Before selling a home that still has a mortgage, there are several important financial steps to consider. First, you need to understand the payoff process, including how much you still owe on your mortgage and what fees may be involved in paying it off early. Next, it’s crucial to factor in the closing costs associated with selling your home, such as real estate agent fees, transfer taxes, and attorney fees. Lastly, you should educate yourself about potential capital gains taxes that might apply when selling a property. By taking these financial steps into account, you can ensure a smoother and more informed home-selling process. Selling a home that still has a mortgage requires careful consideration of various financial steps to ensure a successful and profitable transaction. From assessing your mortgage payoff to estimating capital gains taxes, understanding closing costs, reviewing your home’s market value, preparing the home for sale, determining the listing price, implementing effective marketing and selling strategies, negotiating with potential buyers, preparing for the closing process, and finally completing the sale, each step plays a crucial role in maximizing your financial outcomes and minimizing potential risks. Let’s delve into each of these steps in detail.

This image is property of cdn-digkohb.nitrocdn.com.

Assessing Mortgage Payoff

Before putting your home on the market, it is essential to evaluate the remaining loan balance. By contacting your mortgage lender, you can obtain accurate information about the outstanding balance on your loan. This knowledge will provide you with a clear understanding of the amount needed to pay off the mortgage completely upon the sale of your home.

Determine the Payoff Amount

In addition to determining the remaining loan balance, it is crucial to calculate the payoff amount for your mortgage. The payoff amount includes any interest that has accrued since your last payment, and it may also include other fees or charges specified by your lender. Contact your mortgage lender or review your loan agreement to obtain the exact payoff amount.

Consider Early Repayment Penalties

Some mortgage contracts may include penalties for early repayment. These penalties are designed to compensate the lender for the interest income they would have received had you continued paying your mortgage according to the agreed-upon schedule. Before selling your home, it is important to review your mortgage agreement to determine whether any early repayment penalties apply. If such penalties exist, consult with your lender to understand the potential financial impact of selling your home before the agreed-upon mortgage term.

Understanding Closing Costs

Closing costs refer to the fees and expenses associated with the transfer of ownership from the seller to the buyer. Before selling your home, it is crucial to familiarize yourself with the typical closing costs in your area. Conduct research, consult with real estate professionals, or seek advice from local homeowners who have recently sold their properties. By understanding the average closing costs in your area, you will be better prepared to negotiate these expenses and ensure a mutually beneficial transaction.

Research Typical Closing Costs in Your Area

Closing costs can vary significantly depending on your location. Expenses such as title insurance, attorney fees, appraisal fees, recording fees, and transfer taxes are common components of closing costs. Gathering information about the average closing costs in your area will enable you to set realistic expectations and plan accordingly.

Consider Seller Concessions

In some real estate transactions, sellers offer concessions to encourage potential buyers to complete the purchase. These concessions can come in the form of covering part or all of the buyer’s closing costs. As a home seller, it is important to consider whether offering seller concessions could make your property more attractive to potential buyers. By offsetting some of the buyer’s closing costs, you may increase your chances of receiving competitive offers.

This image is property of hackyourwealth.com.

Negotiate with the Buyer

During the negotiation process, closing costs can be a point of discussion between you and the buyer. By having a clear understanding of the typical closing costs in your area and considering your own financial constraints, you will be better positioned to negotiate and reach a mutually agreeable solution with the buyer. Remember to consult with your real estate agent, who can provide guidance and support throughout the negotiation process.

Estimating Capital Gains Taxes

When selling a home, it is important to consider the potential capital gains tax implications. Capital gains taxes are levied on the profit realized from the sale of an asset, including a home. Understanding the capital gains tax exemption, calculating your potential capital gains, and consulting with a tax professional are vital steps in estimating and managing your tax obligations.

Understand the Capital Gains Tax Exemption

In many countries, including the United States, there is a capital gains tax exemption for primary residences. This exemption allows homeowners to exclude a certain amount of their capital gains from taxation when they sell their homes. To determine whether you qualify for this exemption and to understand the specific rules and regulations in your jurisdiction, consult with a tax professional.

Calculate Your Potential Capital Gains

To estimate your potential capital gains, you need to know the original purchase price of your home, the cost of any renovations or improvements made, and the current market value of the property. By subtracting these costs from the anticipated sale price, you can estimate your capital gains. Keep in mind that additional factors, such as depreciation and allowable deductions, may also impact your final capital gains amount.

Consult with a Tax Professional

Since tax laws can be complex and subject to change, it is crucial to consult with a tax professional before selling your home. A tax professional can analyze your financial situation, consider any applicable capital gains tax exemptions, and provide guidance on how to minimize your tax liability. Seeking professional advice will help ensure compliance with tax regulations and maximize your financial outcomes.

Reviewing Your Home’s Market Value

Determining the market value of your home is a critical step in setting the right listing price and attracting potential buyers. By conducting a comparative market analysis, considering a professional appraisal, and staying informed about market trends, you can accurately assess your home’s market value and optimize your selling strategy.

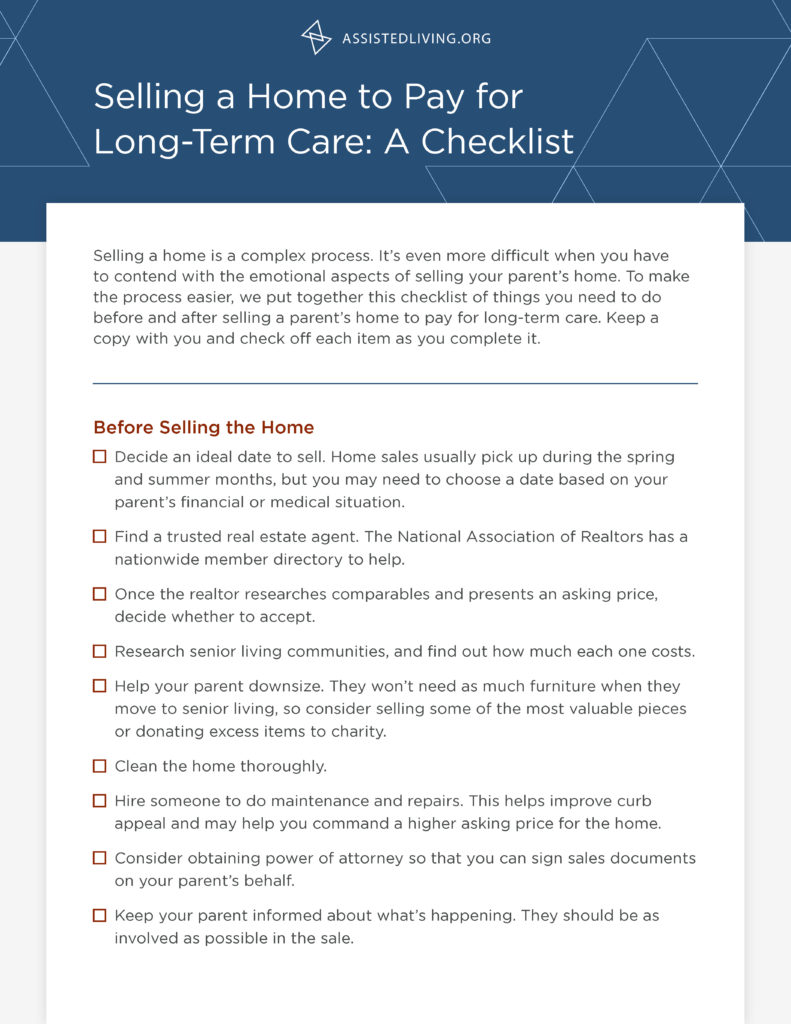

This image is property of www.assistedliving.org.

Conduct a Comparative Market Analysis

A comparative market analysis involves analyzing recent sales data for similar properties in your area. By comparing factors such as location, size, condition, and amenities, you can gain insight into the fair market value of your home. Real estate agents often provide this service as part of their marketing and listing strategy, helping you set a competitive listing price.

Consider a Professional Appraisal

Engaging a professional appraiser to assess the value of your home can provide an unbiased and expert opinion. Appraisals take into account various factors, including recent comparable sales, the condition of your home, and current market trends. While an appraisal may come with a fee, it can help ensure that your listing price accurately reflects your home’s worth.

Take Note of Market Trends

Market conditions can significantly impact the value of your home. Stay informed about local real estate trends, such as changes in supply and demand, interest rates, and other factors that may influence buyer behavior. By staying up-to-date, you can make informed decisions when setting your listing price and negotiating with potential buyers.

Preparing the Home for Sale

Preparing your home for sale is a crucial step in attracting potential buyers and maximizing its market value. Making necessary repairs and improvements, staging the home for optimal presentation, and considering professional photography and marketing strategies are key elements of this process.

Make Necessary Repairs and Improvements

Before listing your home, conduct a thorough inspection to identify any areas that require repair or improvement. Addressing issues such as peeling paint, leaking faucets, or cracked tiles will enhance the overall appeal and value of your home. Consider prioritizing repairs based on their impact on the home’s functionality and visual appeal.

Stage the Home for Optimal Presentation

Staging involves arranging and decorating your home to highlight its best features and create an inviting atmosphere for potential buyers. Decluttering, organizing, and strategically placing furniture and decor can help buyers visualize themselves living in your space. Consider hiring a professional stager or researching staging techniques to maximize the impact of this step.

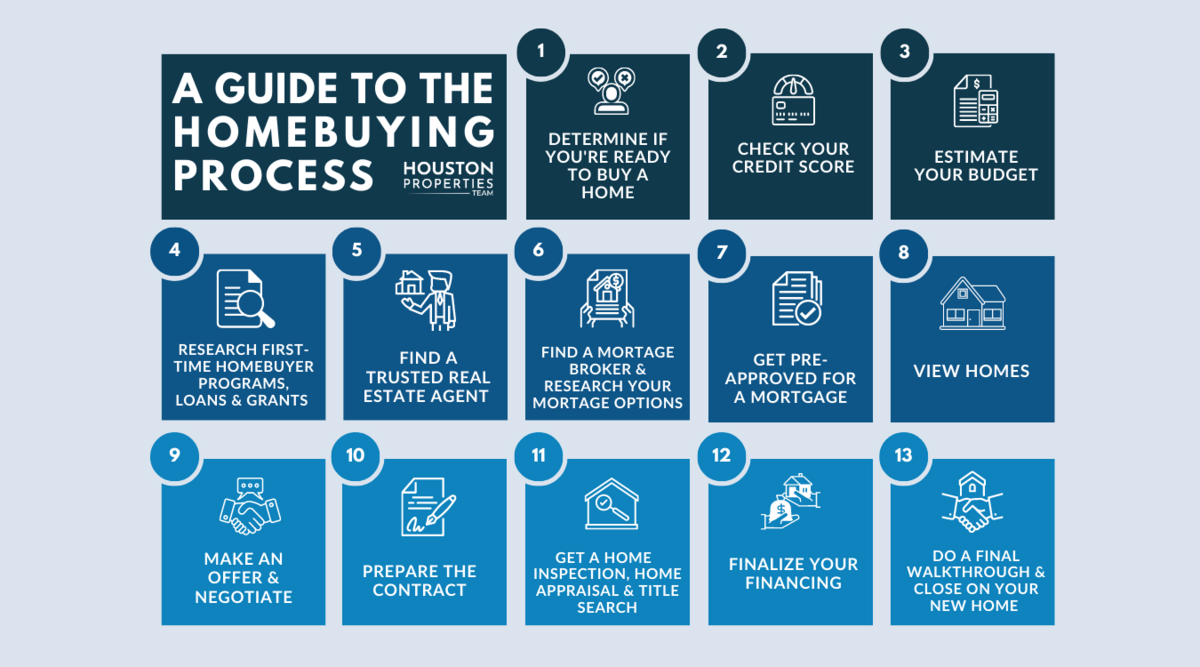

This image is property of media-www.houstonproperties.com.

Consider Professional Photography and Marketing

Capturing high-quality, professional photographs of your home is essential in attracting potential buyers online. High-resolution images that showcase each room’s unique features and the property’s exterior will entice buyers to schedule viewings. Additionally, consider investing in professional marketing materials, such as brochures or virtual tours, to showcase your home’s assets.

Determining the Listing Price

Setting the right listing price is crucial for attracting potential buyers and maximizing your home’s selling potential. Pricing competitively based on market value, factoring in closing costs and potential capital gains taxes, and consulting with a real estate agent are effective strategies when determining the listing price.

Price Competitively Based on Market Value

While it may be tempting to list your home at the highest possible price, pricing competitively is often more effective in attracting potential buyers. By setting a price that aligns with the market value determined through a comparative market analysis, you can increase the likelihood of generating interest and receiving competitive offers.

Factor in Closing Costs and Potential Capital Gains Taxes

When setting your listing price, it is important to consider the impact of closing costs and potential capital gains taxes. By factoring in these expenses, you can determine the minimum acceptable price that will cover all costs and leave you with the desired net proceeds from the sale. Working with a real estate agent and consulting with a tax professional can provide invaluable guidance in this process.

Consult with a Real Estate Agent

Real estate agents possess extensive knowledge and experience in pricing properties accurately. By consulting with a reputable agent, you can benefit from their expertise in analyzing market data, assessing the condition of your home, and considering various factors that may influence the listing price. A real estate agent can provide valuable insights and recommendations based on their knowledge of the local market, helping you make informed decisions throughout the selling process.

Marketing and Selling Strategies

Implementing effective marketing and selling strategies is essential for attracting potential buyers and achieving a successful sale. Utilizing online listing platforms, promoting the home through social media, and hosting open houses and private showings are effective ways to generate interest and engage with prospective buyers.

This image is property of www.bankrate.com.

Utilize Online Listing Platforms

Online listing platforms, such as real estate websites and portals, provide extensive exposure for your home. By creating a compelling listing that includes high-quality photographs, detailed descriptions, and accurate information about your property, you can attract a broader audience of potential buyers. Regularly monitor and update your online listing to maintain its visibility and relevance in the market.

Promote the Home Through Social Media

Harnessing the power of social media platforms can significantly expand your reach and engage with potential buyers. Share your listing across various social media channels, allowing friends, family, and acquaintances to share your post and spread the word about your property. Consider leveraging targeted advertising options to reach specific demographics or individuals interested in your location or property type.

Host Open Houses and Private Showings

Open houses and private showings provide opportunities for potential buyers to experience your home firsthand. By creating an inviting and welcoming atmosphere, you can help buyers envision themselves living in your space. Prepare for open houses by decluttering, cleaning thoroughly, and staging the home to showcase its full potential. Consider offering refreshments and providing information about the neighborhood to create a positive impression.

Negotiating with Potential Buyers

Once you receive offers from potential buyers, evaluating offers and counteroffers, considering contingencies and timelines, and working with a skilled negotiator if needed are vital steps in securing a favorable outcome. Negotiation plays a crucial role in reaching an agreement that satisfies all parties involved.

Evaluate Offers and Counteroffers

Carefully review each offer received, considering not only the offered price but also any contingencies or additional terms attached to the offer. Compare the terms of each offer, such as financing conditions, closing dates, and inclusion or exclusion of certain items, to determine the most favorable option. If the initial offer does not meet your expectations, be prepared to make counteroffers to find common ground.

Consider Contingencies and Timelines

Contingencies and timelines specified in the purchase offer can significantly impact the sale process. Common contingencies include financing contingencies, home inspection contingencies, and appraisal contingencies. Evaluate each contingency to understand the potential risks and implications for the sale. Similarly, review the proposed timeline for closing and determine whether it aligns with your desired timeframe.

Work with a Skilled Negotiator if Needed

If negotiations become complex or challenging, consider working with a skilled negotiator, such as a real estate agent or attorney with expertise in real estate transactions. A professional negotiator can navigate difficult conversations, advocate for your best interests, and help facilitate a mutually acceptable agreement. Their experience and knowledge can be invaluable in achieving a favorable outcome.

Preparing for the Closing Process

As the sale progresses, preparing for the closing process is crucial to ensure a smooth and efficient transaction. Gathering necessary documents, coordinating the mortgage payoff, and reviewing the closing disclosure are essential tasks during this stage.

Gather Necessary Documents

Prior to the closing, gather all relevant documents, including your original purchase agreement, the property’s title deed, mortgage documents, and any documentation related to home improvements or repairs made during your ownership. Organizing these documents in advance will help streamline the closing process and minimize potential delays.

Ensure the Mortgage Payoff is Coordinated

Coordination with your mortgage lender is critical to ensure that the mortgage payoff is processed correctly and timely. Work closely with your lender to understand their requirements, provide the necessary information, and coordinate the transfer of funds to satisfy the outstanding loan balance. Clear communication and prompt action will help facilitate a successful mortgage payoff.

Review the Closing Disclosure

The closing disclosure is a document that outlines the final details of the financial transaction. It includes important information such as the final sale price, closing costs, and any adjustments made. Review the closing disclosure carefully, ensuring that all the details are accurate and in line with the agreed-upon terms. Address any discrepancies or concerns promptly with your real estate agent or attorney.

Completing the Sale

Completing the sale is the final milestone in the selling process. Coordinating with all parties involved, signing necessary documents, and transferring ownership and funds are essential steps to finalize the transaction successfully.

Coordinate with All Parties Involved

Effective communication and coordination with all parties involved, including the buyer, buyer’s agent, lender, and title company, are crucial in bringing the sale to a close. Stay in regular contact with each party, respond promptly to inquiries or requests for additional documentation, and provide any necessary information or assistance to facilitate a smooth transition.

Sign Necessary Documents

On the day of closing, you will be required to sign various legal documents, including the deed transferring ownership to the buyer, the bill of sale, and any additional documents required by your jurisdiction. Take the time to read and understand each document before signing, and ask questions or seek clarification if needed. Consider engaging a real estate attorney or escrow officer to guide you through the closing process and ensure compliance with all legal requirements.

Transfer Ownership and Receive Funds

Following the successful signing of all necessary documents, ownership of your home will be officially transferred to the buyer. At this stage, you will also receive the funds from the sale, which typically occur through a wire transfer or a certified check. Confirm the receipt of funds, and work with your real estate agent or closing agent to ensure that any outstanding payments or liens on the property are addressed appropriately.

In conclusion, before selling a home that still has a mortgage, it is crucial to navigate several financial steps to ensure a smooth and financially advantageous transaction. Assessing your mortgage payoff, understanding closing costs, estimating potential capital gains taxes, reviewing your home’s market value, preparing the home for sale, determining the listing price, implementing effective marketing and selling strategies, negotiating with potential buyers, preparing for the closing process, and completing the sale are all critical elements of a successful home-selling journey. By following these steps diligently and seeking professional guidance when needed, you can maximize your financial outcomes and achieve a successful sale of your home.