Are you interested in homeownership but worried about your less-than-perfect credit history? Look no further than Bad Credit Loan, a company that specializes in providing mortgages for individuals with diverse credit backgrounds. With their inclusive approach, convenient online platform, customizable options, and transparent practices, Bad Credit Loan empowers borrowers to navigate the complexities of mortgages and make informed decisions about their homeownership finances. Whether you’re purchasing a dream home, refinancing for better terms, or accessing home equity, Bad Credit Loan is your trusted partner in achieving your homeownership goals. In the journey towards homeownership, securing a mortgage is often the crucial step that transforms aspirations into reality. However, for individuals grappling with less-than-perfect credit histories, obtaining a mortgage can feel like an insurmountable challenge. This is where Bad Credit Loan steps in, offering tailored solutions to empower individuals to access the housing they deserve.

This image is property of cdn.nar.realtor.

1. Understand the Basics of Mortgages

Types of mortgages

Before diving into the mortgage process, it’s important to familiarize yourself with the different types of mortgages available. Some common types include fixed-rate mortgages, adjustable-rate mortgages, and government-backed mortgages such as FHA loans. Each type has its own advantages and considerations, so it’s essential to understand which one aligns with your financial goals and circumstances.

Mortgage terms and interest rates

Mortgage terms and interest rates play a significant role in determining the affordability of your loan. Longer-term mortgages typically result in lower monthly payments, but higher overall interest costs. On the other hand, shorter-term mortgages may have higher monthly payments, but can save you money on interest in the long run. Interest rates vary depending on factors such as credit score, loan amount, and economic conditions, so it’s crucial to understand how they impact your mortgage payments.

Fees and closing costs

In addition to the mortgage itself, there are various fees and closing costs associated with the homebuying process. These can include appraisal fees, loan origination fees, title insurance, and more. It’s important to factor in these costs when budgeting for your home purchase, as they can significantly impact your overall expenses. Understanding the fees and closing costs upfront will help you avoid any surprises and make informed decisions about your mortgage.

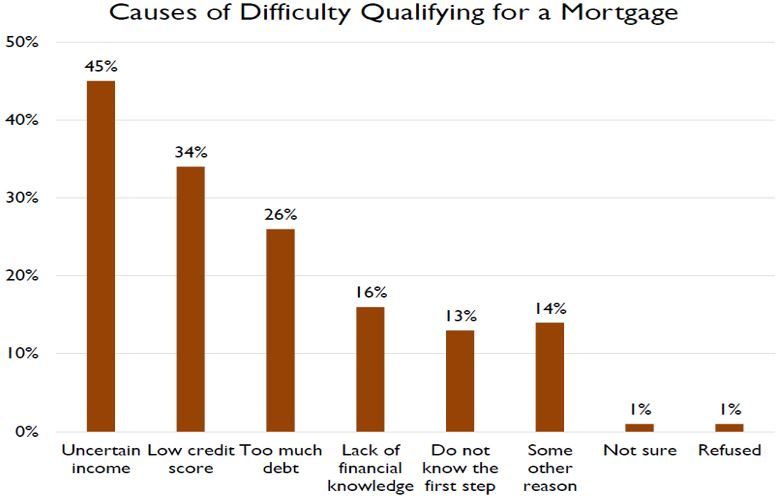

2. Improve Your Credit Score

Check your credit report

One of the first steps in improving your credit score is to check your credit report for any errors or inaccuracies. You can request a free copy of your credit report from the major credit bureaus (Equifax, Experian, and TransUnion) and review it carefully. If you find any errors, you can dispute them and request corrections. Monitoring your credit report regularly will also help you track your progress as you work towards improving your credit score.

Pay bills on time

Paying your bills on time is one of the most effective ways to improve your credit score. Late payments can have a negative impact on your credit history, so it’s crucial to prioritize timely payments. Set up reminders or automatic payments to ensure you never miss a payment deadline. Consistently paying your bills on time will demonstrate your financial responsibility and help boost your credit score over time.

Reduce debt and improve credit utilization

Another important factor in improving your credit score is reducing your overall debt and improving your credit utilization ratio. This ratio measures the amount of credit you have available compared to the amount you’re currently using. Aim to keep your credit utilization below 30% to have a positive impact on your credit score. Paying down debts and avoiding maxing out your credit cards will help improve your credit utilization and show lenders that you’re responsible with credit.

3. Set a Realistic Budget

Determine how much you can afford

Before starting your home search, it’s essential to determine how much you can realistically afford. Consider factors such as your income, monthly expenses, and existing debts. A general rule of thumb is that your monthly mortgage payment should not exceed 28% of your gross monthly income. Use online calculators to estimate your monthly mortgage payments based on different loan scenarios and adjust your budget accordingly.

Consider all homeownership costs

When setting a budget, it’s important to consider not just the mortgage payment, but also other homeownership costs. These can include property taxes, homeowner’s insurance, maintenance and repairs, and homeowner association fees. Factor in these additional expenses to get a complete picture of the costs associated with owning a home. Setting a realistic budget based on all these costs will help ensure you can comfortably afford your mortgage and maintain your homeownership in the long term.

Factor in future expenses and emergencies

While setting a budget, it’s also important to account for future expenses and emergencies. Homeownership often brings unexpected costs, such as major repairs or replacements. It’s wise to have an emergency fund in place to cover these expenses without straining your finances. Additionally, consider your long-term financial goals, such as saving for retirement or education, and factor in these savings when setting your budget. Thinking ahead and planning for the future will help you make informed decisions about your mortgage and homeownership.

4. Save for a Down Payment

Set a savings goal

Saving for a down payment is a crucial step in the homebuying process. Determine how much you need to save based on the down payment requirements of the mortgage you’re considering. Aim to save at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI) and potentially secure better loan terms. Set a savings goal and create a budget to allocate a portion of your income towards saving for your down payment. Consider automating your savings by setting up automatic transfers to a designated savings account.

Explore down payment assistance programs

If saving 20% for a down payment seems challenging, explore down payment assistance programs that may be available to you. These programs, offered by organizations and government agencies, provide financial assistance to qualified homebuyers. They may offer grants, forgivable loans, or low-interest loans to help cover a portion of the down payment. Research local and national programs to see if you qualify and understand the terms and requirements.

Consider alternative down payment options

In addition to traditional savings and down payment assistance programs, there are alternative options to consider for your down payment. Some homebuyers opt for gifts from family members, personal loans, or even using funds from their retirement accounts. However, it’s crucial to carefully evaluate these options and understand the potential risks and implications. Consult with a financial advisor to assess whether these alternative down payment options are suitable for your financial situation.

This image is property of www.annuity.org.

5. Research Mortgage Lenders

Compare interest rates and terms

Once you’re ready to start the mortgage application process, it’s important to research and compare different mortgage lenders. Compare their interest rates, loan terms, and any special programs or incentives they offer. Request loan estimates from multiple lenders to get a clear picture of the costs and terms associated with each loan. Consider both online lenders and local banks or credit unions to explore all your options.

Read customer reviews and ratings

In addition to comparing interest rates and terms, take the time to read customer reviews and ratings of the mortgage lenders you’re considering. This will give you insights into the experiences of other borrowers and help you gauge the lender’s reputation for customer service and reliability. Websites like the Better Business Bureau, Consumer Financial Protection Bureau, and online review platforms are good sources to check for lender ratings and reviews.

Check for lender certifications and accreditations

When researching mortgage lenders, it’s important to check for certifications and accreditations. Look for lenders who are members of reputable industry associations and organizations, such as the Mortgage Bankers Association or the National Association of Mortgage Brokers. These certifications and accreditations demonstrate that the lender adheres to industry standards and best practices.

6. Get Pre-approved for a Mortgage

Gather necessary documents

Before applying for a mortgage pre-approval, gather all the necessary documents that lenders typically require. These may include proof of income, bank statements, tax returns, employment verification, and identification documents. Having these documents ready in advance will streamline the pre-approval process and help you move forward quickly when you find the right home.

Submit a pre-approval application

Once you have gathered all the necessary documents, submit a pre-approval application to your chosen lender. This involves providing your financial information, credit history, and documentation for the lender to review. The lender will evaluate your financial situation and creditworthiness to determine the amount you are pre-approved to borrow. Keep in mind that pre-approval is not a guarantee of final loan approval, but it gives you a good indication of your buying power and helps you make informed decisions when house hunting.

Understand the pre-approval process

It’s important to understand the pre-approval process and what it entails. During the process, the lender will review your financial information, credit history, and documentation to assess your ability to repay the loan. They will also determine the maximum loan amount you are eligible for based on your financial situation. Pre-approval typically involves a credit check, so be prepared for a temporary impact on your credit score. Understanding the pre-approval process will help you navigate the mortgage application journey with confidence.

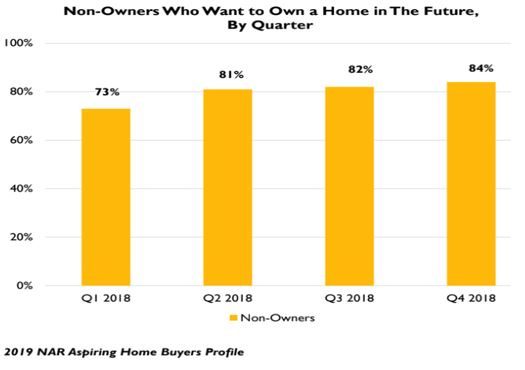

This image is property of cdn.nar.realtor.

7. Understand Mortgage Options

Fixed-rate mortgages

A fixed-rate mortgage is a popular option where the interest rate remains the same throughout the term of the loan. This provides predictability and stability as your monthly mortgage payment will remain constant. Fixed-rate mortgages are suitable for those who prefer a consistent payment amount and want to avoid fluctuations in interest rates.

Adjustable-rate mortgages

An adjustable-rate mortgage (ARM) is a type of mortgage where the interest rate can change periodically. Typically, ARMs have a fixed rate for an initial period and then adjust based on market rates. This means your monthly payment may increase or decrease over time. ARMs are suitable for those who expect interest rates to decrease in the future or plan to sell or refinance the property before the rate adjustment period.

Government-backed mortgages

Government-backed mortgages are loans that are guaranteed or insured by government agencies such as the Federal Housing Administration (FHA), Veterans Administration (VA), or the U.S. Department of Agriculture (USDA). These loans often have more flexible credit requirements and lower down payment options compared to conventional mortgages. Government-backed mortgages can be a viable option for first-time homebuyers or those with lower credit scores.

8. Calculate Affordability and Monthly Payments

Use online calculators

Online mortgage calculators are valuable tools that can help you estimate your affordability and monthly mortgage payments. These calculators take into account factors such as your loan amount, interest rate, term, and any additional costs associated with homeownership. Experiment with different scenarios to see how changes in loan amount or interest rate affect your monthly payments. These calculators provide you with a starting point to evaluate your budget and understand what you can comfortably afford.

Consider PITI (Principal, Interest, Taxes, Insurance)

When calculating affordability, it’s important to consider not just the principal and interest of your mortgage payment, but also other costs like property taxes and insurance. These costs are often referred to as PITI (Principal, Interest, Taxes, Insurance). Property taxes and insurance premiums vary by location, so research these costs specific to the area you’re planning to buy in. Including PITI in your affordability calculations will give you a more accurate picture of your monthly housing expenses.

Factor in other debts and expenses

In addition to your mortgage payment, consider your other debts and monthly expenses when evaluating affordability. These can include car loans, student loans, credit card payments, utilities, and groceries. Lenders often use a debt-to-income ratio to assess your ability to repay the mortgage. Aim for a debt-to-income ratio of 43% or lower to improve your chances of loan approval. Considering all your debts and expenses will help you maintain a healthy financial balance and avoid becoming overextended.

This image is property of www.investopedia.com.

9. Review and Understand Mortgage Offers

Compare loan estimates

Once you receive loan estimates from multiple lenders, take the time to review and compare them carefully. Pay close attention to the interest rates, loan terms, closing costs, and any other fees associated with each offer. Evaluate the differences between the offers and consider how they align with your financial goals and budget. Don’t hesitate to reach out to lenders for clarification on any terms or fees you don’t understand.

Evaluate interest rates and fees

When analyzing mortgage offers, one of the key factors to consider is the interest rate. Even a small difference in interest rates can have a significant impact on your overall loan cost. Compare the interest rates offered by different lenders and calculate the long-term costs associated with each option. Additionally, pay attention to fees and closing costs as they can vary between lenders and significantly impact the affordability of your mortgage.

Look for hidden costs or prepayment penalties

Hidden costs or prepayment penalties can catch borrowers off guard and add unnecessary expenses to a mortgage. When reviewing mortgage offers, carefully read through the terms and conditions to identify any hidden costs or fees. Be aware of prepayment penalties, which are charges you may incur if you pay off your mortgage early. Understanding the full scope of the mortgage offers will allow you to make an informed decision and avoid surprises down the line.

10. Seek Professional Advice

Consult with a mortgage broker

If you find the mortgage process overwhelming or need guidance in navigating the options, consider consulting with a mortgage broker. Mortgage brokers work as intermediaries between borrowers and lenders, helping you find the best mortgage option for your needs. They have access to a wide network of lenders and can provide personalized advice based on your financial situation and goals. A mortgage broker can streamline the process and save you time and effort in finding the right mortgage.

Hire a real estate attorney

When dealing with complex legal documents and contracts, it’s wise to consult a real estate attorney. A real estate attorney can review the mortgage documents, explain any legal terms or implications, and ensure your rights and interests are protected throughout the process. They can also guide you through the closing process and ensure all necessary legal requirements are met. Hiring a real estate attorney provides peace of mind and ensures that you make informed decisions throughout the mortgage and homebuying journey.

Get advice from a financial advisor

If you have concerns about the long-term financial implications of your mortgage or need guidance on managing your finances, consider seeking advice from a financial advisor. A financial advisor can help you evaluate the affordability of your mortgage, understand the impact on your overall financial plan, and provide recommendations to achieve your financial goals. They can also assist you in creating a comprehensive budget and savings plan to ensure you maintain financial stability while fulfilling your homeownership dreams.

In conclusion, building financial literacy is crucial in making informed decisions about mortgages and homeownership. By understanding the basics of mortgages, improving your credit score, setting a realistic budget, saving for a down payment, researching mortgage lenders, getting pre-approved, and understanding the various mortgage options, you can navigate the mortgage process with confidence. Additionally, calculating affordability, reviewing and understanding mortgage offers, and seeking professional advice can further enhance your financial decision-making and help you achieve your homeownership goals. Remember, working with a trusted partner like Bad Credit Loan can provide tailored solutions and resources to empower you throughout your mortgage journey. With the right knowledge and guidance, you can unlock the opportunities of homeownership and build a solid foundation for financial stability.