

- Contacting you at work if they know your employer prohibits such communication

- Harassing, threatening, or using abusive language towards you

- Making false statements or misrepresentations about your debt

If you believe a personal loan collector is violating your rights under the FDCPA, you have the right to take legal action against them. It’s essential to document any incidents of harassment, including dates, times, and details of the interactions, to support your case.

Remember, you have rights as a borrower, so don’t be afraid to stand up for yourself if a loan collector crosses the line.

Communicate Clearly with the Loan Collector

If you find yourself being harassed by a personal loan collector, it’s important to communicate your concerns clearly and assertively. Contact the collector in writing to request that they cease all forms of harassment, quoting specific examples of their behavior that you believe violate the FDCPA.

In your communication, avoid engaging in heated arguments or emotional exchanges with the collector. Instead, maintain a professional and firm tone, focusing on the facts of the situation and your rights as a borrower. Be sure to keep copies of all correspondence with the collector for your records.

Remember, clear and assertive communication can help resolve issues with loan collectors more effectively.

Seek Legal Advice and Assistance

If you’re unable to resolve the harassment issues with a personal loan collector on your own, seeking legal advice and assistance may be necessary. Contacting a consumer rights attorney who specializes in debt collection practices can provide you with valuable guidance and support in handling the situation.

A legal professional can help you understand your rights under the FDCPA, assess the validity of any debt collection claims, and represent you in negotiations with the loan collector. They can also advise you on potential legal avenues to pursue if the harassment continues or escalates.

Remember, legal assistance can be a valuable resource in dealing with aggressive loan collectors and protecting your rights as a borrower.

Review Your Loan Agreement and Financial Situation

As you navigate harassment issues with a personal loan collector, it’s essential to review your loan agreement and understand your financial obligations. Ensure that you’re clear on the terms of repayment, including deadlines, interest rates, and any associated fees.

If you’re experiencing difficulty in meeting your loan obligations due to financial hardship, consider reaching out to the lender to discuss alternative payment arrangements. Some lenders may be willing to work with you to find a solution that aligns with your current financial situation.

Remember, staying informed about your loan agreement and exploring repayment options can help alleviate financial stress and prevent further collection actions.

Consider Debt Consolidation or Credit Counseling

If you’re struggling to manage multiple debts, including a personal loan with aggressive collection tactics, debt consolidation or credit counseling may be viable options. Debt consolidation involves combining multiple debts into a single loan with more favorable terms, making it easier to manage your payments.

Credit counseling services can provide you with expert guidance on managing your debts, creating a budget, and improving your financial literacy. A credit counselor can work with you to develop a personalized financial plan that addresses your specific needs and helps you regain control of your finances.

Remember, exploring debt consolidation and credit counseling services can provide you with valuable support in managing your debts and improving your financial health.

Protect Your Personal Information

In the midst of dealing with harassment from a personal loan collector, it’s crucial to protect your personal information and financial data. Be cautious about sharing sensitive details, such as your social security number, bank account information, or other confidential data, with unknown or unverified parties.

If a loan collector requests personal information over the phone, consider verifying their identity by asking for their name, company affiliation, and contact information. Be wary of unsolicited calls or emails asking for financial information and report any suspicious activity to the relevant authorities.

Remember, safeguarding your personal information is essential in preventing identity theft and financial fraud.

Reach Out to Consumer Protection Agencies

If you’ve exhausted all options in dealing with harassment from a personal loan collector, consider reaching out to consumer protection agencies for assistance. Agencies such as the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) are dedicated to protecting consumers from unfair and deceptive practices in the financial industry.

You can file a complaint with these agencies online, providing details of your experience with the loan collector and any evidence of harassment or violations of consumer protection laws. By reporting your concerns to these agencies, you contribute to efforts to hold loan collectors accountable for their actions and protect other borrowers from similar mistreatment.

Remember, consumer protection agencies can serve as valuable allies in advocating for your rights and holding loan collectors accountable for their actions.

In conclusion, dealing with harassment from a personal loan collector can be a distressing and overwhelming experience. However, by understanding your rights, communicating assertively, seeking legal advice, and exploring alternative options, you can protect yourself and navigate the situation effectively. Remember, you’re not alone in facing these challenges, and there are resources available to support you in addressing harassment issues and regaining control of your financial well-being. Stay informed, stay empowered, and take proactive steps to ensure your rights as a borrower are respected.