If you find yourself in the midst of the exciting journey towards homeownership but are faced with the challenge of a down payment less than 20%, you may be wondering about private mortgage insurance (PMI) and if it’s a wise choice for you. Luckily, Bad Credit Loan is here to help. With a focus on inclusivity, user-friendly online applications, customizable options, and transparent information, Bad Credit Loan offers tailored solutions for individuals with diverse credit backgrounds. They are ready to assist you in achieving your homeownership goals, whether it’s buying your dream home, refinancing for better terms, or accessing home equity. With Bad Credit Loan as your trusted partner, the opportunities of homeownership become within reach.

What is private mortgage insurance (PMI)

Definition of PMI

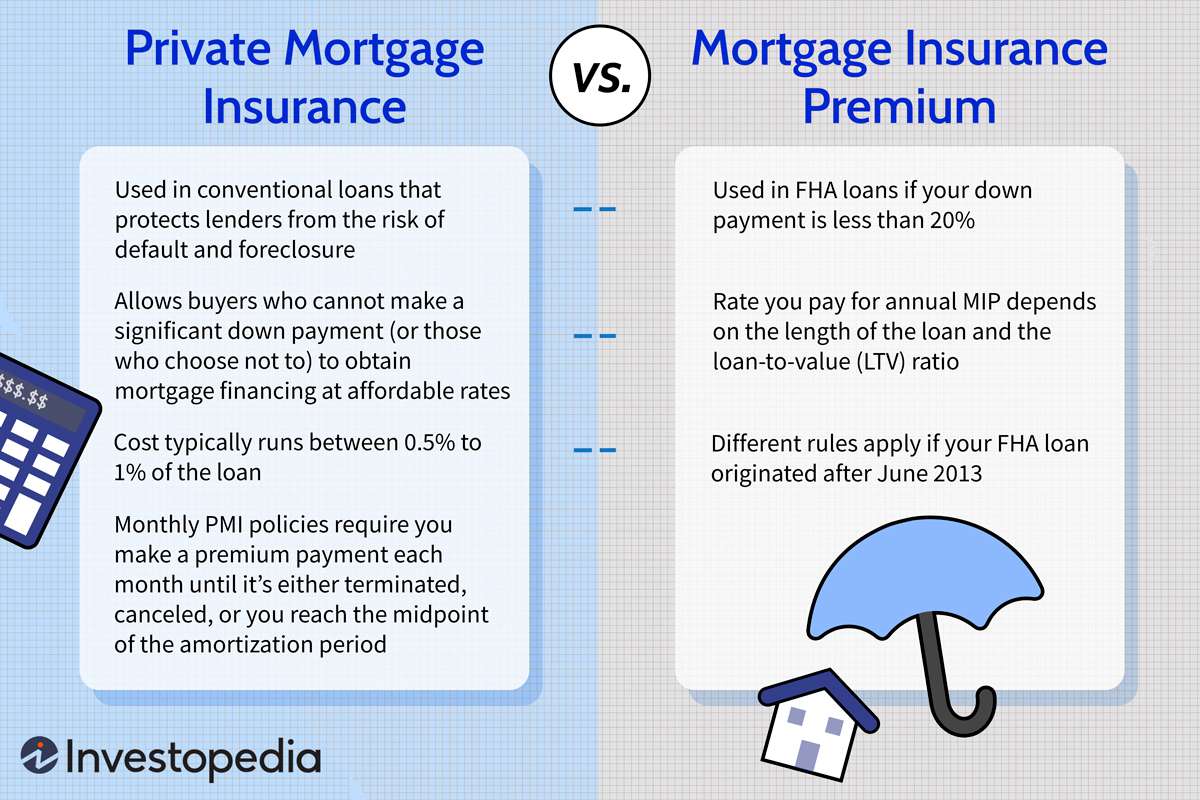

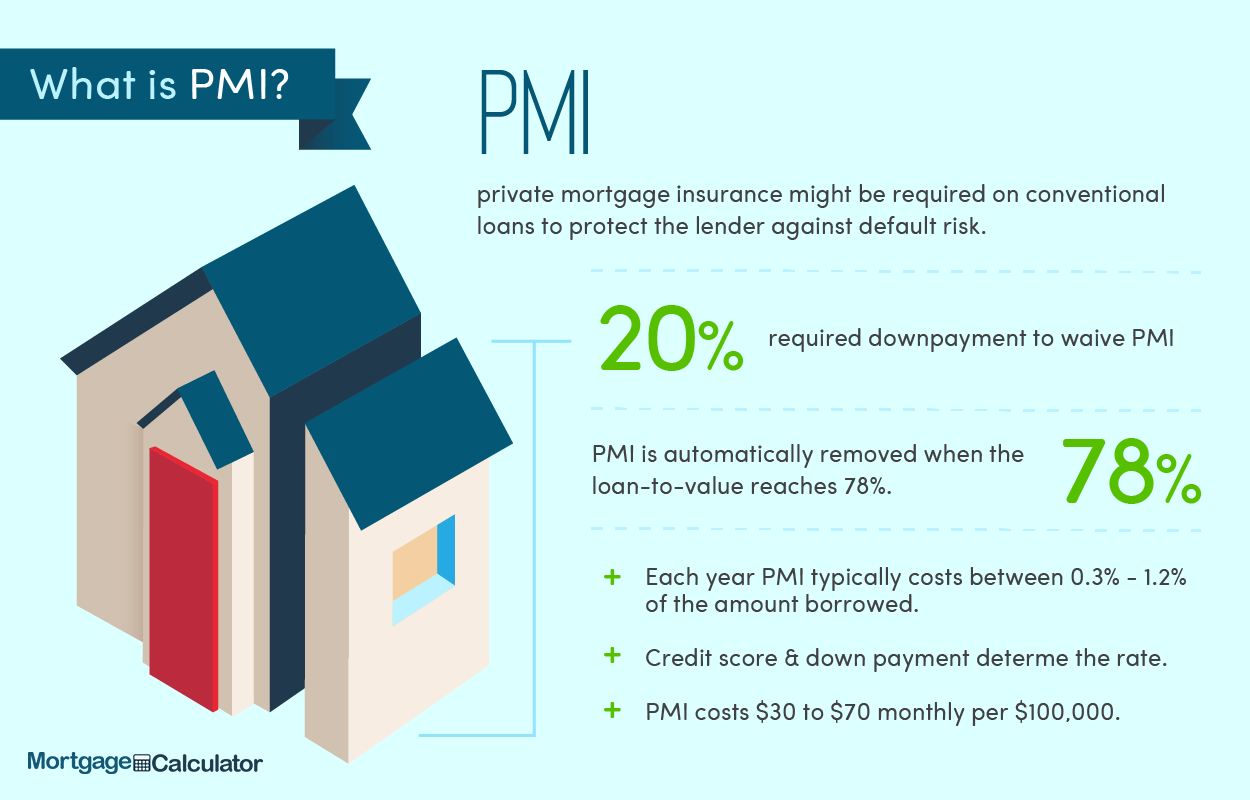

Private mortgage insurance (PMI) is a type of insurance that protects lenders in the event that a borrower defaults on their mortgage payments. It is typically required when the down payment on a home is less than 20% of the purchase price.

Purpose of PMI

The main purpose of PMI is to mitigate the risk for lenders when they provide a mortgage to a borrower with a lower down payment. By requiring PMI, lenders can feel more confident in approving loans for borrowers who may not have enough funds saved for a larger down payment.

How PMI works

PMI is typically paid for by the borrower as part of their monthly mortgage payments. The cost of PMI is calculated based on the loan amount, the borrower’s credit score, and other factors. The insurance premium is added to the borrower’s mortgage payment and is paid until the loan-to-value (LTV) ratio reaches 78%, at which point the borrower may be able to request cancellation of PMI.

The impact of a down payment less than 20%

Lenders’ perspective on down payments

From a lender’s perspective, a larger down payment reduces the risk and potential financial loss associated with a borrower defaulting on their mortgage. When the down payment is less than 20%, lenders may require PMI to protect their investment.

Effects on interest rates

In addition to the requirement for PMI, a lower down payment may also result in higher interest rates on the mortgage loan. This is because a smaller down payment increases the lender’s perceived risk, and they may compensate for this by charging a higher interest rate.

Loan approval process

When the down payment is less than 20%, the loan approval process may be slightly more rigorous compared to a borrower with a larger down payment. Lenders will carefully assess the borrower’s creditworthiness, income stability, and other factors to ensure that they are a low-risk borrower despite the smaller down payment.

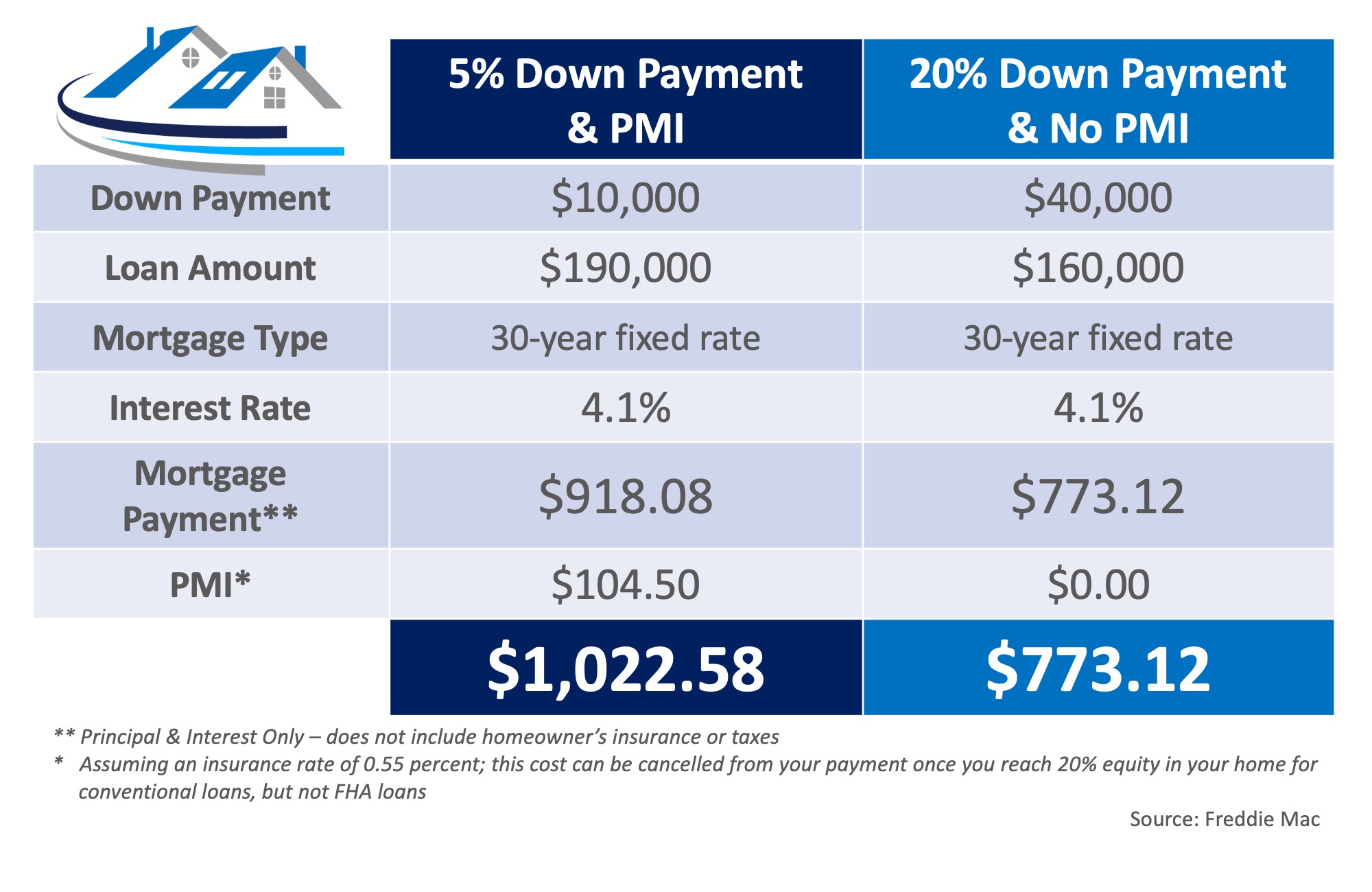

This image is property of files.simplifyingthemarket.com.

Benefits of private mortgage insurance

Increased access to mortgage financing

One of the main benefits of PMI is that it increases access to mortgage financing for borrowers who may not have enough funds saved for a larger down payment. PMI allows borrowers to purchase a home with a smaller down payment, making homeownership more achievable for many individuals and families.

Ability to purchase a home sooner

By requiring a smaller down payment, PMI allows borrowers to fulfill their homeownership dreams sooner. Instead of waiting to save up a larger down payment, borrowers can enter the housing market and start building equity in a home while also taking advantage of potentially low-interest rates.

Lower monthly mortgage payments

While PMI adds an additional cost to the mortgage payment, it can also help borrowers lower their monthly mortgage payments. Without PMI, borrowers would need to save up a larger down payment, which may take years. With PMI, borrowers can spread out their down payment over time, making homeownership more affordable on a monthly basis.

Costs of private mortgage insurance

PMI premiums

PMI premiums, or the cost of PMI, are typically paid on a monthly basis as part of the borrower’s mortgage payment. The exact amount of the premium varies depending on factors such as the loan amount, credit score, and the type of mortgage. On average, PMI can range from 0.5% to 1% of the loan amount per year.

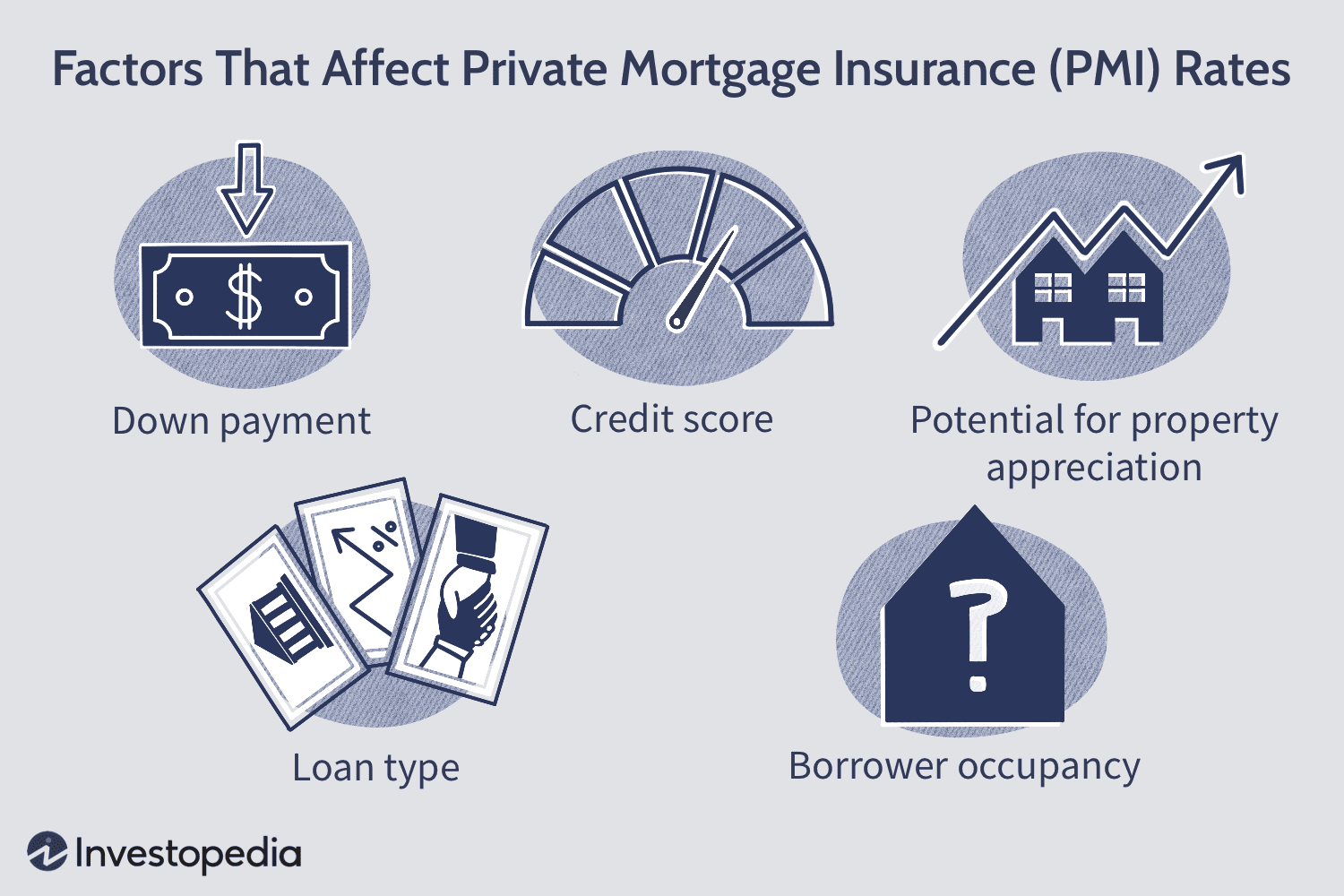

Factors affecting PMI costs

Several factors can affect the cost of PMI. These include the borrower’s credit score, the loan-to-value (LTV) ratio, the size of the down payment, and the type of mortgage. Generally, borrowers with higher credit scores and larger down payments can expect lower PMI costs.

Ways to lower PMI costs

There are several strategies borrowers can employ to lower their PMI costs. One option is to make a larger down payment, as this reduces the amount of money and time needed to pay for PMI. Another option is to improve credit scores, as this can result in lower PMI premiums. Refinancing the mortgage when the LTV ratio reaches 80% or below can also eliminate the need for PMI.

This image is property of www.investopedia.com.

Alternatives to private mortgage insurance

Piggyback loans

A piggyback loan, also known as a second mortgage, is an alternative to PMI. With a piggyback loan, the borrower takes out a second loan to cover a portion of the down payment. This allows the borrower to avoid PMI altogether, but it does require taking on additional debt and potentially having a higher interest rate on the second loan.

Lender-paid mortgage insurance

Lender-paid mortgage insurance (LPMI) is another alternative to PMI. With LPMI, the lender pays the mortgage insurance premium upfront and then passes the cost on to the borrower through a higher interest rate on the mortgage. While LPMI eliminates the need for the borrower to make separate PMI payments, it can result in higher overall interest costs over the life of the loan.

Saving for a larger down payment

The most straightforward alternative to PMI is to save for a larger down payment. By saving up 20% or more of the purchase price, borrowers can avoid the need for PMI altogether. While saving for a larger down payment may take longer, it can result in long-term savings by eliminating the need for PMI and potentially securing a lower interest rate.

How to cancel private mortgage insurance

When PMI can be canceled

PMI can typically be canceled or removed once the loan-to-value (LTV) ratio reaches 78%. However, borrowers can request cancellation of PMI when the LTV ratio reaches 80%. It’s important to note that some loans may have different requirements, so borrowers should carefully review their mortgage agreement or consult with their lender for specific details.

How to request PMI cancellation

To request cancellation of PMI, borrowers should contact their mortgage servicer and inquire about the necessary steps and documentation. In most cases, borrowers will need to provide evidence of the increased value of the home (such as an appraisal) and show a consistent history of on-time mortgage payments. Following the servicer’s instructions and providing the required documentation should initiate the PMI cancellation process.

Automatic PMI termination

In some cases, PMI may be automatically terminated without the need for a borrower request. This can occur when the LTV ratio reaches a certain level, as specified in the mortgage agreement. Borrowers should review their mortgage agreement or consult with their lender to understand whether their loan includes an automatic termination provision.

This image is property of www.investopedia.com.

Considerations in deciding whether to get PMI

Financial situation and goals

When considering PMI, borrowers should assess their current financial situation and their long-term goals. It’s important to determine whether taking on PMI aligns with their overall financial plan and if they can comfortably afford the monthly mortgage payments with the added cost of PMI.

Length of time expected to have PMI

Borrowers should also consider how long they anticipate having PMI. If they expect to reach the LTV ratio threshold for cancellation within a short period, the cost of PMI may be more manageable. However, if they anticipate having PMI for an extended period, it may be worth exploring alternative options or adjusting their homebuying timeline.

Future home value appreciation

Borrowers should also consider the potential for home value appreciation. If they believe that their home’s value will increase significantly over time, it may be worth paying for PMI in the short term with the expectation of reaching the LTV ratio threshold for cancellation sooner.

How to find the right private mortgage insurance provider

Researching PMI providers

When searching for a private mortgage insurance provider, borrowers should conduct thorough research to compare different companies. They should consider factors such as the provider’s reputation, customer reviews, financial stability, and the terms and conditions of their PMI policies.

Comparing PMI terms and conditions

In addition to researching providers, borrowers should compare the terms and conditions of different PMI policies. This includes factors such as the cost of the premium, any additional fees, the length of time PMI is required, and any cancellation requirements. By comparing these factors, borrowers can find a PMI provider that best aligns with their needs and financial goals.

Seeking recommendations

Seeking recommendations from friends, family, or trusted real estate professionals can also be a valuable way to find a reputable PMI provider. Personal recommendations can offer insights into the customer experience, service quality, and overall satisfaction with a specific PMI provider.

This image is property of www.mortgagecalculator.org.

Important factors to consider before getting PMI

The cost of PMI versus the benefits

Before obtaining PMI, borrowers should carefully consider the cost of PMI versus the benefits it provides. They should weigh the monthly expense of PMI against the ability to purchase a home sooner and the potential long-term savings from avoiding the need for a larger down payment.

Long-term financial implications

Borrowers should also think about the long-term financial implications of PMI. They should consider how PMI will impact their monthly budget and their ability to save for other financial goals. It’s important to ensure that taking on PMI does not put a strain on overall financial stability.

Overall affordability of the mortgage

Ultimately, borrowers should assess the affordability of the mortgage, including the cost of PMI, when deciding whether to obtain PMI. They should consider their monthly income, expenses, and other financial obligations to determine whether they can comfortably manage the mortgage payments with the added cost of PMI.

Tips for managing and reducing private mortgage insurance

Making extra mortgage payments

One strategy for managing PMI is to make extra payments towards the principal of the mortgage. By paying down the loan balance faster, borrowers can potentially reach the required LTV ratio for PMI cancellation sooner, reducing the overall duration of PMI payments.

Refinancing to remove PMI

Another option for removing PMI is to refinance the mortgage. If the home has experienced significant appreciation in value or the borrower’s credit score has improved, refinancing can provide an opportunity to secure a new loan without the need for PMI.

Improving credit score

Improving credit score can also help reduce PMI costs. Borrowers can work on building a positive credit history by making all payments on time, keeping credit card balances low, and minimizing new credit applications. Over time, a higher credit score can result in lower PMI premiums and potentially even the ability to cancel PMI sooner.

In conclusion, private mortgage insurance (PMI) can be a useful tool for borrowers with a down payment less than 20% of the purchase price. It provides increased access to mortgage financing, allows borrowers to purchase a home sooner, and can lower monthly mortgage payments. However, it’s important for borrowers to carefully consider the costs of PMI, explore alternatives, and understand the process for canceling PMI. By making informed decisions and managing PMI effectively, borrowers can navigate the homeownership journey with confidence.