When it comes to securing a mortgage, individuals with less-than-perfect credit histories often face significant challenges. However, Bad Credit Loan aims to change that. With their tailored solutions and inclusive approach, Bad Credit Loan empowers individuals to access the housing they deserve. Through their user-friendly online platform, they make the mortgage application process convenient and seamless. With customizable options and transparent practices, Bad Credit Loan stands as a trusted partner for borrowers, ready to support them in achieving their homeownership goals.

What is a cosigner?

Definition of a cosigner

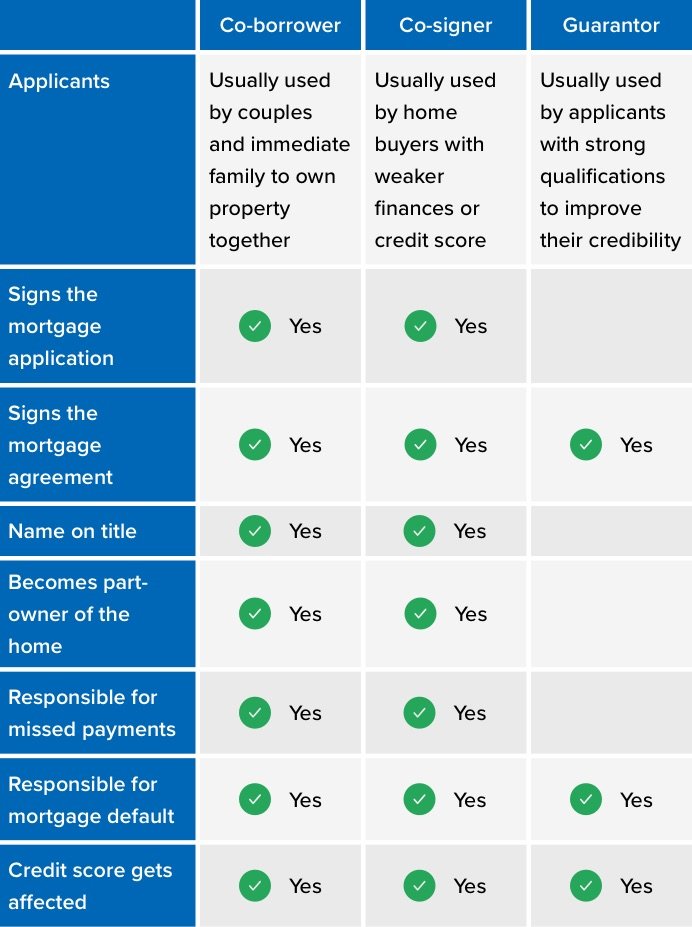

A cosigner is a person who agrees to take on financial responsibility for a loan or mortgage alongside the primary borrower. When someone with a less-than-ideal credit history or insufficient income wants to secure a mortgage, a cosigner can help strengthen their loan application.

Role of a cosigner in a mortgage

In a mortgage, a cosigner serves as a guarantor for the loan. Their role is to provide a sense of financial security to the lender by promising to repay the loan if the primary borrower is unable to do so. Cosigners are typically required when the borrower’s credit history, income, or debt-to-income ratio does not meet the lender’s requirements.

Why would someone need a cosigner for a mortgage?

Insufficient credit history

One common reason for needing a cosigner is having an insufficient credit history. If a borrower has limited or no credit history, lenders may view them as risky because they have no established track record of repaying debts. By having a cosigner with a solid credit history, the borrower can increase their chances of mortgage approval.

Low credit score

Another reason someone may need a cosigner for a mortgage is having a low credit score. A low credit score can be the result of past financial mismanagement, missed payments, or high levels of debt. Lenders may be hesitant to approve a mortgage for someone with a low credit score, but with a cosigner who has a good credit score, the borrower’s application becomes more appealing.

Debt-to-income ratio

A high debt-to-income (DTI) ratio occurs when a borrower’s monthly debts, such as credit card payments, car loans, and personal loans, are a significant portion of their income. Lenders have specific thresholds for what they consider an acceptable DTI ratio. If a borrower’s DTI ratio exceeds this threshold, having a cosigner with a lower DTI ratio can help them qualify for a mortgage.

This image is property of fastercapital.com.

Advantages of having a cosigner for a mortgage

Higher chances of mortgage approval

One of the primary advantages of having a cosigner for a mortgage is an increased likelihood of approval. Lenders may be more inclined to approve a mortgage application when a cosigner is involved, as their presence adds an extra layer of financial security.

Access to better interest rates and loan terms

With a cosigner, borrowers may have access to better interest rates and loan terms. Lenders are more likely to offer favorable rates and terms when a mortgage application is supported by a cosigner with a strong credit history and financial stability.

Ability to afford a higher loan amount

Having a cosigner can also help borrowers qualify for a higher loan amount. The cosigner’s income and creditworthiness can be factored into the loan application, potentially increasing the maximum loan amount that the borrower can obtain. This can be especially beneficial when purchasing a more expensive property or in high-cost housing markets.

Implications of cosigning a mortgage

Financial responsibility and liability

When a cosigner enters into a mortgage agreement, they become financially responsible for the loan. If the primary borrower is unable to make their monthly mortgage payments, the cosigner is legally obligated to step in and make the payments on their behalf. Cosigning a mortgage is a serious commitment that should not be taken lightly.

Impact on the credit scores of both the borrower and cosigner

Cosigning a mortgage can impact the credit scores of both the borrower and the cosigner. Any missed or late payments by the primary borrower will negatively affect both credit scores. On the other hand, making timely payments can have a positive impact on both credit scores. It’s important for both parties to communicate and ensure responsible financial behavior to maintain healthy credit scores.

Potential strain on the relationship between borrower and cosigner

Cosigning a mortgage can introduce potential strain on the relationship between the borrower and the cosigner. Financial obligations and responsibilities can cause tension and disagreement if not managed properly. Open communication, trust, and clear expectations are essential to maintaining a healthy relationship throughout the mortgage term.

Difficulty in getting out of the cosigner arrangement

Exiting a cosigner arrangement can be challenging. Typically, a cosigner is released from their obligations when the borrower meets certain criteria, such as making a specified number of on-time payments or reaching a certain level of equity in the property. However, it can be difficult to refinance or remove the cosigner from the mortgage, especially if the borrower’s financial situation has not significantly improved.

This image is property of fastercapital.com.

How to find a cosigner for a mortgage

Choosing a reliable and trustworthy cosigner

Finding a cosigner involves selecting someone who is reliable and trustworthy. It’s important to choose someone with a good credit history, stable income, and a strong financial standing. The cosigner should be someone who understands and is comfortable with the financial responsibilities and risks involved.

Discussing expectations and responsibilities

Before entering into a cosigner arrangement, it’s crucial to have open and honest discussions about expectations and responsibilities. Both parties should have a clear understanding of their roles and what is expected of them. This includes discussing potential financial challenges, communication strategies, and contingency plans in case of unforeseen circumstances.

Considering legal implications and documentation

When cosigning a mortgage, it’s essential to consider the legal implications and ensure that all necessary documentation is in place. This may include signing a cosigner agreement, which outlines the responsibilities and obligations of both parties. It’s advisable to consult with a legal professional to ensure compliance with all applicable laws and regulations.

Alternatives to getting a cosigner for a mortgage

Improving credit score and financial standing

Instead of relying on a cosigner, borrowers can work on improving their credit score and financial standing. This can be done by making timely payments, reducing debt, and managing credit responsibly. Taking proactive steps to improve creditworthiness can increase the chances of mortgage approval without the need for a cosigner.

Exploring government-backed loan programs

Government-backed loan programs, such as those offered by the Federal Housing Administration (FHA) or the U.S. Department of Veterans Affairs (VA), may provide alternative options for borrowers who do not qualify for conventional mortgages. These programs have less strict credit requirements and may offer more favorable terms for borrowers with lower credit scores or limited down payment funds.

Seeking assistance from specialized lenders

Specialized lenders, such as those who specialize in assisting borrowers with less-than-perfect credit histories, may offer mortgage options without the need for a cosigner. These lenders have a deeper understanding of the unique challenges faced by borrowers with lower credit scores and can provide tailored solutions to meet their needs.

This image is property of fastercapital.com.

Steps to take when applying for a mortgage with a cosigner

Gather necessary financial documents

Both the borrower and the cosigner will need to gather necessary financial documents to support the mortgage application. This typically includes proof of income, bank statements, tax returns, and other relevant financial records. Ensuring all required documents are organized and readily available can streamline the application process.

Complete the mortgage application accurately

Accurate completion of the mortgage application is essential. Both the borrower and the cosigner should carefully review the application, ensuring that all information is correct and up to date. Any inaccuracies or discrepancies can lead to delays or potential denial of the mortgage application.

Provide information and documentation for both borrower and cosigner

The mortgage application will require information and documentation from both the borrower and the cosigner. This includes personal information, employment history, income verification, and credit reports. It’s important to gather all necessary documents and provide them promptly to avoid any processing delays.

Understand the cosigner’s rights and responsibilities

Before finalizing the mortgage agreement, it’s crucial for both the borrower and the cosigner to have a clear understanding of the cosigner’s rights and responsibilities. The cosigner should be familiar with the terms of the mortgage, including the repayment schedule, interest rate, and potential consequences of default. This understanding helps ensure that both parties are on the same page and can fulfill their respective obligations.

Potential challenges and risks of having a cosigner

Strained relationships and conflicts

Having a cosigner for a mortgage can introduce strain and conflict into personal relationships. Financial responsibilities and obligations can be a source of tension, especially when unexpected challenges arise. It’s important to maintain open lines of communication, address concerns promptly, and manage expectations to minimize potential conflict.

Financial burden for the cosigner

Cosigning a mortgage carries a significant financial burden for the cosigner. If the primary borrower is unable to make their monthly mortgage payments, the cosigner may have to step in and cover the costs. This responsibility can place a considerable strain on the cosigner’s finances and potentially jeopardize their own financial stability.

Impact on the cosigner’s creditworthiness

Any missed or late payments by the primary borrower will impact the creditworthiness of both the borrower and the cosigner. Negative reporting to credit bureaus can lower both credit scores and make it difficult for the cosigner to apply for future credit. It’s crucial for both parties to maintain responsible financial behavior to protect their creditworthiness.

Difficulty in removing the cosigner from the mortgage

Removing a cosigner from a mortgage can be challenging. The primary borrower typically needs to demonstrate financial stability and creditworthiness to refinance the mortgage in their name alone. If the borrower is unable to do so, the cosigner may remain obligated for the duration of the loan term, potentially affecting their own financial plans and goals.

This image is property of www.gta-homes.com.

Considerations before getting a cosigner for a mortgage

Trust and communication with the cosigner

Before entering into a cosigner arrangement, trust and communication with the cosigner should be a top consideration. A cosigner is taking on a significant financial responsibility, and it’s important to have a relationship built on trust and open lines of communication. Ensuring that both parties have a clear understanding of their roles and responsibilities helps set the foundation for a successful cosigner arrangement.

Evaluation of long-term financial stability

Both the borrower and the cosigner should evaluate their long-term financial stability before entering into a cosigner arrangement. Financial obligations can span several years, and it’s essential for both parties to have confidence in their ability to fulfill their obligations throughout the mortgage term. This evaluation involves assessing income stability, potential changes in circumstances, and the ability to make on-time mortgage payments.

Awareness of potential consequences

Before getting a cosigner for a mortgage, it’s crucial to be aware of the potential consequences. This includes understanding the financial risks, impact on personal relationships, and the potential difficulty in removing the cosigner from the mortgage. Being fully informed can help borrowers make an educated decision about whether obtaining a cosigner is the right choice for their unique circumstances.

Conclusion

The importance of responsible borrowing cannot be overstated, regardless of credit history. While obtaining a mortgage with less-than-perfect credit may seem challenging, options like those offered by Bad Credit Loan can help individuals achieve their homeownership goals.

Bad Credit Loan specializes in providing mortgages designed for individuals with diverse credit backgrounds. By taking an inclusive approach and recognizing the hurdles faced by those with less-than-ideal credit scores, Bad Credit Loan offers tailored solutions to help individuals access the housing they deserve.

Through its user-friendly online platform, Bad Credit Loan aims to make the mortgage application process convenient and streamlined. By eliminating bureaucratic hurdles and minimizing paperwork, individuals can focus on finding the right home for their needs.

Flexibility is a key advantage of Bad Credit Loan’s offerings. Whether it’s purchasing a first home, refinancing an existing mortgage, or accessing home equity, Bad Credit Loan provides customizable options to meet the diverse needs of borrowers. By tailoring loan terms to individual circumstances, the company empowers individuals to pursue their homeownership goals confidently.

Transparency is a core value at Bad Credit Loan. The company ensures that all relevant information, including interest rates, loan terms, and fees, is clearly communicated to applicants. This transparency builds trust and confidence, enabling borrowers to make informed decisions about their homeownership finances.

Alongside financial assistance, Bad Credit Loan provides additional resources and support to help individuals succeed. Mortgage planning tools, homeownership education, and personalized guidance are all elements of Bad Credit Loan’s commitment to empowering individuals to navigate the complexities of mortgages with confidence.

In conclusion, Bad Credit Loan serves as a trusted partner for individuals seeking access to mortgages tailored to their unique financial circumstances. By providing opportunities and support, Bad Credit Loan empowers individuals to unlock the possibilities of homeownership. Responsible borrowing and diligent repayment are essential for long-term financial stability and maintaining successful homeownership. With Bad Credit Loan’s assistance, individuals can take steps towards achieving their dreams of owning a home.