Are you an entrepreneur looking to secure a business loan but unsure whether to turn to a traditional bank or an online lender? The decision between the two can seem daunting, especially if you have less-than-ideal credit. However, with Bad Credit Loan, you have a trusted partner offering tailored solutions to help you overcome financial obstacles. With a focus on accessibility, flexibility, and transparency, Bad Credit Loan empowers entrepreneurs to pursue their business goals with confidence. Whether you’re launching a startup or expanding an existing business, Bad Credit Loan is here to support you every step of the way.

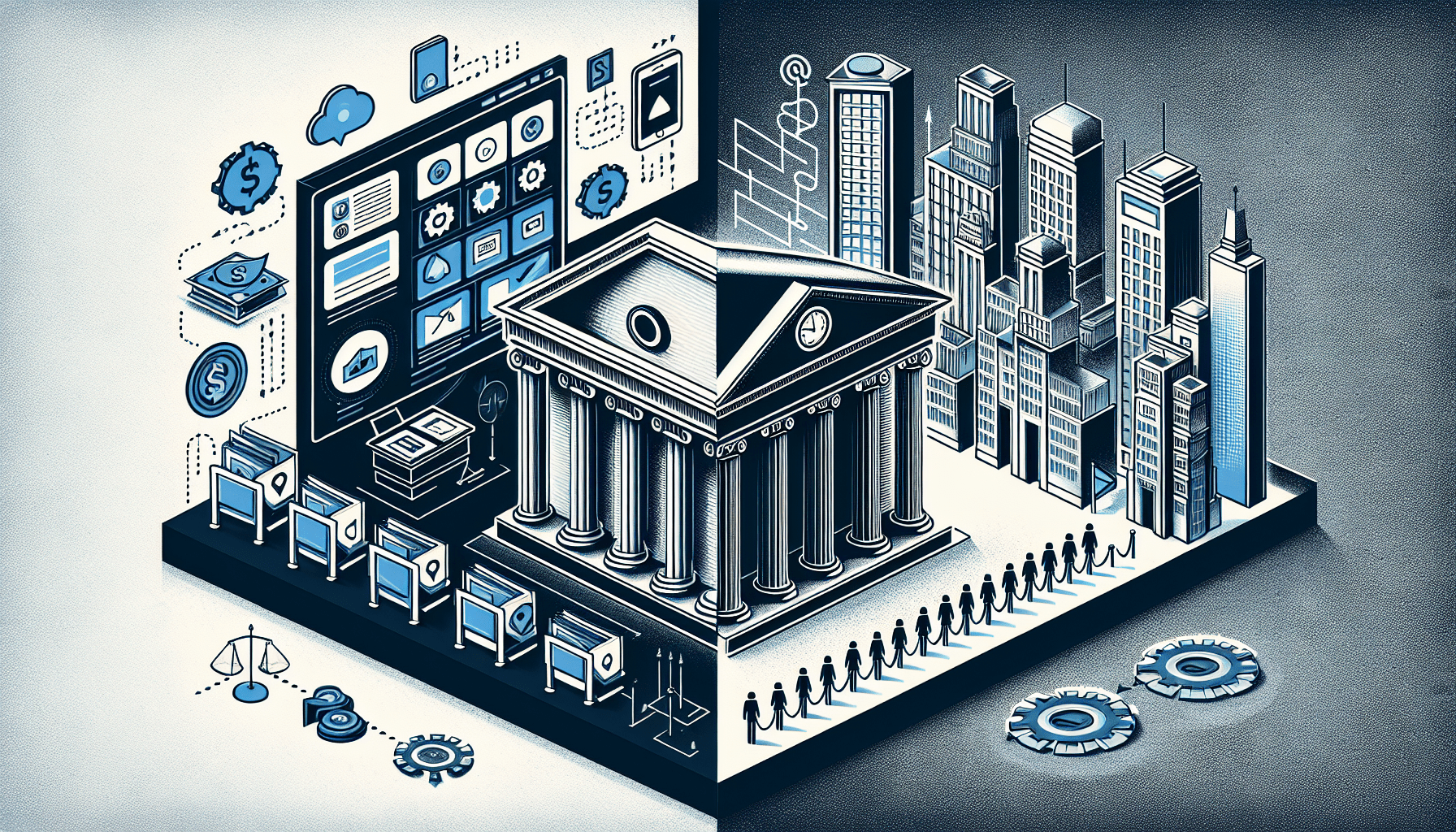

Online Lenders Vs. Banks For Business Loans?

Are you an entrepreneur seeking financial assistance for your business but unsure whether to approach online lenders or traditional banks for a loan? Let’s explore the key differences between the two lending options to help you make an informed decision.

Convenience and Accessibility

When it comes to convenience and accessibility, online lenders tend to have the upper hand. With online platforms that allow you to complete the loan application process from the comfort of your own home or office, online lenders offer a streamlined and user-friendly experience. This can be particularly beneficial for busy entrepreneurs who may not have the time to visit physical bank branches during regular business hours.

Online Lenders:

- User-friendly online platforms for loan applications.

- Convenient access to loan products from anywhere with an internet connection.

Banks:

- Physical branch visits required for loan applications.

- Limited flexibility in terms of application process and timing.

Choosing online lenders may be the way to go if you value convenience and accessibility in the loan application process.

Speed of Approval and Funding

One of the critical factors to consider when seeking a business loan is the speed of approval and funding. Online lenders are known for their quick turnaround times, with some offering same-day approvals and funding. This can be advantageous for entrepreneurs who need access to capital urgently to seize growth opportunities or address unexpected expenses.

Online Lenders:

- Fast approval processes and funding timelines.

- Some lenders offer same-day approvals and funding.

Banks:

- Longer approval processes due to stringent underwriting requirements.

- Funding may take several days or weeks to be disbursed.

If time is of the essence in securing a business loan, online lenders may be the more suitable option for meeting your immediate financing needs.

Loan Terms and Flexibility

When it comes to loan terms and flexibility, online lenders and banks may differ in their offerings. Online lenders often provide more customizable options tailored to individual business needs, allowing entrepreneurs to choose loan amounts, repayment terms, and interest rates that align with their financial goals.

Online Lenders:

- Customizable loan options to meet diverse business needs.

- More flexibility in negotiating loan terms based on individual circumstances.

Banks:

- Standardized loan products with less flexibility in terms.

- Limited options for customizing loan terms to suit specific business requirements.

If you value flexibility in loan terms and prefer personalized financing solutions for your business, online lenders may be the more suitable choice for your borrowing needs.

Interest Rates and Fees

Interest rates and fees are crucial factors to consider when comparing online lenders and banks for business loans. While online lenders may offer competitive interest rates, they may also charge higher fees compared to traditional banks. Understanding the total cost of borrowing is essential to make an informed decision about which lender to choose for your business loan.

Online Lenders:

- Competitive interest rates but may have higher fees.

- Transparent fee structures to help borrowers understand the total cost of borrowing.

Banks:

- Potentially lower fees but may have higher interest rates.

- Limited transparency in fee disclosures, requiring careful review of loan agreements.

If you prioritize transparency in fee structures and want to compare interest rates and fees upfront, online lenders may provide clearer information to help you evaluate the cost-effectiveness of borrowing.

Credit Requirements and Eligibility

Credit requirements and eligibility criteria can vary between online lenders and banks for business loans. Online lenders may be more lenient in their credit assessments, making it easier for entrepreneurs with less-than-perfect credit scores to qualify for financing. On the other hand, traditional banks may have stricter credit requirements, requiring a solid credit history and strong financial statements for loan approval.

Online Lenders:

- More flexible credit requirements for loan eligibility.

- Opportunities for individuals with diverse credit backgrounds to access financing.

Banks:

- Stringent credit assessments and financial criteria for loan approval.

- Higher credit score thresholds and collateral requirements for securing loans.

If you have experienced credit setbacks in the past and need financing options tailored to your credit profile, online lenders may be more accommodating in helping you secure a business loan.

Customer Service and Support

The level of customer service and support provided by lenders can make a significant difference in your borrowing experience. Online lenders are known for their responsive customer support teams and personalized assistance throughout the loan application process. Traditional banks may offer in-person consultations and relationship managers to guide you through the lending process.

Online Lenders:

- Responsive customer service and support via online channels.

- Personalized assistance to address borrower inquiries and concerns.

Banks:

- In-person consultations and relationship managers for personalized service.

- Limited accessibility to customer service outside of standard banking hours.

If you value accessibility and personalized support in your interactions with lenders, online lenders may offer a more convenient and responsive customer service experience.

Conclusion

In the competitive landscape of business lending, the choice between online lenders and traditional banks for business loans ultimately depends on your unique financial needs and preferences. While online lenders offer convenience, speed, and flexibility in loan terms, traditional banks may provide lower interest rates and personalized service. By weighing the pros and cons of each lending option, you can make an informed decision that aligns with your business goals and financial circumstances. Whether you choose an online lender or a bank for your business loan, remember to prioritize transparency, affordability, and responsible borrowing to set your business up for long-term success.