If you’re in the market for a high-value property and need a loan that exceeds the conventional limits, a jumbo loan might be the solution for you. Jumbo loans are designed for financing properties that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. These loans offer borrowers the flexibility to purchase luxury homes or properties in expensive real estate markets. However, it’s essential to carefully consider your financial situation and goals before deciding if a jumbo loan is right for you. Consulting with experts like Bad Credit Loan can help you navigate the complexities of securing a jumbo loan and make informed decisions about financing your dream property.

What Is A Jumbo Loan And Is It Right For Me? (financing High-value Properties)

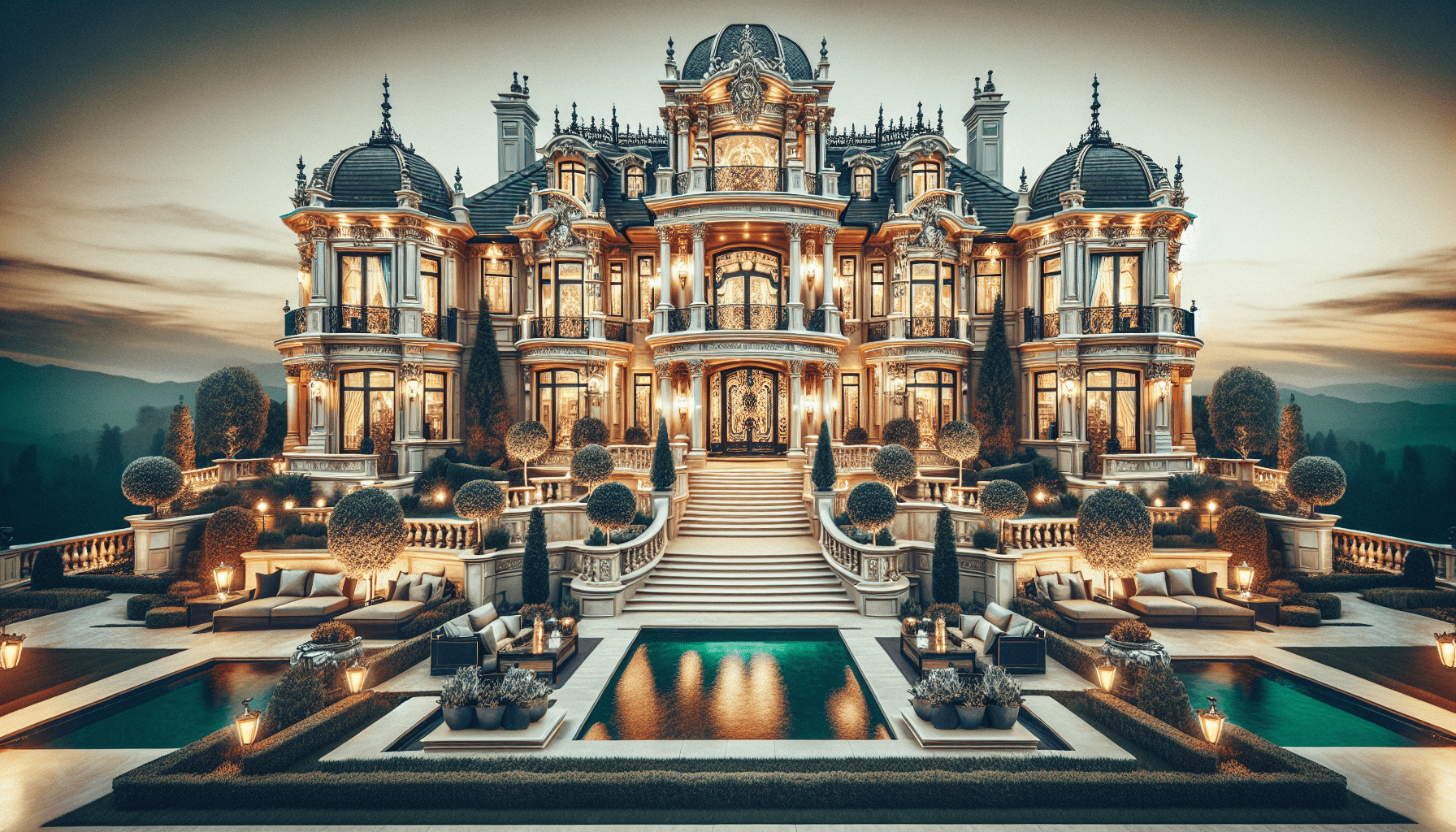

Are you considering buying a high-value property but unsure about your financing options? In this article, we will explore the concept of jumbo loans and help you determine if it is the right choice for you. Whether you are looking to purchase a luxury home or invest in a high-value property, understanding jumbo loans is essential for making informed decisions about your real estate financing.

Understanding Jumbo Loans

Jumbo loans are mortgages that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. In most parts of the United States, these limits are currently set at $548,250 for a single-family home. If you are looking to finance a property that exceeds this limit, you will likely need a jumbo loan.

Jumbo loans are considered non-conforming loans because they do not meet the standard criteria established by government-sponsored entities. As a result, jumbo loans often have stricter eligibility requirements and higher interest rates compared to conventional loans. However, they also provide financing options for high-value properties that would not be possible with conventional mortgages.

Is Your Property Considered High-Value?

Before exploring jumbo loan options, it is crucial to determine if the property you are interested in purchasing qualifies as high-value. High-value properties typically have a purchase price that exceeds the conforming loan limits set by Fannie Mae and Freddie Mac. Factors such as location, size, amenities, and market trends can all influence the value of a property.

If you are unsure whether your property is considered high-value, you can consult with a real estate agent or appraiser to assess its market worth. Understanding the value of the property will help you determine if a jumbo loan is the appropriate financing solution for your needs.

Pros and Cons of Jumbo Loans

Like any financial product, jumbo loans come with their own set of advantages and disadvantages. It is essential to weigh these factors carefully before deciding if a jumbo loan is right for you.

Pros of Jumbo Loans

- Financing High-Value Properties: Jumbo loans allow you to purchase luxury homes or properties that exceed the conforming loan limits.

- Flexibility: Jumbo loans offer flexibility in terms of loan amounts, allowing you to finance properties that may not be eligible for conventional mortgages.

- Customized Terms: Jumbo loans often come with customizable terms to meet your specific financial needs and goals.

Cons of Jumbo Loans

- Higher Interest Rates: Jumbo loans typically have higher interest rates compared to conventional mortgages, resulting in higher monthly payments.

- Strict Eligibility Requirements: Jumbo loans may have stricter eligibility criteria, including higher credit score requirements and lower debt-to-income ratios.

- Increased Down Payment: Jumbo loans often require larger down payments, which can be a significant financial commitment upfront.

Considering these pros and cons will help you determine if a jumbo loan aligns with your financial objectives and purchasing strategy.

Eligibility Requirements for Jumbo Loans

Before applying for a jumbo loan, it is essential to understand the eligibility requirements set by lenders. While these requirements may vary depending on the lender and the specific terms of the loan, some common criteria include:

- High Credit Score: Lenders typically require a higher credit score for jumbo loans compared to conventional mortgages. A credit score of 700 or higher is often recommended.

- Low Debt-to-Income Ratio: Lenders may assess your debt-to-income ratio to determine your ability to repay the loan. A ratio below 43% is generally preferred.

- Financial Reserves: Lenders may require you to have sufficient financial reserves to cover several months’ worth of mortgage payments and other expenses.

- Property Appraisal: A professional appraisal of the property may be required to determine its market value and eligibility for a jumbo loan.

Meeting these eligibility requirements is crucial for securing approval for a jumbo loan and obtaining favorable terms that align with your financial goals.

How to Apply for a Jumbo Loan

If you are considering a jumbo loan for financing a high-value property, the application process typically involves the following steps:

- Prequalification: Begin by consulting with a lender to discuss your financial situation and determine if you meet the eligibility criteria for a jumbo loan.

- Documentation: Prepare necessary documentation, such as proof of income, tax returns, bank statements, and a credit report.

- Property Valuation: Have the property appraised to assess its market value and confirm its eligibility for a jumbo loan.

- Loan Approval: Submit your loan application to the lender for review and approval based on the provided documentation and financial information.

- Closing: Once approved, finalize the loan terms, sign the necessary paperwork, and close the loan to secure financing for the high-value property.

By following these steps and working closely with your lender, you can navigate the application process for a jumbo loan and receive the funding needed to purchase a high-value property.

Comparing Jumbo Loans to Conventional Mortgages

When deciding between a jumbo loan and a conventional mortgage for financing a high-value property, it is essential to consider the key differences between these two options.

Loan Limits

- Jumbo Loans: Jumbo loans exceed the conforming loan limits set by Fannie Mae and Freddie Mac, offering financing for properties that exceed these limits.

- Conventional Mortgages: Conventional mortgages adhere to the loan limits established by government-sponsored entities, making them suitable for properties within these limits.

Interest Rates

- Jumbo Loans: Jumbo loans often have higher interest rates compared to conventional mortgages, reflecting the increased risk associated with financing high-value properties.

- Conventional Mortgages: Conventional mortgages typically offer lower interest rates due to their conforming nature and government backing.

Down Payment Requirements

- Jumbo Loans: Jumbo loans may require larger down payments, often ranging from 10% to 20% or more of the property’s purchase price.

- Conventional Mortgages: Conventional mortgages may allow for lower down payments, such as 3% to 5% of the property’s purchase price, depending on the loan type and lender.

Eligibility Criteria

- Jumbo Loans: Jumbo loans have stricter eligibility requirements, including higher credit score thresholds and lower debt-to-income ratios, compared to conventional mortgages.

- Conventional Mortgages: Conventional mortgages may have more flexible eligibility criteria, making them accessible to a broader range of borrowers.

Comparing these factors will help you determine which financing option best suits your financial needs and goals when purchasing a high-value property.

Working with a Financial Advisor for Jumbo Loans

Navigating the complexities of jumbo loans and high-value property financing can be challenging, especially if you are unfamiliar with the process. Working with a financial advisor specializing in real estate and mortgage solutions can provide valuable guidance and support throughout the home buying journey.

A financial advisor can help you:

- Assess Your Financial Situation: Evaluate your current financial standing, including income, debts, savings, and credit score, to determine your eligibility for a jumbo loan.

- Explore Financing Options: Compare jumbo loans and conventional mortgages to identify the most suitable financing option for purchasing a high-value property.

- Negotiate Loan Terms: Help you negotiate favorable loan terms, including interest rates, down payments, and repayment schedules, to align with your financial goals.

- Navigate the Application Process: Guide you through the application process for a jumbo loan, from prequalification to loan approval and closing, ensuring a seamless experience.

By partnering with a financial advisor, you can leverage their expertise and experience to make informed decisions about jumbo loans and secure financing for your high-value property with confidence.

Conclusion

In conclusion, jumbo loans offer a viable financing solution for individuals seeking to purchase high-value properties that exceed the conforming loan limits. By understanding the basics of jumbo loans, weighing the pros and cons, meeting eligibility requirements, and comparing options with conventional mortgages, you can determine if a jumbo loan is the right choice for your real estate financing needs.

Whether you are purchasing a luxury home, investing in a high-value property, or refinancing for better terms, exploring jumbo loans as a financing option can open doors to unique opportunities in the real estate market. By working with a financial advisor and staying informed about jumbo loans, you can make informed decisions that empower you to achieve your homeownership goals and secure the property of your dreams.