Are you looking to finance an energy-efficient home with a mortgage? If so, you’re in luck. There are potential government incentives and green mortgage options available to help you achieve your goal. In this article, we will explore how you can take advantage of these options to finance your dream home while also contributing to a more sustainable future. By the end, you’ll have a better understanding of the possibilities and the resources available to make your homeownership dreams a reality.

This image is property of www.foxdavidson.co.uk.

Government incentives for energy-efficient homes

Federal tax credits

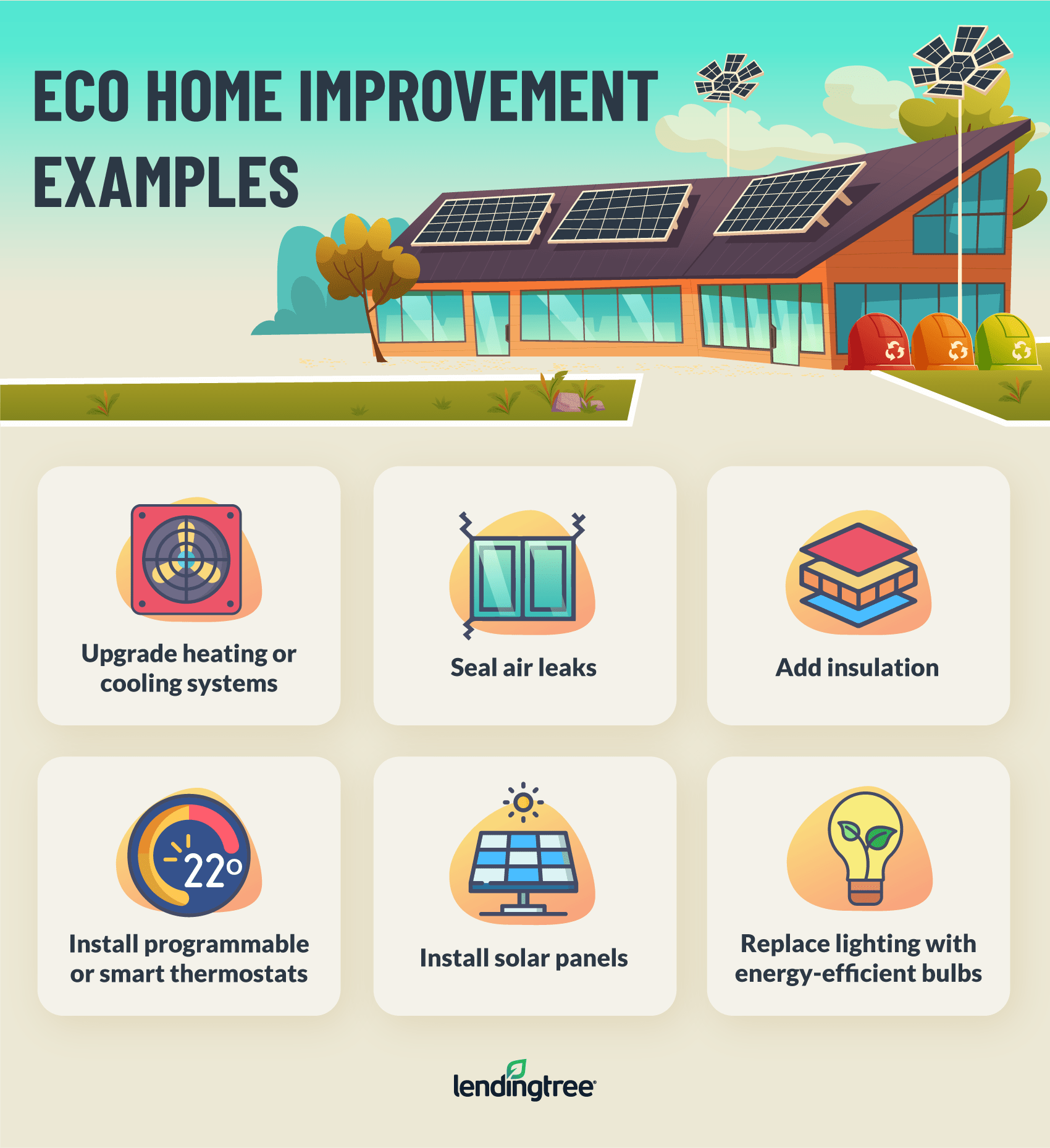

When it comes to financing an energy-efficient home, one option to consider is taking advantage of federal tax credits. The federal government offers tax credits for various energy-efficient improvements made to homes, which can help reduce the overall cost of purchasing or improving an energy-efficient home. These tax credits can include incentives for installing solar panels, energy-efficient windows, insulation, and HVAC systems.

By utilizing these tax credits, not only can you save money on your energy bills in the long run, but you can also offset some of the upfront costs associated with making energy-efficient improvements to your home. It’s important to consult with a tax professional to determine your eligibility for these federal tax credits and to understand how they can benefit you.

State and local incentives

In addition to federal tax credits, many states and local governments offer their own incentives to encourage the purchase and improvement of energy-efficient homes. These incentives can vary depending on your location, but they can include grants, rebates, and low-interest loans specifically designed for energy-efficient improvements.

State and local incentives can cover a wide range of energy-efficient upgrades, such as energy-efficient appliances, insulation, solar water heaters, and more. Some states even offer incentives for purchasing energy-efficient homes, providing additional financial benefits to homebuyers.

To find out what incentives are available in your area, it’s recommended to research the programs offered by your state and local government. Check with your local energy efficiency office or visit their website to learn more about the specific incentives available to you.

Energy-efficient mortgage programs

Energy-efficient mortgage programs are another option to consider when financing an energy-efficient home. These special mortgage programs are designed to provide borrowers with additional funds to finance energy-efficient improvements during the home purchase or refinance process.

Energy-efficient mortgages (EEMs) enable borrowers to include the cost of energy-efficient upgrades into their mortgage loan. This means that borrowers can finance improvements like solar panels, energy-efficient windows, and insulation, all while spreading the cost over the life of their mortgage.

In addition to EEMs, there are also programs like Energy Improvement Mortgages (EIMs) and Energy Star mortgages. Energy Improvement Mortgages allow borrowers to use the anticipated energy savings from their energy-efficient upgrades to qualify for a larger mortgage loan. Energy Star mortgages are specifically for homes that meet the strict energy efficiency standards set by the Environmental Protection Agency.

These specialized mortgage programs can provide borrowers with the means to finance energy-efficient improvements without requiring additional loans or upfront costs. However, it’s important to note that not all lenders may offer these programs, so it’s recommended to research and reach out to lenders that specialize in energy-efficient mortgage options.

This image is property of www.lendingtree.com.

Green mortgage options

Energy-efficient mortgage (EEM)

An energy-efficient mortgage (EEM) is a type of mortgage that allows borrowers to finance energy-efficient improvements to their homes in the mortgage loan. This can provide borrowers with the opportunity to make energy-efficient upgrades without the need for additional loans or upfront costs.

With an EEM, borrowers can finance improvements such as solar panels, energy-efficient windows, insulation, and more. By including these improvements in the mortgage loan, borrowers can spread the cost over the life of their mortgage, making it more manageable and affordable.

The benefits of an energy-efficient mortgage go beyond just financing energy-efficient upgrades. These mortgages can also help borrowers save money on their energy bills in the long run by reducing energy consumption and increasing energy efficiency. Additionally, some lenders may offer discounted interest rates or lower mortgage insurance premiums for energy-efficient homes.

It’s important to note that not all lenders offer energy-efficient mortgages, so it’s recommended to research and reach out to lenders that specialize in these types of mortgage options. Working with a lender experienced in energy-efficient financing can help you navigate the process and find the best mortgage terms for your energy-efficient home.

Energy Improvement Mortgage (EIM)

Energy Improvement Mortgages (EIMs) are another type of green mortgage option that can help finance energy-efficient improvements to homes. These mortgages allow borrowers to use the anticipated energy savings from their energy-efficient upgrades to qualify for a larger mortgage loan.

With an EIM, borrowers can make improvements such as HVAC upgrades, solar installations, and insulation. By taking into account the expected energy savings from these upgrades, lenders can increase the borrower’s qualifying mortgage loan amount. This means that borrowers can finance more extensive energy-efficient improvements without needing additional loans or upfront costs.

The eligibility criteria for Energy Improvement Mortgages can vary depending on the lender and the specific program. It’s recommended to research and reach out to lenders that offer EIMs to understand the requirements and benefits of these mortgage options.

Energy Star mortgage

Energy Star mortgages are specifically designed for homes that meet the strict energy efficiency standards set by the Environmental Protection Agency (EPA). These mortgages provide borrowers with an opportunity to purchase or refinance a home that has been certified as energy-efficient by the EPA.

To receive an Energy Star mortgage, the home must meet certain criteria for energy efficiency, such as a high-performance building envelope, efficient heating and cooling systems, and energy-efficient appliances. These homes are designed to consume less energy, resulting in lower energy bills for homeowners.

By securing an Energy Star mortgage, borrowers can enjoy the benefits of a more energy-efficient home while potentially qualifying for discounted interest rates or lower mortgage insurance premiums. These mortgages also contribute to a greener environment by reducing energy consumption and greenhouse gas emissions.

To take advantage of an Energy Star mortgage, it’s important to work with lenders who offer these specialized mortgage options. By partnering with a lender experienced in Energy Star mortgages, borrowers can navigate the process and find the best terms for their energy-efficient home.

In conclusion, financing an energy-efficient home can be made easier through government incentives and green mortgage options. Federal tax credits can help offset the cost of energy-efficient improvements, while state and local incentives provide additional financial benefits. Energy-efficient mortgage programs, such as EEMs, EIMs, and Energy Star mortgages, offer specialized financing to include energy-efficient upgrades in the mortgage loan. By exploring these options and working with lenders experienced in energy-efficient financing, you can make your dream of owning an energy-efficient home a reality.