Considering Private Mortgage Insurance (PMI) with a down payment <20%? Learn about the benefits, costs, and alternatives in this informative post.

How Can I Save Money On A Home Loan? (comparing Rates, Negotiating Terms, Down Payment)

Learn how to save money on a home loan by comparing interest rates, negotiating loan terms, and making a larger down payment. Implement these strategies to maximize your savings and achieve your homeownership goals.

How Much Home Can I Afford With A Mortgage? (Income, Credit Score, Down Payment Considerations)

Learn how much home you can afford with a mortgage based on your income, credit score, and down payment. Find out the considerations for approval.

How Can I Save Money On A Mortgage? (Down Payment, Comparing Rates, Negotiating Terms)

Learn how to save money on your mortgage by considering a larger down payment, comparing rates, negotiating terms, and more. Achieve your homeownership goals with confidence.

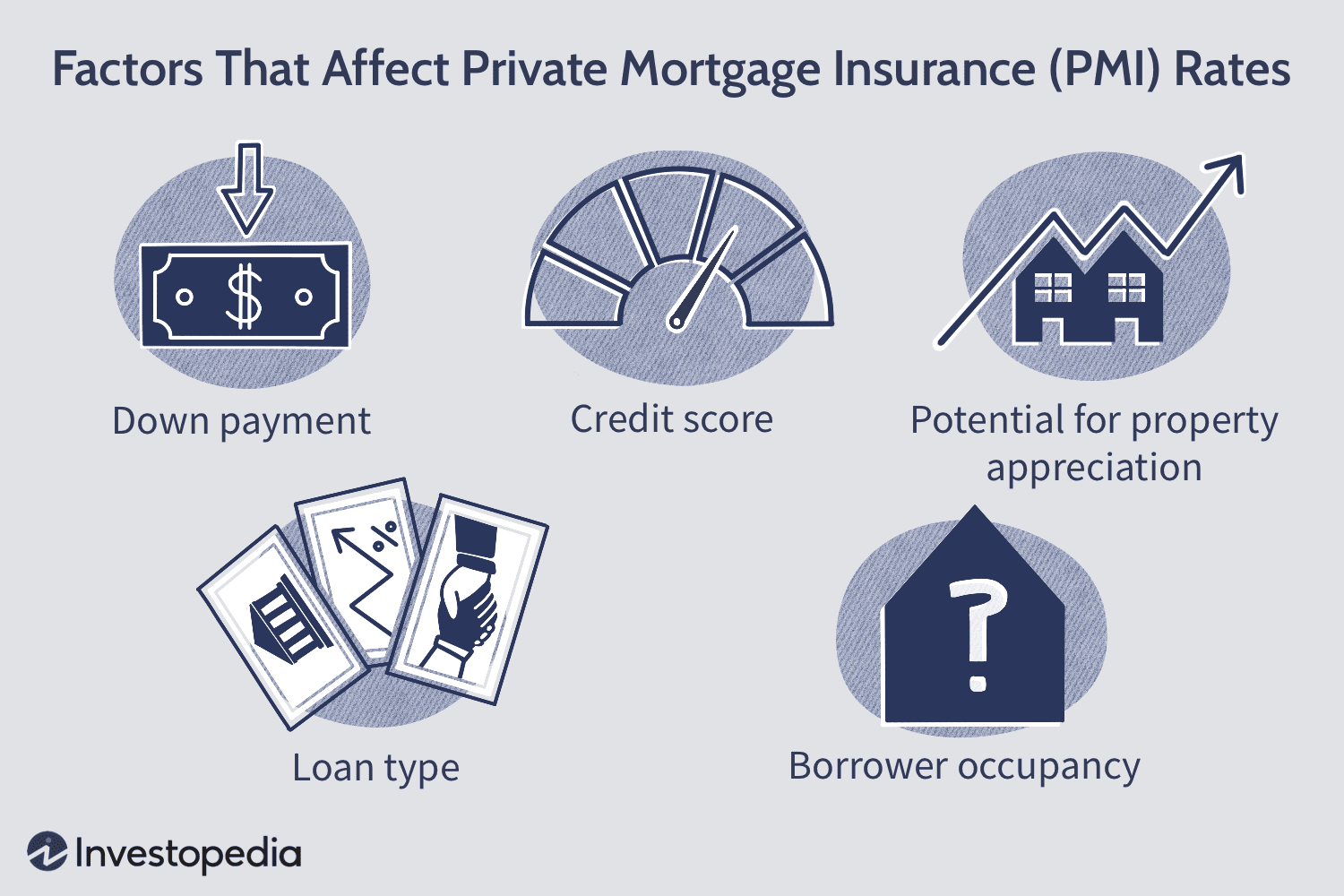

Should I Consider Private Mortgage Insurance (PMI) If My Down Payment Is Less Than 20%?

Wondering if you should get private mortgage insurance (PMI) with a low down payment? This article explores PMI and its impact on homeownership.

Do I Need A Down Payment For A Mortgage? (Minimum Down Payment Options)

Learn about the minimum down payment options for a mortgage and explore alternative down payment options. Make an informed decision about your dream home.