Securing a mortgage on a single income can feel like a daunting task, especially for individuals with less-than-perfect credit histories. But fear not, because Bad Credit Loan is here to help! With their tailored solutions and inclusive approach, they empower individuals to access the housing they deserve. Through their user-friendly online platform, you can conveniently apply for a mortgage from the comfort of your own home, eliminating unnecessary paperwork and bureaucracy. With customizable options and transparent practices, Bad Credit Loan is committed to ensuring that you can pursue your homeownership goals with confidence. Whether you’re a first-time buyer, looking to refinance, or want to access your home equity, Bad Credit Loan is your trusted partner in navigating the complexities of the home buying process.

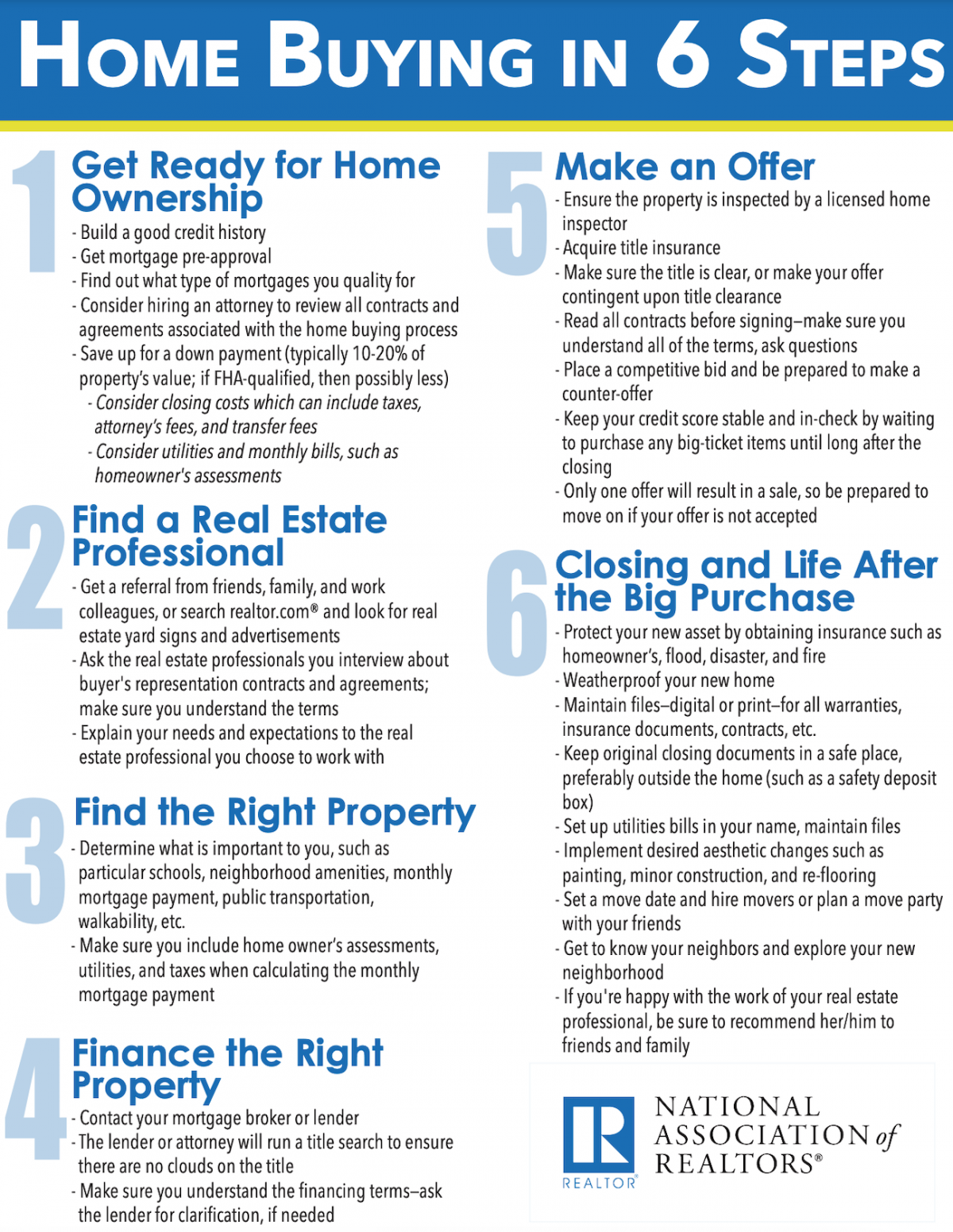

This image is property of cdn.nar.realtor.

Determining Affordability

Assess your financial situation

Before embarking on your home buying journey, it’s essential to take a close look at your financial situation. Evaluate your income, expenses, and debt obligations to determine how much you can comfortably afford to spend on a mortgage each month. Consider factors such as your employment stability, future financial goals, and any potential changes in income that may affect your ability to make mortgage payments.

Calculate your budget

Once you have a clear understanding of your financial situation, it’s time to crunch the numbers and calculate your budget. Consider not only the monthly mortgage payment but also other homeownership costs such as property taxes, insurance, and maintenance expenses. Use a mortgage calculator or consult with a financial professional to determine the maximum mortgage amount that fits within your budget and aligns with your long-term financial goals.

Consider additional expenses

When assessing affordability, it’s crucial to consider additional expenses associated with homeownership. These may include homeowners association fees, utility bills, and potential renovations or repairs. Factoring in these extra costs will give you a more accurate picture of the overall financial commitment of owning a home.

Evaluate your credit score

Your credit score plays a significant role in qualifying for a mortgage and determining the interest rate you will be offered. Request a copy of your credit report and review it carefully for any errors or issues that may impact your credit score. If your credit score is lower than desired, take steps to improve it by paying bills on time, paying down debt, and disputing any inaccuracies. A higher credit score can not only increase your chances of mortgage approval but also help you secure more favorable loan terms and interest rates.

Saving for a Down Payment

Set a savings goal

Saving for a down payment is a crucial step in the home buying process. Determine how much you need to save by considering the minimum down payment requirements set by lenders and any personal goals you may have. Aim to save at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI). Create a realistic savings plan by setting monthly or weekly savings targets and automating your savings contributions.

Explore down payment assistance programs

If saving for a down payment seems challenging, explore down payment assistance programs that may be available to you. These programs, offered by government agencies, nonprofits, and employers, provide financial assistance to eligible homebuyers. Research and understand the requirements, restrictions, and potential benefits of these programs in your area.

Cutting expenses

To accelerate your savings, consider adjusting your budget and cutting unnecessary expenses. Evaluate your spending habits and identify areas where you can reduce or eliminate costs. This may include dining out less frequently, canceling unused subscriptions, or finding more affordable alternatives for everyday expenses. Redirect the money saved towards your down payment fund.

Increase income

Supplementing your existing income can help speed up your savings process. Consider taking on a side job, freelancing, or monetizing a hobby to generate additional income. Direct the extra earnings towards your down payment fund and watch your savings grow more quickly. Remember to consult with a tax professional to understand the potential tax implications of additional income sources.

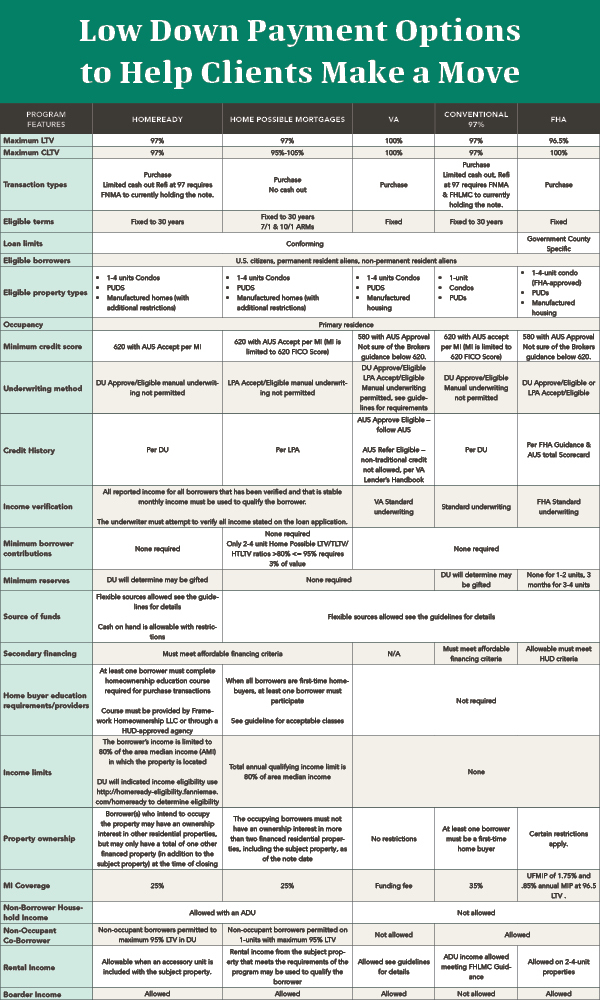

This image is property of movement.com.

Finding the Right Mortgage

Research mortgage options

Take the time to research different types of mortgages to find the one that best fits your financial situation and goals. Common options include conventional loans, Federal Housing Administration (FHA) loans, and Veterans Affairs (VA) loans. Each type of mortgage has its own requirements, benefits, and drawbacks, so it’s important to understand them thoroughly before making a decision.

Compare interest rates and terms

When shopping for a mortgage, it’s crucial to compare interest rates and loan terms from different lenders. Even a slight difference in interest rates can significantly impact the overall cost of your mortgage. Request quotes from multiple lenders and compare them side by side to identify the most favorable options. Consider working with a mortgage broker who can help you navigate the competitive mortgage market and find the best terms for your needs.

Consider government programs

Government programs such as FHA loans, VA loans, and USDA loans can offer specific benefits for eligible borrowers. FHA loans, for example, may be an attractive option for first-time homebuyers with lower credit scores. VA loans are designed for veterans, active-duty service members, and their families. Research these programs and determine if you meet the eligibility criteria to potentially access more favorable terms and conditions.

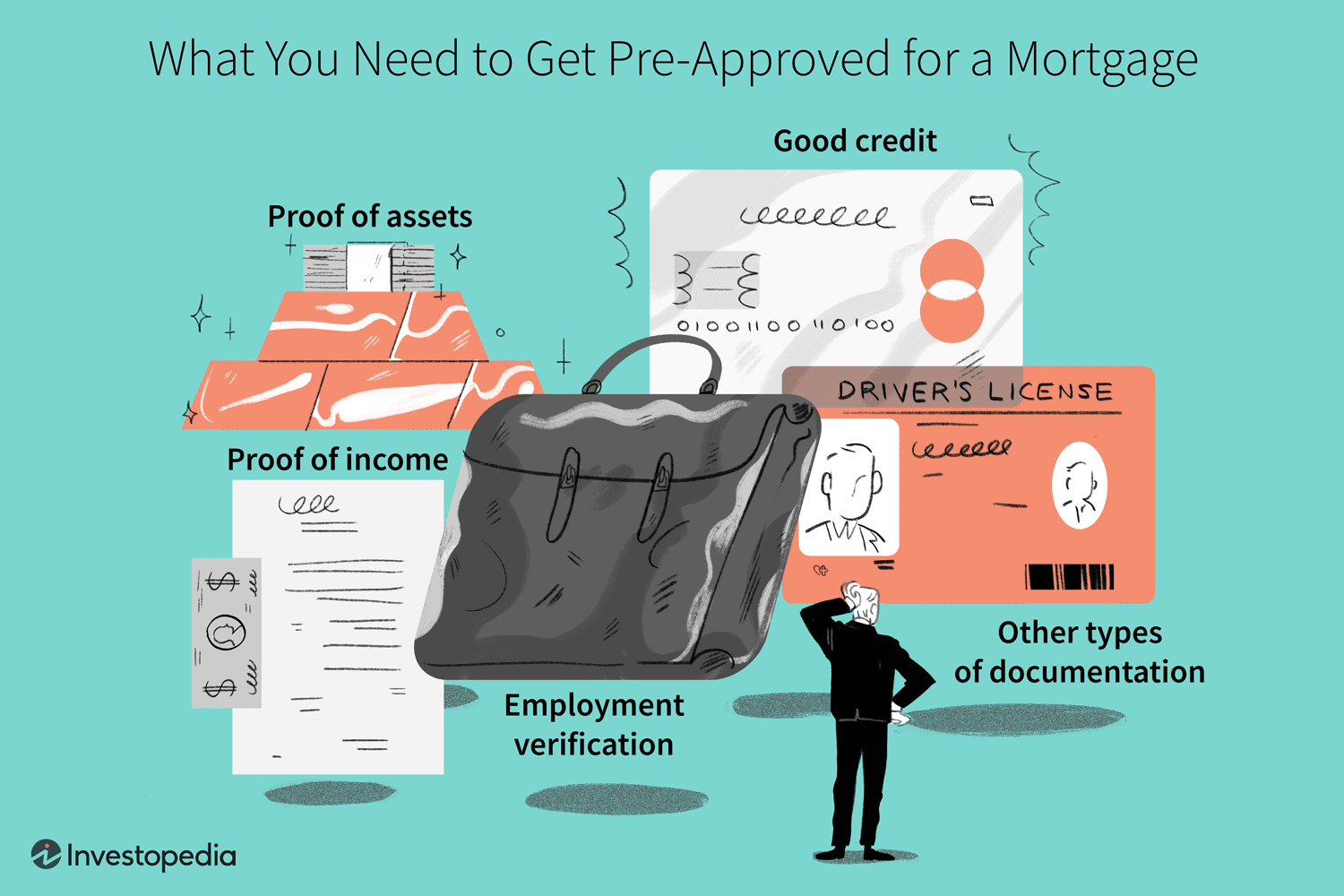

Gather necessary documents

To apply for a mortgage, you will need to gather various documents to demonstrate your financial stability and creditworthiness. These documents typically include income statements, bank statements, tax returns, and proof of identification. Organize these documents early in the process to ensure a smooth and efficient application process.

Getting Pre-Approved

Submit a mortgage application

Once you’ve chosen a lender and mortgage option, it’s time to submit a mortgage application. Fill out the required forms accurately and provide any additional information requested by the lender. Be prepared for a comprehensive review of your financial situation, including income verification, credit checks, and employment history verification.

Provide required documentation

Alongside your mortgage application, you will need to provide the necessary documentation to support your financial information. This may include recent pay stubs, tax returns, bank statements, and asset statements. Be thorough and organized in compiling these documents to streamline the pre-approval process.

Undergo credit check

As part of the pre-approval process, the lender will conduct a credit check to assess your creditworthiness. The lender will review your credit history, credit score, and any outstanding debts or issues. A strong credit profile will increase your chances of pre-approval and help you negotiate better loan terms.

Receive pre-approval letter

If your mortgage application is approved, you will receive a pre-approval letter from the lender. This letter serves as a confirmation that you have met the initial criteria for a mortgage loan. The pre-approval letter is a valuable asset when house-hunting, as it demonstrates to sellers that you are a serious and qualified buyer.

This image is property of cdn2.assets-servd.host.

Working with a Real Estate Agent

Find a reputable real estate agent

A real estate agent can be a valuable ally throughout the home buying process. Take the time to find a reputable and experienced agent who has a good understanding of the local market and your specific needs. Seek recommendations from friends, family, and colleagues, and conduct thorough research to ensure you choose an agent with a track record of success.

Discuss your specific needs

Once you have selected a real estate agent, it’s important to have a detailed discussion about your specific needs and preferences. Communicate your budget, desired location, property must-haves, and any other factors that are important to you. This will help your agent narrow down the search and present you with suitable options.

Tour potential homes

Rely on your real estate agent to schedule and accompany you on tours of potential homes. Take the time to visit each property, exploring its features, layout, and condition. Consider factors such as proximity to amenities, schools, and transportation. Keep an open mind while touring, as properties may require some imagination to envision their full potential.

Negotiate the purchase price

When you find a home that meets your requirements, your real estate agent will guide you through the negotiation process. They will help you determine a competitive offer price based on comparable sales in the area and any unique characteristics of the property. Work closely with your agent to develop a negotiation strategy that aligns with your budget and desired purchase price.

Making an Offer

Set a competitive offer price

After careful consideration and analysis, it’s time to set an offer price for the home you wish to purchase. Base your offer on market research, the property’s condition, and your budget. Your real estate agent will assist you in determining a competitive offer price that has a realistic chance of being accepted while still representing a good value for you.

Include contingencies

Contingencies are conditions that must be met for the purchase to proceed. Common contingencies include a satisfactory home inspection, appraisal, and the ability to secure financing. Including these contingencies in your offer gives you an opportunity to back out of the purchase or renegotiate if certain conditions are not met.

Consider seller concessions

In some cases, you may be able to negotiate seller concessions to help cover closing costs or other expenses. These concessions can lower your out-of-pocket expenses and make the home more affordable. Your real estate agent can advise you on the feasibility of requesting seller concessions based on the local market conditions and seller’s motivations.

Submit the offer

Once you have finalized the offer price, contingencies, and any requested concessions, it’s time to submit your offer to the seller. Your real estate agent will handle the necessary paperwork and ensure that your offer is presented in a timely and professional manner. Be prepared for potential negotiations and counteroffers as the seller considers your offer.

This image is property of www.investopedia.com.

Reviewing and Signing Documents

Review the terms of the mortgage agreement

When you receive the mortgage agreement from your lender, review it carefully. Pay close attention to the terms, including the interest rate, loan duration, repayment schedule, and any associated fees. Ensure that you fully understand the financial commitment you are undertaking and seek clarification from your lender or a financial advisor if needed.

Understand closing costs

Closing costs are expenses incurred during the home buying process, such as appraisal fees, title insurance, and attorney fees. Understand and budget for these costs, as they can add a significant amount to the total amount due at closing. Review the closing disclosure provided by your lender and seek clarification on any items that are unclear.

Sign necessary legal documents

During the closing process, you will be required to sign various legal documents to finalize the purchase of the home. These may include the mortgage agreement, deed of trust, promissory note, and other disclosure forms. Read each document carefully and seek legal advice if necessary to ensure you understand the contractual obligations you are entering into.

Consider hiring a real estate attorney

While not always required, it can be beneficial to hire a real estate attorney to review the legal documents and provide guidance throughout the closing process. An attorney can help protect your interests, ensure that the transaction is legally sound, and address any unforeseen issues that may arise.

Completing the Closing Process

Schedule a home inspection

Before the closing, it’s crucial to schedule a professional home inspection to assess the condition of the property. The inspector will examine the home’s structure, systems, and components for any potential issues or safety concerns. Review the inspection report carefully and discuss any significant findings with your real estate agent, allowing for potential renegotiation or repairs if necessary.

Obtain homeowners insurance

Homeowners insurance is essential to protect your investment and provide coverage for potential damages or liability. Work with an insurance provider to obtain a suitable homeowners insurance policy based on your needs and the requirements of your mortgage lender. Provide evidence of insurance to your lender before the closing.

Conduct a final walkthrough

Before the closing, it’s customary to conduct a final walkthrough of the property. This allows you to ensure that any repairs or agreed-upon changes have been completed and that the property is in the expected condition. Take your time during the walkthrough to thoroughly inspect the property and address any concerns with your real estate agent.

Arrange for the transfer of funds

When closing day arrives, you will need to arrange for the transfer of funds to cover the remaining balance of the purchase price, closing costs, and any other agreed-upon expenses. Work closely with your lender and real estate agent to ensure a smooth transaction. Make sure the necessary funds are available and coordinate with your financial institution to transfer them on time.

This image is property of www.investopedia.com.

Managing Homeownership Finances

Create a budget

Once you’ve closed on your new home, it’s vital to create a budget that reflects your new homeownership expenses. Consider not only the mortgage payment but also ongoing costs such as property taxes, utilities, insurance, maintenance, and repairs. Adjust your budget as necessary to ensure that you can comfortably afford your new financial responsibilities.

Set up automatic mortgage payments

To avoid late payments, consider setting up automatic mortgage payments. Most lenders offer this option, allowing you to have your mortgage payment automatically deducted from your bank account each month. This ensures that you never miss a payment and helps you build a positive payment history.

Establish an emergency fund

Owning a home comes with unexpected expenses and emergencies. To prepare for these situations, establish an emergency fund specifically dedicated to homeownership costs. Aim to save at least three to six months’ worth of mortgage payments and other essential expenses. Having an emergency fund in place provides a financial safety net and peace of mind.

Monitor credit score and report

Even after purchasing a home, it’s crucial to monitor your credit score and report regularly. A good credit score is essential for future financial endeavors and can help you secure better loan terms. Take advantage of free credit monitoring tools and services to stay informed about any changes or potential issues with your credit.

Seeking Additional Support

Utilize homebuyer education programs

Homebuyer education programs can provide valuable information and resources for both first-time and experienced homebuyers. These programs often cover topics such as budgeting, credit management, and the home buying process itself. Take advantage of these educational opportunities to enhance your knowledge and confidence as a homeowner.

Consider post-purchase counseling

Post-purchase counseling can provide guidance and support as you navigate homeownership. These counseling services are designed to help you manage your finances, address any challenges, and make informed decisions related to your home. Seek out reputable counseling agencies that can offer personalized advice tailored to your specific circumstances.

Explore available homeowner resources

As a homeowner, you may be eligible for various resources and benefits. Research local and federal programs that offer assistance with home repairs, energy efficiency improvements, and property tax exemptions. Take advantage of these resources to save money and enhance your homeownership experience.

Communicate with mortgage lender

Maintaining open and regular communication with your mortgage lender is essential throughout your homeownership journey. Stay in touch with your lender to address any questions or concerns you may have about your mortgage, payment options, or potential refinancing opportunities. Strong communication ensures a positive working relationship and can help you navigate any financial challenges that may arise.

In conclusion, navigating the home buying process as a single person with a mortgage may seem daunting, but with careful planning and support, it can be a rewarding experience. By assessing your finances, saving for a down payment, researching mortgage options, and working with a real estate agent, you can find the right home and secure the necessary financing. Reviewing and signing documents, completing the closing process, and managing homeownership finances are crucial steps to ensure a successful homeownership journey. Remember to utilize available resources, seek additional support when needed, and communicate effectively with your mortgage lender to maintain a positive and informed homeownership experience.