If you find yourself facing unexpected expenses or financial emergencies, navigating the world of personal loans can feel intimidating, especially if you have a less-than-perfect credit score. That’s where Bad Credit Loan steps in, offering a lifeline to individuals in need of financial assistance. With their inclusive approach, simplified application process, flexible loan terms, and transparent practices, Bad Credit Loan empowers borrowers to take control of their financial futures. Whether you need to cover immediate expenses, consolidate debts, finance a major purchase, or rebuild credit, Bad Credit Loan is there to support you every step of the way.

Emergencies

Medical bills

Life is full of unexpected surprises, and unfortunately, some of them can come with a hefty price tag. Medical emergencies can quickly drain your savings and leave you struggling to cover the expenses. Whether it’s an unforeseen illness or injury, medical bills can quickly accumulate. This is where a personal loan can come to the rescue.

By taking out a personal loan, you can get the funds you need to cover medical expenses promptly. From doctor’s visits to surgeries and medications, a personal loan can help alleviate the financial burden of medical bills. The funds can be used to pay for procedures, medications, hospital stays, and even rehabilitation.

Car repairs

Owning a car can be a convenient and essential part of daily life. However, vehicles are prone to wear and tear, and unexpected repairs can throw a wrench into your budget. Whether it’s a blown tire, a faulty engine, or a broken transmission, car repairs can be expensive.

When faced with unexpected car repairs, a personal loan can provide the necessary funds to get your vehicle up and running again. By securing a personal loan, you can cover the cost of repairs without having to dip into your savings or rely on high-interest credit cards.

Home repairs

Owning a home comes with the responsibility of maintaining and addressing potential repairs. From leaky roofs to faulty plumbing and electrical issues, unexpected home repairs can be both stressful and expensive. When faced with these unexpected expenses, a personal loan can provide the necessary funds to address the repairs promptly.

By taking out a personal loan, you can tackle home repairs and ensure the safety and comfort of your living space. Whether it’s fixing a leak, replacing a broken appliance, or repairing structural damage, a personal loan can help cover the costs and give you peace of mind.

Debt Consolidation

Credit card debt

Credit card debt can quickly spiral out of control, especially when faced with high-interest rates and multiple payment due dates. If you find yourself drowning in credit card debt, a personal loan can be an effective tool for debt consolidation.

By taking out a personal loan, you can combine all your credit card debt into one manageable monthly payment. This not only simplifies your financial obligations but also allows you to potentially secure a lower interest rate, saving you money in the long run.

Student loans

Pursuing higher education often comes with the burden of student loans. These loans can linger for years, impacting your financial well-being and limiting your ability to save and invest for the future. If you’re struggling to make multiple student loan payments every month, a personal loan can offer relief.

By consolidating your student loans with a personal loan, you can streamline your monthly payments and potentially secure a lower interest rate. This makes it easier to manage your debt and frees up some financial breathing room.

Other outstanding loans

In addition to credit card debt and student loans, you may also have other outstanding loans such as personal loans or payday loans. Juggling multiple loans with different repayment terms and interest rates can be overwhelming. However, consolidating these loans into one manageable monthly payment with a personal loan can make a significant difference.

By consolidating your outstanding loans with a personal loan, you can simplify your repayment process and potentially secure a lower interest rate. This not only makes it easier to manage your debt but also allows you to save money on interest payments over time.

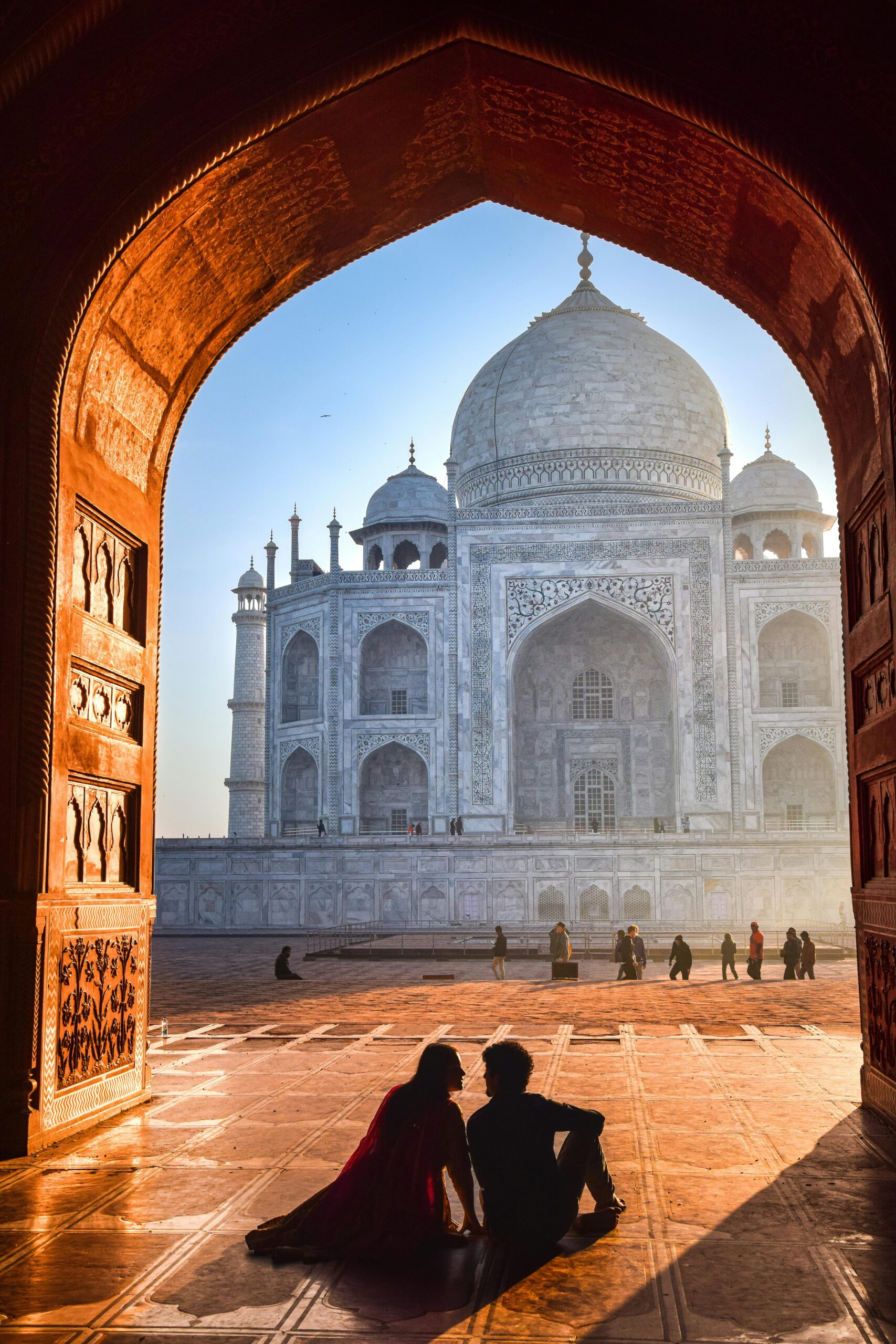

This image is property of images.pexels.com.

Major Purchases

Appliances

Appliances play a crucial role in our daily lives, from keeping our food fresh to washing our clothes. However, when an appliance breaks down unexpectedly, it can disrupt our routines and put a strain on our finances. Whether it’s a refrigerator, dishwasher, or washing machine, replacing these essential appliances can be costly.

By using a personal loan, you can quickly replace a broken appliance and avoid the inconvenience of living without it. With the funds from a personal loan, you can purchase a new appliance and pay it off in manageable monthly installments.

Electronics

From smartphones to laptops, electronics have become integral parts of our lives. However, staying up-to-date with the latest gadgets can be expensive. Whether you need to upgrade your phone or purchase a new computer for work or school, a personal loan can help make these purchases more manageable.

By utilizing a personal loan, you can finance the purchase of new electronics without putting a strain on your budget. With flexible repayment options, you can enjoy the latest technology while spreading out the cost over time.

Furniture

Furniture plays a significant role in creating a comfortable and inviting living space. Whether you’re moving into a new home or simply looking to update your current furniture, the cost of furnishing a space can add up quickly. From sofas and dining sets to bedroom furniture and home office essentials, the expenses can be substantial.

A personal loan can provide the funds needed to acquire the furniture you desire. With the ability to repay the loan over time, you can transform your living space without compromising your financial stability.

Home Renovations

Kitchen remodel

The kitchen is often considered the heart of the home, and a remodel can dramatically enhance your living space and increase the value of your property. However, kitchen renovations can be costly, and many homeowners struggle to cover the expenses upfront.

By using a personal loan, you can finance your kitchen remodel without draining your savings. From new cabinets and countertops to updated appliances and flooring, a personal loan can make your dream kitchen a reality.

Bathroom remodel

Bathrooms are essential rooms in any home, and a well-designed and functional bathroom can greatly improve your daily routine. However, bathroom remodels can be expensive, and many homeowners cannot afford to pay for renovations upfront.

With a personal loan, you can transform your bathroom into a luxurious oasis. Whether it’s updating fixtures and countertops or replacing the bathtub and shower, a personal loan can provide the funds needed to create the bathroom of your dreams.

Outdoor improvements

The outdoor space of your home provides an opportunity to create an inviting and enjoyable environment. Whether it’s a deck, patio, or landscaping project, outdoor improvements can enhance your quality of life and increase your property’s curb appeal.

By utilizing a personal loan, you can finance your outdoor improvement projects and create the outdoor oasis you’ve always envisioned. From installing an outdoor kitchen to adding a pool or landscaping the yard, a personal loan can help you create an outdoor space that reflects your personal style.

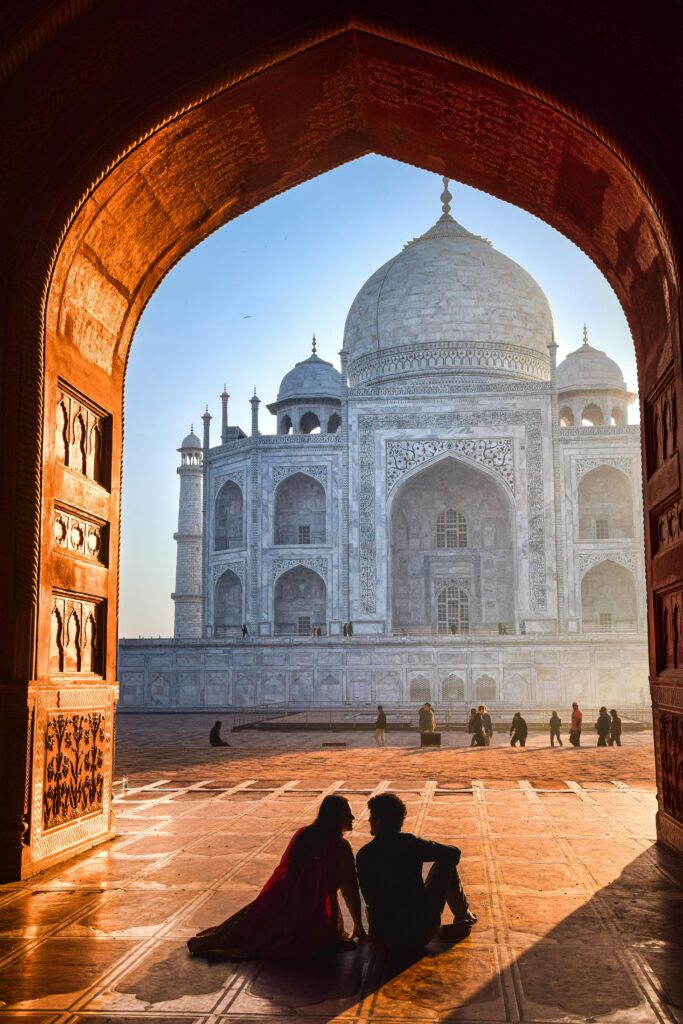

This image is property of images.pexels.com.

Weddings

Venue rental

Choosing the perfect venue for your wedding is an exciting but costly decision. Whether you dream of a rustic barn, an elegant ballroom, or a beachfront ceremony, venue rental fees can quickly add up.

With a personal loan, you can cover the cost of the venue rental and create the wedding setting you’ve always dreamed of. By spreading the expenses over time, you can focus on enjoying your special day without worrying about the financial strain.

Catering

Food plays a crucial role in any wedding celebration, and catering costs can be a significant expense. Whether you plan to have a small intimate gathering or a grand affair, the cost of providing a delicious meal for your guests can quickly become overwhelming.

By taking out a personal loan, you can ensure that your guests enjoy a memorable dining experience without compromising your budget. A personal loan can cover the catering costs and allow you to create a menu that reflects your unique tastes.

Decorations

Decorations are a key element in setting the mood and ambiance of your wedding. From floral arrangements to lighting, table settings, and wedding favors, the cost of decorations can add up quickly.

By using a personal loan, you can bring your wedding vision to life without breaking the bank. With the funds from a personal loan, you can create a stunning visual display that will leave a lasting impression on your guests.

Travel

Vacation expenses

Everyone deserves a break from the hustle and bustle of daily life, but the cost of a vacation can often deter individuals from taking that well-deserved trip. From accommodations and transportation to meals and activities, the expenses of a vacation can quickly add up.

A personal loan can provide the funds needed to explore new destinations and create lasting memories. By spreading the cost of your vacation over time, you can enjoy your trip without worrying about the immediate financial burden.

Airfare

Airfare is often one of the most significant expenses when planning a trip. Whether you’re flying internationally or domestically, the cost of plane tickets can consume a significant portion of your travel budget.

By utilizing a personal loan, you can secure the funds needed to purchase airfare without depleting your savings. With flexible repayment options, you can enjoy your trip knowing that you have a manageable plan for paying off the loan.

Accommodation

Finding suitable accommodations that fit within your budget can be a challenge. Whether you’re looking for a hotel room, a vacation rental, or a resort, the cost of accommodations can significantly impact the overall cost of your trip.

By taking out a personal loan, you can secure comfortable and convenient accommodations without compromising your budget. With the flexibility to repay the loan over time, you can focus on enjoying your vacation while knowing that you have a plan for managing the expenses.

This image is property of images.pexels.com.

Education

Tuition fees

Education is an investment in your future, but the cost of tuition can often be a barrier for many individuals. Whether you’re pursuing a degree, attending vocational school, or taking specialized courses, tuition fees can quickly accumulate.

A personal loan can provide the necessary funds to cover tuition fees and make education more accessible. By spreading out the cost of your education over time, you can focus on acquiring new skills and knowledge without the immediate financial burden.

Books and supplies

In addition to tuition fees, the cost of books and supplies can add up significantly. From textbooks and lab equipment to art supplies and software, the expense of educational materials can strain your budget.

By utilizing a personal loan, you can ensure that you have the necessary resources to support your educational journey. Whether it’s textbooks, technology, or specialized supplies, a personal loan can help you acquire the tools you need to excel in your studies.

Online courses

Online courses have become increasingly popular as individuals seek to expand their knowledge and skills from the comfort of their own homes. However, the cost of online courses can still be a hurdle for many.

By taking out a personal loan, you can invest in your personal and professional development without putting a strain on your finances. With the ability to repay the loan over time, you can focus on gaining new skills and advancing your career.

Starting a Business

Equipment purchase

Starting a business often requires significant investments, especially when it comes to purchasing necessary equipment. Whether you need machinery, vehicles, or technology, the expenses can quickly add up.

By using a personal loan, you can secure the funds needed to purchase the necessary equipment for your business. With the ability to repay the loan over time, you can focus on growing your business without worrying about the immediate financial burden.

Working capital

In addition to equipment purchases, starting a business also requires working capital to cover ongoing expenses such as inventory, marketing, and employee salaries. These expenses can be substantial, especially during the early stages of your business.

A personal loan can provide the necessary working capital to cover these expenses and ensure the smooth operation of your business. By spreading out the cost of these expenses over time, you can focus on building a successful business without the worry of immediate financial strain.

Marketing expenses

Effective marketing is essential for any business’s success, but the cost of marketing campaigns can be prohibitive for entrepreneurs. Whether it’s online advertising, print materials, or social media management, the expenses can quickly mount.

By utilizing a personal loan, you can invest in marketing strategies that will help your business thrive. With the funds from a personal loan, you can create compelling marketing materials, reach your target audience, and increase brand awareness.

Medical Procedures

Cosmetic surgery

Cosmetic surgery procedures can be life-changing, providing individuals with increased confidence and self-esteem. However, these procedures can come with a significant price tag, making them inaccessible to many.

By taking out a personal loan, individuals can finance cosmetic surgery procedures and achieve their desired results. From facelifts and breast augmentations to liposuction and rhinoplasty, a personal loan can provide the necessary funds to transform your appearance.

Dental work

Maintaining good oral health is essential, but dental procedures can be costly. From routine check-ups and cleanings to more involved procedures such as root canals, crowns, and dental implants, the expenses can quickly add up.

A personal loan can provide the necessary funds to cover dental procedures and ensure proper oral health. By spreading out the cost of dental work over time, you can prioritize your oral health without worrying about the immediate financial burden.

Fertility treatments

Fertility treatments can give individuals and couples hope for starting or expanding their families. However, these treatments can be expensive and often not covered by insurance.

By utilizing a personal loan, individuals and couples can pursue fertility treatments without the worry of immediate financial strain. With the funds from a personal loan, you can explore various fertility options and take the necessary steps towards parenthood.

Funeral Expenses

Casket and burial costs

Losing a loved one is an emotionally challenging time, and the financial burden of funeral expenses can further add to the stress. Funeral costs, including caskets, burial plots, and memorial services, can quickly accumulate.

By taking out a personal loan, you can provide your loved one with a dignified send-off without straining your finances. A personal loan can cover the cost of funeral expenses, allowing you to focus on grieving and honoring the memory of your loved one.

Memorial service

Planning a memorial service involves many aspects, including venue rental, flowers, decorations, and catering. These expenses can quickly add up and become overwhelming during an already difficult time.

A personal loan can provide the necessary funds to create a meaningful and memorable memorial service for your loved one. With the funds from a personal loan, you can arrange a service that celebrates their life and provides comfort to family and friends.

Flowers and obituaries

Flowers and obituaries are important elements in honoring the memory of a loved one. However, the cost of flowers and publishing obituaries can be significant.

By utilizing a personal loan, you can ensure that your loved one receives the floral tributes they deserve, and their life is properly acknowledged through obituaries. A personal loan can provide the funds needed for these expenses and alleviate some of the financial burdens during a difficult time.

In conclusion, a personal loan can be a versatile financial tool that can help you navigate various challenges and achieve your goals. From emergencies and debt consolidation to major purchases and life milestones, a personal loan can provide the necessary funds to overcome financial hurdles. However, it is important to approach personal loans responsibly and assess your financial situation to ensure that you borrow only what you can comfortably repay. With the right planning and responsible borrowing, a personal loan can be a helpful resource in achieving your financial objectives.