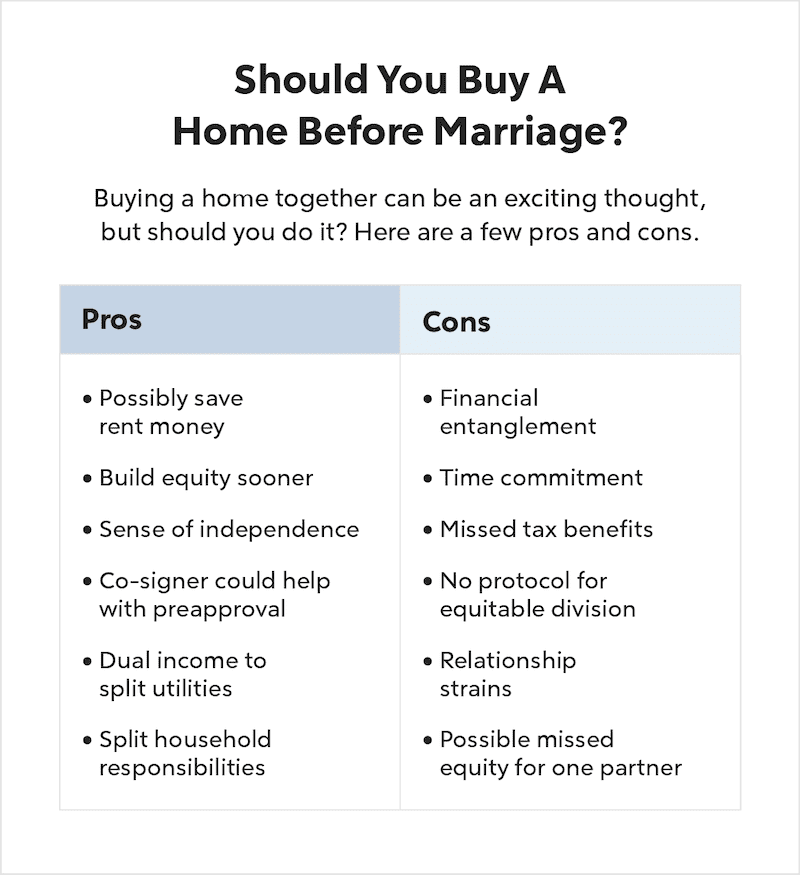

When it comes to buying a home with your partner as an unmarried couple, there are important financial considerations to keep in mind. From establishing the right ownership structure to understanding the legal implications, it is crucial to navigate these aspects carefully. In this article, we will discuss the key factors that unmarried couples should consider when embarking on the journey of homeownership together. By understanding the financial considerations and seeking the right guidance, you can ensure a smooth and successful path towards owning a home with your partner, even without a marriage certificate.

This image is property of www.quickenloans.com.

Financial Considerations

When buying a home with a partner, there are several financial considerations that you should keep in mind to ensure a smooth and successful homeownership journey. From determining affordability to understanding property ownership rights, here are the key factors to consider before taking the plunge.

Determining Affordability

Before embarking on the homebuying process, it’s crucial to assess your affordability. This involves evaluating your income and debt to understand how much you can realistically afford to spend on housing expenses.

To calculate your combined buying power, take into account both you and your partner’s incomes, as well as any existing debts or financial obligations. This will give you a clear picture of how much you can comfortably afford to pay for a home.

It’s also important to consider your individual credit histories. Lenders will review both partners’ credit scores when determining eligibility for a mortgage, so it’s essential to understand any potential impact on interest rates or loan terms.

Ultimately, determining your affordability limit is crucial to avoid becoming financially strained or house-poor after purchasing a home. Make sure to set a budget that aligns with your financial goals and current circumstances.

This image is property of www.tldraccounting.com.

Financial Goals and Planning

When buying a home with a partner, it’s essential to align your financial goals and create a joint financial plan. This involves discussing your long-term objectives, such as saving for retirement, paying off debts, and building equity.

By creating a joint financial plan, you can establish a roadmap for achieving your goals while also factoring in the costs associated with homeownership. This plan should include strategies for saving for a down payment, as well as considerations for the long-term financial impact of owning a home.

Saving for a down payment is a crucial aspect of buying a home. Both partners should contribute to this savings goal, and it’s important to discuss and agree upon the source of the down payment funds. You may choose to contribute equal or unequal amounts, depending on your individual financial situations.

Additionally, it’s important to consider the long-term financial impact of homeownership. This includes budgeting for ongoing homeownership expenses such as property taxes, insurance, maintenance, and unexpected repairs. By incorporating these costs into your joint financial plan, you can ensure that you’re prepared to handle the financial responsibilities of homeownership.

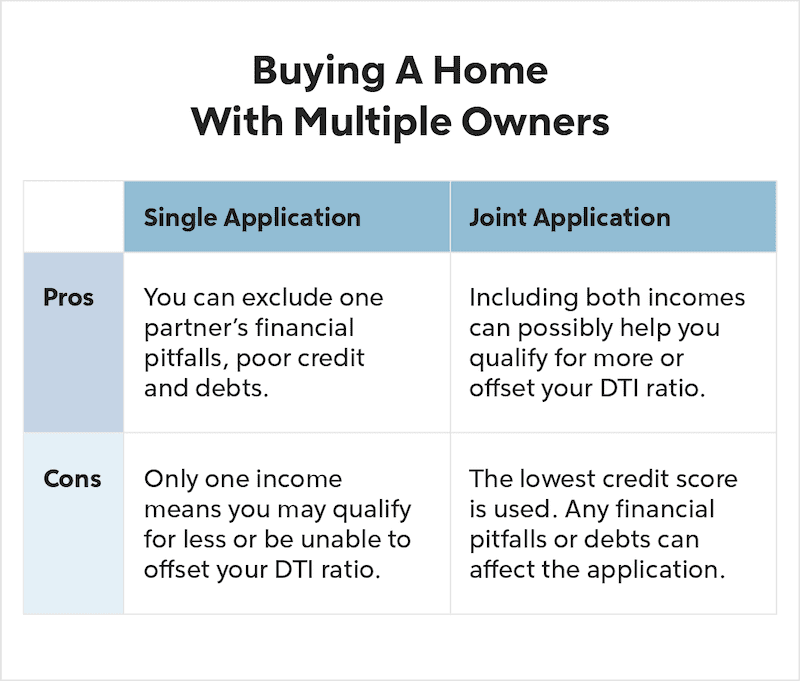

Mortgage Options

When applying for a mortgage as a couple, you have the option to choose between a joint mortgage application or individual mortgage applications. Each option has its advantages and considerations, so it’s important to weigh the pros and cons to determine which option is best for you.

With a joint mortgage application, both partners’ incomes and credit scores are considered, potentially increasing the overall borrowing power and improving interest rates. However, it’s important to remember that both partners will be equally responsible for the mortgage debt, which can have implications in case of default or foreclosure.

Alternatively, you can choose to apply for individual mortgages, where each partner is solely responsible for their own mortgage. This may be a suitable option if one partner has a significantly stronger credit history or a higher income. However, it’s important to consider the potential impact on each partner’s individual buying power and the ability to qualify for a mortgage on their own.

When deciding on mortgage terms, such as the length and type of loan, it’s important to carefully consider your financial goals and circumstances. Think about factors such as interest rates, monthly payments, and the impact on your long-term financial plans.

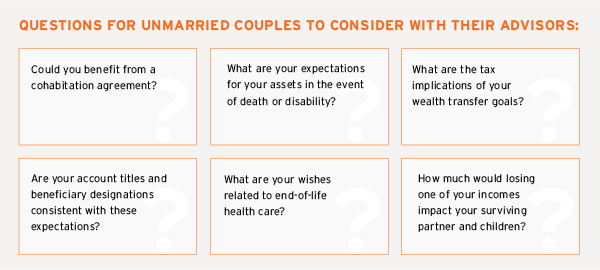

This image is property of blogs.hightoweradvisors.com.

Budgeting for Homeownership Expenses

Owning a home comes with various expenses beyond the monthly mortgage payment. It’s important to determine shared payment responsibilities with your partner to avoid any misunderstandings or financial strain.

Creating a joint household budget can help you allocate funds for mortgage payments, utilities, property taxes, insurance, and maintenance costs. Discuss how you will divide these expenses and set up a system for managing your shared finances.

Additionally, you should account for unforeseen expenses, such as repairs or renovations, in your budget. Creating an emergency fund specifically for homeownership expenses can help you be prepared for unexpected financial challenges.

Co-debt Responsibility

When entering into a mortgage with a partner, it’s crucial to understand the concept of joint and several liability. This means that both partners are equally responsible for the full amount of the mortgage debt. If one partner is unable to make their share of the payments, the other partner will be legally obligated to cover the full amount.

To establish clarity and protect both partners, consider designating primary and secondary borrowers. This can help outline who is primarily responsible for making mortgage payments and provide a clear understanding of each partner’s financial responsibilities.

It’s essential to have open and honest conversations with your partner about the potential implications of default or foreclosure. Understanding the consequences can help you make informed decisions and mitigate any financial risks.

This image is property of www.quickenloans.com.

Tax Implications

Buying a home with a partner can have tax implications that should be considered when making your decision. It’s advisable to consult with a tax professional to understand how homeownership will impact both partners’ taxes.

Certain tax deductions and benefits may be available to homeowners, such as deducting mortgage interest payments or property tax payments. Understanding these potential tax advantages can help you maximize your savings and reduce your tax liability.

Additionally, it’s important to consider how homeownership may affect both partners’ tax brackets and overall financial situation. Some tax credits or deductions may phase out as your combined income increases, so it’s crucial to plan accordingly.

Property Ownership Rights

Understanding the different types of property ownership and deciding on the ownership structure is an important consideration when buying a home with a partner.

You can choose between tenancy in common or joint tenancy. Tenancy in common means that each partner owns a specific percentage of the property, which can be divided unequally if desired. Joint tenancy means that both partners have an equal share and right to the property.

The decision on ownership structure can impact the distribution of the property in case of separation or any other legal matters. It’s important to carefully consider your relationship dynamics and future plans when deciding on the ownership structure.

This image is property of s.yimg.com.

Exit Strategy

While it may not be pleasant to consider at the beginning of homeownership, having an exit strategy is a crucial part of long-term financial planning.

It’s essential to discuss and establish a legal agreement, such as a cohabitation agreement, that outlines how the property will be handled in the event of a separation or the end of the partnership. This agreement should address property ownership, distribution, and dispute resolution to protect both partners’ interests.

Having a clear exit strategy in place can provide peace of mind and help avoid potential disputes or complications down the road.

Legal Agreement

To protect the financial interests of both partners, it’s advisable to draft a legal agreement, such as a cohabitation agreement, when buying a home together.

A cohabitation agreement outlines the financial agreements between partners, including the division of property and assets. It ensures that both partners are on the same page and have a clear understanding of their financial responsibilities.

Addressing property ownership and distribution in the agreement can help prevent any future disputes or legal complications. The agreement should also include a dispute resolution clause to provide a framework for resolving any conflicts that may arise.

Creating a legally binding agreement may seem unnecessary at the beginning of a relationship, but it’s a proactive step to protect both partners’ rights and ensure a fair resolution in case of unforeseen circumstances.

In conclusion, buying a home with a partner requires careful consideration and planning. Determining affordability, setting financial goals, understanding mortgage options, budgeting for homeownership expenses, and establishing legal agreements are all essential steps to create a solid financial foundation for your joint homeownership journey. By addressing these financial considerations, you and your partner can embark on your homeownership adventure with confidence and peace of mind.