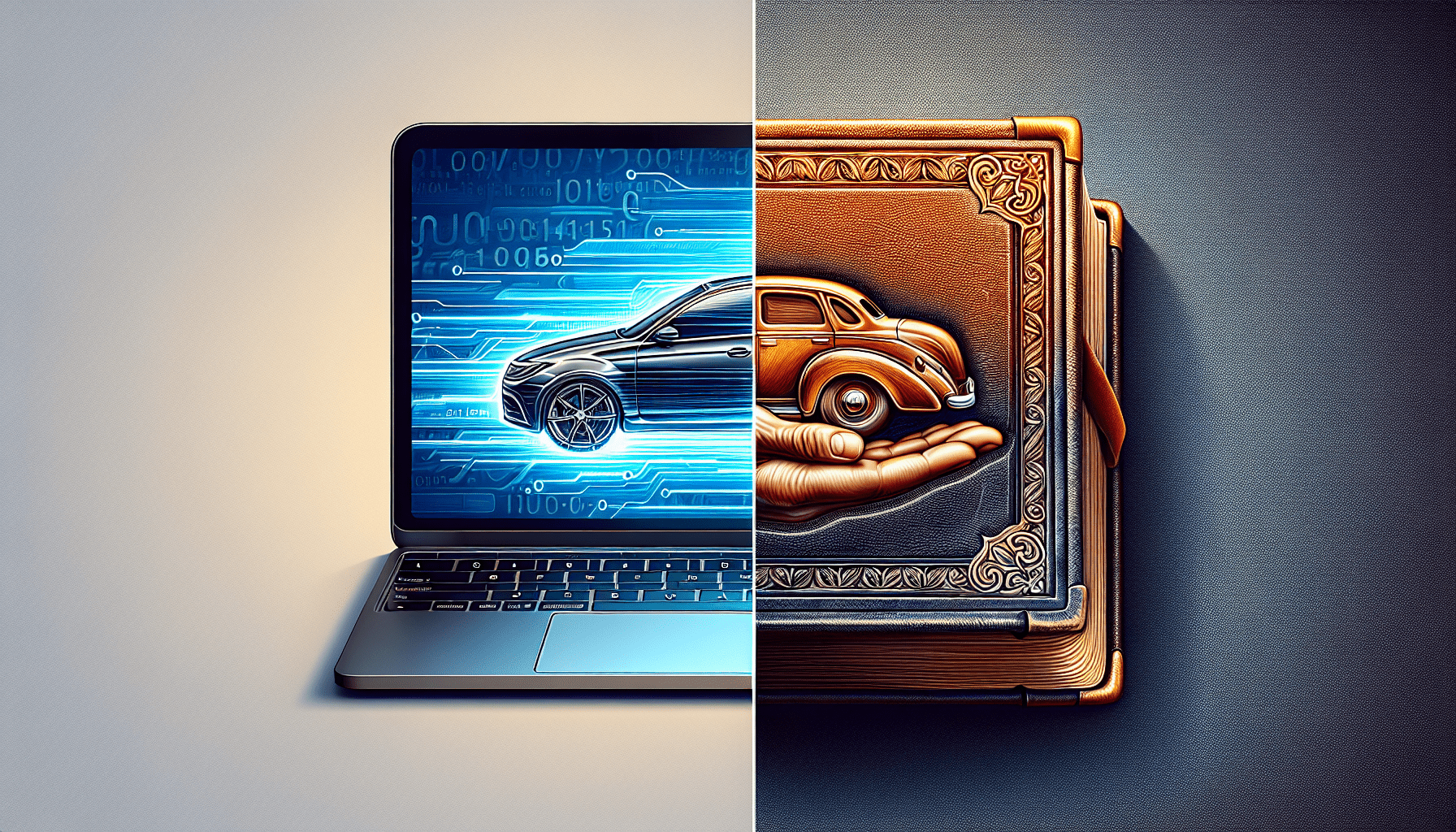

Are you considering obtaining an auto loan but unsure whether to go with an online auto loan lender or a traditional lender? Understanding the pros and cons of each can help you make an informed decision. Online auto loan lenders like Bad Credit Loan offer convenience, flexibility, and transparency, making the application process easier and more accessible. On the other hand, traditional lenders might offer in-person support and a more personal touch, but they can also come with stricter requirements and longer processing times. By weighing the advantages and disadvantages of both options, you can choose the best fit for your unique financial situation and transportation needs.

Online Auto Loan Lenders Vs. Traditional Lenders: Understanding the Pros and Cons

Are you in the market for an auto loan but unsure whether to go with an online auto loan lender or a traditional lender? Don’t worry, we’ve got you covered! In this article, we’ll break down the pros and cons of both options to help you make an informed decision that suits your unique financial situation and needs.

Online Auto Loan Lenders: Advantages and Disadvantages

Online auto loan lenders have gained popularity in recent years due to their convenience and accessibility. Let’s take a closer look at the pros and cons of working with an online auto loan lender.

Pros:

- Convenience: One of the most significant advantages of online auto loan lenders is the convenience they offer. You can apply for a loan from the comfort of your home, eliminating the need to visit a physical branch.

- Quick Approval Process: Online lenders typically have faster approval processes compared to traditional lenders. This means you can get approved for a loan and access funds more quickly.

- Competitive Rates: Online lenders often have competitive interest rates and loan terms, making it possible to secure a favorable deal for your auto loan.

Cons:

- Limited Personal Interaction: Working with an online lender means you may have limited personal interaction with a loan officer. This could be a drawback if you prefer face-to-face communication.

- Potential Scams: Due to the online nature of these lenders, there is a risk of encountering scams or fraudulent lenders. It’s essential to research and choose reputable online lenders to avoid falling victim to scams.

Traditional Auto Loan Lenders: Advantages and Disadvantages

Traditional auto loan lenders, such as banks and credit unions, have been the go-to option for many borrowers for years. Let’s explore the pros and cons of working with a traditional auto loan lender.

Pros:

- Personalized Service: Traditional lenders often offer personalized service, allowing you to speak directly with a loan officer and address any questions or concerns you may have.

- Established Reputation: Banks and credit unions typically have established reputations in the financial industry, providing a sense of security and trust for borrowers.

- In-Person Support: If you prefer face-to-face interactions, working with a traditional lender gives you the opportunity to receive in-person support throughout the loan process.

Cons:

- Strict Requirements: Traditional lenders may have stricter requirements for loan approval, including higher credit scores and income levels. This could make it challenging for individuals with less-than-perfect credit histories to qualify.

- Lengthy Approval Process: Unlike online lenders, traditional lenders often have longer approval processes, which can delay access to funds for purchasing a vehicle.

- Limited Options: Traditional lenders may have limited options for borrowers, especially those with unique financial situations. This could restrict your ability to find a loan that fits your specific needs.

Making the Right Choice for Your Auto Loan

When deciding between an online auto loan lender and a traditional lender, consider the following factors to make the best choice for your auto loan:

- Credit History: If you have a less-than-ideal credit history, online auto loan lenders that specialize in bad credit loans may be a better option for securing financing.

- Timeline: If you need quick access to funds and a fast approval process, online lenders are often the way to go. However, if you have the luxury of time and prefer a personalized approach, traditional lenders may be a better fit.

- Interest Rates and Terms: Compare the interest rates, loan terms, and fees offered by both online and traditional lenders to find the most competitive deal for your auto loan.

- Reputation and Trust: Research the reputation and credibility of lenders, whether online or traditional, to ensure you’re working with a trustworthy financial partner.

By weighing these factors and considering the pros and cons of each option, you can make an informed decision that aligns with your financial goals and preferences. Whether you choose an online auto loan lender or a traditional lender, the most crucial aspect is to secure a loan that meets your needs and helps you achieve your goal of owning a vehicle.

Remember, the key to successful borrowing is responsible financial management and diligent repayment. By choosing the right lender and staying proactive in managing your auto loan, you can pave the way for a positive borrowing experience and a brighter financial future.

So, whether you opt for the convenience of an online auto loan lender or the personalized service of a traditional lender, make sure to explore your options thoroughly and choose the best fit for your auto financing needs. Your dream of owning a vehicle is within reach – now it’s time to take the next step towards making it a reality!