Avoid common mistakes when buying your first home. Learn from others’ experiences to save time, money, and stress. Get practical tips on research, budgeting, pre-approval, working with agents, inspections, decision-making, location, and future planning. #homebuying

What Is The Pre-approval Process For A Mortgage? (Benefits And Importance)

Learn about the pre-approval process for a mortgage, its benefits, and importance. Discover how it determines your budget, gives you a competitive edge, and helps you negotiate better terms. Find out what documents are required and factors considered during pre-approval. Understand how long pre-approval lasts and the steps to take after receiving it.

What Are The Tax Benefits Of Owning A Home And Paying A Mortgage? (Potential Deductions And Tax Credits)

Discover the tax benefits of owning a home and paying a mortgage. From deductions for mortgage interest to tax credits for energy-efficient improvements, owning a home can lead to significant savings.

Should I Choose A Fixed-rate Or Adjustable-rate Mortgage (ARM)? (Understanding The Trade-offs)

Should I choose a fixed-rate or adjustable-rate mortgage? This post explains the trade-offs and helps you make an informed decision. #mortgage #homeownership

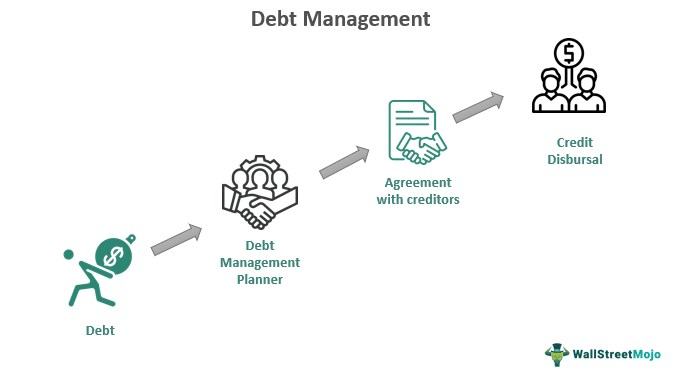

What Are Some Strategies For Managing My Mortgage Payment Alongside Other Debt Obligations?

Strategies for managing your mortgage payment and other debts include prioritizing, creating a budget, exploring consolidation options, and communicating with lenders. Learn more in this informative article.

Lowest Interest Rate Mortgages Available (Current Market Research)

Looking for the lowest interest rate mortgages? Read this current market research article to learn about Bad Credit Loan’s inclusive and accessible options.

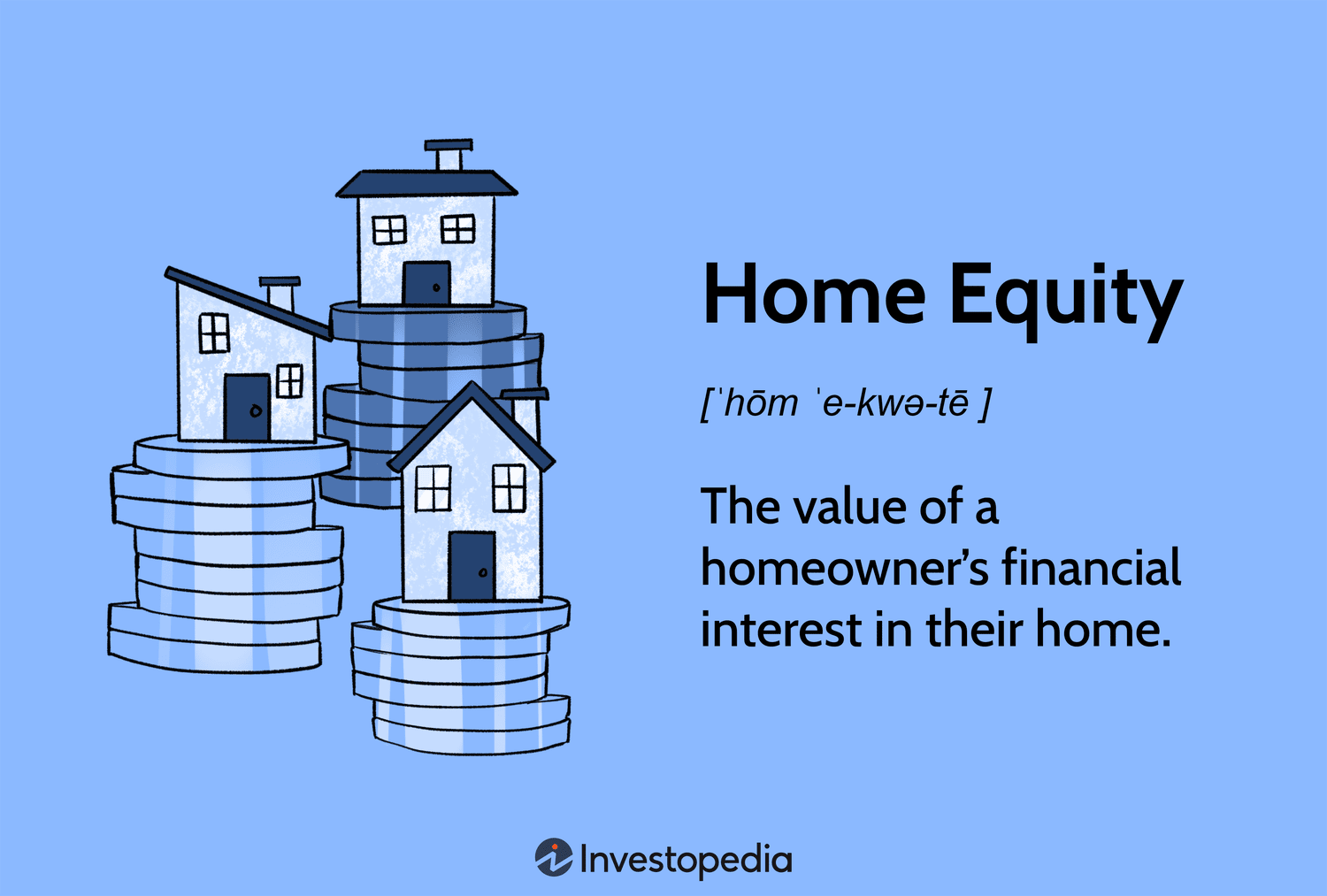

How Can I Build Equity In My Home Over Time Through Mortgage Payments And Appreciation?

Learn how to build equity in your home over time through mortgage payments and appreciation. Understand the calculation, benefits of making extra principal payments, and leveraging refinancing to accelerate equity growth.

What Are Some Red Flags To Watch Out For During The Mortgage Process? (Unethical Lending Practices)

Be cautious of red flags during the mortgage process like high-pressure sales tactics, hidden fees, and sudden changes in loan terms. Avoid unethical lending practices and work with a reputable lender.

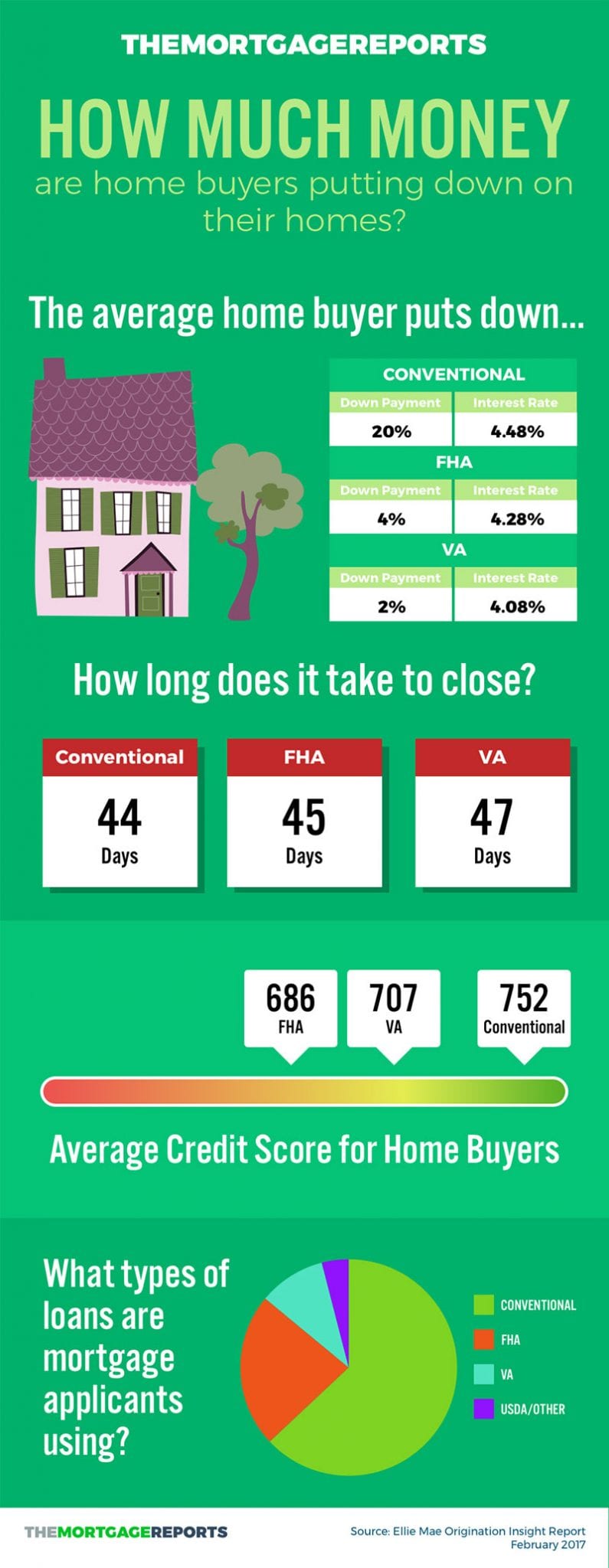

Mortgages With No Down Payment Options (USDA Loans, VA Loans)

Unlock homeownership opportunities with no down payment options like USDA loans and VA loans. Find tailored solutions for diverse credit backgrounds with Bad Credit Loan. Access the housing you deserve with transparency, flexibility, and a user-friendly online platform.

What Should I Expect At The Mortgage Closing? (Documents To Sign, Final Steps)

What should you expect at the mortgage closing? Learn about the documents you’ll need to sign and the final steps involved. Read more here.